Market Size & Trends

The Europe consumer network attached storage market size was valued at USD 1.59 billion in 2023 and is projected to grow at a CAGR of 12.5% from 2024 to 2030. The major factors driving the adoption of network-attached storage (NAS) devices are the rapid digitalization in small and medium-sized businesses (SMEs) and the increased unstructured data. Businesses require centralized storage systems for the availability of data, and network attached storage (NAS) allows multiple users to share and store files over transmission control protocol (TCP) or internet protocol (IP) networks using an ethernet cable or Wi-Fi. A home user or small to medium-sized business requiring centralized file storage can use a consumer NAS.

The strong upsurge in data creation in the last few years has fueled the demand for high-capacity NAS devices. The high-quality media, home gadgets, and remote work culture necessitate secure and centralized storage options. Moreover, the increasing popularity of 4K and 8K streaming requires additional storage for buffering and downloaded material, making NAS devices perfect for increasing home entertainment experiences. The rising need for secure data storage, a data-driven lifestyle, and the increasing value placed on data privacy drive market growth.

A broad consumer base of electronic, telecommunication, automotive users, and other industries are searching for innovative solutions using artificial intelligence (AI). As a result, companies are mainly investing in AI technology. Continuous developments in AI result in the launch of consumer NAS products with enhanced data transfer rates and increased storage sizes for home offices and small businesses. The increasing need for consumer NAS systems with advanced features is creating substantial prospects for market expansion. Consumer NAS solution companies are dedicating resources to research and development to bring forth effective NAS solutions.

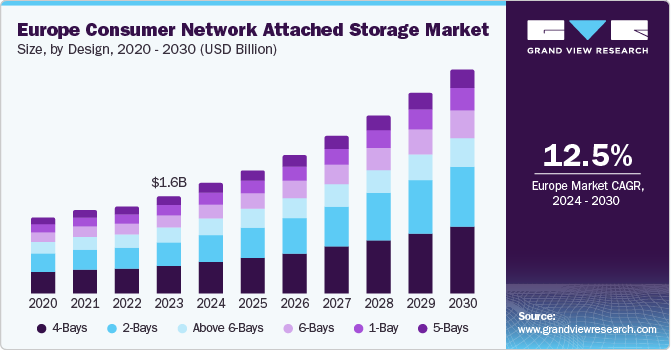

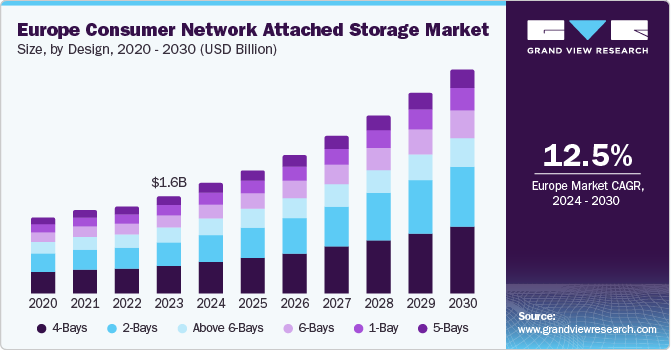

Design Insight

The 4-bays segment dominated the market and accounted for a share of 28.6% in 2023. The 4-bays design provides higher storage capacity to users than 1-bay or 2-bay models. This design allows customers scalability as users can increase their storage capacity by incorporating extra drives when required. With the growing digital media consumption and high-definition streaming services, personal libraries, and 4k content, users need additional space to store photos, videos, and music libraries, driving the market growth. The rise in remote work culture has created a demand for secure storage solutions centralized for use in home offices, creating more demand for 4-bay designs. Furthermore, as the volume of data generated increases, the importance of reliable backup options rises significantly.

The 2-bays segment is expected to register the fastest CAGR during the forecast period. The sector's growth is due to 2-bay consumer network attached storage devices providing improved security and storage space compared to 1-bay consumer. 2-bay devices are usually used by home users or individuals interested in creative fields such as photography, music, and video creation. Families with multiple devices such as laptops, tablets, and smartphones may find a 2-bay NAS useful for centralized storage and streaming media. 2-bay devices provide secure and centralized storage solutions for documents, spreadsheets, and other work files, which small offices and home office setups largely use. 2-bay devices are more economical than 4-bay consumer NAS devices. Various market participants provide consumer NAS devices with two bays. These companies continuously create and introduce new 2-bay devices to meet customer needs.

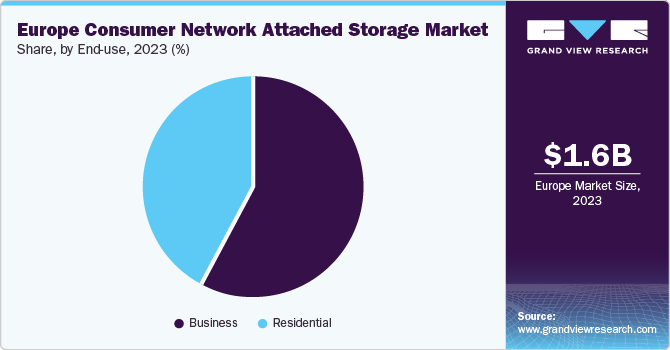

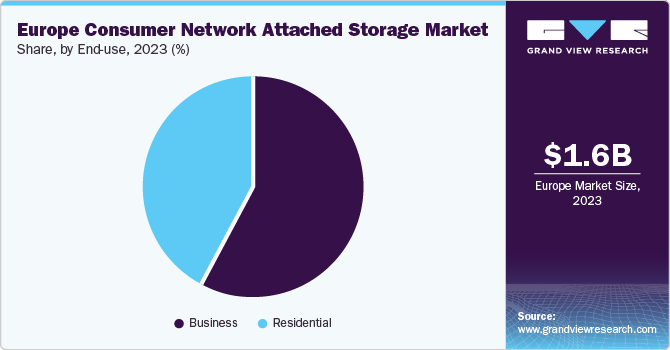

End Use Insights

The business segment dominated the market in 2023. The NAS devices cater to businesses with various features such as scalability, high-performance capabilities, advanced security, and data encryption to support a larger number of users and workloads. The factor attributed to the segment growth is that NAS devices provide businesses with secure and centralized data storage. These devices ensure effective file sharing and collaboration between employees within a workplace setting. It offers strong data backup options that help companies to recover from data loss incidents. Various industries require mandatory data security storage devices for business, and NAS devices comply with these requirements.

The residential segment is expected to register the fastest CAGR during the forecast period due to the rise in remote work culture, which requires secure and easily accessible data storage for work documents. The growing demand for high-definition streaming services such as Netflix and Hotstar requires NAS devices as they offer seamless streaming across the entire home network. The matured technology behind NAS devices makes them affordable for the average European household. The wider accessibility of these devices fuels market growth.The increasing creation and consumption of data such as photos, videos, music libraries, and even smart home devices contribute to the segment growth.

Country Insights

The European consumer NAS market is experiencing a surge due to increased high-definition media, remote work requirements, and rising privacy concerns. The key European tech firms are leading the market by investing in research and development to create advanced NAS solutions that offer ample storage capacity, robust security, and smooth media streaming. These innovations directly benefit the consumer.

The UK consumer NAS market dominated in 2023 due to the presence of major key players and the tech-savvy population in the country. A strong focus on data privacy and security among users drives the UK market growth. Consumers' early adoption of new technologies is driving the country's market.

Key Europe Consumer Network Attached Storage Company Insights

Some of the key companies in the Europe consumer network attached storage market include ASUSTOR Inc., Buffalo Americas, Inc., NETGEAR, QNAP Systems, Inc., and Synology Inc. Major players in the market are focusing on providing technologically advanced NAS solutions to large organizations and small businesses. Organizations are providing cost-effective solutions to increase their customer base.

-

QNAP Systems, Inc., the producer of Network-Attached Storage (NAS) appliances, provides high-quality NAS products for both home and business users, offering solutions for storage, backup, virtualization, teamwork, multimedia, and additional features. QNAP sees NAS as more than just a place to store data. It has developed various innovations to inspire users to run the Internet of Things, artificial intelligence, and machine learning projects on their QNAP NAS.

-

ASUSTOR Inc., a subsidiary of ASUS, offers private cloud storage and video surveillance solutions. The company also develops and integrates associated firmware, hardware, and applications.

Key Europe Consumer Network Attached Storage Companies:

- ASUSTOR Inc.

- Buffalo Americas, Inc.

- NETGEAR

- QNAP Systems, Inc.

- Synology Inc.

- Thecus Technology Corporation

- Western Digital Corporation

- Zyxel Communications Inc.

Recent Developments

-

In July 2024, ASUSTOR Inc. introduced backing for PaperOffice, a document management system (DMS) that provides users with a productive platform for storing and managing documents efficiently. It boasts a wide range of features and great management effectiveness.

-

In March 2024, Buffalo Americas, announced the TeraStation 5020 series and the 71210RH series network storage are FIPS 140 CAVP validated after the most recent firmware update.FIPS 140 is an essential standard for cryptography that guarantees the security and confidentiality of sensitive information.

Europe Consumer Network Attached Storage Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 1.81 billion

|

|

Revenue forecast in 2030

|

USD 3.66 billion

|

|

Growth Rate

|

CAGR of 12.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

December 2024

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Design, end use

|

|

Country scope

|

UK, Germany

|

|

Key companies profiled

|

ASUSTOR Inc.; Buffalo Americas, Inc.; NETGEAR; QNAP Systems, Inc.; Synology Inc.; Thecus.COM; Western Digital Corporation; Zyxel Communications Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Europe Consumer Network Attached Storage Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe consumer network attached storage market report based on design, end use, and country:

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

1-Bay

-

2-Bays

-

4-Bays

-

5-Bays

-

6-Bays

-

Above 6-Bays

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Country Outlook (Revenue, USD Million, 2018 - 2030)