- Home

- »

- Display Technologies

- »

-

Europe Digital Signage Market Size, Industry Report, 2030GVR Report cover

![Europe Digital Signage Market Size, Share, & Trends Report]()

Europe Digital Signage Market Size, Share, & Trends Analysis Report By Application, By Display Type, By Location, By Component, By Display Size, By Content Type, By Venue, By Region, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-297-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Europe Digital Signage Market Size & Trends

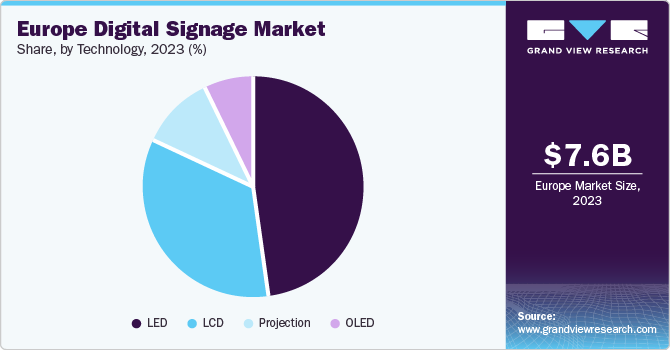

The Europe digital signage market size was estimated at USD 7.6 billion in 2023 and is expected to grow at a CAGR of 7.1% from 2024 to 2030. The market growth is driven by the increasing popularity of digital advertisements for both public awareness campaigns and commercial promotions; advancements in technology, such as touch screen and Near-Field Communication (NFC) capabilities; and the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into digital signage systems. Furthermore, a rise in the number of smart city projects across the region contributes to market growth. These factors, combined with the growing trend of targeted content delivery and data-driven contextual advertising, are driving the expansion of the digital signage market in Europe.

The Europe digital signage market accounted for 28.3% revenue share of the global digital signage market in 2023. The European regulatory landscape significantly influences the market. A prominent example is the Digital Markets Act (DMA), a legislative framework established by the European Parliament and Council. The DMA aims to foster fair and competitive digital markets by defining criteria for designating "gatekeepers" - large online platform providers - and imposing specific obligations and prohibitions on their conduct.

The DMA seeks to curb unfair practices employed by gatekeepers that could stifle competition in core platform services. This regulation directly affects the market, as it governs the behavior of digital service providers within the industry. A digital signage provider designated as a gatekeeper would be subject to the DMA's obligations and prohibitions, potentially impacting their business operations and market strategies.

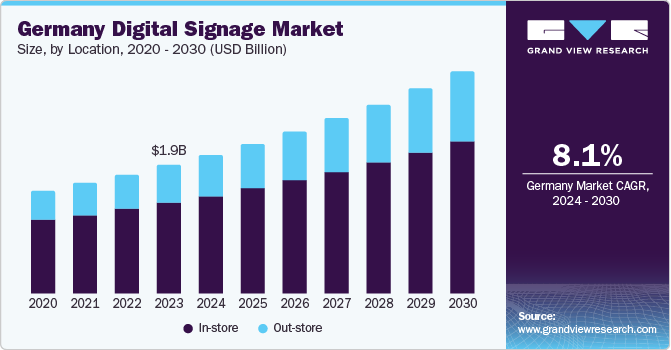

Location Insights

The indoor location segment dominated the market with a share of 71.2% in 2023. The widespread adoption of digital signage within retail stores, hospitals, corporate buildings, and transportation hubs is driving the dominance of the indoor segment. Indoor digital signs are used for advertising, wayfinding, and information sharing, enhancing customer experience and engagement. The growing trend of personalized & interactive digital signage, coupled with advancements in display technologies, further drives the segment growth.

The outdoor location segment is expected to register the fastest CAGR from 2024 to 2030 due to the increasing use of digital billboards, kiosks, and digital screens in public spaces for advertising and public information dissemination. The rise of smart cities and the integration of digital signage in public infrastructure, such as city planning and transportation, also contribute to segment growth. The outdoor digital signage market is expected to continue its upward trajectory, propelled by technological advancements and rapid digitization of the advertising industry.

Type Insights

The video walls segment held the largest revenue share at 26.5% in 2023. Organizations across various sectors, including retail, transportation, hospitality, and corporate environments, use video walls for advertising, information dissemination, and brand promotion. The appeal of video walls lies in their ability to capture attention and convey dynamic content. They are commonly found in shopping malls, airports, train stations, and corporate lobbies. As technology advances, video walls continue to evolve, offering higher resolutions, improved brightness, and enhanced interactivity.

The transparent LED screens segment is predicted to grow at the fastest CAGR of 9.9% from 2024 to 2030. These screens allow viewers to see through the display, making them ideal for storefronts, museums, and architectural installations. They blend seamlessly with the environment, creating an immersive experience. Transparent LED screens can be customized in various shapes and sizes, adapting to unique architectural designs. As touch-sensitive technology improves, transparent LED screens can also serve as interactive touchpoints for users.

Component Insights

The hardware segment dominated the market with a revenue share of 57.4% in 2023. The segment is also expected to grow at the fastest CAGR over the forecast period due to the increasing demand for high-quality display panels and rapid advancement in display technologies. The hardware components of digital signage include display panels, media players, mounts & other accessories, and more.

The trend of ultra-high-definition (UHD) and large-format displays is further driving the segment growth. The software component segment is projected to register the second-fastest CAGR of 7.5% from 2024 to 2030. Software plays a crucial role in the operation of digital signage systems, enabling content management, interactivity, and data integration. The growing demand for dynamic and targeted content delivery is driving the growth of the software segment.

Application Insights

The transportation segment held the largest market share of 19.2% of the total revenue in 2023. This dominance is likely to continue as the segment is projected to maintain its fast-paced growth trajectory. Digital signage is widely deployed in airports and train stations for various purposes. It provides real-time flight information, gate details, wayfinding assistance, and advertising opportunities. Along highways and major roads, digital billboards engage commuters with eye-catching advertisements. Their ability to change content quickly allows advertisers to target specific time slots or events.

The healthcare segment is expected to witness the second-fastest CAGR of 9.0% from 2024 to 2030 due to the rising adoption of digital signage in hospitals, clinics, and pharmacies to enhance patient engagement, deliver critical information, and streamline operations. Digital screens in waiting rooms entertain patients, reducing perceived wait times. They can display health-related content, news, or educational material. For instance, it can promote vaccination campaigns, wellness programs, and preventive measures. Moreover, hospitals use digital displays to communicate with staff members, sharing updates, training materials, and emergency protocols.

Size Insights

The smaller displays, with the below 32-inch segment, accounted for a share of 40.0% in 2023. This dominance suggests a widespread adoption of digital signage for applications that benefit from compact screens, such as indoor advertising in retail stores, informational displays in elevators and hallways, or menu boards in restaurants. While smaller displays will likely maintain a significant presence, the 32 to 52-inch segment is projected to experience the fastest CAGR of 7.5% over the forecast period.

This segment indicates a growing demand for medium-sized displays. This could be driven by many factors, including the need for better visual impact for certain applications, increasing affordability of larger screens, and rising adoption of digital signage in sectors like corporate offices & transportation hubs where larger displays can improve content visibility. Displays in this size range strike a balance between visibility and space efficiency. They are suitable for both indoor and outdoor installations.

Content Type Insights

The non-broadcast content type segment dominated the market with a share of 44.7% in 2023. This segment likely encompasses a wide range of content tailored for specific audiences and purposes, such as digital menus, product promotions, and informational displays. Touchscreens and interactive kiosks fall under this category. Users can engage with content, explore product details, and make informed decisions. Non-broadcast screens also serve as wayfinding tools in airports, malls, and big venues. They guide visitors, display directories, and enhance navigation.

The broadcast content type segment is projected to register the fastest CAGR of 8.0% from 2024 to 2030 due to the increasing demand for real-time information and engaging content, such as live news, sports updates, and social media feeds. Broadcast screens are ideal for promoting upcoming events, concerts, and theater shows. Their dynamic nature captures attention and generates interest.

Technology Insights

The LED segment held the largest share of 47.5% in 2023. The LED segment is also expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the numerous advantages of LED displays, such as high brightness, durability, and energy efficiency. LED displays are widely used in indoor and outdoor digital signage due to their ability to deliver clear and bright images even in direct sunlight. The trend of ultra-high-definition (UHD) and large-format LED displays is further driving the growth of this segment.

The LCD segment is expected to witness the second-fastest growth rate of 6.1%, in terms of revenue, from 2024 to 2030. LCDs are popular in the market due to their high resolution, cost-effectiveness, and wide range of sizes. They are commonly used in indoor applications, such as retail stores, restaurants, and corporate buildings. The advent of advanced LCD technologies, such as quantum dots and OLED, is expected to further boost the segment growth.

Country Insights

Germany Digital Signage Market Trends

The Germany digital signage market held the largest market share of 25.4% in the region in 2023 and is projected to expand further at the fastest growth rate from 2024 to 2030. This growth can be attributed to the rapid adoption of AI, machine learning (ML), and extensive use of IP-based devices. The high adoption of digital screens by restaurants, fast-food chains, and commodity showrooms for displaying required information also contributes to market growth.

France Digital Signage Market Trends

The digital signage market in France is expected to witness significant growth over the forecast years. The growing demand for interactive and personalized experiences and 4K embedded displays are driving the domestic market growth. The rise of smart cities and the integration of digital signage in public infrastructure, such as transportation and city planning, also contribute to market growth.

UK Digital Signage Market Trends

The UK digital signage market is projected to witness the second-fastest growth rate of 7.5% from 2024 to 2030. This robust growth is primarily driven by the rapid adoption of AI and ML technologies, along with the widespread implementation of IP-based devices.

Key Europe Digital Signage Company Insights

The Europe digital signage market indicates a diverse and competitive structure. Given the rapid technological advancements and the growing demand for digital signage solutions, many providers have established their presence in the region.

-

LG Display Co. Ltd. is a South Korean company specializing in the display panel sector, including digital signage. LG Display offers a variety of digital signage solutions, such as LCD and OLED displays, that are widely used in various industries, such as retail, hospitality, and corporate

Key Europe Digital Signage Companies:

- Samsung (Samsung Display Solutions)

- LG Display Co. Ltd.

- Innolux Corp.

- FocusNeo AB

- Raystar Optronics Inc.

- Adversign Media GmbH

- OSRAM OLED GmbH

- ST Digital

- Winstar Display Co. Ltd.

- Visionbox Co. Ltd.

Recent Developments

-

In January 2024, Samsung Electronics unveiled its cloud-based VXT platform for streamlined content creation and remote digital signage management at Integrated Systems Europe 2024

-

In February 2024, LG unveiled its new Business Cloud CMS platform at ISE 2024, streamlining remote management and subscriptions for their commercial digital signage solutions

-

In November 2023, ZetaDisplay secured a multi-year deal with Axfood to develop and implement a new digital signage concept across 220 Hemköp grocery stores in Sweden

Europe Digital Signage Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 12.2 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Location, type, component, application, size, content type, technology, and country

Key companies profiled

Samsung Display Solutions (Samsung Electronics Co. Ltd.); LG Display Co. Ltd.; Innolux Corp.; FocusNeo AB; Raystar Optronics Inc.; Adversign Media GmbH; OSRAM OLED GmbH; ST Digital; Winstar Display Co. Ltd.; Visionbox Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Digital Signage Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe digital signage market report based on location, type, component, application, size, content type, technology, and country:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Video Walls

-

Video Screen

-

Transparent LED Screen

-

Digital Poster

-

Billboards

-

Kiosks

-

Interactive Kiosks

-

Self-service Kiosks

-

Others

-

-

Others

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Displays

-

Media Players

-

Projectors

-

Others

-

-

Software

-

Service

-

Installation Services

-

Maintenance & Support Services

-

Consulting Services

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

LCD

-

LED

-

OLED

-

Projection

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Hospitality

-

Entertainment

-

Stadiums & Playgrounds

-

Corporate

-

Banking

-

Healthcare

-

Education

-

Transport

-

-

Location Outlook (Revenue, USD Million, 2017 - 2030)

-

In-store

-

Out-store

-

-

Content Category Outlook (Revenue, USD Million, 2017 - 2030)

-

Broadcast

-

News

-

Weather

-

Sports

-

Others

-

-

Non-Broadcast

-

-

Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 32 Inches

-

32 to 52 Inches

-

More than 52 Inches

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

UK

-

Germany

-

France

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."