- Home

- »

- Communications Infrastructure

- »

-

Europe Creative Software Market Size, Industry Report 2030GVR Report cover

![Europe Creative Software Market Size, Share & Trends Report]()

Europe Creative Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud, On-Premises), By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-291-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The Europe creative software market size was estimated at USD 2.37 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The market is driven by factors such as the increasing demand for digital content creation across various industries, including media and entertainment, advertising, design, and architecture. As businesses and individuals seek to enhance their digital presence and create engaging content, there is a growing need for sophisticated software tools that facilitate creativity and innovation.

Technological advancements, such as artificial intelligence and cloud computing, are driving the evolution of creative software solutions. These technologies enable enhanced features like automated workflows, predictive analytics, and real-time collaboration, which improve productivity and streamline users' creative processes.

The rise of remote work and distributed teams enabled the adoption of cloud-based creative software platforms. These platforms allow users to collaborate seamlessly from different locations and access their projects from any device. This flexibility and accessibility contribute to the growing popularity of Europe creative software solutions.

Government initiatives and funding programs aimed at supporting creative industries have also contributed to driving market growth. Investments in education, training, and research and development initiatives help foster talent and innovation in the creative sector, fueling demand for creative software solutions.

During the COVID-19 pandemic, there has been a notable increase in the utilization of free audio and video editing software. For instance, Adobe Inc. launched a complimentary trial for its Adobe Creative Cloud—a high-quality software for video editing and music production. With the pandemic-induced lockdowns prompting a surge in online activities, including content creation by online businesses, emerging YouTubers, and social media influencers, there's a growing demand for tools to enhance multimedia content.

The video and audio editing software providers are extending their free trial periods to meet this rising demand. This increase in the need for editing software can be attributed to the significant transition towards remote work setups. To cater to this trend, vendors offer more free tools, enabling customers to familiarize themselves with the software and potentially increase their adoption rates.

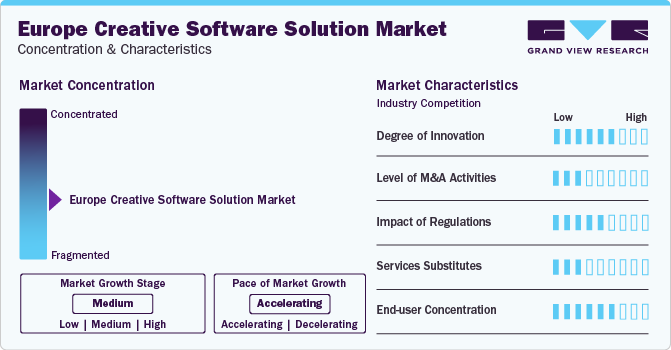

Market Concentration & Characteristics

The Europe creative software industry is significantly fragmented. Its growth stage is medium with an accelerating pace. Innovation plays a significant role in driving competition and differentiation within the industry. Companies continually strive to develop cutting-edge features and functionalities to meet evolving user needs and stay ahead of competitors. The degree of innovation in the market often determines companies' competitiveness and ability to attract and retain customers.

Regulations play a significant role in shaping the operating environment for companies in the European creative software industry. Regulatory frameworks govern various software development, distribution, and usage aspects, including data privacy regulations such as the General Data Protection Regulation (GDPR), copyright laws, and intellectual property rights protection. Compliance with regulations is crucial for companies to mitigate legal risks, ensure data security and privacy, and maintain the trust of their customers. Regulation changes can impact product development strategies, distribution channels, and industry entry considerations for companies operating in the region.

End-user concentration in the European creative software industry varies across different segments, including large enterprises, small and medium-sized businesses (SMEs), freelancers, and individual users. Each segment has distinct requirements, preferences, and purchasing behaviors, influencing product development and marketing strategies. Companies often tailor their products and services to target specific end-user segments, offering customized solutions, pricing plans, and support services to address their unique needs effectively.

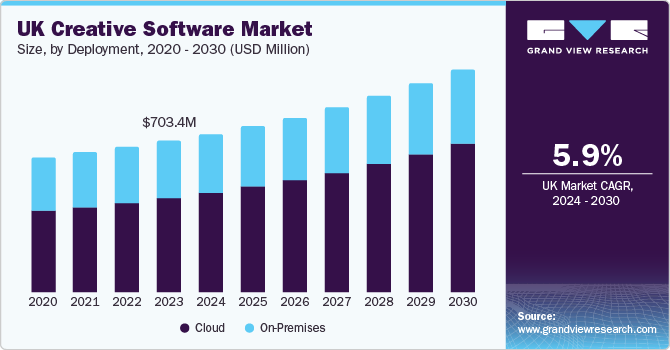

Deployment Insights

Based on deployment, the cloud segment held the largest market share of 64.5% in 2023 and is expected to witness the fastest CAGR during the forecast period. Innovative solutions and service providers offer cloud-based solutions to increase bandwidth and efficiency. Cloud-based deployment is utilized by streaming service providers over on-premises setup as it manages more significant amounts of data material and provides a better viewing experience. For instance, in September 2023, Adobe launched an AI-driven Creative Cloud, featuring its generative AI capabilities seamlessly integrated across various Adobe Creative Cloud applications such as Photoshop and Illustrator. Alongside, Creative Cloud paid plans encompass Firefly, a web application allowing users to explore AI-assisted creative works. Express Premium, an all-encompassing creativity application, offers novel generative AI functionalities such as text-to-image and text effects.

On-premises deployment is expected to grow at a significant CAGR during the forecast period. Large corporations are opting for this strategy because it enables them to preserve mission-critical data and enhance server data security. The category is anticipated to be driven by rising enterprise software and creative solutions spending during the projection period.

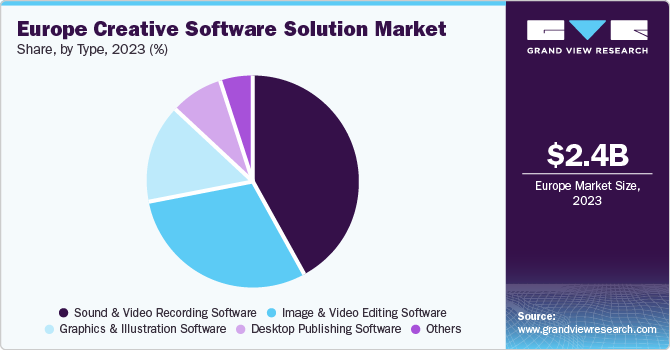

Type Insights

Based on type, sound & video recording software held the largest market share in 2023. Increased use of cloud-based solutions and the increasing digitization of television broadcasts are expected to drive considerable growth in the audio and video recording software market. In addition, the development of smartphones and other smart devices and increased broadcast channels are driving the segment's growth. In addition, the industry is expanding due to the development of OTT and streaming technologies.

Desktop publishing software is anticipated to grow at the fastest CAGR during the forecast period. The shift towards digital publishing and multi-channel distribution is fueling the adoption of desktop publishing software in Europe. With the rise of digital platforms, e-books, and online publishing, businesses, and publishers are adopting desktop publishing software solutions that support multi-channel publishing workflows. Desktop publishing tools that offer responsive design, HTML5 export, and integration with digital publishing platforms. It enables users to create content once and publish it across multiple channels, including print, web, mobile, and social media, driving demand for desktop publishing software.

Country Insights

The UK creative software market held the largest revenue share of 29.6% in the European region in 2023. The UK's commitment to supporting creative industries through government initiatives, funding programs, and incentives further accelerates the growth of the creative software solution market. Government agencies, such as the Department for Digital, Culture, Media and Sport (DCMS), and funding bodies, such as Innovate UK, provide financial support, grants, and tax incentives to creative businesses and startups to stimulate innovation, drive growth, and promote exports. This support ecosystem creates opportunities for software developers, startups, and established companies to innovate, collaborate, and commercialize their creative software solutions, driving growth and competitiveness in the European market.

The creative software market in France is expected to grow at the fastest CAGR during the forecast period. France's creative industries, encompassing sectors such as fashion, art, and publishing, are flourishing, creating a growing demand for advanced software tools to support content creation, editing, and distribution. Furthermore, government initiatives and investments to foster innovation and digital transformation in the creative sector contribute to the accelerated growth of the French market.

Key Europe Creative Software Company Insights

Some of the key companies operating in the Europe market are Autodesk Inc. and Blackmagic Design Pty. Ltd.

-

Autodesk, Inc. is a global software company that offers various suites of products and services catered to multiple sectors, including manufacturing, construction, media, education, architecture, engineering, and entertainment. With a broadened portfolio, Autodesk provides various software tailored for design, engineering, entertainment, and consumer applications. In manufacturing, Autodesk's digital prototyping solutions, such as Fusion 360, Autodesk Inventor, and the Autodesk Product Design Suite, are essential tools, enabling visualization, simulation, and analysis of real-world performance through digital models throughout the design phase.

-

Blackmagic Design Pty. Ltd. specializes in manufacturing products for feature film, post-production, and broadcast industries. The company is recognized for its focus on creative video technology and innovative solutions tailored for film and television professionals. Blackmagic Design offers a range of products, such as optical converters, image editing software, and other related technologies. With a strong commitment to quality and stability, the company has gained prominence in the industry by developing affordable, high-end quality editing workstations that leverage their software and hardware expertise.

Key Europe Creative Software Companies:

- Autodesk Inc,

- Blackmagic Design Pty. Ltd.

- MAXON COMPUTER GMBH

- Foundry

- Pixelogic

- MAGIX Software GmbH.

- Steinberg Media Technologies GmbH.

- Ableton AG

- Cascade Parent Limited

- Native Instruments

Recent Developments

-

In March 2024, Canva, the web-based graphic design platform, acquired Affinity, a creative software suite for professional photo editing. This strategic move enables Canva to address the requirements of designers across all proficiency levels, broadening its scope and enriching its array of AI-driven tools. By incorporating Affinity, which boasts 3 million users, Canva is poised to expand its presence in the professional design sector. This acquisition forms a key component of Canva's European expansion strategy.

-

In October 2021, Autodesk Inc. launched Fusion 360 extensions, specifically the Product Design Extension and the Simulation Extension, as part of its cloud-based 3D modeling platform. These extensions brought advanced customer product design and simulation capabilities, offering a significant advantage over traditional 3D modeling due to their algorithm-driven approach. The extensions allow users to explore infinite design variants quickly, optimize product performance based on specific needs, and access complex machining strategies, generative design, and additive manufacturing workflows.

Europe Creative Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.49 billion

Revenue forecast in 2030

USD 3.64 billion

Growth Rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, type

Country scope

UK; Germany; France

Key companies profiled

Autodesk Inc; Blackmagic Design Pty. Ltd.; MAXON COMPUTER GMBH; Foundry; Pixelogic; MAGIX Software GmbH; Steinberg Media Technologies GmbH; Ableton AG; Cascade Parent Limited; Native Instruments

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Creative Software Market Report Segmentation

This report forecasts revenue growth at region and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe creative software market report based on deployment, type, and country.

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Sound & Video Recording Software

-

Image & Video Editing Software

-

Graphics & Illustration Software

-

Desktop Publishing Software

-

Others

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

UK

-

Germany

-

France

-

Frequently Asked Questions About This Report

b. The Europe creative software market size was estimated at USD 2.37 billion in 2023 and is expected to reach USD 2.49 billion in 2024

b. The Europe creative software market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 3.64 billion by 2030

b. U.K. dominated the Europe creative software market with a share of 29.6% in 2023. The U.K.'s commitment to supporting creative industries through government initiatives, funding programs, and incentives further accelerates the growth of the creative software solution market.

b. Some key players operating in the Europe creative software market include Autodesk Inc, Blackmagic Design Pty. Ltd., MAXON COMPUTER GMBH, Foundry, Pixelogic, MAGIX Software GmbH., Steinberg Media Technologies GmbH., Ableton AG, Cascade Parent Limited, Native Instruments

b. Factors such as increasing demand for digital content creation tools across diverse industries and the growing emphasis on visual storytelling and brand communication are driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.