Europe Dietary Supplements Market Size, Share & Trends Analysis Report By Ingredient, By Form (Tablets, Capsules, Soft Gels, Powders), By End User, By Application, By Type, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-065-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Europe Dietary Supplements Market Trends

The Europe dietary supplements market size was valued at USD 40.73 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2030. The primary factors driving the market growth are increased awareness about healthcare, affordable/state-sponsored healthcare, a growing geriatric population, and a focus on preventive healthcare and personalized nutrition. Furthermore, consumers are shifting towards self-directed care driven by the growing personal health and well-being trend. Residents of the European Union are comparatively stricter and well-informed about nutrition and physical well-being.

Growing awareness about fitness among youngsters is therefore expected to increase the demand for energy and weight management supplements. The increasing acceptance of sports as a career is another factor expected to increase the demand for sports nutrition, which, in turn, benefits market growth. Furthermore, the rising number of social media influencers and wellness bloggers has had a significant impact on the market, with many consumers looking to these influencers for guidance on which products to use to support their health and well-being. The COVID-19 pandemic largely affected European countries, such as Italy, Spain, the UK, France, and Germany. The dietary supplement industry is largely concentrated in these regions.

This, in turn, benefitted from the situation as the market witnessed a surge in demand for immunity-boosting supplements. Many consumers in Europe are becoming more health-conscious and are seeking out natural and organic alternatives to conventional medicines. As a result, the demand for dietary supplements made from natural and organic ingredients is on the rise. Among dietary supplement manufacturers, R&D is touted as a key success factor, the challenge being that these require heavy investments. Also, stringent regulations regarding the health benefit claims and labeling of the products are expected to create challenges for dietary supplements from 2024 to 2030.

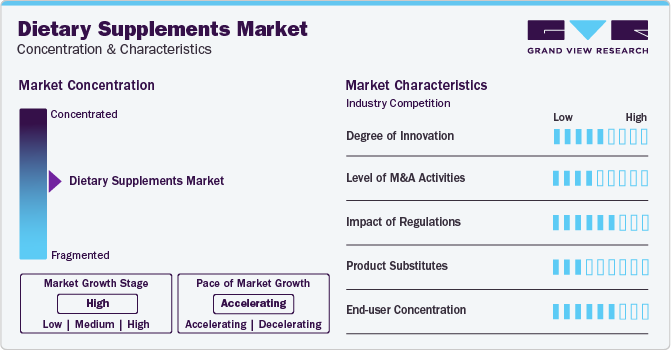

Market Concentration & Characteristics

The Europe dietary supplements industry has experienced a high degree of innovation attributed to evolving consumer preferences and technological advancements. Nanoencapsulation and microencapsulation technologies have gained popularity over the past few years owing to controlled release and minimum utilization of ingredients. Increasing application of encapsulation technologies in the fortification of food & beverage products is expected to tap new markets.

The Europe dietary supplements industry has witnessed a substantial level of mergers and acquisitions as companies seek to expand their product portfolios, enhance research and development capabilities, and gain access to new geographic markets. Acquisitions can allow dietary supplement companies to diversify their product portfolios. They can acquire companies specializing in different categories or applications, thereby reducing dependence on single player.

The Europe dietary supplements industry is regulated by various restrictions and regulations set up by the countries across the globe. Various regulations by FICCI, FDA and European Union on additives, ingredients, allergens and packaging is expected to hinder the growth of digestive health supplements market.

The Europe dietary supplements market exhibits a diverse end-user concentration, encompassing health-conscious individuals, fitness enthusiasts, and those seeking preventive healthcare solutions. With a growing awareness of holistic well-being, the market caters to a broad spectrum of consumers, ranging from aging populations seeking nutritional support to younger demographics embracing proactive health measures.

Ingredient Insights

Vitamins dietary supplements accounted for a share of over 29% of the Europe revenues in 2023. This is primarily attributed to growing new multivitamin supplement launches, growing consumer interest in overall wellness, and growing awareness about lifestyle disorders.

Protein & amino acids dietary supplements is anticipated to expand at a CAGR of 11.4% from 2024 to 2030. Increasing demand for protein supplements like whey powders and amino acid products like creatine, tyrosine, citrulline, and proline from consumers owing to the increasing awareness about health and diet is expected to drive the market from 2024 to 2030. Energy and weight management product manufacturers are recently focusing more on incorporating nutraceutical ingredients to enhance the nutritional value of the products. It has increased the demand for fibers and specialty carbohydrates that are indigestible by humans but help reduce cholesterol levels, weight management, and control blood sugar levels.

Probiotics Dietary Supplements Market

The manufacturers of prebiotics dietary supplements are capitalizing on the opportunity presented by the growing demand for digestive supplement products. For instance, in February 2021, Probiotics company Probi and health and wellness company Perrigo entered a semi-exclusive agreement to introduce premium probiotic digestive and immune health products across 14 European countries. Perrigo introduced three dietary supplements, including Probify Digestive Support for digestive function, Probify Daily Balance for immune system support and overall wellness, and Probify Travel Protect for maintaining gut flora while traveling.

Pre & Postbiotics Dietary Supplements Market

The market for prebiotics dietary supplements has been growing steadily owing to the recent ban on animal killings in the country is expected to contribute to the demand for prebiotics and postbiotics over the forecast period while restricting the demand for animal-based digestive enzyme supplements.

Form Insights

The tablets segment accounted for a share of over 32% of the Europe revenues in 2023. The higher prevalence of multivitamin products in the form of tablets owing to easy dosage, low cost, higher shelf life, and higher convenience is expected to positively impact the market from 2024 to 2030.

The Europe liquid dietary supplements market is anticipated to grow at a CAGR of 10.4% from 2024 to 2030. The growing demand for liquid dietary supplements in the sports nutrition sector is expected to boost the segment growth over the forecast period. The favorable growth of the health and wellness industry on account of the increasing application of natural health products for the treatment of cardiovascular disease and malnutrition is likely to drive the demand for liquid dietary supplements.

Application Insights

Energy & weight management supplements accounted for a share of over 31% of the Europe revenue in 2023. The growing obesity concerns in Europe are projected to drive the demand for weight management products. Consumers are shifting from traditional diet products with short-term benefits towards weight management products, which are associated with long-term satiety and appetite control. The growing penetration of supplements in households for weight monitoring and management is likely to widen the growth opportunities for the market.

Prenatal health supplements is anticipated to expand at a CAGR of 10.3% from 2024 to 2030. The sales of prenatal supplements have also risen globally due to increased promotional activities by manufacturers of these supplements and surged income levels of the masses. Manufacturers are launching various products owing to the increasing demand for prenatal supplements.

End-user Insights

Adults were the largest consumers of supplements with a revenue share of 45% in 2023. The demand for dietary supplements among adults are due to high health awareness among working professionals and athletes about the importance of maintaining a balanced diet, which creates a significant demand for dietary supplements to maintain general health. Changing lifestyles and hectic work schedules among working adults are leading to nutritional deficiencies, which are expected to lead to increased consumption of dietary supplements by adults. The increasing prevalence of obesity, cardiovascular diseases, diabetes, and other related conditions among adults in Europe is also expected to be the key factor driving the segment. Increasing acceptance of sports as a professional career among adults will further drive the demand for products like protein, vitamins, amino acids, and others from 2024 to 2030.

The infant segment is projected to grow at the fastest CAGR of 12.2% from 2024 to 2030. The high birth rates and rising population of young mothers in the region are factors likely to spur the demand for infant nutrition in the region. In addition, the growing consumption of packaged baby nutrition formulas owing to the increasing number of working mothers is anticipated to propel the demand for infant formulas in the region.

Type Insights

The OTC dietary supplements segment held the largest revenue share of around 73% in 2023. The consumer trend of self-directed health care is likely to drive the demand for OTC supplements. OTC supplements are often less expensive than prescription supplements, which can make them an affordable option for consumers. With the growth of e-commerce and online retailers, it has become easier for consumers to purchase dietary supplements online, which has contributed to segment growth.

Prescribed dietary supplements are projected to grow at a CAGR of 7.4% from 2024 to 2030. Prescribed supplements are manufactured with strict standards similar to that of pharmaceutical drugs. These supplements provide minimalistic side effects along with proper labeling. Strict regulation by the governing bodies and limited awareness among individuals related to labeling and health claims is expected to drive the sales of prescription-based dietary supplements. An increasing number of prescribed dietary supplements for individuals with nutritional deficiencies for the precise delivery of nutrients is expected to drive sales through prescription from 2024 to 2030.

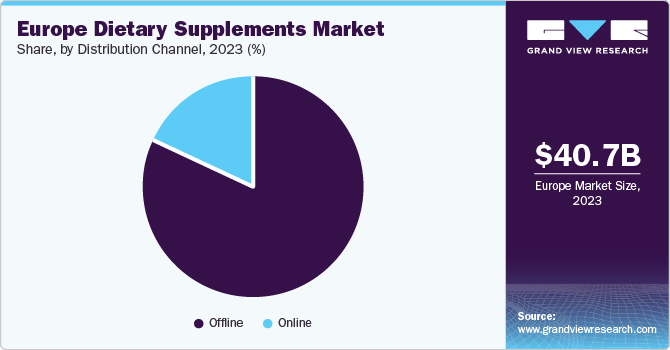

Distribution Channel Insights

Offline sales of dietary supplements accounted for over 82% of the overall revenues in 2023. Sales of dietary supplements through offline distribution channels are anticipated to witness steady growth owing to the flexibility of consumers as consumers get personalized attention from store staff which provides knowledgeable second opinions on the new products in the market. Furthermore, introduction of private label brands by retail channel players is expected to further boost the demand for dietary supplements markets.

The online segment is projected to grow at a CAGR of 8.0% from 2024 to 2030. Online retailing is the trending distribution channel in Europe as it promotes the sales of dietary supplements through mobile and user-friendly websites, e-mails, paid marketing, affiliate marketing, and paid promotions through e-commerce websites. The younger population prefers online shopping more than in-store purchases. The emerging private label supplement brands may have advantages by opting for online retailing as it is cost-effective. Also, it takes lesser time to reach maximum population across the region when compared to other marketing strategies.

Regional Insights

Italy Dietary Supplements Market

The dietary supplements market in Italy dominated the market in 2023 and accounted for the largest revenue share of 18.28% owing to the growing consumer base and growing trend towards preventive healthcare.

Spain Dietary Supplements Market

The dietary supplements market in Spain is anticipated to witness the highest CAGR of 7.8% from 2024 to 2030 owing to the increasing health consciousness and rising incidence of chronic diseases. Furthermore, global market players are expanding their business in Spain to meet the increasing demand for dietary supplements. In February 2023, ADM, a global leader in nutrition and ingredient solutions invested USD 30 million in a new facility in Spain to meet the growing demand for probiotics.

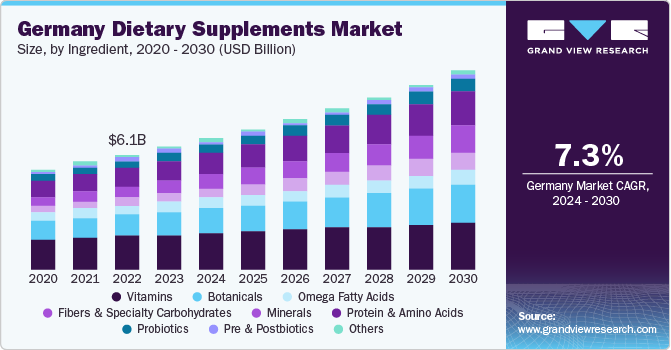

Germany Dietary Supplements Market

The dietary supplements market in Germany is fueled by the rising clinical evidence to support the benefits or effectiveness of these supplements in disease treatment and the maintenance of general health. Dietary supplements are being increasingly consumed in the country for the treatment of Inflammatory Bowel Disease (IBD), infectious diarrhea, and lactose intolerance.

UK Dietary Supplements Market

The manufacturers of dietary supplements market in the UK are focusing on innovating their product offerings to cater to a varied set of consumers in the country. For instance, Yakult Honsha, a Japan-based supplement manufacturing company, has been developing strains (patented) of microorganisms to stay ahead of the competition in the UK dietary supplements market.

France Dietary Supplements Market

The consumption trend of dietary supplements market in France is similar to that of most other countries in Europe. In this regard, consumers in France have principally preferred product consumption in the form of capsules and tablets. The growth of these segments (capsules and tablets) is being driven by the increase in prescriptions these product forms by medical practitioners.

Key Europe Dietary Supplements Company Insights

The market is fragmented and is expected to witness high competition among the companies owing to the presence of numerous players. Key players, such as Amway Corp., Reckitt Benckiser Group PLC, Abbott, NooCube, Mind Lab Pro (Performance Lab Group Ltd), Bayer AG, Glanbia plc, and many more are characterized as market leaders owing to several factors including a broad product portfolio and strong distribution network. Manufacturers have focused on strategies, such as investments, new product launches, expansions, and acquisitions.

Key Europe Dietary Supplements Companies:

The following are the leading companies in the Europe dietary supplements market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Europe dietary supplements companies are analyzed to map the supply network.

- Amway Corp.

- Reckitt Benckiser Group PLC

- Abbott

- NooCube

- Mind Lab Pro (Performance Lab Group Ltd)

- Bayer AG

- Glanbia plc

- Pfizer Inc.

- Archer Daniels Midland

- NU SKIN

- GlaxoSmithKline plc.

- Herbalife Nutrition Ltd.

- Nature's Sunshine Products, Inc.

- DuPont de Nemours, Inc.

- Nature's Bounty

- NOW Foods

- Intelligent Labs

Recent Developments

-

In September 2022, Cosmos Holdings, Inc., operating under the name Cosmos Health, announced that it has established an exclusive agreement with Mediprovita GbR for the sale of its proprietary line of nutraceuticals, Sky Premium Life, in Germany. The partnership with Mediprovita GbR will allow Cosmos Health to tap into this market and expand its presence in Europe.

-

In November 2022, NOW Foods partnered with TerraCycle, a recycling company, to divert its flexible packaging from landfills under its NOW Recycling Program. Consumers can collect 1 USD for every 1 pound of waste shipped to TerraCycle, which they can donate to a charitable, non-profit organization or school.

-

In September 2022, Neuriva, a cognitive health supplement brand under Reckitt, partnered with chef and food enthusiast Alton Brown to promote a holistic approach to brain health. Through this partnership, Alton Brown aimed to empower consumers to prioritize their brain health as an integral part of their overall well-being. As part of Neuriva's "Think Bigger" campaign, Alton Brown was featured nationally across various media platforms, including broadcast, digital channels, and social media.

Europe Dietary Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 43.48 Billion |

|

Revenue forecast in 2030 |

USD 65.43 Billion |

|

Growth rate (Revenue) |

CAGR of 7.0% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Ingredient, Form, Application, End User, Type, Distribution Channel and Region |

|

Country scope |

Germany; France; Italy; UK; Spain |

|

Key companies profiled |

Amway Corp.; Reckitt Benckiser Group PLC; Abbott; NooCube; Mind Lab Pro (Performance Lab Group Ltd); Bayer AG; Glanbia plc; Pfizer Inc.; Archer Daniels Midland; NU SKIN; GlaxoSmithKline plc.; Herbalife Nutrition Ltd.; Nature's Sunshine Products, Inc.; DuPont de Nemours, Inc.; Nature's Bounty; NOW Foods; Intelligent Labs |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe dietary supplements market report on the basis of product, form, end-user, application, type, distribution channel, and region:

-

Ingredient Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vitamins

-

Botanicals

-

Minerals

-

Protein & Amino Acids

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Pre & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft gels

-

Powders

-

Gummies

-

Liquids

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity, Cardiac Health

-

Diabetes, Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia, Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infants

-

Children

-

Adults

-

Pregnant women

-

Geriatric

-

-

Type Outlook (Revenue, USD Billion; 2018 -2030)

-

OTC

-

Prescribed

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies/Drugstores

-

Specialty Stores

-

Practitioners

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

Frequently Asked Questions About This Report

b. The Europe dietary supplements market was valued at USD 38.19 billion in 2022 and is projected to reach USD 40.73 billion in 2023.

b. The Europe dietary supplements market is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2023 to 2030, to reach USD 65.44 billion by 2030.

b. Italy accounted for the largest share of 18.34% of the Europe dietary supplements market revenue in 2022, owing to the growing consumer base and growing trend towards preventive healthcare.

b. Some of the key market players in the Europe dietary supplements market include Amway, Abbott, Bayer AG, Glanbia plc, Pfizer Inc., Archer Daniels Midland, GlaxoSmithKline plc., NU SKIN, Herbalife Nutrition, and Nature's Sunshine Products Inc.

b. Key factors driving the Europe dietary supplements market growth include increasing geriatric population, changing consumer habits, rising health consciousness, and shift from pharmaceutical to nutraceutical products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."