- Home

- »

- Medical Devices

- »

-

Europe Clear Aligners Market Size, Industry Report, 2030GVR Report cover

![Europe Clear Aligners Market Size, Share & Trends Report]()

Europe Clear Aligners Market (2024 - 2030) Size, Share & Trends Analysis Report By Age Group (Adults, Teens), By Distribution Channel (Offline, Online), By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-018-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Clear Aligners Market Size & Trends

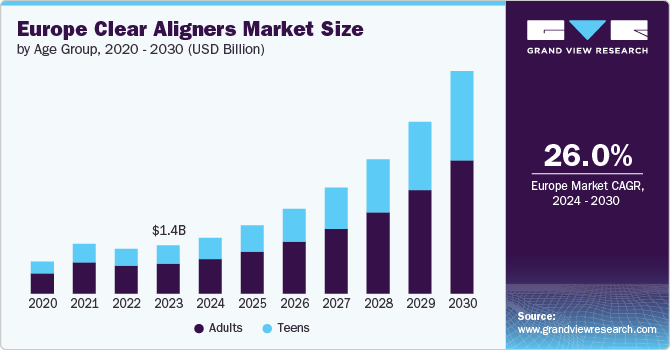

The Europe clear aligners market size was estimated at USD 1.38 billion in 2023 and is projected to grow at a CAGR of 26.0% from 2024 to 2030. Clear aligners are transparent orthodontic appliances that straighten up crooked or misaligned teeth. The growing prevalence of malocclusion is one of the primary factors driving the market's growth. According to a WHO article published in April 2023, about 50.1% of the adult population in Europe is affected by major oral diseases, making oral disease rates the highest in Europe among all six WHO regions globally.

This high prevalence of oral health issues is contributing to the growing patient population with malocclusion and other dental alignment concerns. Moreover, the significant prevalence of both mixed dentition and permanent dentition stages across Europe presents a growth opportunity for providers of clear aligners. Mixed dentition between ages 6 and 12 features a combination of primary and emerging permanent teeth, offering a prime opportunity for early orthodontic intervention with clear aligners.

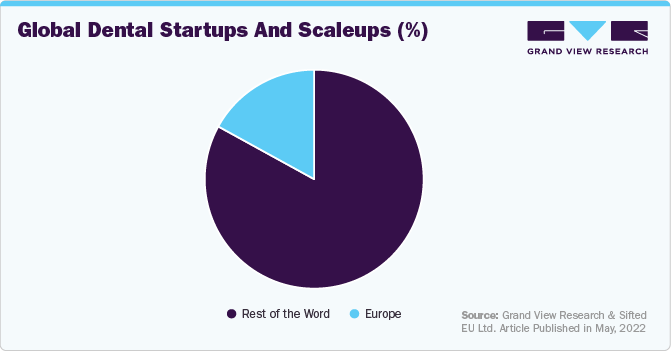

The prevalence of oral diseases is increasing. Thus, the need for advancements in orthodontics is also growing. Digital computer imaging and 3D technology are increasingly used in orthodontic practices to create an accurate fit. Copper-titanium & nickel wires, 3D impression scanners, digital scanning technology, additive fabrication, temporary anchorage devices, CAD/CAM appliances, incognito lingual braces, and clear aligners are among the latest advancements leading to the delivery of more efficient, customized, predictable, and effective orthodontic treatments. Europe is witnessing a surge in dental technology innovation. According to a Sifted EU Ltd. article published in May 2022, the region accounts for 17% of the world's dental startups and scaleups. This robust ecosystem includes over 370,000 dentists across the EU and UK, all expected to gain from and contribute to these advancements.

One of the leading companies driving this change is Dental Monitoring, the first dental software company in the world to achieve unicorn status, with a valuation exceeding USD 1 billion. This company offers advanced software for remote monitoring and management of orthodontic treatments, revolutionizing patient experience. Another significant player is Impress, which operates a network of 120 orthodontic clinics across Europe. Impress uses a hybrid treatment model that combines digital and human elements, ensuring patients receive the best of both worlds, the efficiency of technology and the personal touch of professional care.

Growing demand for customized aligners fuels the market growth. According to a Eurostat article published in February 2024, several EU Member States had dentist-to-population ratios exceeding one dentist per 1,000 inhabitants in 2021. These countries include Greece, Portugal, Cyprus, Bulgaria, Lithuania, Romania, and Estonia, indicating a robust availability of dental professionals relative to their population. This statistic highlights the region's readiness to cater to increasing needs for personalized dental care, including the growing preference for custom aligners among patients seeking effective and fitted orthodontic treatments.

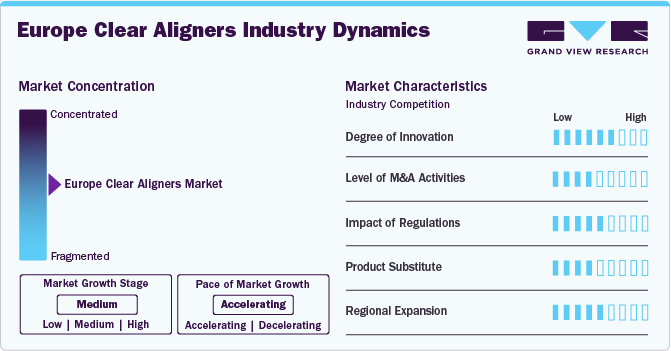

Market Concentration & Characteristics

The market is witnessing high innovation, with companies launching advanced aligner systems that incorporate new materials, improved technologies, and enhanced treatment capabilities.

Several market players, such as Dentsply Sirona, Institut Straumann AG, Align Technology, and 3M Company, are involved in merger and acquisition activities. Through M&A activity, these companies employ vital strategies such as age group innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing prevalence of malocclusion. For instance, In September 2023, The Straumann Group acquired AlliedStar, a Chinese intraoral scanner manufacturer. This acquisition would help Straumann provide a competitive intraoral scanner solution in China and cater to more price-sensitive markets & customer segments. AlliedStar would continue serving its existing channels under the Straumann Group.

Regulations play a crucial role in the Europe market by enforcing safety, efficacy, and quality standards. While strict regulatory processes may delay approval for specific age groups and impact market entry, they bolster patient trust and ensure that only reliable, high-quality devices are available, thus fostering long-term market growth.

There are currently direct substitutes for clear aligners. These include traditional metal braces, ceramic braces, and lingual braces. These alternatives offer different approaches to orthodontic treatment, catering to various patient needs and preferences.

Market players in the Europe transparent aligners sector are expanding their presence by entering new geographical markets, forming strategic partnerships with local distributors, and tailoring their age group offerings to align with specific regional healthcare requirements. For instance, in July 2022,CareStack, a cloud-based dental technology company, partnered with the Straumann Group. This partnership would help CareStack expand its services and presence in the U.S. and internationally. CareStack offers an integrated digital practice solution, allowing clinicians to replace multiple service subscriptions with a comprehensive practice management system that enhances clinical, business, & marketing operations.

Age Group Insights

Based on age group, the adult segment led the market with the largest revenue share of 62.2%, in 2023. The adult group includes people over 15 years old. A growing number of adults are opting for orthodontic treatment, subsequently increasing the demand for clear aligners that are more aesthetic and comfortable than traditional appliances like metal braces. Some CAT systems, like Crystal Braces and Smile Care Club, do not require the involvement of a dental practitioner at any stage. With growing consciousness about aesthetics, people now prefer comfortable dental treatment that does not impact their social life; hence, numerous adults opt for clear aligners to treat malocclusion. According to the Verdict Media Limited article published in February 2024, the dental health crisis in the UK has intensified, with over 12 million adults in the UK facing unmet dental needs due to difficulties accessing subsidized care through the National Health Service (NHS). Media reports highlight long queues and challenges accessing dental services, emphasizing the growing demand for alternative solutions like clear aligners among adults seeking timely and effective orthodontic treatments. This situation has prompted several adults to explore private options that offer quicker access and more comprehensive care.

The teens segment is expected to grow at the fastest CAGR over the forecast period. The age range considered in the teens group is 7-15 years. The removable nature of clear aligners and the comfort & control they give to patients have made them highly popular among teens who are more aware and want to avoid traditional treatments, such as metal braces. In addition, the high levels of unmet dental needs across all age groups in Europe emphasize significant opportunities for market growth. According to the Verdict Media Limited article published in February 2024, government statistics highlight tooth decay as a leading cause of hospital admissions among children aged 6 to 10 years in recent years. In addition, the UK Oral Health Foundation’s findings indicate that dental issues cause children to miss an average of three school days annually. These trends highlight a growing demand for effective orthodontic solutions like clear aligners among teenagers, seeking to address dental issues proactively and cautiously.

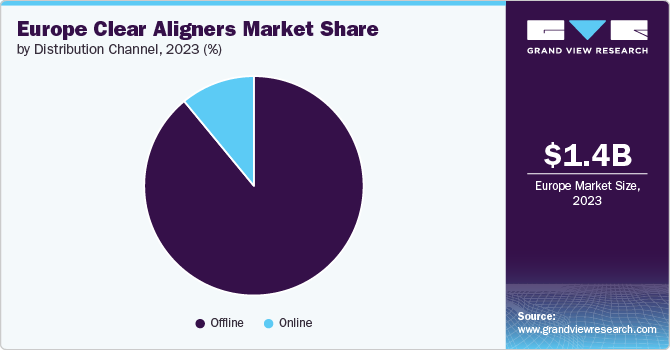

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 89.3% in 2023, owing to key players’ analysis, a significant portion of the distribution and sales of digitally automated clear aligners are through offline channels. The end users are dental specialists, laboratories, orthodontists, Dental Service Organizations (DSOs), and third-party distributors. Clear aligner treatments are widely accessible across Europe, assisted by companies like Modern Clear, operating in all 27 countries of the EU. These treatments are typically administered through traditional dental clinics and orthodontic offices, emphasizing the importance of specialized care provided by qualified orthodontists or dental technicians with appropriate degrees. This ensures that treatment planning and execution meet the required standards for effective orthodontic outcomes. Moreover, in April 2024, Space Dental, a prominent provider of clear aligner treatments in the UK, completed around 2,345 clear aligner cases annually. This represents their commitment to delivering high-quality orthodontic care through traditional dental practices, fueling segment growth.

The online segment is expected to grow at the fastest CAGR over the forecast period. The rise in the number of direct-to-consumer (DTC) clear aligner companies in Europe has resulted in the high adoption of online sales channels. For instance, K Line Europe GmbH, based in Germany, is a leading Original Equipment Manufacturer (OEM) of clear aligners in Europe. The company offers K Clear and ClearX aligners, focusing on innovative, sustainable production processes with a 5-day turnaround for aligner delivery. AlignerCo operates in France and contributes to fitted solutions. Bee Correct provides clear aligners across the EU and UK, emphasizing affordability and convenience with a direct-to-patient model. This company offers a comprehensive package including a lifetime warranty, whitening kit, orthodontic reviews, and free retainers. Invisalign is a key player in clear aligner systems, including Europe, known for its digital orthodontic treatment approach that has benefited over 17 million patients worldwide. They work through a network of authorized doctors to deliver their treatment solutions.

Sales Channel Insights

Based on sales channel, the business to business (B2B) segment led the market with the largest revenue share of 83.2% in 2023. The B2B channel focuses on transactions between manufacturers, dental laboratories, orthodontists, and dental clinics. This channel is characterized by bulk sales and professional partnerships, where clear aligners are supplied to healthcare providers, who then administer them to patients. B2B transactions ensure that orthodontic treatments are delivered through established healthcare networks, emphasizing quality control and professional oversight throughout the treatment process. According to the PlusSmile article published in February 2023, the Europe and Germany markets are now witnessing increased activity. Germany boasts around 15 suppliers of clear aligners, from established international leaders, such as Invisalign and ClearCorrect, to innovative start-ups like DrSmile, and Sunshinesmile.

The business to consumer (B2C) segment is expected to grow at the fastest CAGR over the forecast period. The B2C channel involves direct sales of clear aligners to end consumers. This approach bypasses traditional healthcare providers and allows individuals to purchase orthodontic treatments directly from the provider. B2C sales serve consumers seeking convenience and direct access to orthodontic solutions outside conventional dental clinics. This channel often includes marketing strategies aimed at educating and enticing consumers about the benefits of clear aligners and promoting accessibility & choice in orthodontic care options across Europe. For instance, in October 2022, K Line Europe, headquartered in Düsseldorf-Benrath, Germany, secured €5.3 million (USD 5.7 million) in Series A funding led by Maki.vc. The company plans to utilize these funds to expand its orthodontics-at-home business across Europe and to venture into global markets such as Asia, the Middle East, and North America. This strategic move aims to strengthen its presence in the B2C, focusing on providing clear aligner treatments directly to consumers outside of traditional dental clinics.

Country Insights

The clear aligners market in Europe is the most significant contributor to the clear aligners market. Key countries in the European region are Germany, the UK, Spain, and France. The growing importance of aesthetics and improved self-confidence post-treatment are major factors expected to boost the market growth. Companies like Dentsply Sirona have a long-established presence in Europe’s market, especially in Germany, Sweden, France, and the UK. The region reports the highest net sales for the company in dental products, contributing around 40% to total sales.

UK Clear Aligners Market Trends

The UK clear aligner market is anticipated to grow at the fastest CAGR over the forecast period. Oral care in the UK is provided by the National Health Service (NHS); however, as there is a longer waiting time, an increasing number of individuals are opting for private care. According to the Department of Health and Social Care’s annual report for 2022-23, NHS dentistry expenditure totaled USD 3.146 billion per year on dental services. Many people avoid visiting the dentist due to treatment costs and worry that the dentist might find other issues with their teeth. Most people opt for private treatment, as the NHS does not cover the cost of esthetic dental treatments.

Spain Clear Aligners Market Trends

The clear aligners market in Spain held a significant share in Europe in 2023. According to the NCBI article published in December 2021, Spain, with a population of 47.1 million, has around 37,787 registered dentists, of which about 1,400 work within the Spanish national health system. According to the latest National Health Survey, around 50.3% of the population in Spain has sought dental care services over the past year. This translates to around 23 million dental visits annually. Of these visits, 10.6% were to public dentists, while 89.4% were to private dentists. This data highlights the significant preference for private dental care among the population in Spain.

France Clear Aligners Market Trends

The France clear aligners market has a well-established healthcare infrastructure and greater accessibility to medical services. Various factors, such as high disposable income, the rising adoption of advanced dental technology, and growing awareness about the effectiveness of clear aligners, are expected to boost the country's market. Most dental payment systems in the country are built around the fee-for-service model, which solely remunerates clinical procedures. According to the State of Health in the EU France article published in 2023, in France, while overall healthcare access is generally good, shortages of general practitioners in underserved areas pose challenges to primary care accessibility.

Germany Clear Aligners Market Trends

The clear aligners market in Germany accounted for the largest revenue share of 24.9% in 2023. The easy availability of advanced dental facilities is one factor expected to facilitate market growth over the coming decade. Various factors, such as growing adoption and awareness about aesthetic procedures, technological advancements, rising collaborations, availability of skilled professionals, and increasing beauty consciousness, are driving the market growth. In Germany, dental insurance coverage varies significantly depending on whether individuals are covered under public or private health insurance schemes. According to the Germany Visa article published in August 2023, public health insurance generally covers essential dental services, such as check-ups, fillings, and some preventive care, with subsidies increasing based on regular preventive behaviors recorded in bonus booklets. However, coverage for complex procedures can be limited, with public insurance typically reimbursing up to 75% of costs.

Italy Clear Aligners Market Trends

The Italy clear aligner market is expected to grow at the fastest CAGR over the forecast period. Private arrangements in Italy mainly provide oral healthcare. The public healthcare system offers only 5% to 8% of oral healthcare services, and this percentage differs across cities. People in Italy are sensitive to oral hygiene and consider it an essential part of personal care. Companies such as Straumann and Dentsply Sirona have a firm hold on the market in Italy. According to ResearchGate, in 2019, a survey of 3,491 secondary and higher secondary school children reported that 40% of the surveyed subjects had class II malocclusion, and 43% presented mandibular dental crowding.

Key Europe Clear Aligners Company Insights

Some of the key players operating in the industry include Dentsply Sirona, Institut Straumann AG, Align Technology, and 3M Company. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, ALS Dental, DMU Dental Manufacturing Unit GmbH and Prismlab China Ltd. are some of the emerging players in Europe clear aligners.

Key Europe Clear Aligners Companies:

- Dentsply Sirona

- Institut Straumann AG

- Align Technology

- 3M Company

- Argen Corporation

- Envista Holdings Corporation

- K Line Europe GmbH

- Dentaurum GmbH & Co. Kg

- Prodways

- ALS Dental

- DMU Dental Manufacturing Unit GmbH

- Prismlab China Ltd.

Recent Developments

-

In June 2024,Solventum, previously 3M Health Care, introduced 3M Clarity Aligners in the UK market. The launch event occurred at Frameless, an immersive art gallery and multisensory venue in London. Attendees discovered how Clarity Aligners enable dentists to create custom patient treatment plans, improving aesthetics and reducing plastic waste. In addition, a new attachment solution designed exclusively for Clarity Aligners was showcased

-

In September 2023, Align Technology, Inc. introduced innovations for the Invisalign system, enhancing orthodontic and restorative dental treatment planning. These advancements included the integration of CBCT imaging into the ClinCheck treatment planning software

-

In August 2023, Ormco Corporation unveiled the Spark Clear Aligners Release 14, which included Spark Approver Web and integration with DEXIS iOS, among other updates. This launch focused on expanding the capabilities and features of the Clear Aligner product line, enhancing treatment planning & integration with digital tools for orthodontic professionals

Europe Clear Aligners Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.59 billion

Revenue forecast in 2030

USD 6.37 billion

Growth rate

CAGR of 26.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age group, distribution channel, sales channel, country

Country scope

Europe

Regional scope

UK; Germany; Spain; France; Italy; Denmark; Norway; Sweden

Key companies profiled

Dentsply Sirona; Institut Straumann AG; Align Technology; 3M Company; Argen Corporation; Envista Holdings Corporation; K Line Europe GmbH; Dentaurum GmbH & Co. Kg; Prodways; ALS Dental; DMU Dental Manufacturing Unit GmbH; Prismlab China Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Clear Aligners Market Report Segmentation

This report forecasts revenue growth at Europe region & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe clear aligners market report based on age group, distribution channel, sales channel, and region:

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Teens

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B (Business to Business)

-

B2C (Business to Consumer)

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Spain

-

France

-

Germany

-

Italy

-

Denmark

-

Norway

-

Sweden

-

-

Frequently Asked Questions About This Report

b. The Europe clear aligners market size was estimated at USD 1.38 billion in 2023 and is expected to reach USD 1.59 billion in 2024.

b. The Europe clear aligners market is expected to grow at a compound annual growth rate of 26.0% from 2024 to 2030 to reach USD 6.37 billion by 2030.

b. Germany dominated the Europe clear aligners market and held a share of 24.9% in 2023. The increasing prevalence of malocclusion cases, the adoption of telehealth, increasing awareness of dental health, growing adoption of esthetic dentistry, increased competition among market players, and advanced technologies are attributed to the market growth.

b. Some of the key players in the Europe clear aligners market are Dentsply Sirona; Institute Straumann; Align Technology, Inc.; Henry Schein, Inc; 3M; Argen Corporation; Envista; TP Orthodontics, Inc; K Line Europe GmbH; DENTARUM GmbH & Co.KG.

b. Key factors contributing to the market growth include the growing geriatric population with dental problems, increasing incidence of malocclusion, adoption of telehealth, rising demand of esthetic dentistry, availability of technologically advanced clear aligner therapy tools such as Intraoral scanners.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.