- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Blow Molded Plastic Market, Industry Report, 2030GVR Report cover

![Europe Blow Molded Plastic Market Size, Share & Trends Report]()

Europe Blow Molded Plastic Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology, By Product (Polypropylene, ABS, PVC, PET, Others), By Application, By Point Of Usage, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-156-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Blow Molded Plastic Market Trends

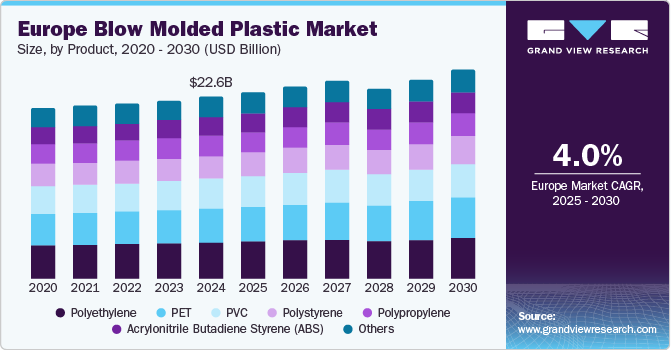

The Europe blow molded plastic market size was valued at USD 22.61 billion in 2024 and is projected to grow at a CAGR of 4.0% from 2025 to 2030. Growing health concerns and strict government regulations on carbon emissions have boosted the use of plastics in the automotive industry to produce lightweight vehicles with improved fuel efficiency.

The market is shaped by the enforcement of stringent environmental regulations, such as DIRECTIVE (EU) 2019/904 and Commission Regulation (EU) No 10/2011, issued by regulatory authorities like the European Chemicals Agency (ECHA) and the European Commission, along with other federal-level bodies. Meanwhile, growing consumerism and expanding manufacturing activities in Eastern Europe are anticipated to positively impact market growth.

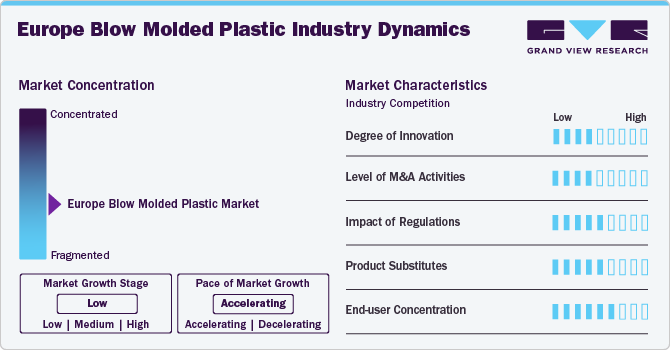

Market Concentration & Characteristics

The Europe blow molded plastic market growth is low however, the pace of market growth is accelerating. The market is characterized by a moderate degree of innovation, driven by growing health concerns and stringent government regulations on carbon emissions, which have led to increased use of plastics in the automotive industry to produce lightweight vehicles with improved fuel efficiency.

The Europe blow-molded plastic market is also characterized by a moderate level of merger and acquisition (M&A) activity among leading players, driven by increasing demand for lightweight and sustainable packaging, stringent environmental regulations, and the need to enhance production efficiency and expand market presence. Additionally, the increasing regulatory scrutiny, driven by stringent environmental policies, and the growing need to reduce carbon emissions and plastic waste are fueling the market growth.

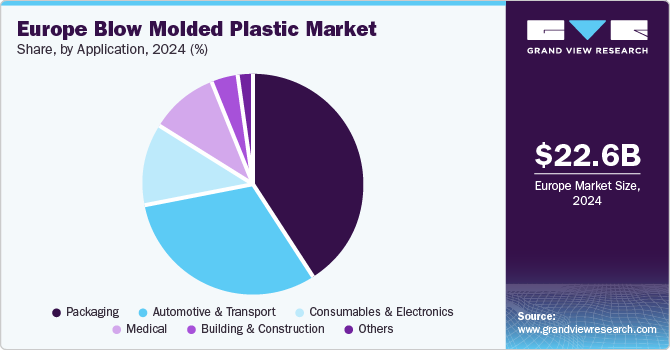

The end user concentration in the Europe blow-molded plastic market is moderately high, with a few key sectors accounting for most of the demand. Packaging remains the leading end use segment in the blow molded plastic industry, holding the largest market share owing to its broad application across food and beverages, personal care, household items, and healthcare products. The automotive sector is another key contributor, particularly in regions such as Europe and North America, where the demand for lightweight plastic parts is high due to the increasing need to enhance vehicle fuel efficiency.

Technology Insights

Extrusion blow molding accounted for the largest share of 37.7% in 2024. The segment is expected to maintain its position over the forecast period. As per the latest trend, recycling and bio-based plastics have found increasing adaptation in most European manufacturers to meet very strict environmental regulations and consumer expectations. Organizations such as ALPLA have also confronted a significant call for investments in recycling infrastructure in order to process a record number of recycled PET and HDPE each year. These factors together are boosting product adoption.

The injection blow molding (IBM) segment is expected to grow at the fastest CAGR over the forecast period. The main driver for IBM's demand is the ever-increasing need for top-class plastic packaging in food, beverage, pharma, and cosmetics. Other modern products, such as automation, energy-efficient systems, and real-time monitoring, have improved the operational efficiency and accuracy of IBM machine operations, consequently lowering production costs while reducing waste. Overall, the European IBM industry is showing a strong growth trend due to advancing technologies and environmental efforts to increase industrial applications.

Product Insights

The polyethylene product segment held the largest market share in 2024. The expanding use of PE compounds in the building, electronics, and packaging industries is the main driver of this significant market share. Polystyrene components are utilized across various industries, such as consumer goods, electrical and electronics, building and construction, and packaging. Its resistance to photolysis contributes to its non-biodegradable nature.

Acrylonitrile Butadiene Styrene (ABS) is expected to register the fastest CAGR during the forecast period. Acrylonitrile Butadiene Styrene (ABS) provides properties like rigidity, high strength, and dimensional stability, making it ideal for use in consumer goods and electrical and electronics applications. Major uses of ABS include LEGO toys and electronic equipment and components. Additionally, as a thermoplastic, ABS offers heat and impact resistance and can be easily melted to manufacture blow-molded products.

Application Insights

The packaging application segment dominated the Europe blow molded plastic market in 2024, and it is expected to maintain its leading position over the forecast period. This dominance is primarily driven by the sustained and growing demand for packaging solutions across various sectors, particularly in healthcare and consumer goods. In the wake of heightened awareness around hygiene and infection control, there has been a significant surge in the consumption of Personal Protective Equipment (PPE) and related medical supplies such as face shields, masks, gloves, protective suits, and medical kits.

The automotive & transport segment is expected to register significant growth during the forecast period. A variety of plastics are utilized in the automotive & transport sector, spanning applications from interior components to engine parts. Polypropylene (PP) compounds are increasingly replacing metals and other engineering plastics because of their excellent mechanical properties and ease of molding. Multiple grades of PP compounds have been developed to meet varying performance needs. Additionally, the rising demand for sustainable materials has been a key driver in the increased use of lightweight blow molded plastics within this segment.

Point Of Usage Insights

The automotive & transportation segment held the largest revenue share in 2024. This substantial share is driven by the rising use of lightweight, durable, and long-lasting blow molded plastic components, which contribute to improved vehicle efficiency and reduced overall weight. Additionally, the increasing demand for electric vehicles (EVs) to lower carbon emissions is anticipated to fuel segment growth over the forecast period.

The household industrial chemical containers segment is expected to register the fastest CAGR over the forecast period. Household industrial chemical containers are used to store products such as floor cleaners, glass cleaners, phenyl, disinfectants, and more. The growing focus on hygiene and cleanliness, along with rising consumer awareness about health and sanitation, is expected to drive the demand for blow molded plastics in the household industrial chemical containers segment.

Food and beverage bottles are extensively utilized for packaging carbonated and non-carbonated beverages, bottled water, edible oils, and a variety of packaged and processed food products. The increasing demand for packaged and processed foods is anticipated to drive the segment’s growth over the forecast period.

Country Insights

Germany dominated the blow molded plastics market in Europe in 2024. Germany ranks among the leading plastics manufacturers in Europe, supported by a substantial number of high-capacity production facilities. The country exports plastics to neighboring nations, driven by its high-quality output and large-scale manufacturing capabilities. Additionally, Germany recycles a considerable volume of plastic waste, converting it into products such as fibers, sheets, and films.

Germany is the largest consumer of non-alcoholic beverages and packaged and processed food products in Europe, fueling the demand for blow molded plastics in food and beverage packaging applications. In Italy, the packaging and automotive industries are the primary drivers of market growth. Additionally, increasing environmental awareness across the region has accelerated the demand for packaging products made from recycled plastics, further supporting overall market expansion.

Key Europe Blow Molded Plastic Company Insights

Some of the key companies in the Europe blow molded plastic market include Agri-Industrial Plastics, ALPLA-Werke Alwin Lehner GmbH & Co KG, APEX Plastics, Berry Global, Inc., Comar, LLC and others. Organizations have been tactically implementing various expansion plans such as mergers and acquisitions, strengthening of online presence, production enhancement and new product launches to gain a competitive advantage.

-

Agri-Industrial Plastics specializes in the production of large, complex components for industries such as agriculture, automotive, and industrial equipment. Leveraging advanced blow molding technologies, the company focuses on delivering lightweight, durable, and sustainable plastic solutions. Its expertise in custom blow molding positions it as a strong contributor to market growth, particularly as demand rises for innovative, high-performance plastic products.

-

ALPLA-Werke Alwin Lehner GmbH & Co KG specializes in the development and production of innovative blow molded bottles, closures, and injection-molded parts for industries such as food and beverage, personal care, household, and pharmaceuticals. With a strong focus on sustainability, ALPLA operates multiple recycling plants and invests in circular economy initiatives, reinforcing its commitment to environmentally responsible packaging.

Key Europe Blow Molded Plastic Companies:

- Agri-Industrial Plastics

- ALPLA-Werke Alwin Lehner GmbH & Co KG

- APEX Plastics

- Berry Global, Inc.

- Comar, LLC

- Creative Blow Mold Tooling

- Custom-Pak

- Dow Inc.

- Garrtech, Inc.

- Gemini Group, Inc.

- HTI Plastics

- INEOS Group

- International Automotive Components (IAC) Group

- LyondellBasell Industries Holdings B.V.

- Magna International, Inc.

- Plastipak Holdings, Inc.

- Rutland Plastics Ltd.

- The Plastic Forming Company, Inc.

Recent Developments

-

In April 2025, Ingenia Polymers expanded its global presence by launching its first European manufacturing facility in Obernburg, Germany. This strategic move enables the company to better serve the growing regional demand for high-performance polymer products. The facility strengthens Ingenia’s supply chain capabilities and responsiveness across Europe. It also underscores the company’s commitment to supporting local customers with advanced polymer solutions.

-

In December 2024, TekniPlex Healthcare announced an expansion of its European operations, increasing capacity for injection blow molded bottles and five-layer blown film. This initiative addresses the rising demand for advanced pharmaceutical packaging. The expansion enhances the company’s ability to serve healthcare markets across the region with high-quality, multi-layer packaging solutions.

-

In February 2022, Comar expanded its international presence by acquiring Automatic Plastics Ltd., a European medical and pharmaceutical injection molder. This acquisition enhances Comar's capabilities in the healthcare packaging sector.

Blow Molding Plastic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.17 billion

Revenue forecast in 2030

USD 28.22 billion

Growth Rate

CAGR of 4.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, point of usage, and country

Country scope

Germany, UK, France, Italy, Central Europe (Poland, Slovakia, Czech Republic, Hungary, Romania, former Yugoslavian countries)

Key companies profiled

Agri-Industrial Plastics, ALPLA-Werke Alwin Lehner GmbH & Co KG, APEX Plastics, Berry Global, Inc., Comar, LLC, Creative Blow Mold Tooling, Custom-Pak, Dow Inc., Garrtech, Inc., Gemini Group, Inc., HTI Plastics, INEOS Group, International Automotive Components (IAC) Group, LyondellBasell Industries Holdings B.V., Magna International, Inc., Plastipak Holdings, Inc., Rutland Plastics Ltd., The Plastic Forming Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Blow Molded Plastic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe blow molded plastic market report based on technology, product, application, point of usage, and country.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Extrusion Blow Molding

-

Injection Blow Molding

-

Stretch Blow Molding

-

Compound Blow Molding

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Polypropylene

-

Acrylonitrile butadiene styrene (ABS)

-

Polyethylene

-

Polystyrene

-

PVC

-

PET

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Consumables & Electronics

-

Automotive & Transport

-

HVAC Ducts

-

Air Intake Ducts

-

Others

-

-

Building & Construction

-

Medical

-

Others

-

-

Point of Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Household Industrial Chemical Containers

-

Toiletries & Cosmetics and Personal Care & Medical

-

Food & Beverage Bottles

-

Industrial Containers & Drums

-

Pipes, Cables & Insulation

-

Automotive & Transportation

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

U.K.

-

France

-

Italy

-

Central Europe

-

Poland

-

Slovakia

-

Czech Republic

-

Hungary

-

Romania

-

Former Yugoslavian Countries

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.