Europe Clinical Laboratory Services Market Size, Share & Trends Analysis Report By Test Type, By Service Provider, By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-300-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

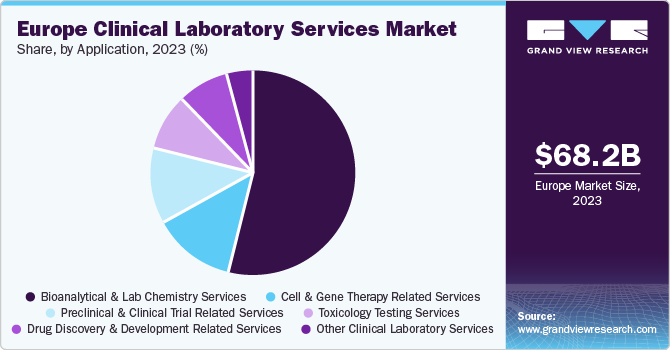

The Europe clinical laboratory services market size was estimated at USD 68.2 billion in 2023 and is anticipated to grow at a CAGR of 2.3% from 2024 to 2030. Market growth can be attributed to the significant increase in collaborations between European universities and clinical laboratory service providers. This trend has led to the development of cutting-edge research and innovative technologies, driving advancements in diagnostics and treatment options.

In 2023, the Europe region accounted for approximately 29.3% revenue share of the global clinical laboratory services market. The industry is driven by various initiatives undertaken by government and private organizations. These efforts aim to fund research and development in clinical laboratory tests and services, as well as promote awareness about early diagnosis.

Key government organizations, such as the European Organization for Research and Treatment of Cancer (EORTC), the European Medicines Agency (EMA), and the National Health Service (NHS), are working together to develop a comprehensive program focused on improving diagnosis in the region. For instance, the UK government has made £2.3 billion available for reform diagnostics in England, establishing over 155 Community Diagnostic Centers that have delivered over 7 million tests, checks, and scans across the country as of March 2023.

The COVID-19 pandemic has accelerated the adoption of advanced diagnostic technologies in Europe, including chemiluminescence immunoassays, real-time PCR, mass spectrometry, flow cytometry, and high-throughput assays. Countries such as Germany, Italy, the UK, and France are leading the way in implementing these cutting-edge technologies, enhancing the accuracy, efficiency, and accessibility of clinical testing, and driving market growth across the region.

Test Type Insights

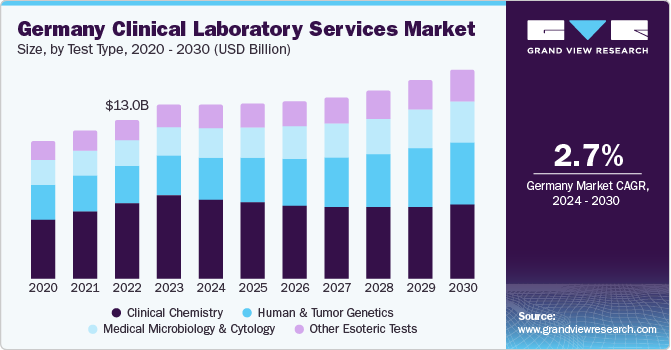

Clinical chemistry tests emerged as the dominant market segment in 2023, accounting for 51.2% of the total revenue. Clinical chemistry tests are essential for primary diagnosis and laboratory testing, using techniques like spectrophotometry, immunoassay, and electrophoresis. The market is driven by innovations in chronic kidney disease, heart failure, and osteoporosis testing.

Human & tumor genetics testing is expected to experience the fastest CAGR of 6.5% over the forecast period. In countries with advanced healthcare infrastructure and a focus on precision medicine, the demand for personalized care with accurate and early diagnosis in oncology is driving growth. The adoption of next-generation sequencing and other cutting-edge diagnostic technologies is also accelerating market expansion in Europe.

Service Provider Insights

In 2023, hospital-based laboratories led the service providers segment, accounting for over 50% of the total revenue. This dominance is expected to continue as more hospitals integrate laboratories into their facilities, driven by the increasing number of outreach programs and the high demand for timely testing and diagnosis of complex and major diseases.

Clinic-based laboratories are expected to experience a lucrative CAGR of 3.2% over the forecast period. The segment growth is driven by the increasing demand for diagnostic testing, technological advancements, and the adoption of Point-Of-Care testing. The integration of Laboratory Information Systems with electronic health records also improves workflow efficiency and data sharing, while accreditation ensures high-quality and reliable results.

Application Insights

Bioanalytical & lab chemistry services held the largest market share in 2023, accounting for 53.9% of the total revenue. European laboratories are harnessing the power of advanced technologies such as mass spectrometry and flow cytometry to transform clinical chemistry analysis, delivering precise, efficient, and accessible testing services. Moreover, the surge in research activities focused on genetic and proteomic studies of hereditary and gene-mutation disorders is expected to drive revenue growth for this segment over the forecast period.

The toxicology testing services segment is anticipated to exhibit the most rapid growth, with a projected CAGR of 7.6% over the forecast period. Stringent regulatory standards and a focus on product safety across industries, such as pharmaceuticals and chemicals, are key drivers. Moreover, the increasing demand for specialized toxicology testing services tailored to specific industries and applications is also contributing to the market growth.

Country Insights

Germany Clinical Laboratory Services Market Trends

The Germany clinical laboratory services market held the largest market share in the Europe region, accounting for 20.8% of the total revenue in 2023. This large share is attributed to the presence of many laboratories and access to innovative technologies. The country’s favorable reimbursement environment, characterized by higher prices set by manufacturers, also contributed to its market share.

The aging population, paired with the rising incidence of chronic diseases, is fueling the demand for clinical laboratory services in the UK, particularly for early and accurate disease diagnosis. A significant number of tests are conducted in the UK every year. According to the NHS, in England, over 1.12 billion pathology tests are performed every year, with private labs facing competition from low-cost NHS tests. Thus, the country has been at the forefront of investing in diagnostic testing, particularly in response to the COVID-19 pandemic.

France Clinical Laboratory Services Market Trends

The France clinical laboratory services market is expected to experience rapid growth over the forecast period, with a CAGR of 3.4% from 2024 to 2030, driven by the increasing prevalence of infectious diseases, technological advancements, and consumer awareness. The elderly population (21.7% of France’s population in 2022, as reported by the World Bank) requires more diagnostic services, making clinical laboratory services essential for accurate diagnosis and treatment.

Key Europe Clinical Laboratory Services Company Insights

The Europe market is driven by strategic initiatives like mergers, acquisitions, and product launches. These advancements enable more accurate and efficient testing, fueling market growth across the region as countries adopt innovative solutions.

Some key players operating in this market include Eurofins Scientific, SYNLAB International GmbH, UNILABS, Quest Diagnostics Incorporated, and Sonic Healthcare Limited.

-

Eurofins Scientific is a prominent player in the Europe market, offering a comprehensive range of testing services across various specialties. Its advanced infrastructure, extensive network, and focus on innovation, quality, and customer service have enabled it to establish a strong presence in the region.

-

SYNLAB International GmbH is a leading provider of clinical laboratory services in Europe, operating a large network of laboratories across the region. The company offers a wide range of testing services and is committed to quality, innovation, and customer satisfaction.

Key Europe Clinical Laboratory Services Companies:

- Eurofins Scientific

- SYNLAB International GmbH

- UNILABS

- Quest Diagnostics Incorporated

- Sonic Healthcare Limited

- NeoGenomics Laboratories

- ARUP Laboratories

- Mayo Foundation for Medical Education and Research

Recent Developments

-

In April 2024, Unilabs, a leading European diagnostic provider, deployed the SOPHiA DDM Platform across its network in Switzerland to support cancer diagnostics and treatment. This collaboration enabled Unilabs to use AI technology to detect Homologous Recombination Deficiency in solid tumors, providing faster and more accurate testing results.

-

In December 2023, a partnership between ARUP Laboratories and Medicover expanded access to the companion diagnostic AAV5 DetectCDx in the European Union, facilitating patient testing for BioMarin’s gene therapy ROCTAVIAN.

-

In November 2023, Mayo Clinic Laboratories (Mayo Foundation for Medical Education and Research) and Progentec Diagnostics collaborated to bring advanced biomarker testing services for autoimmune diseases. This partnership aims to increase accessibility across the U.S. and select global markets, including Europe.

-

In May 2023, Dedalus launched its flagship InVitro Suite at EuroMedLab - WorldLab 2023, consolidating regional knowledge and expertise into a global platform. This comprehensive suite supports healthcare professionals worldwide in achieving superior outcomes for patients, enhancing accuracy, accelerating results, and facilitating collaboration.

Europe Clinical Laboratory Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 68.2 billion |

|

Revenue forecast in 2030 |

USD 80.0 billion |

|

Growth rate |

CAGR of 2.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical Data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Test type, service provider, application, country |

|

Country scope |

Germany; UK; France; Italy; RoE |

|

Key companies profiled |

Eurofins Scientific; SYNLAB International GmbH; UNILABS; Quest Diagnostics Incorporated; Sonic Healthcare Limited; NeoGenomics Laboratories; ARUP Laboratories; Mayo Foundation for Medical Education and Research |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options. |

Europe Clinical Laboratory Services Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe clinical laboratory services market report based on test type, service provider, application, and country:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human & Tumor Genetics

-

Clinical Chemistry

-

Medical Microbiology & Cytology

-

Other Esoteric Tests

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-based Laboratories

-

Standalone Laboratories

-

Clinic-based Laboratories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioanalytical & Lab Chemistry Services

-

Toxicology Testing Services

-

Cell & Gene Therapy Related Services

-

Preclinical & Clinical Trial Related Services

-

Drug Discovery & Development Related Services

-

Other Clinical Laboratory Services

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

RoE

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."