- Home

- »

- Advanced Interior Materials

- »

-

Europe Construction Connectors Market Size, Report, 2030GVR Report cover

![Europe Construction Connectors Market Size, Share, Trends Report]()

Europe Construction Connectors Market (2024 - 2030) Size, Share, Trends Analysis Report By Connector Type, By Product (Truss Connectors And Others), By Application, By Installation Type, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-319-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The Europe construction connectors market size was estimated at USD 304.6 million in 2023 and is projected to grow at a CAGR of 11.5% from 2024 to 2030. An increase in expenditure by European countries on modern infrastructure and buildings is anticipated to be opportunistic for market growth in the upcoming years. Wood, having an eco-friendly nature, is one of the most prominent materials used for construction due to its reduced carbon consumption and CO2 emissions. Concerns over building safety regulations by various European countries are driving the adoption of high-quality construction connectors.

Construction connectors are crucial in enhancing the building and infrastructure's durability, strength, and longevity. The safety of these buildings and the prevention of various structural failures depict the importance of the connectors. Germany is the leading construction market in Europe and already has multiple projects in line that are due for completion in the coming years. For instance, the Hamburg Youth Center Development project in Billwerder, Hamburg, was started in Q4 of 2023 and is expected to be completed by Q1 2027. Such projects provide significant opportunities for the market.

The COVID-19 pandemic significantly impacted the construction connectors market, disrupting the regional supply chain. As a substantial market and hub for construction activities, Europe faced challenges in sourcing construction connectors and other materials. Many projects were put on hold as investors and developers reassessed their financial viability amidst the economic uncertainties.

Market Concentration & Characteristics

The Europe construction connectors industry is significantly fragmented in nature. However, the growth stage of the industry is high, and the pace of industry growth is accelerating. Due to new infrastructural developments and urbanization, the construction connectors industry is expected to grow rapidly in the European market. Emerging trends in using eco-friendly materials such as wood for construction are expected to boost the demand for wood construction connectors. For instance, in France, a wood construction-promoting policy was adopted in February 2020, stating that half of the materials used in constructing public infrastructure should be made of wood. This initiative boosts the use of wood and reduces carbon footprint, thus contributing to the growth of the construction connectors industry in the region.

The degree of innovation in the construction connectors industry is relatively high, as the manufacturers must keep up with the changing trends in the construction industry. For instance, in February 2022, Pryda invented FastFix, a new type of screws that are used as connectors during construction and are comparatively easy and fast to fix.

The impact of regulation on the connectors industry is high due to various policies and safety standards being implemented by governments. The European Union formed Construction Products Regulations (CPR) that ensure the durability and stability of products used to construct European buildings. These regulations cover all construction materials such as tools, timber, connectors, cables, and others.

Companies such as Simpson Strong-Tie Company, Inc., MiTek, Inc., Knapp GabH, and others have adopted multiple strategies, which include new product developments, expansions, innovations, and new technologies to maximize their market share. Continuous R&D investments are necessary to be up to date with the trends in the industry.

Connector Type Insights

The market is segmented into wood construction connectors and other connectors based on connector types. Wood construction connectors have been further bifurcated into engineered wood connectors and others. Wood construction connectors accounted for the largest revenue share of 81.5% in 2023. These connectors are essential to support various wood structural systems, from wood-to-wood, wood-to-concrete, or masonry connections. The rising demand for sustainable and environmentally friendly materials in construction is driving the demand for wood construction connectors.

Other segments include joint hangers, outdoor accents, framing angles & bearing plates, and other standard connectors. The segment is expected to capture a significant CAGR during the forecast period as they provide stability and are essential components in construction projects. These connectors ensure structural integrity and safety, which is crucial for infrastructural developments.

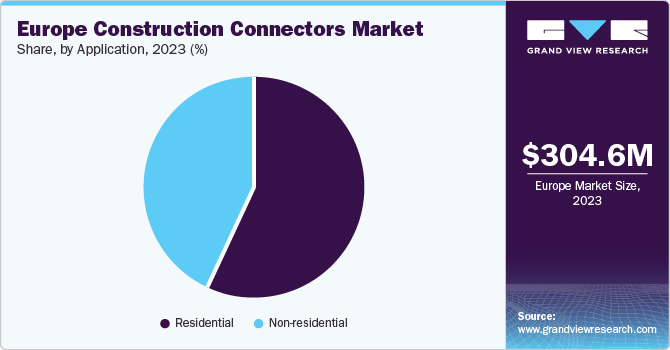

Application Insights

Based on application, the market is bifurcated into residential and non-residential segments. The residential segment held the largest market share in 2023 and is expected to maintain its dominance during the forecast period. Increasing urbanization and population have led to housing shortages in Europe, thus increasing the demand for new constructions across Europe. For instance, the UK government aims to provide more than 300,000 new homes to the people due to a nationwide housing crisis. Cities such as London and Brighton are facing major crises.

The non-residential segment is anticipated to grow at a significant CAGR over the forecast period. Major commercial developments planned by the government and regional industries are anticipated to drive the market demand in the non-residential segment. For instance, Poland is set to launch the Central Communication Port in Warsaw, which will be the largest airport in the country by 2027. The Central Communication Port consists of an airport, a high-speed rail, and a highway that link up with the rest of the country.

Product Insights

Based on product type, truss connectors accounted for a significant market share in 2023. These connectors maintain the framework's stability and are generally made of wood or steel. Buildings with suspended ceilings are usually connected with trusses to improve their lifespan and take on heavy loads. Manufacturers offer versatile and adaptable truss connector options to cater to a broader range of end-users.

The others segment include deck and fence connectors, holdowns and tension ties, and rigid tie. The segment is expected to grow at the fastest CAGR during the forecast period. Deck and fence connectors are core elements for attaching fencing and other outdoor projects. In contrast, holdowns and tension and rigid tie provide a secure and stable connection to withstand heavy loads. Increasing focus on the safety and security of the respective constructions by the construction and infrastructure industries is expected to fuel the market growth of this segment.

Installation Type Insights

Based on installation type, the market is segmented into professional installations and do-it-yourself (DIY). The professional installations segment dominated the market in 2023 and is expected to maintain its dominance during the forecast period. The key factors driving the demand for construction connectors in professional installations are the increasing focus on building sustainable constructions and the growing emphasis from architects, builders, and sustainability advocates to build aesthetically pleasing buildings. Additionally, rapidly changing preferences in commercial construction and the increasing need to speed up the construction process further fuel the demand for wood construction connectors in professional installations. It additionally creates a need for timber construction connectors to ensure the structural integrity of these buildings.

The do-it-yourself (DIY) segment is anticipated to grow at a significant CAGR over the forecast period. The DIY segment in the construction connectors market is significantly increasing, and companies are making DIY kits for enthusiasts who undertake construction projects independently. For instance, Dua Lima Retail Private Limited provides toolbox kits of connectors and other necessary tools for construction purposes in its retail outlets, MR. DIY.

Country Insights

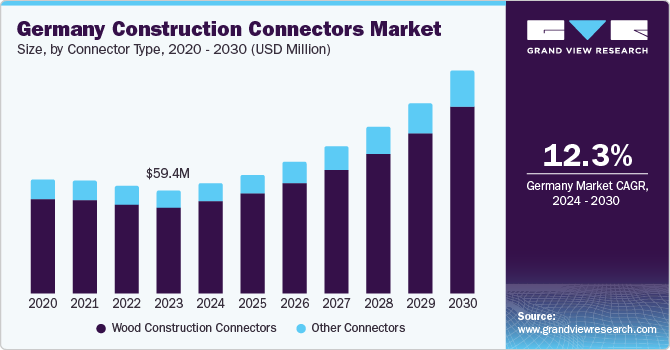

Germany Construction Connectors Market Trends

Germany accounted for the largest market share of 19.5% in the construction connectors market in 2023 and is expected to grow at a significant CAGR during the forecast period. The government of Germany has taken several initiatives to develop and support the country's construction industry. For instance, the Fehmarn Belt tunnel, a submerged 18-kilometer-wide tunnel between Denmark and Germany, started in January 2021 and is set to open by 2029.

UK Construction Connectors Market Trends

The UK accounted for a significant market share in 2023 and is expected to grow at a significant CAGR over the forecast period. The demand for construction connectors is rising due to various new development projects in the country. For instance, High-Speed Rail 2 (HS2), the largest transport infrastructure in the UK, is an under-works project that commenced in 2018 and is planned to be completed by 2033. These projects provide significant growth to the connectors market.

Sweden Construction Connectors Market Trends

Sweden is anticipated to grow at the fastest CAGR of 12.7% during the forecast period due to an increase in the construction sector. Various projects are initiated nationwide, including residential buildings and large-scale infrastructure developments. These projects are part of the country's effort to address housing shortages, improve infrastructure, and transition towards more sustainable and environmentally friendly construction practices.

Key Europe Construction Connectors Company Insights

Some of the key companies operating in the Europe construction connectors market are Simpson Strong-Tie Company, Inc., BeA Fastening Systems Ltd., and others.

-

Simpson Strong-Tie Company, Inc. is a manufacturing company that provides structural connectors, anchors, and other building fasteners. The company mainly focuses on strengthening various wood-to-wood connections through various wood connectors. Over the years, the company has introduced new product lines and a wide range of products for commercial, industrial, and residential construction projects.

-

BeA Fastening Systems Ltd. is one of the key manufacturers of construction connectors and industrial fasteners. The company offers one of the highest quality fasteners, such as nails, screws, wood connectors, and others. BeA Fastening Systems Ltd. is constantly expanding its logistics capacities across Germany to provide fast, effective, and efficient service to its end users.

Key Europe Construction Connectors Companies:

- BeA Fastening Systems Ltd.

- BPC Building Products Ltd.

- BTS Befestigungselemente-Technik GmbH

- Cullen Timber Engineering Connectors

- E.u.r.o.Tec GmbH

- GH Baubeschlöge GmbH

- Knapp GmbH

- MiTek, Inc.

- pgb-Polska

- Pitzl Metallbau GmbH & Co. KG

- Simpson Strong-Tie Company, Inc.

Recent Developments

-

In February 2024, Knapp GmbH added the Megant S connector under its Mass Timber Construction product offerings. It is suited for structures that need protection from high-power transmissions and prevent tensions in the connected components. The product's innovative design provides a hinged connection and can transmit extreme loads.

-

In January 2024, BPC Building Products Ltd. launched engineered restraint straps, HX and VX. Compared to the conventional restraint straps, the new connectors are easy to install and handle. The products suit multiple purposes, such as tying timber roofs and floors into masonry walls.

-

In April 2022, Simpson Strong-Tie Company Inc. announced the acquisition of ETANCO GmbH, one of the well-known manufacturers of connectors and fixing solutions in Europe. This acquisition enabled Simpson Strong-Tie Company Inc. to enhance its product portfolio and reach new customers across Europe.

Europe Construction Connectors Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 304.6 million

Revenue forecast in 2030

USD 621.2 million

Growth rate

CAGR of 11.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Connector type, product, application, installation type, country

Country scope

Germany; UK; France; Italy; Spain; Denmark; Belgium; Netherlands; Poland; Switzerland; Austria; Sweden; Portugal; Norway; Ireland

Key companies profiled

BeA Fastening Systems Ltd; BPC Building Products Ltd.; BTS Befestigungselemente-Technik GmbH; Cullen Timber Engineering Connectors; E.u.r.o.Tec GmbH; GH Baubeschlöge GmbH; Knapp GmbH; MiTek, Inc.; pgb-Polska; Pitzl Metallbau GmbH & Co. KG; Simpson Strong-Tie Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Construction Connectors Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Europe construction connectorsmarket research report based on the connector type, product, application, installation type, and country:

-

Connector Type (Revenue, USD Million, 2018 - 2030)

-

Wood Construction Connectors

-

Engineered Wood

-

Others

-

-

Other Connectors

-

-

Product (Revenue, USD Million, 2018 - 2030)

-

Truss Connectors

-

Others

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Installation Type (Revenue, USD Million, 2018 - 2030)

-

Do-it-yourself

-

Professional Installation

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Belgium

-

Netherlands

-

Poland

-

Switzerland

-

Austria

-

Sweden

-

Portugal

-

Norway

-

Ireland

-

Frequently Asked Questions About This Report

b. The Europe construction connectors market size was estimated at USD 304.6 million in 2023 and is expected to reach USD 323.3 million in 2024.

b. The Europe construction connectors market is expected to grow at a compound annual growth rate of 11.5% from 2024 to 2030 to reach USD 621.2 million by 2030

b. The residential application segment led the market and accounted for over 57.0% share of the revenue in 2023. The growth of this segment of the market can be attributed to the increasing timber-based construction of low- to medium-sized single-family and multifamily homes.

b. Some of the key players operating in the Europe construction connectors market include Simpson Strong-tie Company, Inc., MiTek, Inc., E.u.r.o.Tec GmbH, BPC Building Products Limited, Cullen Timber Engineering Connectors, GH Baubeschloge GmbH, Pitzl Metallbau Gmbh & Co. KG, BeA Timber Connectors, BTS Befestigungselemente-Technik GmbH.

b. The key factors that are driving the Europe construction connectors market include increasing product penetration across residential and non-residential construction is expected to contribute to the overall growth of the market in the region over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.