Europe Computer Numerical Control Machine Market Size, Share & Trends Analysis Report By Type (Lathe Machines, Milling Machines, Laser machines, Grinding Machines, Others), By End-use (Automotive, Power & Energy), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-905-0

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

The Europe computer numerical control machine market size was valued at USD 24.09 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. The growth of the market can be attributed to the increasing demand for computer numerical control (CNC) machines from automotive manufacturers. The growing preference for automation to reduce overall operating costs also bodes well for the growth of the market. The strong emphasis of various industries, including aerospace & defense and automotive, toward mass production is driving the adoption of automatic machines.

Advancements in technology, which can potentially help in reducing the machining time, are also expected to contribute to the growth of the market. The progressing energy industry, particularly in France, which is driving the need for precision and accuracy while manufacturing parts, such as rotor shafts and turbines, is expected to play a vital role in the growth of the market. At the same time, innovations in wireless communication technology have integrated IoT compatibility with computer numerical control machines, thereby adding to the convenience of the end-users and contributing to the growth of the market.

The growing preference for automation and the fast-paced adoption of the latest technologies and computer-aided manufacturing (CAM) and CNC techniques are expected to drive the demand for CNC machines in Europe. Research funding schemes being announced by various governments in collaboration with universities are also encouraging companies to pursue R&D activities, thereby ensuring greater prospects for the growth of the market. The presence of various technology developers and manufacturers of high-end machining centers required for milling, boring, pressing, bending, cutting, and several other operations also bodes well for the growth of the CNC machines market in Europe.

Manufacturers of CNC machines are focusing on the latest advancements in the field of software to enhance the connectivity of machines as part of the efforts to add to the convenience of operators and improve the flexibility of machining shop floors. Several companies are increasingly investing in R&D activities to improve the machine design to reduce the floor space machines occupy and allow multiple operations to be carried out by the same machine, thereby improving the productivity of the machining shop. For instance, in 2020, Biesse Group, a manufacturer of CNC machines, invested around USD 35 million in research and development activities, including technology upgrades, new product development, and updates to existing products.

However, despite the advantages CNC machines can offer over conventional machines, the high purchasing and maintenance costs associated with CNC machines are expected to restrain the growth of the market over the forecast period. The safety regulations for such machines, such as mandatory dry runs of the machines, are also expected to hinder the growth of the market to a certain extent. The significant investments required for training the existing machine operators to operate modern CNC machines are also emerging as another potential market restraint. Nevertheless, CNC machine vendors, such as The Shoda Company; Haas Automation, Inc.; and SCM Group are responding to the situation by offering various training programs.

End-use Insights

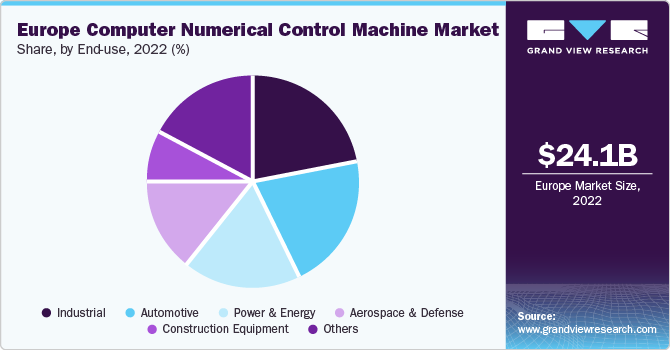

The industrial segment accounted for the largest revenue share of around 21.6% in 2022. CNC machines are particularly used by incumbents of the industry verticals that involve manufacturing, metal cutting, metal removing, fabrication, and other machining operations to perform the machining of workpieces. CNC machines can potentially improve the productivity of manufacturing units and reduce operational costs significantly, thereby driving the market demand.

The automotive segment is estimated to register the fastest CAGR of 10.5% over the forecast period. Europe is considered the automotive hub of the world. The presence of major automotive manufacturers in European countries, such as Germany, France, Italy, and the U.K., is primarily driving the demand for CNC machines across Europe. CNC machines can help in producing high-value parts with accuracy and machining intricate parts without employing any additional resources. Hence, the demand for computer numerical control machines from the incumbents of the power and energy industries is also increasing significantly.

Type Insights

The lathe machines segment accounted for the largest revenue share of 28.4% in 2022. Lathe machines have wide-ranging applications across various industry verticals owing to their exceptional features and the ability to function in all kinds of rotating surfaces. Lathe machines can perform various operations, such as knurling, drilling, chambering, and reaming, among others.

The milling machines segment is expected to expand at the fastest CAGR of 10.1% during the forecast period. Milling machines aid in the process of metal removal while improving the accuracy of machining. The ability of milling machines to perform operations on slots, gears, shafts, spiral surfaces, and several other curved surfaces is expected to drive the demand for milling machines over the forecast period. The demand for winding machines is also expected to expand remarkably over the forecast period. Winding machines are typically used for the production of motors, transformers, and solenoids.

Country Insights

Rest of Europe dominated the Europe computer numerical control machine market and accounted for the largest revenue share of 39.4% in 2022. Europe has a large railway network, and hence, computer numerical control machines are used extensively in Europe for machining steel plate wheels and frames of rail cars, among other parts. The rapid growth in energy industry also contributes to the CNC machine market growth in Europe.

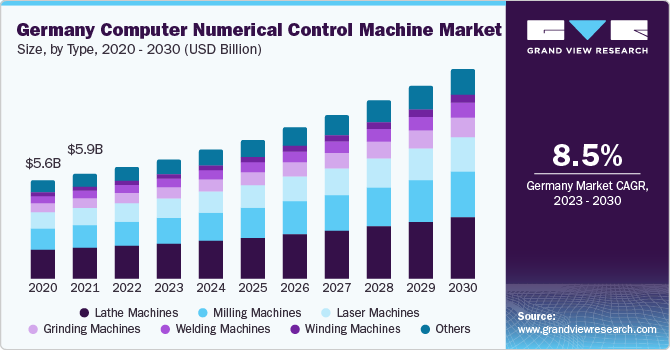

Germany is expected to expand at the fastest CAGR of 8.5% over the forecast period. Incumbents of various industry verticals based in Germany are putting a strong emphasis on automation and are hence adopting CAM and CNC techniques. The German government is encouraging companies to collaborate with universities and pursue R&D activities.

Italy is expected to witness significant growth during the forecast period. The growth can be attributed to the rising demand for computer numerical control machines from the manufacturing industry in Italy. The Italian manufacturing industry includes a few multinational companies and several SMEs. Meanwhile, the growth of the CNC machines market in France can be attributed to the flourishing energy industry in the nation. Parts, such as turbines, which form an inseparable part of the energy industry, need to be machined with high accuracy.

Key Companies & Market Share Insights

The leading players in the market are undertaking strategies such as product developments, mergers and acquisitions, strategic partnerships, and business expansions to maintain their foothold on the market. For instance, in April 2023, Okuma America Corporation introduced a new business segment dedicated to providing comprehensive support for manufacturing production line systems. This newly established division aimed to recommend, sell, and offer assistance for integrated solutions consisting of Okuma CNC machine tools and advanced automation technologies. By launching this division, Okuma strengthened its ability to deliver a wide variety of Okuma machine tools paired with suitable automation systems, ensuring optimal solutions tailored to the specific needs of customers.

Key Europe Computer Numerical Control Machine Companies:

- AMADA MACHINERY CO., LTD.

- AMERA.SEIKI

- DMG MORI CO., LTD.

- General Technology Group Dalian Machine Tool Co., Ltd.

- FANUC CORPORATION

- Haas Automation, Inc.

- Hurco Companies, Inc.

- Okuma Corporation

- Shenyang Machine Tool Part Co., Ltd.

- Yamazaki Mazak Corporation

Recent Developments

-

In March 2023, AMADA PRESS SYSTEM CO. launched the ‘LM-16A’. The LM-16A is a wire rotation torsion spring machine equipped with a wire-rotating mechanism, eight processing slides, and 15-axis control. This machine specializes in the production of torsion springs but can also handle various wire processing forming tasks such as extension, compression, and other spring forms. The LM-16A stands out as the first of its kind in the industry to feature a double-swing axis, enabling numerical control of the lateral movement of the processing slides.

-

In December 2020, Mazak Corporation unveiled the QT-Ez Series, a brand-new lineup of CNC turning machines designed and manufactured in Kentucky. This series provides job shops and manufacturers an affordable access to Mazak's advanced technology and engineering expertise. The QT-Ez Series encompasses a diverse range of turning centers, including models with multi-tasking capabilities.

-

In November 2020, AXYZ Tailored Router Solutions, a division of AXYZ Automation Group based in Burlington, Canada, introduced the Innovator NC router as a replacement for the previous Z-Series model. The Innovator serves as an entry-level machine designed to cater to the needs of various industries.

Europe Computer Numerical Control Machine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 25.77 billion |

|

Revenue forecast in 2030 |

USD 44.16 billion |

|

Growth rate |

CAGR of 8.0% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, country |

|

Regional scope |

Europe |

|

Country scope |

UK; Germany; Italy; France; RoE |

|

Key companies profiled |

AMADA MACHINERY CO., LTD.; AMERA.SEIKI; DMG MORI CO., LTD.; General Technology Group Dalian Machine Tool Co., Ltd.; FANUC CORPORATION; Haas Automation, Inc.; Hurco Companies, Inc.; Okuma Corporation; Shenyang Machine Tool Part Co., Ltd.; Yamazaki Mazak Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Computer Numerical Control Machine Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europecomputer numerical control machine market report based on type, end-use, and country:

- Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Lathe Machines

- Milling Machines

- Laser Machines

- Grinding Machines

- Welding Machines

- Winding Machines

- Others

- End-use Outlook (Revenue, USD Billion, 2017 - 2030)

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

- Others

- Country Outlook (Revenue in USD Billion, 2017 - 2030)

- Europe

- UK

- Germany

- Italy

- France

- RoE

- Europe

Frequently Asked Questions About This Report

b. The Europe computer numerical control machine market size was valued at USD 24.09 billion in 2022 and is expected to reach USD 25.77 billion in 2023.

b. The Europe computer numerical control machine market is expected to witness a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 44.16 billion by 2030.

b. The lathe machines segment dominated the Europe CNC machine market with a share of around 28% in 2022. This is attributable to as they are widely used in activities such as cutting, drilling, chambering, turning, and knurling.

b. Some key players operating in the Europe CNC machine market include Amada Machine Tools Co., Ltd.; Amera Seiki; DMG Mori Co., Ltd.; Dalian Machine Tool Group Corporation; FANUC Corporation; Haas Automation, Inc.; Hurco Companies, Inc.; Okuma Corporation; Shenyang Machine Tool Co., Ltd.; and Yamazaki Mazak Corporation.

b. Key factors that are driving the Europe CNC machine market growth include increasing demand for mass production in the aerospace and defense as well as industrial verticals and technological advancements in automation, which have allowed manufacturers to reduce machining time.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."