- Home

- »

- Medical Devices

- »

-

Europe Clinical Trials Market Size, Industry Report, 2030GVR Report cover

![Europe Clinical Trials Market Size, Share & Trends Report]()

Europe Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, Phase II), By Indication (Oncology, Diabetes), By Study Design, By Service Type, By Sponsor, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-916-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Europe Clinical Trials Market Size & Trends

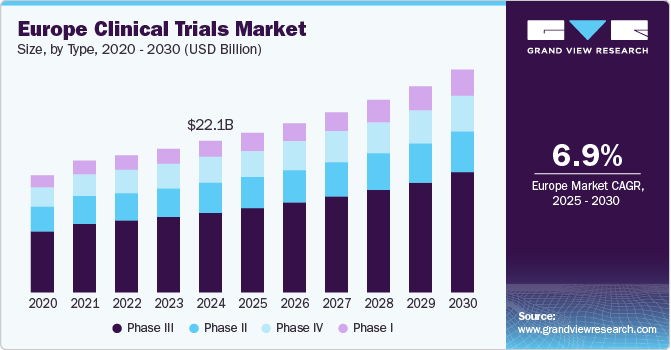

The Europe clinical trials market size was valued at USD 22.06 billion in 2024 and is projected to grow at a CAGR of 6.86% from 2025 to 2030. The large patient pools, a growing number of clinical trials, the close relationship between healthcare facilities & patients, and increasing requirement for potential groundbreaking therapies are likely to drive the clinical trials number, resulting in innovative treatments for prevention, diagnosis, and deeper understanding of diseases. The region has large patient pools and advanced medical expertise. For instance, according to the European Medicines Agency (EMA), around 4,000 trials are authorized annually across the EEA in partnership with other global research partners, transforming how patients treat diseases.

In addition, competitive costs for clinical development & cost per patient are critical factors for sponsors to look for solutions and ways to optimize the conduct of their clinical trials. Moreover, the demand for personalized medicines in the region due to significant research funding for personalized therapies by public organizations drives the market growth in the region. For instance, in August 2024, the UK Government mentioned a deal with the Association of the British Pharmaceutical Industry to accelerate the country’s clinical trials industry with a USD 520.01 million (£400m) investment. In addition, the UK’s Department of Health & Social Care mentioned establishing a new voluntary scheme for branded medicines pricing, access, and growth (VPAG), aimed at saving the NHS £14bn (USD 17.5bn) over five years.

Several European pharmaceutical companies are increasingly adopting a strategic approach to outsourcing, enabling them to concentrate on their core competencies such as drug discovery and development, enhancing operational efficiency, and reducing the costs associated with in-house R&D. According to the European Medicines Agency, in March 2024, the accelerating clinical trials in the European Union initiative established a multi-stakeholder platform to improve the environment for clinical trials across the European Union. Accelerating Clinical Trials in the EU is a collaboration among the Heads of Medicines Agencies (HMA), EMA, and the European Commission (EC), seeking to transform clinical trial’s initiation, design, and run.

Furthermore, the growing demand for better clinical facilities, diagnostics, and treatment facilities has led collaborative research base and substantial clinical research to further drive pharmaceutical and medical device market growth. For instance, in June 2024, The European Medicines Agency (EMA), in collaboration with the Heads of Medicines Agencies (HMA) and the European Commission (EC), mentioned accelerating clinical trials in the EU initiative, launching two advisory pilots to improve clinical trials in the EU. In addition, strengthening the coordination of the European medicines regulatory network has offered applicants support to enhance the quality of their applications for marketing and clinical trial authorization.

Phase Insights

In terms of phase, the market is segmented into Phase I, Phase II, Phase III, and Phase IV. In 2024, the Phase III segment dominated the market, accounting for a revenue share of 53.25%. Although the number of drugs in phase III is relatively low, the complexity associated with this phase is the highest. This phase witnesses the highest failure rate due to complexities in study design and a larger sample pool. This, in turn, leads to difficulty in preparing an optimum-level dosing regime. Phase III trials require a vast patient population, which is one of the prime reasons for the high cost of this trial. These factors are attributed to the cost-intensive nature of this segment.

Moreover, the studies in phase last for a longer time, compared to phases I and II, which further increase the trial's cost and boost the market's segment share. In addition, growing strategic initiatives undertaken by market players, government investments, and demand for outsourcing clinical trials drive segment growth. For instance, in January 2024, BioNTech SE & Duality Biologics mentioned the first patient with metastatic breast cancer that has been treated in a Phase 3 trial evaluating the efficacy & safety of the next-generation antibody-drug conjugate candidate BNT323/DB-1303 targeting HER2.

The phase I segment is expected to register a CAGR of 7.49% during the forecast period. This is due to the significant R&D investments by public organizations and private firms for clinical trials in the region. The demand for new treatments & biologics in the region is further contributing to the growth of the segment. For instance, in June 2024, Medicenna Therapeutics Corp. announced the MEA had approved the Clinical Trial Application for conducting Phase 1/2 ABILITY-1 (A Beta-only IL-2 ImmunoTherapY) Study with MDNA11 in combination/alone with pembrolizumab (KEYTRUDA) expanding the clinical trial in the EU. In addition, the ABILITY-1 study is enrolling patients for advanced solid tumor treatment with MDNA11, a novel IL-2 super-agonist, as a monotherapy or in combination with KEYTRUDA at U.S., Canada, Korea and Australia clinical trial sites.

Study Design Insights

The market is segmented into interventional studies, observational studies, and expanded access studies. The interventional studies segment dominated the market with a share of 80.57% in 2024. The segment's growth is mainly due to the increasing number of studies performed by study design, owing to the greater accuracy and relevance observed by interventional studies compared to observational study design. The majority of interventional studies are done for drugs and biologics, and the growing demand for these drugs is further contributing to segment growth. This type of study design consists of large randomized clinical trials, thus helping detect small-to-moderate effects of drugs. Interventional studies provide the best means of minimizing the effect of confounding, thus improving its adoption, as compared to other clinical study designs.

The observational study segment is projected to witness the fastest growth during the forecast period. An observational study is usually considered when intervention study designs are unfeasible or unethical. These studies provide greater proximity to real-life situations and are cheaper than randomized clinical trials. These studies are used to investigate rare outcomes and to detect unusual side effects of a drug in the trials. Observational studies are used to create new hypotheses and prove the external validity of randomized clinical trials already performed. Such advantages of observation studies are driving demand in the market. During the pandemic, the European Medicines Agency (EMA) recommended that researchers conduct high-quality observational research to develop safe and effective vaccines and treatments. Such actions by the EMA are likely to impact the market positively.

Indication Insights

The market is segmented into Autoimmune/inflammation, Pain management, Oncology, CNS conditions, Diabetes, Obesity, Cardiovascular, and Others. The oncology segment dominated the market with a revenue share of 36.51% in 2024, owing to the increasing prevalence of cancer and the requirement for effective treatments against various types of cancer. For instance, according to IKNL, cancer is one of the major diseases in Europe. In 2022, there were an estimated 2.78 million new cases of cancer in the 27 member states of the European Union (EU27) plus Iceland and Norway (EU+2 countries), equivalent to about five new diagnoses every minute. Furthermore, it is expected to be the leading cause of death in Europe by 2035.

Furthermore, growth can be attributed to growing product launches, increasing demand for outsourcing, and focusing on developing anti-cancer treatments driving segment growth. In addition, a substantial pipeline of products for anti-cancer therapies is in development phases, with numerous drugs set to be introduced to the market. For instance, in June 2024, AstraZeneca’s Truqap, i.e., capivasertib with Faslodex (fulvestrant), was approved by the EU for treating adult patients with ER-positive, HER2‑negative locally advanced/metastatic breast cancer with more PIK3CA, AKT1/PTEN-alterations following progression or recurrence on or after an endocrine-based regimen.

The autoimmune/inflammation segment is anticipated to register a CAGR of 6.98% during the forecast period. Autoimmune diseases have increased considerably in the past decade and are expected to rise further due to lifestyle changes & an aging population. Due to the growing prevalence of autoimmune diseases, there has been a significant increase in R&D spending on autoimmune diseases. For instance, in January 2024 ,UCB announced that the European Commission (EC) granted marketing authorization for RYSTIGGO (rozanolixizumab) as an add-on to standard therapy for treating generalized myasthenia gravis in adults who are anti-acetylcholine receptors/anti-muscle-specific tyrosine kinase positive antibody.

Service Type Insights

The market is segmented into protocol designing, site identification, bioanalytical testing services, patient recruitment, laboratory services, clinical trial data management services, and others. In 2024, the laboratory services segment dominated the market with a 34.8% share owing to the increasing advantages in clinical trials and growing strict adherence to quality control and regulatory requirements. Moreover, growth in employing state-of-the-art technology and leveraging of skilled expertise services are expected to offer crucial support and resources that enhance the overall conduct of clinical trials. For instance, in October 2024, SGS launched ‘CDISC Open Rules Consultancy,’ a service designed to transform & accelerate clinical trial submissions. The various benefits of CDISC Open Rules within an organization include compliance, quality assurance, interoperability, efficiency, and flexibility.

The patient recruitment segment is anticipated to register a 7.13% CAGR during the forecast period. The significance of patient recruitment in efforts to effectively diagnose, treat, or prevent disease resulted in investigating numerous characteristics influencing the recruitment process. It entails identifying suitable patients, comprehending the research concept, and recognizing the trial’s risks & benefits. For instance, in September 2024, the European Clinical Trials Information Network mentioned its patient recruitment platform across Europe to connect with research centers conducting clinical trials for rare and serious diseases with patients.

Sponsor Insights

The market is segmented into pharmaceutical & biopharmaceutical companies, medical device companies, and others. In 2024, the pharmaceutical & biopharmaceutical companies segment dominated the market owing to the increased availability of services from drug discovery to post-marketing surveillance, further simplifying the processes for pharmaceutical and biotechnological organizations by providing them the option to outsource R&D activities to reduce infrastructure investment. In addition, growing emphasis on innovative drugs & devices is expected to create new demand, leading to market growth. This has led to an increase in ongoing initiatives and developments, which is the key strategy implemented by the market to sustain the competitive edge, enhancing the clinical trial market landscape revenue. Moreover, the growing shift toward personalized medicine leading to increased usage of pharmacogenetics in the clinical trial phase is expected to boost the number of drugs in the pipeline.

The medical device companies segment is anticipated to register a CAGR of 6.31% during the forecast period. The growing healthcare per capita and increased clinical trials undertaken to seek FDA approval have led to market growth. In addition, many companies have shifted their focus to outsourcing due to the increasing regulatory requirements and long approval timelines. In addition, high research costs further prompt companies to outsource clinical trials to other research organizations. This has led to most outsourcing activities in Europe.

Regional Insights

The European clinical trials market is anticipated to grow over the forecast period owing to increasing demand for networks/platforms for international cooperation, national initiatives (including trials), pilot projects, and infrastructure development. Moreover, such factors are expected to create opportunities for European clinical trials. In addition, strong opportunities for several new entrants to enter and establish their presence in the region drive the market growth.

UK Clinical Trials Market Trends

The clinical trials market in the UK is expected to grow at a CAGR of 7.37% over the forecast period. The region’s growth is driven by various pharmaceutical companies, significant R&D spending, healthcare research, and rapidly evolving CROs focused on phases I to IV developments of new drugs & devices. Moreover, the government’s support for clinical trials through funding initiatives and favorable regulatory frameworks attracts domestic and international pharmaceutical companies to invest in the country. For instance, in May 2023, according to the UK government, clinical trials are expected to speed up, making it easier for healthcare treatments to get to NHS patients. The trials are backed by USD 151.90 million (GBP 121 million) in government funding. This funding would benefit key areas, such as cancer and infectious disease, to improve the delivery of all trials.

Germany Clinical Trials Market Trends

Germany's clinical trials market is driven by growing advancements in technology and quality clinical resources. In addition, government initiatives for clinical research activities have accelerated the market. Furthermore, according to GTAI, the country provides the appropriate environment for the development & production of research-intensive, high-grade products.

France Clinical Trials Market Trends

The clinical trials market in France is driven by various strategic initiatives undertaken by market players, a large patient pool, government investments, and demand for outsourcing clinical trials. For instance, according to ClinicalTrials.gov, by the third quarter of 2023, there were around 34,380 clinical studies in France sites. The increasing number of clinical trials is likely to drive the market growth.

Key Europe Clinical Trials Company Insights

The market players operating across Europe clinical trials are adopting in-organic strategic initiatives such as mergers & acquisitions, service launches, expansions, partnerships & agreements, and others to increase market presence & revenue, gain a competitive edge, and drive market growth. Hence, an increasing number of strategic initiatives are anticipated to boost the revenue share of players operating across the market. For instance, in November 2023, AstraZeneca launched Evinova to offer its knowledge of clinical trial design & study delivery. The Anglo-Swedish pharmaceutical giant will deliver solutions at scale to trial sponsors, CROs, care teams, and patients. It will reduce the time and cost of developing new medicines.

Key Europe Clinical Trials Companies:

- IQVIA HOLDINGS, INC.

- PAREXEL International Corporation

- Pharmaceutical Product Development (PPD) LLC.

- Syneos Health Inc.

- Eli Lilly and Company

- Novo Nordisk A/S

- Pfizer, Inc.

- Dr. Notghi Contract Research GmbH

- Charite Research Organisation GmbH

- Janssen Global Services, LLC

- Mondosano GmbH

- KFGN

- Clariness

- Invisio clinical studies consulting

Recent Developments

-

In March 2024, Veeda Clinical Research Limited announced the acquisition of Heads, a CRO based in Europe specializing in clinical trials for oncology. With the acquisition, Veeda Clinical Research entered the global CROs with capabilities to enhance contract research services from drug discovery to clinical development.

-

In September 2023, IQVIA announced a collaboration with three university medical centers in the Netherlands: Radboud university medical center (Radboudumc), University Medical Center Utrecht (UMC Utrecht), and Maastricht University Medical Center+ (MUMC+). This collaboration led to the establishment of the first Prime Site in the country, aimed at advancing clinical research through the application of data and innovation.

-

In August 2023, RQM+ mentioned the acquisition of Kottmann, a German CRO, to expand the Pittsburgh-based MedTech service’s offerings & global footprint. The Kottmann company is focused on clinical studies for medical devices, pharmaceuticals, and in vitro diagnostics.

Europe Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.28 billion

Revenue forecast in 2030

USD 32.43 billion

Growth Rate

CAGR of 6.86% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, study design, indication, service type, sponsor, region

Regional scope

Europe

Key companies profiled

IQVIA HOLDINGS, INC., PAREXEL International Corporation, Pharmaceutical Product Development, (PPD) LLC., Syneos Health Inc., Eli Lilly and Company, Novo Nordisk A/S, Pfizer, Inc., Dr. Notghi Contract Research GmbH, Charite Research Organisation GmbH, Janssen Global Services, LLC, Mondosano GmbH, KFGN, Clariness, and Invisio clinical studies consulting among others.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe clinical trials market report based on phase, study design, indication, service type, and sponsor.

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional studies

-

Observational studies

-

Expanded access studies

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Autoimmune/inflammation

-

Rheumatoid arthritis

-

Multiple sclerosis

-

Osteoarthritis

-

Irritable Bowel Syndrome (IBS)

-

Others

-

-

Pain management

-

Chronic pain

-

Acute pain

-

-

Oncology

-

Blood cancer

-

Solid tumors

-

Other

-

-

CNS conditions

-

Epilepsy

-

Parkinson's Disease (PD)

-

Huntington's Disease

-

Stroke

-

Traumatic Brain Injury (TBI)

-

Amyotrophic Lateral Sclerosis (ALS)

-

Muscle regeneration

-

Others

-

-

Diabetes

-

Obesity

-

Cardiovascular

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Protocol Designing

-

Site Identification

-

Patient Recruitment

-

Laboratory Services

-

Bioanalytical Testing Services

-

Clinical Trial Data Management Services

-

Others

-

-

Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & biopharmaceutical companies

-

Medical device companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe clinical trials market size was estimated at USD 22.06 billion in 2024 and is expected to reach USD 23.28 billion in 2025.

b. The Europe clinical trials market is expected to grow at a compound annual growth rate of 6.86% from 2025 to 2030 to reach USD 32.43 billion by 2030.

b. The Phase III accounted for largest revenue share of 53.25% in 2024 and is also anticipated to witness the fastest growth over the forecast period. The segment growth is due to growing strategic initiatives undertaken by market players, government investments, and demand for outsourcing clinical trials drives the segment growth

b. Some key players operating in the Europe clinical trials market include IQVIA HOLDINGS, INC., PAREXEL International Corporation, Pharmaceutical Product Development, (PPD) LLC., Syneos Health Inc., Eli Lilly and Company, Novo Nordisk A/S, Pfizer, Inc., Dr. Notghi Contract Research GmbH, Charite Research Organisation GmbH, Janssen Global Services, LLC, Mondosano GmbH, KFGN, Clariness, and Invisio clinical studies consulting among others.

b. Key factors that are driving the clinical trials market growth include growing number of CRO, increasing Shift toward personalized medicine and adoption of new technology in clinical research

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."