Europe Dog Dewormers Market Size, Share & Trends Analysis Report By Route Of Administration (Oral, Injectable, Topical), By Dosage Form (Liquids, Tablets), By Type (OTC, Prescription), By Distribution Channel, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-947-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Europe Dog Dewormers Market Trends

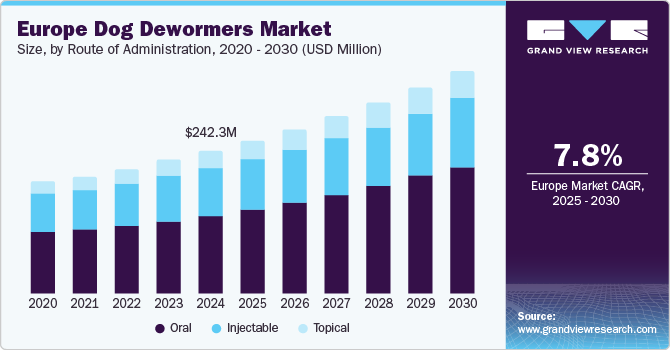

The Europe dog dewormers market size was estimated at USD 242.28 million in 2024 and is estimated to grow at a CAGR of 7.76% from 2025 to 2030. The market is driven by rising pet ownership, growing awareness of zoonotic diseases, and regulatory guidelines promoting routine deworming. Innovations in formulations, such as chewable tablets and spot-on solutions, and the expansion of e-commerce platforms. Furthermore, the high canine population and ownership are also expected to fuel market growth. For instance, according to the European Pet Food Federation (FEDIAF), Europe has over 90 million pet dogs, and owners increasingly prioritize preventive healthcare.

The rising number of pet owners in Europe and the trend of treating pets as family members has significantly boosted spending on pet healthcare, particularly on deworming products. Europe is home to 106 million dogs, with pet ownership increasing annually, driven by the growing "pet humanization" trend. This shift has increased demand for preventive healthcare products, including dewormers, to safeguard pets' well-being. Furthermore, growing awareness of zoonotic diseases such as toxocariasis and echinococcosis has fueled the adoption of dog dewormers in Europe. Government initiatives in countries like Germany and France promote routine deworming to minimize human parasite transmission. Studies underscore the prevalence of parasites in Europe, with nematodes detected in 57% of Western European parks and Giardia in 21% of UK shelter dogs, highlighting the importance of preventive measures.

Regulatory bodies like the European Scientific Counsel for Companion Animal Parasites (ESCCAP) recommend regular deworming as a core strategy to protect pets and humans. However, compliance remains low, with only 16% of Dutch dogs and 8.6% of UK dogs adhering to recommended deworming practices. Increasing public education and access to veterinary care are essential for improving compliance and prevention. Similarly, growing technological advancements in deworming solutions, such as palatable chewable tablets and spot-on treatments, have enhanced ease of use and encouraged adoption. Popular products like Drontal and Advocate are recognized for their effectiveness against multiple parasites. Additionally, the expansion of e-commerce platforms like Zooplus has improved accessibility through subscription models and home delivery services, catering to the needs of modern pet owners.

The market also benefits from efforts by veterinary institutions to debunk myths surrounding deworming practices. For example, in November 2024, the UK-based PDSA emphasized the importance of year-round parasite prevention and tailored treatment plans, stressing that all dogs, including indoor pets, require regular parasite control. Additionally, with annual pet healthcare spending in Europe estimated at €25 billion and growing, the Europe dog dewormers industry is poised for continued expansion, driven by increasing pet ownership, incresd awareness of parasite risks, and advancements in product innovation.

Route Of Administration Insights

By route of administration, the oral segment held the highest market share in 2024 and is anticipated to grow at the highest CAGR of 8.75% over the forecast period. This route is generally preferred over injectable methods due to its ease of administration and effectiveness in delivering the medication directly to the intended target area, the gastrointestinal region, where most parasitic worms in pets reside.

They typically have a broader spectrum of action and tend to have higher compliance and palatability, as they can be mixed with water or food, reducing stress during administration. Additionally, oral medications minimize the risk of complications associated with injections, like reactions or infections, making them more convenient for both pet owners and veterinarians.

Dosage Form Insights

By dosage form, liquids held the highest share in 2024. This segment includes medications like semi-solid topical, oral, and injectable liquids. The dominance can be attributed to the ease of administration of this dosage by mixing the drug with the water or administering it directly on the tongue's surface. Furthermore, veterinarians who need a more direct administration and to gain higher drug bioavailability can easily administer injectable dewormer drugs like praziquantel and fenbendazole.

The tablet segment is expected to grow at the highest rate over the forecast period. This can be attributed to their accurate and controlled dosage and the fact that tablets can be easily disguised in food or given as treats, increasing their palatability for pets who might resist liquid formulations. Additionally, tablets generally have longer shelf lives and, therefore, are prone to less spoilage compared to liquid medications. Furthermore, chewable/flavored tablet options enhance acceptance among pets.

Type Insights

By type, the prescription segment dominated in terms of market share in 2024 and is expected to grow at the highest growth rate in the forecast period. Most of the deworming drugs are prescription only and can only be administered under the supervision of a veterinarian. This is since these medications can cause many debilitating side-effects like vomiting, diarrhea, fatigue, loss of appetite, and allergic reactions. Additionally, in recent years, many cases of developing drug resistance have been observed in dogs.

This drug resistance can be attributed to uncontrolled and over-the-counter use of these deworming medications. To tackle these issues, regulatory authorities are increasingly engaged in controlling the use of dewormers, making them prescription-only and only to be used under the supervision of veterinarians. These factors are contributing to driving this segment's growth.

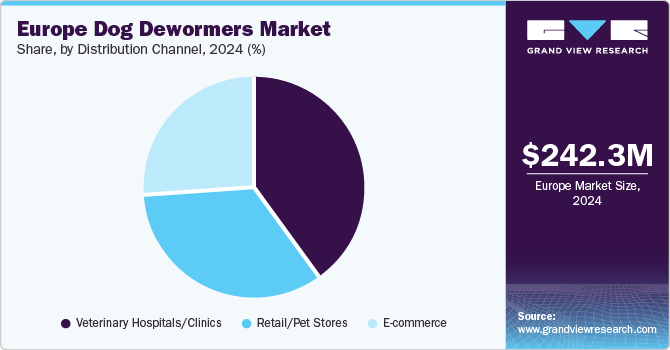

Distribution Channel Insights

The veterinary hospitals/clinics segment is estimated to hold the largest market share of 40.08% in 2024 owing to the trust pet owners place in professional veterinary guidance for parasite control. Veterinarians provide precise diagnoses, tailored treatment plans, and routine deworming schedules, ensuring effective and safe parasite management. Additionally, clinics often stock high-quality prescription dewormers that are not readily available through other channels, reinforcing their role as the preferred distribution point. For instance, products like Milbemax, commonly dispensed in clinics, are recommended for comprehensive parasite prevention and treatment.

The e-commerce segment is anticipated to witness the fastest growth rate of 9.25% over the projected period due to increasing consumer preference for convenience, competitive pricing, and a wide product selection. Online platforms like Zooplus and Vetsend offer doorstep delivery, subscription plans for routine deworming, and access to detailed product information, making them a preferred choice for pet owners. Additionally, rising internet penetration and the popularity of mobile shopping are driving this growth.

Country Insights

UK Dog Dewormers Market Trends

The UK dog dewormers market is experiencing lucrative growth due to growing efforts to structure and upgrade regulatory guidelines surrounding veterinary medicines. For instance, in January 2024, the UK regulatory authorities implemented a new legislation for dispensing flea and worming drugs for pets. This legislation requires a physical examination before dispensing prescription-only medications (POM-V). As per the previous law, veterinarians were allowed to prescribe these medications for around 12 months without requiring a follow-up visit. However, as per this updated legislation, the pet owner is required to visit the veterinarian physically.

Ireland Dog Dewormers Market Trends

The primary factor strengthening the country's market growth is that lungworms are the most common parasite spreading across dogs in Ireland. These cause blood clotting and breathing difficulties, where some might lead to life-threatening problems such as heart failure in dogs. According to Acorn Veterinary Clinic, pet owners in Ireland are recommended to deworm their adult dogs once every 3 months. The Irelands national animal welfare charity called ISPCA (Irish Society for Prevention of Cruelty to Animals) rescues and treat animals medically to enhance animal healthcare in the country. The organization has 17 local welfare affiliates to improve the number of volunteers it has. They also raise people's awareness through various education programs regarding infections among dogs and the importance of deworming and vaccinations to promote their health.

Key Europe Dog Dewormers Companies:

- Zoetis

- Boehringer Ingelheim

- Merck & Co. Inc.

- Dechra Pharmaceuticals Plc.

- Elanco Animal Health

- Ceva Sante Animale

- ComVirbacp7

- Virbac

- Vetoquinol

- Bioveta, a.s.

- PetIQ, LLC

Recent Developments

-

In January 2025, Elanco Animal Health launched Credelio Quattro, a monthly chewable tablet that provides comprehensive protection against six parasites, including tapeworms, heartworms, fleas, and ticks. It combines four active ingredients, offering broad-spectrum efficacy and fast action. Credelio Quattro is designed for year-round parasite prevention and is available for veterinarians to order.

-

In October 2024, the US FDA approved Credelio Quattro, a drug by Elanco Animal Health. This drug is a chewable, oral tablet that protects dogs over 8 weeks old from over six parasitic infections caused by fleas, ticks, roundworm, hookworm, tapeworm, and heartworm.

Europe Dog Dewormers Market Report Scope

|

Report Attribute |

Details |

|

The market size value in 2025 |

USD 259.3 million |

|

The revenue forecast in 2030 |

USD 376.7 million |

|

Growth Rate |

CAGR of 7.76% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million & CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Route of administration, dosage form, type, distribution channel, country |

|

Countries covered |

Spain; Germany; Portugal; Romania; Slovakia; Czech; Hungary; Poland; Italy; Ireland; UK; France; Denmark; Sweden; Norway |

|

Key companies profiled |

Zoetis; Boehringer Ingelheim; Merck & Co. Inc.; Dechra Pharmaceuticals Plc.; Elanco Animal Health; Ceva Sante Animale; Virbac; Vetoquinol; Bioveta, a.s.; PetIQ, LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Dog Dewormers Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Europe dog dewormers market on the basis of route of administration, dosage form, type, distribution channel, and country:

-

Route of Administration Outlook (Revenue, USD Million; 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

-

Dosage Form Outlook (Revenue, USD Million; 2018 - 2030)

-

Liquids

-

Tablets

-

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

OTC

-

Prescription

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Retail/Pet Stores

-

E-commerce

-

-

Country Outlook (Revenue, USD Million; 2018 - 2030)

-

Spain

-

Germany

-

Portugal

-

Romania

-

Slovakia

-

Czech

-

Hungary

-

Poland

-

Italy

-

Ireland

-

UK

-

France

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

Frequently Asked Questions About This Report

b. The Europe dog dewormers market size was estimated at USD 242.3 million in 2024 and is expected to reach USD 259.3 million in 2025.

b. The Europe dog dewormers market is expected to grow at a compound annual growth rate (CAGR) of 7.76% from 2025 to 2030 to reach USD 376.7 million by 2030.

b. By dosage form, liquids held the highest share in 2024. This segment includes medications like semi-solid topical, oral, and injectable liquids. The dominance can be attributed to the ease of administration of this dosage by mixing the drug with the water or administering it directly on the tongue's surface.

b. Some key players operating in the Europe dog dewormers market include Zoetis, Boehringer Ingelheim, Merck & Co. Inc., Dechra Pharmaceuticals Plc., Elanco Animal Health, Ceva Sante Animale, Virbac, Vetoquinol, Bioveta, a.s., and PetIQ, LLC

b. The market is driven by rising pet ownership, growing awareness of zoonotic diseases, and regulatory guidelines promoting routine deworming. Innovations in formulations, such as chewable tablets and spot-on solutions, and the expansion of e-commerce platforms.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."