- Home

- »

- Next Generation Technologies

- »

-

Europe Digital Insurance Market Size, Industry Report, 2030GVR Report cover

![Europe Digital Insurance Market Size, Share & Trends Report]()

Europe Digital Insurance Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Insurance Type (Life & Health), By Distribution Channel (Brokers, Tied Agents & Branches), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-490-8

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Europe Digital Insurance Market Trends

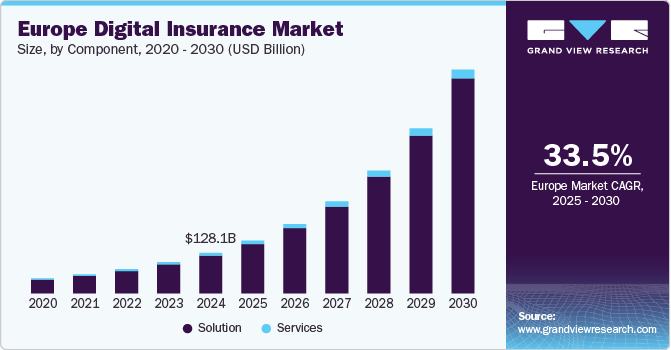

The Europe digital insurance market size is estimated at USD 128.14 billion in 2024 and is projected to grow at a CAGR of 33.5% from 2025 to 2030. The growing digitization of the Europe insurance industry is driving market growth. Insurance companies are pursuing new methods of cooperation and are increasingly shifting toward innovative third-party service providers for efficient and quick access to new technologies and business models. For the past decade, digitization has already started enabling an improved customer experience for users and is also aiding insurance companies to improve their sales and process efficiency. Factors such as advances in Artificial Intelligence (AI) and prediction tools, the rise of the sharing economy, and the ever-increasing flow of data from connected and IoT devices are expected to drive more significant changes in the insurance business model, more technology integration, and necessary changes in regulations.

In addition, the increasing adoption of AI and the use of data exchanges governed by standardized application programming interfaces facilitate the development of improved front and back-office processes and online access to insurance policies. Insurance companies use AI to enhance customer service and offer improved insight into customer demands. Customers are adopting this innovation in insurance because it addresses their needs and enhances their interactions with insurers, offering increased convenience.

Furthermore, the COVID-19 pandemic has accelerated the digital transformation in the industry. Lockdowns announced during the pandemic caused a notable surge in e-commerce activity, a trend that extended to the insurance industry as well. Since the start of the COVID-19 pandemic and subsequent lockdowns, consumers have shown their interest in partially digitizing their buying process. This shift has resulted in changes to customers’ preferred modes of contact with insurance agents.

The integration of advanced technologies such as AI and Machine Learning (ML) in digital insurance solutions and services presents numerous opportunities to revolutionize the financial services industry. A compelling trend in insurance involves leveraging chatbots and artificial intelligence for customer service purposes. AI is also utilized to assist customers in selecting suitable insurance policies. Insurers gather data from various sources, such as social media and credit reports to build digital profiles of customers, enabling personalized policy recommendations based on this information. ML aids in the automation of the insurance sector by giving insurers the ability to automate repetitive and time-consuming operations, improve customer experience, and increase operational effectiveness.

Furthermore, AI and ML for the insurance sector also enable the improved prediction of Customer Lifetime Value (CLV). ML algorithms analyze customer demographics, claims histories, purchase histories, and other related factors in generating predictive models to estimate a customer’s future value to the insurer. By predicting CLV, insurance companies identify the most valuable customers and target them with personalized services and products that meet their needs.

Component Insights

The solution segment accounted for the largest revenue share of 93.1% in 2024. The growth of the segment can be attributed to the growing preference for managing insurance needs through online platforms, primarily fueled by the paradigm shift toward the utilization of digital channels for purchasing insurance policies, managing diverse coverage, and processing claims. Insurers are actively enhancing their online interfaces, focusing on user-centric designs to streamline customer experiences. This trend is indicative of the transition of the European insurance industry toward digitization.

The services segment is expected to grow at a significant CAGR from 2025 to 2030. The services segment covers a spectrum of services essential for executing, running, and refining digital insurance solutions. These services encompass various specialized support services, including policy administration, claims processing, underwriting, and customer relationship management. The segment’s growth can be attributed to the increasing reliance of insurance providers on these specialized services to implement and manage their digital platforms effectively. As insurers strive to enhance operational efficiency and deliver seamless customer experiences, the demand for these services is poised to grow in the industry.

Insurance Type Insights

The life & health segment held the largest revenue share in 2024. The increasing adoption of digital insurance platforms and the integration of innovative digital features related to health insurance, including telemedicine services, online claims processing, and wellness tracking, into these platforms are driving the growth of the life & health segment. These features are particularly encouraging policyholders scouting for convenient access to life insurance and health insurance services and streamlined administrative processes to opt for digital insurance platforms.

The others segment is expected to grow at a significant CAGR from 2025 to 2030. The others segment covers various non-life insurance products categorized under property & casualty, auto, home, travel, marine, liability, commercial property, and renters, among others, which equally form a significant part of the insurance industry. The growth of the segment can be primarily attributed to the rising consumer demand for convenient, digitally enabled insurance solutions across diverse non-life categories. The growing preference for online transactions, customized coverage, and simplified claims processing bodes also fuels growth of the segment in the Europe digital insurance industry.

Distribution Channel Insights

The brokers segment dominated the market in 2024. Brokers play the pivotal role of independent intermediaries offering a diverse range of insurance policies from various insurers to clients. The growing demand for unbiased advice, personalized insurance solutions, and access to a wide array of policies from multiple insurers is driving the growth of the brokers segment. Brokers leverage digital platforms to provide consumers with convenient access to various insurance offerings, facilitating comparison, tailored recommendations, and simplified policy management.

The tied agents & branches segment is projected to grow at a significant CAGR from 2025 to 2030. The growth of the tied agents & branches segment can be attributed to the increasing adoption of digital channels for both insurance sales and customer service. Insurers are giving a higher preference for tied agents leveraging digital platforms for policy sales and physical branches employing digital tools for customer interaction and policy management.

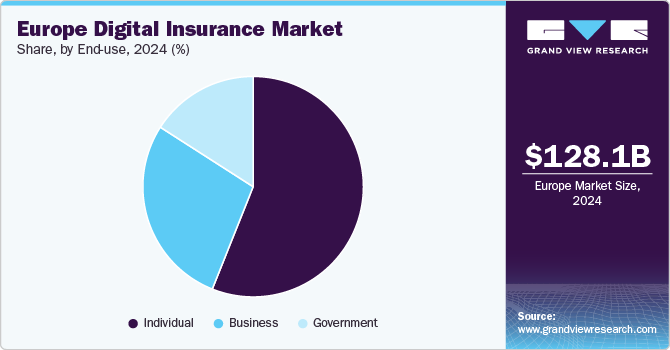

End-use Insights

The individual segment dominated the market in 2024. The segment’s growth can be attributed to the increasing adoption of digital channels for insurance acquisition by individuals preferring online platforms to acquire policies for personal financial protection, particularly aimed at securing the future of their beneficiaries in the event of unforeseen events. The efforts being pursued by insurers to enhance digital accessibility and streamline the purchasing process for such individuals, guaranteeing convenience and user-friendly digital experiences, is driving growth of the Europe digital insurance industry.

The business segment is expected to expand at a significant CAGR from 2025 to 2030. The segment covers companies acquiring insurance policies online to offer employee benefits or manage risks effectively. The growth of the segment can be attributed to the growing preference among businesses for digital channels to procure insurance coverage efficiently. Policies procured online by businesses serve as integral components of the comprehensive employee benefits packages or strategic risk management initiatives pursued by businesses.

Regional Insights

The rapid expansion of digital channels and tools in Europe digital insurance market has fundamentally reshaped the insurance landscape. Consumers now prefer the convenience and accessibility of purchasing insurance policies online or through mobile applications. Digital platforms enable users to compare policies, customize coverage, and access instant quotes, reducing the need for traditional agent interactions.

UK Digital Insurance Market Trends

The digital insurance market in the UK held the largest market share in the Europe digital insurance industry. The rise of Insurtech startups in the UK is driving the adoption of new technologies, leading to innovation and intensifying competition. For instance, in October 2022, digital insurance company Lemonade entered the UK market in a long-term, strategic partnership with leading UK insurer Aviva, thereby marking its fourth market in Europe after France, Germany, and the Netherlands.

Sweden Digital Insurance Market Trends

Sweden digital insurance market is expected to grow at the fastest CAGR over the forecast period in the Europe digital insurance industry. In Sweden, digital insurance platforms are enhancing customer experience by guaranteeing convenient policy management, claims processing, and communication with insurers. This ease of access aligns with the specific preferences of the tech-savvy population, contributing to increased customer satisfaction and loyalty.

Key Europe Digital Insurance Company Insights

Key companies in the European industry market include Wefox Insurance AG, elipsLife AG, Oscar Health, Inc., Zego, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as product launches, and partnerships with other major companies.

-

Wefox Insurance AG is an insurance company that has grown into a digital insurance platform across Europe. The company operates through a unique model that connects consumers with insurance providers, enabling users to compare and manage their insurance products seamlessly. It serves over 2 million customers across five countries, including Germany, Switzerland, Austria, Italy, and Poland.

-

Oscar Health, Inc. is a health insurance company powered by its own differentiated full-stack technology platform. The company aims to transform the healthcare experience through technology-driven solutions, focusing on individual and small-group health plans. Oscar offers a range of insurance products, including individual and family plans available on health insurance marketplaces and small group plans for businesses with up to 50 employees.

Key Europe Digital Insurance Companies:

- Squarelife Insurance AG (Squarelife)

- Getsafe

- INZMO

- Lemonade, Inc.

- Wefox Insurance AG

- iptiQ Life S.A

- Alan Insurance

- elipsLife AG

- Oscar Health, Inc.

- Hedvig AB

- Zego

- Vitality

- Veygo

Recent Developments

-

In November 2024, iptiQ Life S.A. collaborated with Zurich Insurance to launch a fully digital life insurance solution, which leverages iptiQ Life S.A.’s innovative platform to facilitate automated medical underwriting. The solution can help Zurich Insurance’s customers purchase an individual term life insurance policy within 15 minutes.

-

In February 2023, Vitality announced three improved and new Serious Illness Cover products, namely Serious Illness Cover 2X, Serious Illness Cover 1X, and Serious Illness Cover 3X. All three products vary in terms of levels of cover. The product launch is anticipated to streamline the advice process for advisors while retaining the best features of Serious Illness Cover.

Europe Digital Insurance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 167.15 billion

Revenue forecast in 2030

USD 708.74 billion

Growth rate

CAGR of 33.5% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, insurance type, distribution channel, end-use, region

Country scope

UK; Germany; France; Italy; Spain; Sweden; Luxembourg; Poland; Czech Republic; Austria; Switzerland; Norway; Holland; Belgium

Key companies profiled

Squarelife Insurance AG (Squarelife); Getsafe; INZMO; Lemonade, Inc.; Wefox Insurance AG; iptiQ Life S.A; Alan Insurance; elipsLife AG; Oscar Health, Inc.; Hedvig AB; Zego; Vitality; Veygo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Digital Insurance Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe digital insurance market report based on component, insurance type, distribution channel, end-use and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Insurance Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Life & Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Tied Agents & Branches

-

Brokers

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual

-

Government

-

Business

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Luxembourg

-

Poland

-

Czech Republic

-

Austria

-

Switzerland

-

Norway

-

Holland

-

Belgium

-

-

Frequently Asked Questions About This Report

b. The Europe digital insurance market size was estimated at USD 128.14 billion in 2024 and is expected to reach USD 167.15 billion in 2025.

b. The Europe digital insurance market is expected to grow at a compound annual growth rate of 33.5% from 2025 to 2030 to reach USD 708.74 billion by 2030.

b. The U.K. dominated the Europe digital insurance market with a share of 10.28% in 2024. The rise of Insurtech startups in the U.K. is driving the adoption of new technologies, leading to innovation and intensifying competition.

b. Some key players operating in the Europe digital insurance market include Squarelife Insurance AG (Squarelife); Getsafe; INZMO; Lemonade, Inc.; Wefox Insurance AG; iptiQ Life S.A; Alan Insurance; elipsLife AG; Oscar Health, Inc.; Hedvig AB; Zego; Vitality; Veygo

b. Key factors that are driving the market growth include the growing digitization of the European insurance industry and the increasing shift toward innovative third-party service providers for efficient and quick access to new technologies and business models.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."