- Home

- »

- Network Security

- »

-

Europe Cyber Security Market Size, Industry Report, 2030GVR Report cover

![Europe Cyber Security Market Size, Share & Trends Report]()

Europe Cyber Security Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Security Type, By Solution, By Services, By Deployment, By Organization Size, By Verticals, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-291-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Cyber Security Market Size & Trends

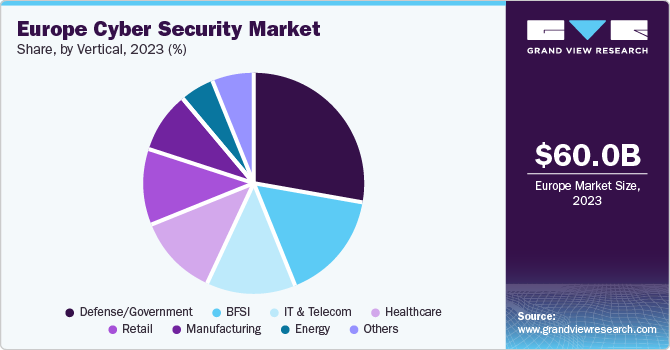

The Europe cyber security market size was anticipated at USD 60.0 billion in 2023 and is expected to grow at a CAGR of 12.3% from 2024 to 2030. An increase in the number of reported cyber-attacks across the world, the proliferation of e-commerce and online payment applications, the rapid adoption of smart devices and the deployment of the cloud have created an upsurge in demand for the cyber security market. In addition, the emergence of technologies such as the Internet of Things (IoT) and artificial intelligence is expected to result in increased cyber threats in upcoming years.

The Europe cyber security market held a 26.9% share of the global cyber security industry in 2023. The European market for cyber security is characterized by the existence of large technology solution providers that are based in the region and operate across the world. This has encouraged the growth of this industry in terms of innovation, the emergence of new technologies, intensive investments in R&D, constant product and service developments, worldwide deployments, and quality assurance.

With changing and advancing technologies, the cyber environment is becoming an enormously integrated system. This has developed a need for versatile, self-learning, and multifaceted security systems. Furthermore, the increasing adoption of smartphone-integrated technologies, an unceasing prevalence of electronic communication, growing response to social media platforms, a rise in online shopping through retailer websites and e-commerce platforms, and growing dependence of organizations and governments on Big Data have developed an undeniable need of defensive security systems that can be updated and empowered with latest technologies according to changing nature of cyber threats.

Component Insights

Based on component, services dominated the market and accounted for 58.2% of aggregated revenue in 2023. This is primarily due to the availability of suitable cyber security solutions diligently designed according to the organizational requirements and a growing inclination towards deploying solutions based on the organizational structure. With the emergence of computing technologies, almost every organization in the business manages huge amounts of data, company-owned resources, and network connectivity across numerous devices at the same time. This can be targeted by cybercriminals from any part of the world with the use of technologies. To avoid this potentially damaging scenario, many companies are subscribing to security services that can help them build robust structures of cyber security.

The hardware segment is expected to experience a CAGR of 12.7% from 2024 to 2030. Technologically advanced cybersecurity solutions provided by security vendors have created the need for high-end information technology infrastructure. Solutions based on artificial intelligence and machine learning cannot be operated with full potential without the presence of next-generation security hardware.

Security Type Insights

Based on security type, the infrastructure protection segment dominated the market and accounted for 26.0% of aggregated revenue in 2023. With the growing adoption of initiatives such as BYOD (bring your own device), the vulnerability of cyberattacks is expected to rise day by day. This has resulted in organizations actively tracking and managing the activities of users to maintain accountability and minimize the risk of security breaches.

The cloud security segment is expected to experience a CAGR of 15.9% from 2024 to 2030. This growth can be attributed to an increasing preference for cloud computing and significant cost-saving attained through the use of cloud-based platforms. An increasing number of organizations and governments migrating from other technologies to cloud-based platforms is leading to a surge in demand for cloud-based cyber security solutions. Detection, response and prevention of cyber-attacks are prime responsibilities of such solutions.

Solution Insights

Identity and Access Management (IAM) dominated the European cyber security industry in 2023. An increase in expenditure by organizations operating on a global scale and government agencies in order to ensure regulatory compliance is expected to fuel the growth of this segment in the upcoming years.

The Intrusion Detection Systems (IDS)/Intrusion Prevention Systems (IPS) segment is anticipated to experience a lucrative CAGR from 2024 to 2030 owing to increasing spending on IT security in the region, growing adoption of associated products, and more. These systems are preferred by users as they constantly monitor the entire traffic flow on the network while identifying malicious behavior at a rapid pace.

Service Insights

Based on services, professional services held a 73.6% share of the market in 2023. This can be attributed to factors such as an increase in demand for services such as enterprise risk assessment, physical security testing, cyber security defense, and penetration testing. These services are also adopted by organizations to train their employees in terms of IT security. These professional services are delivered by highly skilled professionals who diligently asses the business requirements as well as potential cyber threats and risks in order to deliver the most cost-effective and suitable versions of cyber security solutions.

Managed cyber security services are expected to experience a CAGR of 11.5% from 2024 to 2030. This is primarily due to the growing inclination toward adopting security solutions services provided by expert organizations instead of employing an in-house team for this function. These providers concentrate on improving overall operations while constantly observing patterns of potential threats and deploying suitable security solutions.

Deployment Insights

Based on deployment, the on-premises segment dominated the market and accounted for 58.7% of the aggregated revenue in 2023. An increase in inclination toward complete ownership of security solutions in order to ensure absolute data security has driven the growth of this segment. On-premise type of deployment reduces the dependency of companies on third-party organizations.

The cloud-based deployment segment is expected to experience a CAGR of 12.9% from 2024 to 2030. Factors attributing to this projected growth include high costs associated with on-premises deployment of cyber security solutions. In addition, increased inclination toward remote working post-pandemic period is driving the growth of this segment.

Organization Size Insights

Based on organization size, the large enterprise segment dominated the market in 2023. The large scale makes the cyber security measure imperative for these organizations while their capacity to invest huge amounts results in growing expenditure of cyber security solutions to ensure uninterrupted operations on a large scale. These companies possess storage equipment, several servers, endpoints and networks that are susceptible to potential cyber threats if not protected with the right security measures.

The Small and Medium Enterprises (SMEs) segment is expected to experience the fastest growth rate over the forecast period. In general, SMEs are constantly at risk of cyber-attacks due to the lower level of cyber security they employ with the limited resources they have. Furthermore, the absence of security policies and lack of related skills also creates an atmosphere where they are prone to cyber-attacks. To overcome such encounters, SMEs tend to invest in cyber security insurance as it defends them from terminal financial losses that can be caused by organized cyber-attacks or data breaches.

Vertical Insights

Based on vertical, the defense/government segment dominated the market and accounted for 28.5% of aggregated revenue in 2023. This is mainly due to the significance of security associated with the government’s sensitive data, intellectual property, electronic communications and records, and other intangible assets. Developed economies highly rely on digital technologies on these fronts. In the recent past, many incidents of cyber-attacks have been recorded which were initiated through security breaches and progressed into larger threats to data associated with national security. This has driven the demand for effective, multi-dimensional, and self-learning cyber security measures.

The healthcare segment is expected to experience a CAGR of 13.9% from 2024 to 2030. This can be attributed to the increasing adoption of technology in the healthcare industry, growing dependency on technology for data storage and management, inclusion of technology in the healthcare insurance industry, and the use of advanced technological solutions related to healthcare such as Electronic Health Records (EHR), The Internet of Medical Things (IoMT), robotics, digital health monitoring, wearables technology, medical devices run by technology, smart implants, etc.

Country Insights

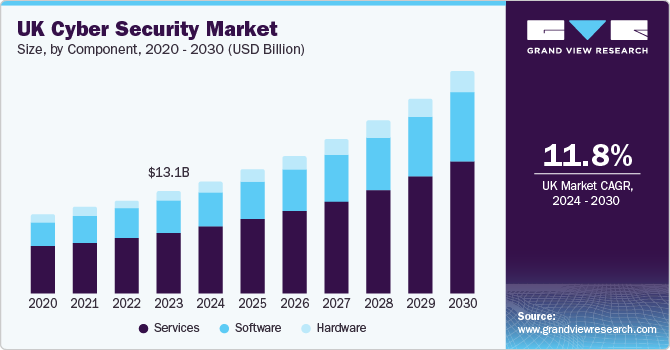

UK Cyber Security Market Trends

The UK dominated the market and accounted for 21.9% of aggregated revenue in 2023. The adoption of digital technologies and connected devices is growing at a rapid pace in the UK, while the adoption of digital technologies and connected devices has also been increasing. An increase in inclination toward remote and hybrid nature of work has driven the demand for security solutions equipped with advanced technologies.

France Cyber Security Market Trends

France cyber security market is expected to experience a CAGR of 14.1% from 2024 to 2030. It can be attributed to factors such as increased vulnerability associated with data due to the growing use of wireless networks and the rising use of the internet in the key countries of Europe region. In addition, in February 2022, France government introduced a brand new center for cybersecurity in Paris. This facility extends across 20,000 square meters and has 60 entities working in the cybersecurity space in its ownership share. This has brought cybersecurity specialists from reputed public companies and private sector organizations in France.

Key Europe Cyber Security Company Insights

Some of the key companies in the Europe cyber security market include Sophos Ltd., Darktrace Holdings Limited, F-Secure, STORMSHIELD, SHIELD AI Technologies Pte. Ltd. and others. In recent years, competition in this market has become intense, and companies have started adopting strategies such as new product deployments, innovation, enhanced client services, and collaborations.

-

Sophos Ltd., one of the leading companies in next-generation cyber security technologies, is a cyber-security solutions provider for many reputed organizations around the world. It offers products such as Next-Gen Antivirus, Endpoint Detection and Response (EDR), Zero Trust Network Access (ZTNA), Next-Gen Firewall Appliance, Email and Phishing Protection and services such as incident response, risk management, Managed Detection and Response (MDR) and operational support services.

-

Darktrace, founded in 2013 and emerging as a key company in the cyber security industry, is known for the inclusion of self-learning AI and machine learning technologies in its cyber security immune system products. The company has its offices across 30 offices worldwide.

Key Europe Cyber Security Companies:

- Sophos Ltd.

- Darktrace Holdings Limited

- F-Secure

- STORMSHIELD

- SHIELD AI Technologies Pte. Ltd.

- Bitdefender

- Bridewell

- SecurityHQ

- Hacken.io

- InfoGuard AG

Recent Developments

-

In May 2024, Sophos Ltd., a renowned next-gen cyber security solutions provider, announced its most recent distribution agreement with one of the leading technology platforms and trustworthy experts in cyber security, Infinigate. As its prime distributor in Europe, the Middle East, and Africa, Infinigate is expected to play a vital role in Sophos’s expansion plans on the UK cyber security market.

-

In April 2024, Darktrace, one of the global service providers in cybersecurity AI, launched its latest innovation-backed product, Darktrace ActiveAI Security Platform. Its newly launched product uses AI to convert cyber security operations from reactive nature to proactive nature which enhances the resilience to potential cyber threats.

Europe Cyber Security Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 134.4 billion

Growth Rate

CAGR of 12.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

Germany; France; Italy; Spain; UK

Segments covered

Component, security type, solutions, services, deployment, organization size, vertical, country

Key companies profiled

Sophos Ltd.; Darktrace Holdings Limited; F-Secure; STORMSHIELD; SHIELD AI Technologies Pte. Ltd.; Bitdefender; Bridewell; SecurityHQ; Hacken.io; InfoGuard AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Cyber Security Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe cyber security market report based on component, security type, solutions, services, deployment, organization size, vertical, and country:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Security Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Endpoint Security

-

Cloud Security

-

Network Security

-

Application Security

-

Infrastructure Protection

-

Data Security

-

Others (Wireless Security, Web & Content Security)

-

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Unified Threat Management (UTM)

-

IDS/IPS

-

DLP

-

IAM

-

SIEM

-

DDoS

-

Risk & Compliance Management

-

Others (Firewall, Antimalware, Antivirus)

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional Services

-

Risk and Threat Assessment

-

Design, Consulting, and Implementation

-

Training & Education

-

Support & Maintenance

-

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

Retail

-

BFSI

-

Healthcare

-

Defense/Government

-

Manufacturing

-

Energy

-

Others (Education, Media & Entertainment)

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

Frequently Asked Questions About This Report

b. Factors such as an increase in the number of reported cyber-attacks across the world, the proliferation of e-commerce and online payment applications, the rapid emergence and adoption of smart devices, and the deployment of the cloud have created an upsurge in demand for the cyber security market are driving the regional market growth

b. The Europe cyber security market size was estimated at USD 60.0 billion in 2023 and is expected to reach USD 66.1 billion in 2024

b. The Europe cyber security market is expected to grow at a compound annual growth rate of 12.3% from 2024 to 2030 to reach USD 134.4 billion by 2030

b. The services segment held the highest market share of 58.2% in 2023, it is attributed to the availability of suitable cyber security solutions diligently designed according to the organizational requirements and a growing inclination towards deploying solutions based on the organizational structure

b. Some key players operating in the Europe cyber security market include Sophos Ltd.; Darktrace Holdings Limited; F-Secure; STORMSHIELD; SHIELD AI Technologies Pte. Ltd.; Bitdefender; Bridewell; SecurityHQ; Hacken.io; InfoGuard AG

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.