Europe Bone Grafts And Substitutes Market Size, Share & Trends Analysis Report By Material Type (Allograft, Synthetic), By Application (Craniomaxillofacial, Foot & Ankle, Joint Reconstruction, Long Bone, Spinal Fusion), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-298-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

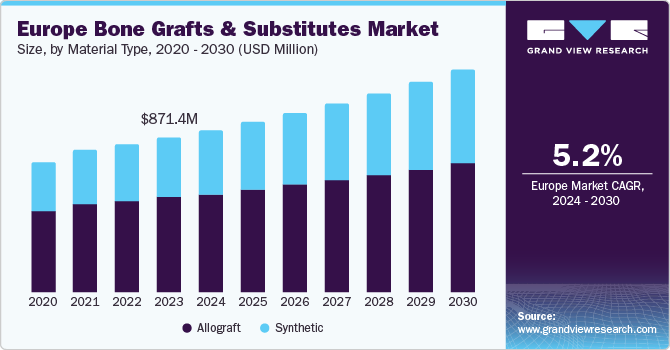

The Europe bone grafts and substitutes market size was estimated at USD 871.4 million in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The rising elderly population across Europe is leading to a growing demand for orthopedic solutions. As people age, they become more susceptible to conditions such as osteoporosis and fractures, often requiring bone grafting procedures for repair. In addition, advancements in medical technology are playing a crucial role in the development of innovative bone graft materials and surgical techniques. This innovative technology is improving the efficacy and accessibility of these procedures.

In 2023, the Europe market accounted for 36.8% revenue share of the global bone grafts and substitutes market. The increasing prevalence of dental implant surgeries and other procedures requiring bone regeneration is creating a strong demand for bone grafts and substitutes. These combined factors are paving the way for a robust and flourishing European bone grafts and substitutes industry in the coming years.

Regulations play a significant role in the European bone grafts and substitutes industry. The European Union (EU) enforces strict regulations through directives and regulations such as the Medical Devices Regulation (MDR) (Regulation (EU) 2017/745) and the Tissue and Cells Products Regulation (TCPR) (Regulation (EU) 1394/2007). These regulations ensure the safety, efficacy, and quality of bone grafts and substitutes marketed in Europe. For instance, the MDR mandates rigorous pre-clinical and clinical testing to assess the safety and performance of bone graft substitutes. These stringent regulations can slow down market entry for new products but ultimately protect patients by ensuring the materials meet high safety standards.

Material Type Insights

The market is currently dominated by allografts, which held a commanding 61.2% share in 2023. This preference for bone grafts derived from human tissue can be attributed to several factors. Surgeons have long been familiar with allografts, fostering a sense of comfort and established techniques for their use. In addition, allografts possess a natural composition closely resembling the bone structure, potentially promoting optimal osseointegration, the process by which implants bond with the bone.

Synthetic bone grafts are experiencing a surge in adoption and are expected to grow at a CAGR of 6.4% from 2024 to 2030. This growth can be linked to advancements in material science. Researchers are developing increasingly biocompatible and osteoconductive synthetic materials. Biocompatibility ensures the body tolerates the implant, while osteoconductivity refers to the material's ability to promote bone cell growth along its surface. Moreover, synthetic grafts offer the potential advantages of reduced disease transmission risk compared to allografts and a potentially limitless supply, addressing donor scarcity concerns.

Application Insights

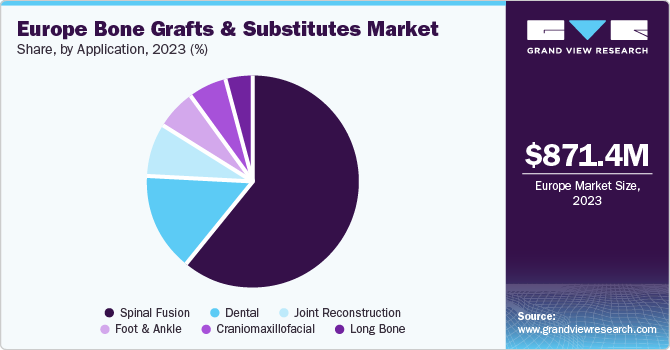

The spinal fusion procedures segment dominated the market in 2023 with a revenue share of 61.3%. This dominance reflects the prevalence of spinal disorders such as degenerative disc disease and spondylolisthesis, necessitating spinal fusion surgeries to achieve stability and alleviate pain. Bone grafts and substitutes play a crucial role in these procedures, promoting bone growth and facilitating fusion between vertebrae.

Dental applications are expected to experience the fastest CAGR of 7.6% from 2024 to 2030. This surge is attributable to several factors, including the rising geriatric population with the increased need for dental implants, growing awareness of dental aesthetics, and advancements in bone graft materials specifically designed for jaw reconstruction and implant placement. As dental procedures become more sophisticated, the demand for effective bone grafts and substitutes to enhance the success rate of implants and improve oral functionality is expected to propel the segment growth.

Country Insights

Germany Bone Grafts And Substitutes Market Trends

Germany bone grafts and substitutes market dominated the European region by capturing the largest revenue share of 22.8% in 2023. This leadership likely reflects a combination of factors, such as a well-established healthcare system, high patient awareness regarding bone surgeries, and a robust research and development infrastructure in the medical device industry.

UK Bone Grafts And Substitutes Market Trends

The bone grafts and substitutes market in the UK is poised for the fastest growth within the European region, with a projected CAGR of 5.5% between 2024 and 2030. This surge could be attributed to several reasons, including an aging population with a rising need for bone repair procedures, increasing government investments in healthcare, and potential advancements in bone graft substitute technologies.

Key Europe Bone Grafts And Substitutes Company Insights

The bone grafts and substitutes market in Europe exhibits a notable concentration. This is influenced by several factors, including the presence of abundant bone graft resources within the countries. Some of the key players operating in this market are:

-

Geistlich Pharma AG: Geistlich Pharma, headquartered in Switzerland, is a provider of biomaterials for regenerative medicine. Their bone graft products are widely used in dental and orthopedic applications.

-

Medtronic: Medtronic, a global medical technology company, has a significant presence in Europe. Their bone graft materials, including autografts, allografts, and synthetic substitutes, cater to various clinical needs.

Key Europe Bone Grafts And Substitutes Companies:

- Geistlich Pharma AG

- Stryker

- Medtronic

- ZimVie Inc.

- CAMLOG Biotechnologies GmbH

- Dentsply Sirona

- Matricel GmbH

- Institut Straumann AG

- Resorba Medical GmbH

- Regenity

Recent Developments

-

In April 2024, Locate Bio Ltd. secured an additional USD 11.7 million in venture capital funding. The round was co-led by established investors Mercia Ventures and Business Growth Fund. The proceeds will be directed towards financing a clinical trial of LDGraft, Locate Bio's novel bone graft substitute for spinal fusion.

-

In March 2024, Stryker acquired SERF SAS, a French company in the joint replacement space, from Menix. This strategic move strengthens Stryker's European and global joint replacement portfolio, allowing it to expand its patient reach through a bolstered implant product line.

Europe Bone Grafts And Substitutes Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 1,250.9 million |

|

Growth rate |

CAGR of 5.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Material type, application, country |

|

Country scope

|

Germany; UK; Spain; France; Italy |

|

Key companies profiled |

Geistlich Pharma AG; Stryker; Medtronic Plc; ZimVie Inc; CAMLOG Biotechnologies GmbH; Dentsply Sirona Inc; Matricel GmbH; Institut Straumann AG; Resorba Medical GmbH; Regenity Biosciences Inc |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Bone Grafts And Substitutes Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe bone grafts and substitutes market report based on material type, application, and country:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Allograft

-

Demineralized Bone Matrix

-

Others

-

-

Synthetic

-

Ceramics

-

HAP

-

β-TCP

-

α-TCP

-

Bi-phasic Calcium Phosphates (BCP)

-

Others

-

-

Composites

-

Polymers

-

Bone Morphogenic Proteins (BMP)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Craniomaxillofacial

-

Dental

-

Foot & Ankle

-

Joint Reconstruction

-

Long Bone

-

Spinal Fusion

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."