Europe Building-integrated Photovoltaics Market Size, Share & Trends Analysis Report By Power Rating, By Application (Deep Learning, Machine Learning), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-225-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

Market Size & Trends

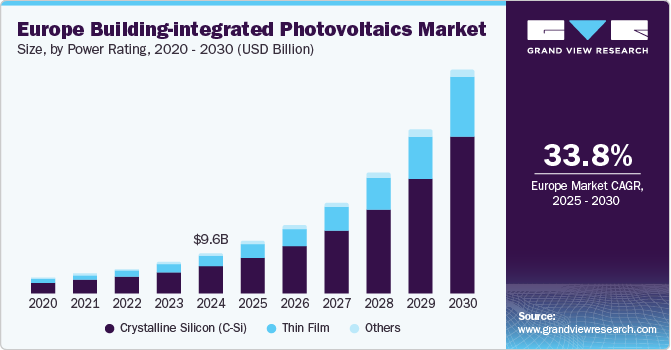

The Europe building-integrated photovoltaics market size was estimated at USD 9.61 billion in 2024 and is projected to grow at a CAGR of 33.8% from 2025 to 2030. Market growth in the region is driven by a confluence of government initiatives and regulatory frameworks advocating renewable energy adoption in construction. The European Green Deal, aimed at making Europe the first climate-neutral continent by 2050, provides a vital impetus by promoting energy-efficient building practices. Supporting policies, including financial incentives, tax rebates, and subsidies, make building-integrated photovoltaics (BIPV) installations more economically attractive for developers and building owners. This solidifies BIPV as an essential component of sustainable construction, facilitating the transition to green buildings.

Market growth in the region is driven by a confluence of government initiatives and regulatory frameworks advocating renewable energy adoption in construction. The European Green Deal, aimed at making Europe the first climate-neutral continent by 2050, provides a vital impetus by promoting energy-efficient building practices. Supporting policies, including financial incentives, tax rebates, and subsidies, make BIPV installations more economically attractive for developers and building owners. This solidifies BIPV as an essential component of sustainable construction, facilitating the transition to green buildings.

National regulations have further bolstered the BIPV market by establishing tailored incentives across various European countries. For instance, Germany’s Renewable Energy Sources Act (EEG) fosters a robust market for solar energy projects, including BIPV, through feed-in tariffs. Similarly, France and Italy provide tax credits and value-added tax reductions for solar installations, enhancing BIPV viability within the residential and commercial sectors. Such regulatory support cultivates a conducive environment for market growth, encouraging greater adoption of BIPV technologies in line with national energy targets.

Furthermore, innovations aimed at improving the efficiency, aesthetics, and cost-effectiveness of BIPV systems make them increasingly appealing to consumers and businesses. Projects such as BIPVBOOST focus on reducing installation costs while enhancing performance, aligning with regulatory objectives for energy efficiency. As the demand for sustainable solutions rises, these technological improvements contribute significantly to BIPV’s market penetration and the overall transition toward renewable energy integration in the built environment.

The growing urbanization and emergence of smart cities in Europe present unique opportunities for BIPV installations. The trend toward creating aesthetic and functional buildings that harness renewable energy dovetails with consumer preferences for sustainable living. Combined with stringent environmental regulations promoting the integration of solar solutions, these factors position the BIPV market for robust growth, ultimately driving innovation and investment in sustainable building practices across the continent.

Power Rating Insights

Crystalline Silicon (C-Si) dominated the market with a revenue share of 68.8% in 2024. C-Si technology offers superior energy conversion efficiencies and durability, making it highly suitable for building integration. Moreover, decreasing costs of C-Si cells improve their economic feasibility, while diverse aesthetic options meet consumer demands for attractive solar solutions. The sustainability trend and government incentives further bolster the adoption of C-Si BIPV systems in construction.

Thin film technology is expected to grow at the fastest CAGR of 35.4% over the forecast period due to its lightweight and flexible nature, suitable for weight-sensitive applications. Technological advancements have improved efficiency and aesthetics, while supportive government incentives foster increased adoption of thin film BIPV in both residential and commercial sectors.

Application Insights

The roofs segment held the largest revenue share of 41.0% in 2024, providing ideal surfaces for solar integration with minimal installation disruption. The shift towards energy-efficient buildings and supportive government incentives for renewable energy propel the adoption of the BIPV system. At the same time, innovations in lightweight, aesthetically pleasing solar tiles attract developers and environmentally conscious homeowners.

The façade segment is expected to register significant growth over the forecast period. Photovoltaic-integrated facades enhance solar energy capture without compromising architectural aesthetics. Ventilated photovoltaic facades improve energy yield in low irradiation and boost insulation performance. Government incentives and consumer demand for visually attractive solar solutions further support their adoption in renewable energy integration.

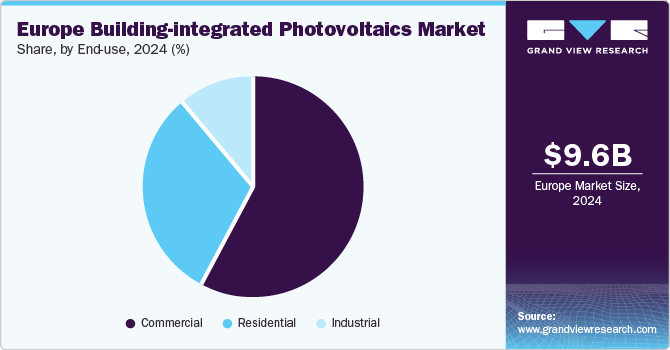

End Use Insights

The commercial segment led the market and accounted for a share of 58.0% in 2024. Businesses increasingly focus on sustainability and energy efficiency to meet corporate social responsibility objectives. Government incentives and favorable regulations promote adopting the BIPV system in commercial buildings, providing long-term cost savings and increased property value. On-site renewable energy generation further reduces operational costs and carbon footprints, aligning with smart building and urbanization trends.

The residential sector is projected to grow at the fastest CAGR of 36.0% over the forecast period, driven by favorable government regulations and attractive financial incentives, including subsidies and tax rebates. Consumer awareness of renewable energy benefits, particularly in Germany and France, alongside the aesthetic appeal of BIPV solutions, supports energy independence and sustainable living.

Country Insights

Germany Building-integrated Photovoltaics Market Trends

The Germany building-integrated photovoltaics market led the Europe market with a revenue share of 24.6% in 2024 fueled by strong government support and a favorable regulatory environment for renewable energy. Incentives such as feed-in tariffs and subsidies enhance economic viability, while technological advancements lower installation costs. This commitment to sustainability has positioned Germany as a prominent member of the regional market.

Italy Building-integrated Photovoltaics Market Trends

The building-integrated photovoltaics market in Italy is expected to grow at the fastest CAGR of 39.4% over the forecast period. The Italian government provides substantial feed-in tariffs for electricity produced from integrated solar components, increasing the appeal of BIPV systems. Initiatives such as Onyx Solar’s R2M solutions address consumer demand for aesthetic solar facades. With major investments in renewable energy, Italy is positioned for significant growth in the BIPV sector.

Key Europe Building-integrated Photovoltaics Company Insights

Some key companies operating in the market include AGC Inc., Heliatek GmbH, Hanergy Thin Film Power Group Europe, and Ertex Solar. The market is marked by collaboration and innovation among key players, driven by strategic partnerships, regulatory support, and a focus on cost-effective, energy-efficient solutions.

-

Heliatek GmbH specializes in organic photovoltaic (OPV) technology, offering lightweight and flexible solar films that integrate seamlessly into diverse building surfaces. Their products aim to improve energy efficiency while preserving aesthetic appeal, making them ideal for new constructions and retrofitting existing structures in the region.

-

ISSOL SA is a French company specializing in developing and manufacturing building-integrated photovoltaic solutions, particularly solar facades and roofs. Their innovative products merge energy generation with architectural design, facilitating seamless integration into residential and commercial buildings.

Key Europe Building-integrated Photovoltaics Companies:

- AGC Inc.

- Heliatek GmbH

- Hanergy Thin Film Power Group Europe

- Ertex Solar

- ISSOL sa

- Onyx Solar Group LLC

- BELECTRIC

- SOLAXESS

- Tesla

- Canadian Solar

- Metsolar

- UAB GLASSBEL BALTIC

- SUNOVATION

- BiPVco

- Polysolar

Recent Developments

-

In October 2024, AGC Glass Europe partnered with ROSI to enhance circularity in the glass industry, utilizing recycled materials from solar panels to reduce environmental impact and promote sustainable resource use.

-

In July 2024, Recurrent Energy (a subsidiary of Canadian Solar) secured a loan of approximately USD 54.0 million from the European Investment Bank to enhance its solar energy portfolio in Italy, supporting the country’s clean energy transition and emission reduction goals.

-

In May 2024, Heliatek completed a double-façade installation of HeliaSol solar films at Erlanger Stadtwerke, demonstrating innovative energy generation capabilities and reinforcing the company’s commitment to sustainability and technology.

-

In March 2024, SUNOVATION launched BIPV modules featuring innovative quarter-cell technology, becoming the first manufacturer to adopt high-performance G12 cells for building-integrated photovoltaics in glass-glass modules.

-

In December 2023, AGC announced the adoption of Sunjoule BIPV glass for the Shizuoka Station bicycle parking roof, enabling a maximum solar output of 3.7 kW and promoting sustainable community initiatives.

Europe Building-integrated Photovoltaics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 12.46 billion |

|

Revenue forecast in 2030 |

USD 53.48 billion |

|

Growth rate |

CAGR of 33.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Power rating, application, end use, region |

|

Regional scope |

Europe |

|

Country scope |

Germany, UK, Italy, France, Spain, Switzerland |

|

Key companies profiled |

AGC Inc.; Heliatek GmbH; Hanergy Thin Film Power Group Europe; Ertex Solar; ISSOL sa; Onyx Solar Group LLC; BELECTRIC; SOLAXESS; Tesla; Canadian Solar; Metsolar; UAB GLASSBEL BALTIC; SUNOVATION; BiPVco; Polysolar |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Building-integrated Photovoltaics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe building-integrated photovoltaics market report based on power rating, application, end use, and region:

-

Power Rating Outlook (Revenue, USD Million, 2018 - 2030)

-

Crystalline Silicon (C-Si)

-

Thin Film

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Roofs

-

Facade

-

Glass

-

Wall

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

Switzerland

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."