Europe Coin-operated Laundries Market Size, Share & Trends Analysis Report By Application (Residential, Commercial), By Country (UK, Germany, France, Russia, Spain, Italy, Rest Of Europe), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-708-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

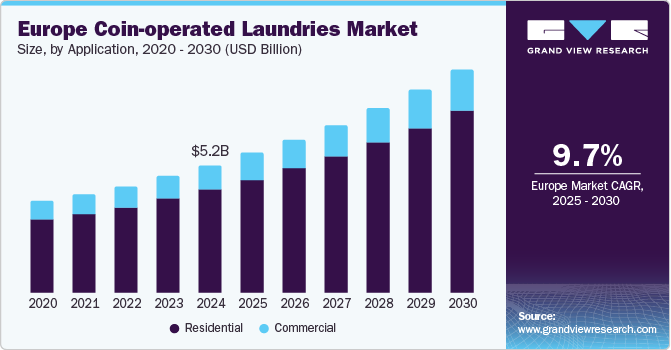

The Europe coin-operated laundries market size was valued at USD 5.21 billion in 2024 and is projected to grow at a CAGR of 9.7% from 2025 to 2030. Growth of this market is mainly driven by changing lifestyles, a large number of individuals engaged in prolonged work hours, the availability of advanced technology, and the convenience offered by the product.

Urbanization has been significantly contributing to market growth. In the European Union (EU), 75.0% of total inhabitants live in urban areas, including cities, towns, and suburbs. The number of individuals engaged in extensive work shifts has grown rapidly. This has developed demand for multiple technology-driven products and offerings that provide convenience and time-saving benefits. Coin-operated laundries, primarily found in countries such as Germany, the U.K., France, Spain, Italy, and others, are located in public areas, commonly near public transportation hubs.

Over the past few decades, laundry and convenient power supply technologies have improved significantly. Key market participants have launched energy and water-efficient washing machines equipped with high-performance dryers. However, the unavailability of space, the large number of students residing in European countries, and the continuous inflow of travelers have resulted in the growing use of public laundries.

Laundromats, self-service laundry machines, offer various benefits, including ease of use, customer convenience, automated systems, and more. Technology-driven operations also allow service providers to monitor remotely. Multiple laundromats have also been offering additional customer services such as Wi-Fi, available vending machines for snacks, beverages, etc., and dedicated play areas for children. In addition, it has become common for laundromats to remain open for 24 hours every day, which ensures extra convenience for customers.

Coin-operated laundries are also accompanied by detergent for sale, an ATM nearby, and drop-off services for an additional price. The availability of multiple turn-key facilities across European urban areas and growth in shared living among working professionals and students is expected to increase demand. Adopting advanced machinery designed for fast-paced processes and reduced cycle time is projected to increase consumption.

Application Insights

The residential segment dominated the Europe coin-operated laundries industry with revenue share of 81.0% in 2024. Residential users, primarily students and working professionals residing in urban areas, prefer coin-operated laundry services over buying costly washing machines with one time investments. Increasing migrations across countries and cities for professional assignments or education and increasing number of families and individuals living in rented accommodations across Europe are also contributing the growth experienced by this segment.

The commercial segment is anticipated to experience significant growth during the forecast period. The availability of dedicated services and special stations for commercial users contributes a noteworthy revenue share to this market. Commercial users for coin-operated laundries include hotels, manufacturing industries with uniform clothing requirements, healthcare sector establishments, facility management companies, local salons, spas, etc. Multiple businesses in the region utilize coin-operated laundries for washing tablecloths, sheets, upholstery, pillow covers, and more.

Country Insights

Germany dominated the Europe coin-operated laundries industry with revenue share of 17.0% in 2024. According to Statistisches Bundesamt (Destatis), in 2023, nearly 52.4% of the population lived in rented accommodation in Germany. Growth in urbanization, an increasing number of students, and a growing demand for self-service laundry solutions in densely populated cities are projected to drive the development of this market over the forecast period. Growth in the availability of smart systems, strong machinery manufacturing industry operating in the country, and value-added services offered by the service providers are likely to add growth opportunities to this market.

Spain coin-operated laundries are anticipated to experience the fastest growth during the forecast period. The convenience and flexibility offered by the services primarily generate increased market growth. According to the Political, social, and economic background and trends by the European Commission, in 2022, 81.0% of the total population of Spain lived in urban areas. Trends such as growth in rental accommodations in key urban areas, changing lifestyles, and an increasing number of international visitors traveling across Spain are also contributing to the increase in demand experienced by this market.

Key Europe Coin-operated Laundries Company Insights

Some of the key companies in the Europe coin-operated laundries industry are Elis, WASH’ N DRY (LAVERIE LIBRE SERVICE), Wash.ME, LAVISA SRL, Broomfield Launderette, and others. To address growing demand and increasing competition driven by new service stations opened at new locations, businesses are embracing strategies such as portfolio expansions, equipment enhancements, and more.

-

Elis offers specialized laundry services for various industries. This includes work wear laundry, hospitality laundry, healthcare laundry, care home laundry, and more. The company actively promotes rental over purchase, eco designs, and reuse of products in its commitment to sustainability.

-

Wash.ME is a self-service launderette service available to users for 24 hours every day. It provides professional laundry services featuring high-quality washing and drying machines for residential and commercial users.

Key Europe Coin-operated Laundries Companies:

- Elis

- COLÁN Córdoba

- Quesada Laundry Service

- WASH’ N DRY (LAVERIE LIBRE SERVICE)

- Wash.ME

- REMBLI

- LAVISA SRL

- Broomfield Launderette

- Girbau

- Johnson Service Group PLC

Recent Developments

-

In March 2024, Elis, launched a brand-new laundry facility in Bridgwater dedicated only to care homes. Links with transport network and availability of latest technology driven machines are expected to enable company in delivery of effective services in the region.

-

In February 2024, WASH’ N DRY (LAVERIE LIBRE SERVICE) launched its services in three new locations in France. These three locations include avenue de Violesi in BOUC-BEL-AIR, avenue de la petite Synthe in Dunkerque, and ECLARON-BRAUCOURT-SAINTE-LIVIERE. This is expected to strengthen its positioning in the commercial laundry service market in France.

Europe Coin-operated Laundries Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.71 billion |

|

Revenue forecast in 2030 |

USD 9.08 billion |

|

Growth Rate |

CAGR of 9.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, country |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.K., Germany, France, Russia, Spain, Italy |

|

Key companies profiled |

Elis; COLÁN Córdoba; Quesada Laundry Service; WASH’ N DRY (LAVERIE LIBRE SERVICE); Wash.ME; REMBLI; LAVISA SRL; Broomfield Launderette; Girbau; Johnson Service Group PLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Coin-operated Laundries Market Report Segmentation

This report forecasts revenue growth at Europe, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the Europe coin-operated laundries industry report based on application and country.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.K.

-

Germany

-

France

-

Russia

-

Spain

-

Italy

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."