Europe Biotechnology And Pharmaceutical Services Outsourcing Market Size, Share & Trends Analysis Report By Service (Consulting, Auditing & Assessment), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-300-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

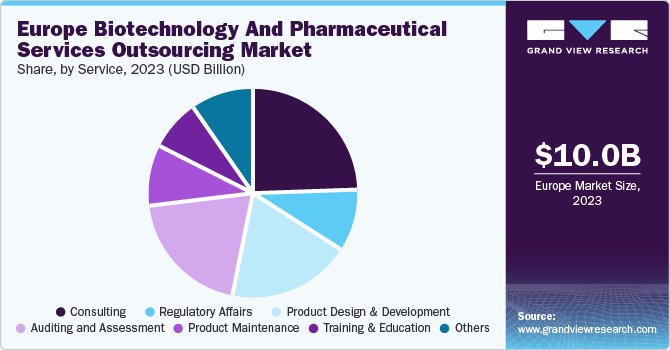

The Europe biotechnology and pharmaceutical services outsourcing market size was estimated at USD 10.0 billion in 2023 and is expected to grow at a CAGR of 5.75% from 2024 to 2030. Some of the key factors driving the growth of this market include the substantial increase in inclination towards outsourcing R&D activities to expert organizations, changing regulatory landscape, rising focus of biotechnology and pharmaceutical on core competencies, high clinical development failure rates, and increasing drug development costs.

Europe biotechnology and pharmaceutical services outsourcing market held a share of 21.7% of the global biotechnology and pharmaceutical services outsourcing market revenue in 2023. Several industry dynamics are encouraging biotechnology and pharmaceutical companies to outsource functions, such as clinical development, quality management, regulatory writing & publishing, product registration & clinical trial applications, research, strategy, & concept generation design verification & validation, auditing, product maintenance, training, and more.

Well-established regulatory outsourcing firms, contract research organizations (CROs), management consulting firms, and manufacturers working on contracts are diligently taking care of the complex demands of the pharmaceutical and biotechnological sectors.

End-use Insights

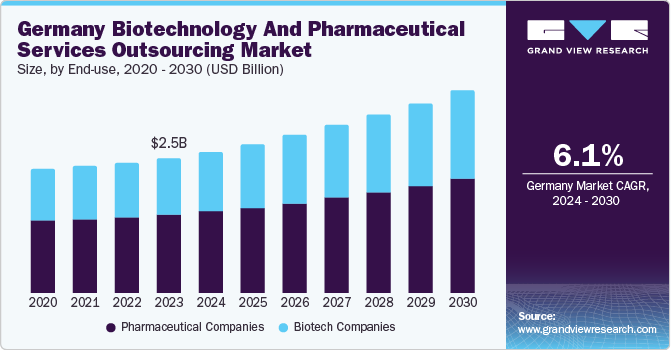

Based on the end-use, the pharmaceutical companies segment held the largest share of 57.6% in 2023. This segment is primarily driven by factors, such as the need for assistance developed due to the changing nature of regulatory scenarios, enhanced product design & development accomplished through outsourcing, and improved product testing & validation attained through expert assistance.

An increase in expenditure on R&D by pharmaceutical companies for the discovery and development of potential unique products is anticipated to drive market growth in the coming years. The biotech companies segment is expected to reregister a CAGR of 6.11% from 2024 to 2030.

Service Insights

The consulting services segment dominated the regional market and held a revenue share of 24.4% in 2023. Consulting businesses provide various services to assist companies in meeting regulatory compliances as well as quality standards and reducing environmental damages. For a pharmaceutical company, these businesses offer an enhanced level of expertise and experience. A rise in fraudulent cases and constant growth in technological innovations are two of the major challenges encountered by pharmaceutical/biotechnological companies. Therefore, such companies are inclined towards outsourcing a few functions.

The training & education segment is expected to register a CAGR of 4.31% from 2024 to 2030. This is mainly due to the ever-changing nature of the industry. Technological enhancements, changes in business functions, and fluctuations in political & economic scenarios make this industry extremely dynamic. This creates challenges for employees and professionals in keeping up with the required know-how and skills. The training and education services provided by expert organizations assist them in keeping themselves updated and equipped with the necessary competencies.

Country Insights

Germany Biotechnology And Pharmaceutical Services Outsourcing Market Trends

The Germany biotechnology and pharmaceutical services outsourcing market dominated the regional industry and accounted for a share of 25.2% in 2023. Germany is one of the largest pharmaceutical markets in the world after the U.S., Japan, and France, which is one of the major factors responsible for the high demand for pharmaceutical and biotechnology contract services in the country.

France Biotechnology And Pharmaceutical Services Outsourcing Market Trends

The biotechnology and pharmaceutical services outsourcing market in France is expected to register a CAGR of 6.2% from 2024 to 2030. Smaller pharmaceutical and biotechnology companies in France are increasingly entering the market by offering generics at lower prices and shifting the focus of major players in the healthcare industry toward innovation by developing novel drugs.

Key Europe Biotechnology And Pharmaceutical Services Outsourcing Company Insights

Some of the key and emerging companies in the Europe biotechnology and pharmaceutical services outsourcing market include Concept Heidelberg GmbH, ICON plc, Venus Pharma GmbH, Kindeva Drug Delivery, Midas Pharma GmbH, IQVIA Inc., and others. The highly competitive market encourages companies to embrace advanced technologies, accommodate changes in manufacturing processes, and develop highly skilled and competitive teams of experts.

-

Concept Heidelberg GmbH offers consulting, as well as training & education, services to multiple organizations. The company delivers approximately 350 conferences and seminars in nearly 10 countries. These seminars are related to areas, such as Good Manufacturing Practice (GMP), Good Distribution Practice (GDP), GDP certifications, GMP certifications, and more

-

Venus Pharma GmbH provides services, such as licensing, contract manufacturing, product development, product testing & release, packaging, warehouse & logistics, and research

Key Europe Biotechnology And Pharmaceutical Services Outsourcing Companies:

- Concept Heidelberg GmbH

- ICON PLC

- Venus Pharma GmbH

- Kindeva Drug Delivery

- Midas Pharma GmbH

- IQVIA Inc.

Recent Developments

-

In January 2024, Kindeva Drug Delivery, one of the leading organizations in drug-device combination products, acquired Summit Biosciences Inc., a renowned drug-delivery contract development and manufacturing organization (CDMO)

Europe Biotechnology And Pharmaceutical Services Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 14.6 billion |

|

Growth rate |

CAGR of 5.75% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Country scope |

Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway |

|

Segments covered |

End-use, service, country |

|

Key companies profiled |

Concept Heidelberg GmbH; ICON PLC; Venus Pharma GmbH; Kindeva Drug Delivery; Midas Pharma GmbH; IQVIA Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Biotechnology And Pharmaceutical Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe biotechnology and pharmaceutical services outsourcing market report based on end-use, service, and country:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotech Companies

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Consulting

-

Regulatory Consulting

-

Clinical Development Consulting

-

Strategic Planning & Business Development Consulting

-

Quality Management Systems Consulting

-

Others

-

-

Regulatory Affairs

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Others

-

-

Product Design & Development

-

Research, Strategy, & Concept Generation

-

Concept & Requirements Development

-

Detailed Design & Process Development

-

Design Verification & Validation

-

Process Validation & Manufacturing Transfer

-

Production & Commercial Support

-

-

Auditing & Assessment

-

Product Maintenance

-

Training & Education

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe biotechnology and pharmaceutical services outsourcing market size was estimated at USD 10.0 billion in 2023 and is expected to reach USD 10.64 billion in 2024.

b. The Europe biotechnology and pharmaceutical services outsourcing market is expected to grow at a compound annual growth rate of 5.75% from 2024 to 2030 to reach USD 14.6 billion by 2030.

b. The Germany dominated the Europe biotechnology and pharmaceutical services outsourcing market with a share of 25.17% in 2023. This is attributable to advanced healthcare infrastructure, high number of clinical trials, and upsurge in R&D investment among others.

b. Some key players operating in the Europe biotechnology and pharmaceutical services outsourcing market include Concept Heidelberg GmbH; ICON PLC; Venus Pharma GmbH; Kindeva Drug Delivery; Midas Pharma GmbH; IQVIA Inc.

b. Key factors that are driving the market growth include growing focus on clinical trials, strong presence of CROs and CDMOs in the region, increasing R&D activities, and rising outsourcing trends among biopharmaceutical companies among others.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."