- Home

- »

- Medical Devices

- »

-

Europe Dermatology Devices Market Size, Report, 2030GVR Report cover

![Europe Dermatology Devices Market Size, Share & Trends Report]()

Europe Dermatology Devices Market Size, Share & Trends Analysis Report By Product (Diagnostic Devices, Treatment Devices), By End-use (Hospitals, Clinics), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-312-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Dermatology Devices Market Trends

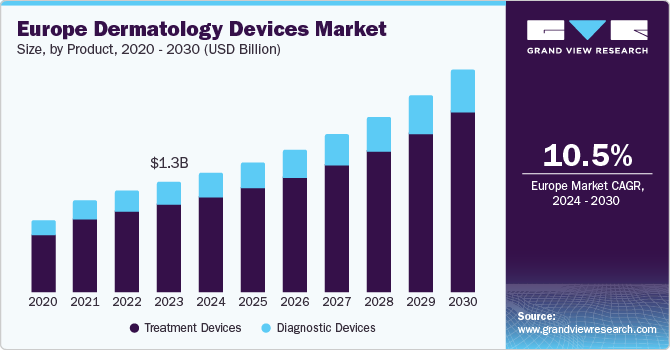

The Europe dermatology devices market size was estimated at USD 4.0 billion in 2023 and is projected to grow at a CAGR of 11.7% from 2024 to 2030. The growth is attributed to Europe's aging demographic prioritizing aesthetics and preventative care, leading to a surge in demand for devices addressing wrinkles, hyperpigmentation, and photodamage. In addition, rising disposable income and societal pressure around appearance are significant contributors to market growth. As individuals prioritize self-investment and aesthetics, the demand for dermatology devices that enhance appearance and well-being is anticipated to witness an upward trajectory in the coming years.

The Europe dermatology devices market accounted for a share of 26.0% of the global dermatology devices market revenue in 2023. The market in Europe is subject to a strict regulatory framework designed to ensure patient safety and device efficacy. The Medical Devices Regulation (MDR) 2017/745 is a key regulation that replaced previous directives in 2021. The MDR imposes stricter requirements for classifying devices, conducting clinical evaluations, and maintaining post-market surveillance. This can lengthen and complicate the approval process for new devices, potentially impacting innovation and launch timelines. However, these regulations also lead to a market with higher quality and more rigorously tested devices.

Product Insights

The treatment devices segment dominated the market with a share of 79.8% in 2023. This segment is expected to retain its position due to the continuous advancements in technologies like lasers, radiofrequency devices, and other therapeutic equipment. These advancements are enabling a wider array of effective and minimally invasive dermatological procedures, making treatment more accessible and appealing to a broader patient base. This segment's dominance is likely to persist as these technological innovations continue to reshape the landscape of dermatological treatment.

The diagnostic devices segment is projected to witness a CAGR of 10.8% from 2024 to 2030. This surge is attributed to the growing emphasis on early and accurate skin cancer detection. Furthermore, the rising adoption of advanced diagnostic technologies, such as confocal laser microscopy and digital mole mapping systems, is propelling the segment's growth.

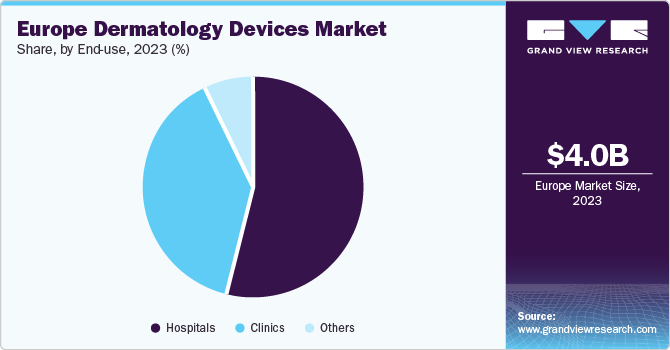

End-use Insights

The hospitals segment accounted for the largest revenue share of 54.2% in 2023. Hospitals serve as primary centers for diagnosing and treating various skin conditions, including skin cancers, psoriasis, and other dermatological disorders. Hospitals’ comprehensive infrastructure, specialized medical staff, and access to advanced diagnostic and treatment equipment make them key players in the dermatology devices market.

The clinics segment is predicted to grow rapidly in the coming years. The growing disposable income in European nations is expected to increase the demand for aesthetic procedures. The increasing focus on preventative healthcare encourages patients to seek early intervention for skin concerns, leading them to visit clinics for consultations and treatment.

Country Insights

Germany Dermatology Devices Market Trends

The dermatology devices market in Germany accounted for the largest market share of 34.3% of the total revenue in 2023. German manufacturers are renowned for their precision and quality in developing dermatology devices, particularly in segments, such as laser and cryosurgery devices. Their advanced technologies and commitment to innovation have solidified their position in the market.

UK Dermatology Devices Market Trends

The UK dermatology devices market is predicted to register a CAGR of 12.8% from 2024 to 2030. Technological advancements in skin care instruments have led to greater adoption of dermatology devices. Moreover, rising disposable income and a growing demand for quick and accurate diagnosis of skin disorders contribute to a rise in demand. With the growing importance of skin health and aesthetics, the country’s role in shaping the Europe regional market for dermatology devices remains pivotal.

Key Europe Dermatology Devices Company Insights

Some of the key players operating in the market include Alma Lasers, Ltd., Syneosite GmbH, Cutera, Inc., and Cynosure Inc.

-

Syneosite GmbH specializes in innovative dermatological solutions, including laser devices for hair removal, skin rejuvenation, and treatment of vascular lesions

-

Alma Lasers Ltd. manufactures laser and light-based medical aesthetic and therapeutic devices, including systems for dermatology, surgery, and ophthalmology

Key Europe Dermatology Devices Companies:

- Alma Lasers, Ltd.

- Cutera, Inc.

- Cynosure Inc.

- Syneosite GmbH

- Lumenis, Ltd.

- Solta Medical

- Bruker Corporation

- Carl Zeiss

- Candela Corporation

- Genesis Biosystems, Inc.

- TOOsonix A/S

Recent Developments

-

In February 2024, Cutera Inc. announced the commercial release of AviClear, the first energy-based device for the long-term treatment of mild, moderate, and severe acne

-

In May 2024, TOOsonix announced that their System ONE-M, which utilizes high-intensity focused ultrasound (HIFU) technology to treat common skin cancers and a wide range of dermatological diseases and conditions typically in a single session taking under 90 seconds, has been awarded CE certification according to the European Medical Device Regulation

-

In January 2024, investment firm Bridgepoint acquired RoC Skincare, a leading anti-aging cosmetics brand. This move strengthens Bridgepoint's presence in the European dermo-cosmetics market and positions them to capitalize on RoC's established brand recognition and growth potential

Europe Dermatology Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 8.6 billion

Growth rate

CAGR of 11.7% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Value & revenue forecast, competitive landscape, growth factors, trends

Segments covered

Product, end-use, country

Country scope

Germany; France; Italy; Spain; Switzerland; the Netherlands; Belgium; UK

Key companies profiled

Alma Lasers, Ltd.; Cutera, Inc.; Cynosure Inc.; Syneosite GmbH; Lumenis, Ltd.; Solta Medical; Bruker Corp.; Carl Zeiss; Candela Corp.; Genesis Biosystems, Inc.; TOOsonix A/S

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Dermatology Devices Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe dermatology devices market report based on product, end-use, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnostic Devices

-

Dermatoscopes

-

Microscopes

-

Other Imaging Devices

-

Biopsy Devices

-

-

Treatment Devices

-

Light Therapy Devices

-

Lasers

-

Electrosurgical Equipment

-

Liposuction Devices

-

Microdermabrasion Devices

-

Cryotherapy Devices

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

France

-

Italy

-

Spain

-

Switzerland

-

The Netherlands

-

Belgium

-

UK

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."