Europe, CIS & Africa Spatial Transcriptomics Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Technology (Sequencing-based Methods, IHC), By Workflow, By Sample Type, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-375-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

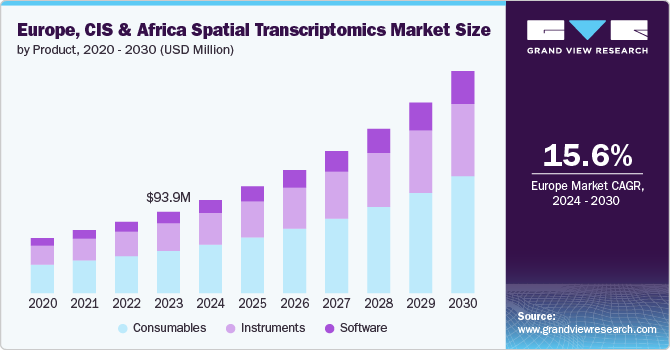

The Europe, CIS & Africa spatial transcriptomics market size was estimated at USD 93.9 million in 2023 and is projected to grow at a CAGR of 15.57% from 2024 to 2030. The emerging potential of spatial omics analysis for cancer research, the advent of the fourth generation of sequencing (in-situ sequencing), and the increasing funding & collaborative initiatives in spatial biology research are some of the factors that drive the market growth.

The rising prevalence of cancer is a major driving factor in the market. The growing prevalence of such chronic diseases necessitates efficient biomarker discovery and early & accurate diagnosis for effective disease management as well as treatment. In oncology, spatial omics analysis has shown significant promise for enhancing the understanding of tumor heterogeneity, identifying potential biomarkers, and guiding personalized treatment strategies.

One key advantage of spatial omics analysis is its ability to capture the spatial distribution of different cell types within a tumor, aiding the study of tumor heterogeneity. For instance, according to a research article published in Nature in May 2024, scientists studied tumor heterogeneity and molecular interactions in Colorectal Cancer (CRC) using spatial and single-cell transcriptomics. This technique helped scientists study the mechanisms underlying the progression of CRC.

Moreover, spatial omics techniques, such as spatial transcriptomics and imaging mass cytometry, offer a holistic view of the cellular composition & architecture of tumors. This detailed spatial information plays a crucial role in visualizing complex cellular interactions within the tumor microenvironment, providing valuable insights for informed therapeutic decision-making. Thus, integrating spatial omics data with clinical information, such as patient outcomes, treatment responses, and survival rates, can enhance the predictive power of diagnostic models.

Furthermore, in situ sequencing is gaining momentum for studying complex heterogeneous organs such as the brain. For instance, in October 2020, researchers used in situ sequencing data to identify the mouse brain’s spatial compartments. The study involved using ISH-Allen Mouse Brain Atlas patterns to decode spatial gene expression and related expression patterns. The study highlighted the importance of automated spatial gene expression for studying spatial molecular compartments without the need for costly manual annotations.

Moreover, pharma companies and CROs are increasingly building multi-platform ecosystems to leverage different technologies & platforms based on their specific research needs. In addition, they are arranging workshops, seminars, & conferences to connect scientists and industry to accelerate the adoption of spatial biology. For instance, in August 2023, Lunaphore Technologies SA (now Bio-techne) announced the launch of Spatial Biology Tour 2023 Europe, held from September 12, 2023, to November 9, 2023. In addition, Oxford Global is organizing a conference on spatial biology in October 2024, aiming to network and share knowledge with pharmaceutical, and biotechnology companies & academicians. Such initiatives are likely to boost market growth.

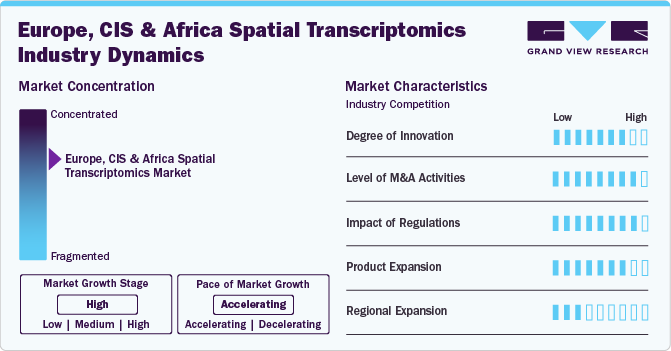

Market Concentration & Characteristics

The industry has seen significant technological advancements that have revolutionized spatial transcriptomics applications. Innovations such as the launch of fully automated multi-omics workflows that facilitate parallel detection of protein and RNA fuel market growth. Furthermore, platform upgradation to enhance throughput and increase workflow efficiency aids in rapid result outcomes, driving market growth.

The market is observing a high level of merger and acquisition activities. Companies in this sector have engaged in strategic partnerships, acquisitions, and mergers to enhance their market presence, expand their product offerings, and capitalize on emerging opportunities. These activities have been driven by the need for technological advancements, access to new markets, and the desire to strengthen competitive positions.

The stringent regulatory frameworks in the Europe, CIS & Africa spatial transcriptomics market may pose significant challenges for new entrants. High compliance costs and complex approval processes may deter potential entrants, leading to a more consolidated market dominated by established companies.

The spatial transcriptomics industry is experiencing high growth due to the expanding applications, advancements in biotechnology & production processes, and increased research & development activities in the genomics area. Numerous industry players are focusing on expanding their product and services portfolio. For instance, in January 2024, Lunaphore (Bio-Techne) and Advanced Cell Diagnostics (ACD) launched a fully automated multi-omics workflow with the same section hyperflex detection of protein and RNA biomarkers. This workflow was made commercially available in Q2 2024.

The industry is witnessing a low regional expansion level as spatial transcriptomics technology is nascent in African countries. It requires significant investment in specialized equipment & reagents, and the high costs of instruments, as well as the requirement of skilled labor to operate them, could be a potential restraint for the market. Furthermore, the Russia-Ukraine war impacted the CIS countries' market due to the potential geopolitical and economic repercussions.

Product Insights

The consumables segment dominated the market in 2023 with a 52.16% share. Its dominance can be attributed to high product penetration, increasing use of reagents & kits, wide product availability, and frequent purchase of consumables to run instruments. The development of any new instrument or upgrade of any existing instrument directly impacts the segment growth as the development of any new instrument will result in the need for developing the required consumables. Genetic research has been revolutionized in recent decades with the introduction of advanced technologies and innovations in sequencing.

The software segment is expected to witness the fastest growth over the forecast period. The software segment includes products for visualization, interpretation, and management of data generated after the spatial studies of RNA molecules. The increasing volume of ongoing genomic research studies has led to the need for robust software solutions for data management and their interpretation. This is anticipated to drive the segment in the coming years.

Technology Insights

The sequencing-based methods segment dominated the market in terms of revenue in 2023, with a market share of 54.64%, and is anticipated to grow at the fastest over the forecast period. This segment is further categorized into laser capture microdissection (LCM), transcriptome in-vivo analysis (TIVA), in situ sequencing, and microtomy sequencing. Sequencing-based platforms have revolutionized gene expression study by enabling high-dimensional gene expression measurements at spatial resolution. These platforms capture messenger RNA (mRNA) molecules at spatial measurement locations on tissue sections, tag them with unique spatial barcodes, and generate a readout through sequencing. NGS can capture polyadenylated RNA transcripts, enabling the discovery of new differential genes or biological mechanisms.

Furthermore, the microscopy-based RNA imaging techniques segment is expected to grow at a significant CAGR over the forecast period. These imaging techniques can help visualize and study RNA molecules within cells, enabling researchers to observe the spatial distribution, dynamics, and interactions of RNA molecules in real-time. This provides valuable insights into gene expression regulation, RNA localization, and RNA-protein interactions.

Workflow Insights

The sample preparation segment dominated the market with a 55.49% share in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. Sample preparation is crucial for obtaining high-quality sequencing products for performing genomics & transcriptomics studies. Companies launching new products for streamlining and automating the sample preparation procedure are expected to boost segment growth. For instance, in June 2022, 10x Genomics launched Visium CytAssist, a compact, benchtop spatial instrument that can help streamline sample processing. It enables the transfer of analytes from tissue sections premounted on standard glass slides to Visium slides.

Furthermore, the instrumental analysis segment is expected to register significant CAGR from 2024 to 2030. The growth can be primarily attributed to substantial advancements in instruments, such as microscopy and mass spectrometry. Mass spectrometry is one of the most promising tools for quantifying nucleic acid & proteins. This analysis facilitates novel applications, such as new drug development, biomarker discovery, and diagnostics.

Sample Type Insights

The Formalin-Fixed Paraffin-Embedded (FFPE) segment dominated the market with the largest revenue share of 64.57% in 2023. FFPE is a standard sample type widely used to preserve human tissue for clinical diagnosis. It holds the majority share in the market. This technique is considered the best in researching tissue morphology for clinical histopathology & diagnostic purposes. FFPE specimens are abundant in clinical tissue banks, which can be attributed to segment growth. However, they are incompatible with single-cell level transcriptome sequencing owing to RNA degradation & damage during storage and extraction. Hence, researchers are focusing on new approaches for increasing the application of FFPE in spatial transcriptomic studies. Furthermore, market players implement strategies to gain market share and boost market growth. For instance, in June 2023, Bionano Genomics introduced new kits for its Ionic Purification System, enhancing nucleic acid extraction from challenging samples, such as FFPE & tumors. The technology, based on isotachophoresis, aims to improve quality and yield.

Furthermore, the fresh frozen segment is expected to grow at the fastest CAGR over the forecast period. The growth of the fresh frozen segment can be attributed to its wide scope of applications in proteomic studies based on tandem Mass Spectrometry (MS). However, the use of fresh frozen specimens is still limited. This is because repeated sampling of a fresh specimen is often not a practical solution in cases of limited material availability, such as for tumors of small size. Hence, to overcome these challenges generally, FFPE samples are used as they offer a better long-storage ability and are considered a more economical solution with high availability in tissue biobanks worldwide.

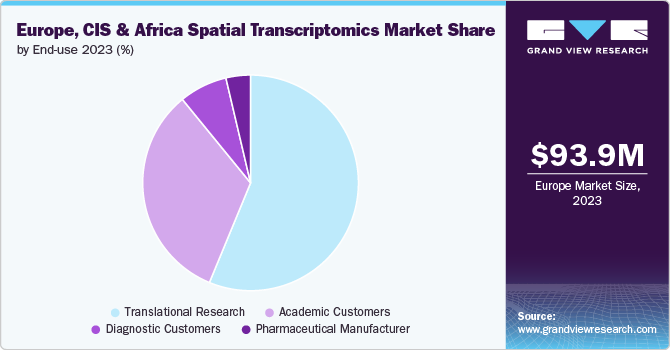

End-use Insights

The translational research segment held the largest market share of 56.24% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Spatial transcriptomics plays a crucial role in advancing translational research. This technology enables researchers to analyze gene expression within the context of tissue structure, providing valuable insights into cellular interactions and functions. The integration of spatial transcriptomics into translational research holds significant promise for bridging the gap between basic scientific discoveries and clinical applications. Spatial transcriptomics is used in cancer research for understanding cell-to-cell interaction and tumor progression of different cell types within tumors, including immune cells, stromal cells, and cancer cells.

In addition, by mapping gene expression patterns within tissues, spatial transcriptomics helps understand molecular mechanisms underlying disease pathogenesis. Researchers can identify key genes and pathways associated with specific diseases, leading to the discovery of potential therapeutic targets.

The academic customers segment is expected to witness growth at a significant CAGR from 2024 to 2030. Academic institutes are crucial in advancing spatial transcriptomics research by providing access to laboratory facilities, workflow platforms, and expertise. One such example of academic involvement in spatial transcriptomics is the Sweden’s Science for Life Laboratory (SciLifeLab) collaboration. In addition, The National Genomics Infrastructure offers RNA-seq analysis through the 10X Genomics Visium spatial gene expression assay for the spatial analysis of microdissected tissue sections.

Country Insights

Europe dominated the market and accounted for a 94.57% share in 2023 owing to the established biotechnology research & development sector, growing focus on spatial biology research, and the presence of key players. Furthermore, significant investments and funding from public and private sources enable the expansion of spatial transcriptomics research & the commercialization of spatial omics products.

The spatial transcriptomics market in the UK is expected to grow over the forecast period, driven by technological advancements in spatial biology and their increasing applications in various fields, such as oncology, neurology, and personalized medicine. Moreover, events such as the 12th Annual Single Cell & Spatial Analysis UK Congress under the Next Gen Omics 2024, scheduled for October 23-25, 2024, in London, highlight the UK’s role as a hub for innovation in this field. This conference would bring together global experts to discuss the latest trends, technologies, and future directions in spatial biology.

Germany spatial transcriptomics market is witnessing substantial growth in the multi-omics field. It is characterized by active participation from renowned academic institutions, biotechnology and pharmaceutical companies, and government funding for research projects. For instance, in February-March 2024, the European Molecular Biology Laboratory (EMBL) in Germany hosted a series of events and courses with a primary focus on integrating and analyzing multiomics data.

The spatial transcriptomics market in France is predicted to witness significant growth due to the increasing adoption of advanced genomic technologies and the expanding applications in various fields, including cancer research, drug discovery, and translational research. In addition, government initiatives and investments in genomic research further support the market's growth in France.

The Commonwealth of Independent States (CIS) Market Trends

The spatial transcriptomics market in the Commonwealth of Independent States (CIS) countries is expected to witness growth, which is expected to be driven by factors such as increasing adoption of advanced technologies in genomics & transcriptomics, rising research focusing on spatial biology, and growing demand for deeper insights into cellular function & organization. Several CIS countries, such as Russia, Ukraine, Belarus, Kazakhstan, and others, have significant research capabilities & academic institutions with molecular biology and biotechnology expertise.

Africa Spatial Transcriptomics Market Trends

The spatial transcriptomics market in South Africa is expected to exhibit considerable growth in the near future due to a rise in the demand for improved diagnostics that aid in the prevention & treatment of diseases.

The Nigerian spatial transcriptomics market is still in a nascent stage. It requires significant investment in specialized equipment and reagents, and the high costs of instruments, as well as the requirement of skilled labor to operate them, could be a potential restraint for the market.

Key Europe, CIS & Africa Spatial Transcriptomics Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Europe, CIS & Africa Spatial Transcriptomics Companies:

- Illumina, Inc.

- Bruker

- 10X Genomics

- EdenRoc Sciences (Cantata Bio, LLC)

- Shimadzu Corporation

- Waters Corporation

- Bio-Techne

- Vizgen Inc.

- Spatial Genomics

- Akoya Biosciences, Inc

Recent Developments

-

In April 2024, Vizgen expanded its single-cell spatial transcriptomics offering by launching the MERSCOPE Ultra Platform and MERFISH 2.0 chemistry.

-

In March 2024, Bruker acquired the optical cell imaging company Phasefocus, further enhancing Bruker’s existing cell imaging product portfolio.

-

In February 2024, NanoString (now Bruker) launched the CosMx Human 6K Discovery Panel, enabling researchers to measure over 6,000 RNA targets.

-

In February 2024, DNAnexus and Curio Bioscience collaborated to make data analysis simplified and streamlined for whole transcriptome spatial mapping studies.

-

In October 2023, Bruker acquired PhenomeX, a provider of research tools for single-cell biology, to strengthen its existing cellular & subcellular analysis tools, including the CellScape spatial biology platform.

Europe, CIS & Africa Spatial Transcriptomics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 107.5 million |

|

Revenue forecast in 2030 |

USD 256.1 million |

|

Growth rate |

CAGR of 15.57% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product, technology, workflow, sample type, end-use, region |

|

Regional scope |

Europe, Commonwealth of Independent States (CIS), Africa |

|

Country scope |

U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, Netherlands, Belgium, Finland, Switzerland, Poland, South Africa, Nigeria, Morocco |

|

Key companies profiled |

Illumina, Inc.; Bruker; 10X Genomics; EdenRoc Sciences (Cantata Bio, LLC); Shimadzu Corporation; Waters Corporation; Bio-Techne; Vizgen Inc.; Spatial Genomics; Akoya Biosciences, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe, CIS & Africa Spatial Transcriptomics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe, CIS & Africa spatial transcriptomics market report based on product, technology, workflow, sample type, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

By Mode

-

Automated

-

Semi-automated

-

Manual

-

-

By Type

-

Sequencing Platforms

-

IHC

-

Microscopy

-

Flow Cytometry

-

Mass Spectrometry

-

Others

-

-

-

Consumables

-

Software

-

Bioinformatics Tools

-

Imaging Tools

-

Storage And Management Databases

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sequencing-based Methods

-

Laser Capture Microdissection (LCM)

-

Transcriptome In-Vivo Analysis (TIVA)

-

In Situ Sequencing

-

Microtomy Sequencing

-

-

IHC

-

Microscopy-based RNA Imaging Techniques

-

Single Molecule RNA Fluorescence In-Situ Hybridization (smFISH)

-

Padlock Probes & Rolling Circle Amplification

-

Branched DNA Probes

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Preparation

-

Instrumental Analysis

-

Data Analysis

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

FFPE

-

Fresh Frozen

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Translational Research

-

Academic Customers

-

Diagnostic Customers

-

Pharmaceutical Manufacturers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Netherlands

-

Belgium

-

Finland

-

Switzerland

-

Poland

-

-

The Commonwealth of Independent States (CIS)

-

Africa

-

South Africa

-

Nigeria

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The Europe, CIS & Africa spatial transcriptomics market size was estimated at USD 93.9 million in 2023 and is expected to reach USD 107.5 million in 2024.

b. The Europe, CIS & Africa spatial transcriptomics market is expected to grow at a compound annual growth rate of 15.57% from 2024 to 2030 to reach USD 256.1 million by 2030.

b. The consumables segment dominated the market in 2023. Its dominance can be attributed to high product penetration, increasing use of reagents & kits, wide product availability, and frequent purchase of consumables to run instruments.

b. Some of the key players of the market include Illumina, Inc.; Bruker; 10X Genomics; EdenRoc Sciences (Cantata Bio, LLC); Shimadzu Corporation; Waters Corporation; Bio-Techne; Vizgen Inc.; Spatial Genomics; and Akoya Biosciences, Inc.

b. The emerging potential of spatial omics analysis for cancer research, the advent of the fourth generation of sequencing (in-situ sequencing), and the increasing funding & collaborative initiatives in spatial biology research are some of the factors that drive the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."