Europe Carbon Capture Utilization Market Size, Share & Trends Analysis Report By Application (Enhanced Oil Recovery, Industrial, Agriculture), By Country, Competitive Analysis, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-825-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

Market Size & Trends

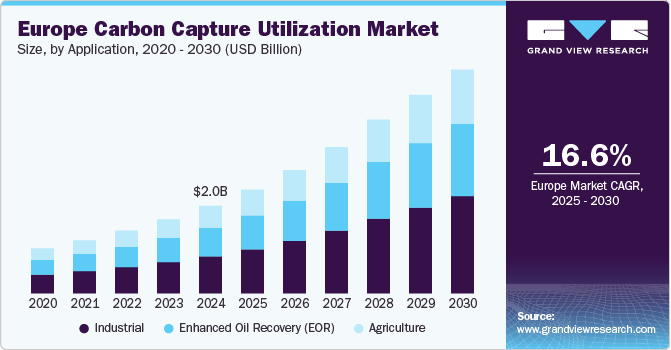

The Europe carbon capture utilization market size was estimated at USD 2,009.28 million in 2024 and is projected to grow at a CAGR of 16.6% from 2025 to 2030. Factors such as increasing applications of carbon capture utilization (CCU) in the enhanced oil recovery (EOR) in the oil & gas segment are expected to contribute to the growth of the market. Further, the food & beverages, chemicals, cement, and other industries are anticipated to be the major application segments that are expected to contribute to the market growth for carbon capture utilization in Europe over the forecast period. Germany is one of the major contributors to carbon dioxide emissions and a major market for carbon capture and utilization in Europe.

Technological advancements play a crucial role in enhancing the efficiency and cost-effectiveness of CCU solutions, thereby attracting further investment. The integration of CCU with hydrogen production is also gaining traction as Europe moves towards a hydrogen-based economy. In addition, ongoing research and development efforts are focused on expanding CCU applications beyond traditional sectors into manufacturing and refining industries, which are actively seeking to decarbonize their operations. Overall, the convergence of governmental support, corporate sustainability initiatives, and technological innovation is positioning the Europe CCU market as a pivotal element in the region's strategy to combat climate change.

The demand for low-carbon products, such as sustainable fuels, chemicals, and building materials, is another key driver of the CCUS market. Carbon utilization, in particular, has seen an increased focus as industries seek to convert captured carbon dioxide into valuable products. European companies are exploring innovative ways to integrate CO2 into manufacturing processes, such as producing synthetic fuels, plastics, and construction materials. This shift toward a circular economy is helping to expand the utilization side of CCUS technologies.

Application Insights

Based on the application, the Europe carbon capture utilization industry is segmented into enhanced oil recovery, industrial, and agriculture. The industrial segment led the market with the largest revenue market share of 42.34% in 2024 and is expected to grow at the fastest CAGR of 17.1% during the forecast period. The industrial segment of this market is driven by a combination of regulatory, environmental, and economic factors. Firstly, stringent climate regulations play a pivotal role in shaping the market. The European Union's commitment to achieving net-zero carbon emissions by 2050 has led to the introduction of policies such as the Emissions Trading System (ETS) and Carbon Border Adjustment Mechanism (CBAM). These initiatives incentivize industrial players to adopt CCU technologies to reduce their carbon footprint, avoid penalties, and maintain competitiveness in the global market.

Carbon capture utilization in EOR is one of the significant industries, which has a growth rate of 16.4%from 2025 to 2030. The strong underpinning expertise and the availability of high-end technologies are the most crucial factors favoring the adoption of carbon capture utilization across the oil & gas industry. Furthermore, factors such as comprehensive value chain relationships, access to low-cost finance, and revenues generated by the market players, are used to fund to adopt the carbon capture utilization in the oil and gas industry.

Country Insights

Germany Carbon Capture Utilization Market Trends

Germany dominated the Europe carbon capture utilization market with the largest revenue share of 20.76% in 2024. Germany plays a pivotal role in the Europe carbon capture and utilization industry due to its commitment to achieving ambitious climate targets and transitioning toward a circular economy. As a leader in industrial innovation, the country has invested significantly in advanced technologies to mitigate greenhouse gas emissions. Germany's goal of achieving net-zero carbon emissions by 2045 has prompted a surge in research, development, and deployment of CCU technologies across sectors such as chemicals, energy, and manufacturing. Supportive government policies, including subsidies and tax incentives, further encourage the adoption of CCU, making Germany a key driver of the market in Europe.

Germany's influence extends to shaping regional and international CCU standards and practices. By spearheading initiatives such as the European Green Deal and participating in cross-border carbon management projects, Germany reinforces its commitment to combating climate change through CCU. The country’s focus on integrating CCU with hydrogen production and renewable energy further strengthens its market position, setting an example for other European nations. With its comprehensive approach to technology, policy, and collaboration, Germany is a cornerstone in driving the market growth in Europe.

France Carbon Capture Utilization Market Trends

The France carbon capture utilization market is anticipated to grow at the fastest CAGR during the forecast period. France is a key player in the European carbon capture and utilization industry due to its strong commitment to reducing carbon emissions and achieving climate neutrality by 2050. The country’s leadership in renewable energy, particularly in nuclear power, provides a stable and low-carbon energy supply that supports CCU technologies. Government policies, such as France’s National Low-Carbon Strategy (SNBC) and its alignment with the European Green Deal, are significant drivers for CCU adoption. These frameworks promote the development of carbon capture technologies and incentivize industries to reduce emissions through research grants, tax incentives, and funding for pilot projects.

Key Europe Carbon Capture Utilization Company Insights

The European carbon capture utilization industry is moderately consolidated with the presence of various multinational players. This makes the industry highly competitive in nature as it also requires high initial investments and R&D costs. Some of the significant industry participants include Royal Dutch Shell, Equinor ASA, Linde, and Aker Solution.

Key Europe Carbon Capture Utilization Companies:

- Aker Solutions

- Equinor ASA

- Fluor Corporation

- Linde Plc

- Mitsubishi Heavy Industries Ltd. (MHI)

- Royal Dutch Shell

- Siemens Energy

Recent Development

- In April 2024, Holcim announced the Carbon2Business carbon, capture, and utilization (CCU) project in the Lägerdorf cement plant. The project aims to contribute to the development of a CO2 economy in Germany.

Europe Carbon Capture Utilization Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2,380.60 million |

|

Revenue forecast in 2030 |

USD 5,130.00 million |

|

Growth rate |

CAGR of 16.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, Volume in million tons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Application, country |

|

Regional scope |

Europe |

|

Country Scope |

Germany; France; Netherlands; Poland; Austria |

|

Key companies profiled |

Royal Dutch Shell; Aker Solutions; Equinor ASA; Linde Plc; Siemens Energy; Fluor Corporation; Sulzer Ltd.; Mitsubishi Heavy Industries Ltd. (MHI) |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Carbon Capture Utilization Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe carbon capture utilization market report based on application, and country:

-

Application Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Enhanced Oil Recovery (EOR)

-

Industrial

-

Chemicals

-

Cement

-

Others

-

-

Agriculture

-

-

Country Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

Netherlands

-

Poland

-

Austria

-

Frequently Asked Questions About This Report

b. The Europe carbon capture utilization Market value was estimated at USD 2,009.28 million in 2024 and is expected to reach USD 2,380.60 million in 2025.

b. The Europe carbon capture utilization Market is expected to witness a compound annual growth rate of 16.6% from 2025 to 2030 to reach USD 5,130.00 million by 2030.

b. Industrial was the largest application segment accounting for 42.34% of the total revenue in 2024 on account of a wide range of CCU applications at various stages in industries such as cement, chemicals. and others.

b. Some of the key players operating in the Europe carbon capture utilization Market include Royal Dutch Shell, Equinor ASA, Linde, and Aker Solution.

b. Key factors driving the growth of the Europe carbon capture utilization market include favorable government regulations and funding initiatives in the European Union and increasing use of carbon dioxide in enhanced oil recovery (EOR).

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."