Europe Bioplastics Market Size, Share & Trends Analysis Report By Product (Biodegradable, Non-biodegradable), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-217-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Europe Bioplastics Market Size & Trends

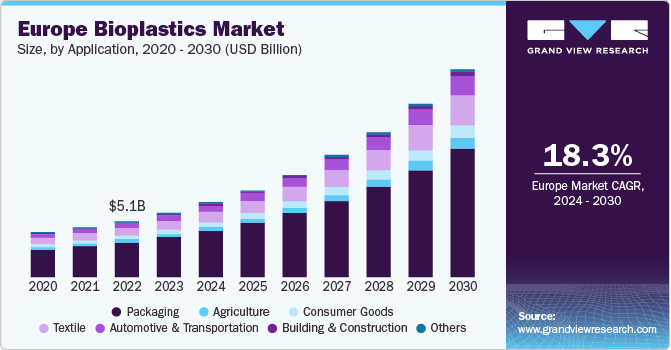

The Europe bioplastics market size was estimated at USD 5.82 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 18.3% from 2024 to 2030. Bioplastic packaging is a sustainable solution for improved and aesthetic packaging. Europe's food industry has experienced a major boom in recent years, in turn, driving the need for flexible packaging solutions. Additionally, the growing prominence of nutraceuticals and support from the European Commission to regulate the use of polymers in food packaging applications are expected to drive the growth of the bioplastics market.

Strong growth in the healthcare sector in Europe is likely to trigger the demand for pharmaceuticals, thereby positively impacting the demand for flexible packaging. This, in turn, is expected to drive the growth of the bioplastics market in the coming years. Polylactic acid is also used in medical implants in various forms such as plates, rods, pins, screws, and anchors. Europe is expected to witness significant growth owing to the increasing penetration of PLA and rising demand for bio-compatible polymers and 3D printing filament applications in the medical industry.

The market is governed by stringent regulatory standards such as EN 13432, EN 14995, EN 17033, EN 14045, ISO 18606, and ISO 17088. The European Association has established a certification system that categorizes products and packaging based on their content. Products certified under this protocol are entitled to receive an “OK biodegradable” label. In July 2022, Asahi Kasei Corporation announced that they had joined the European Bioplastics (EUBP) association. EUBP is an association of companies involved in bioplastics and aims to enhance the regulatory framework in Europe to grow the bioplastics market.

European key strategies supporting bioplastics production include:

-

Waste Framework Directive (review 2023)

-

Packaging & Packaging Waste Directive (review 2022)

-

New EU Circular Economy Action Plan (2020)

-

EU Climate Law (2021) & EU Taxonomy (2020)

-

EU Green Deal (2019)

-

EU Bioeconomy Strategy (2018)

-

EU Plastics Strategy (2018)

Market Concentration & Characteristics

Market growth stage is high, and the pace is accelerating owing to a moderately consolidated market. Bioplastic manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, new product launches, and production expansion, among others. For instance, in February 2022, Carbios and Indorama Ventures collaborated to launch a bio-recycled PET plant in France by the end of 2025. This strategic collaboration is strongly supported by the Grand-Est Region and the French Government, with significant non-dilutive financing.

The market is fragmented in nature, with the presence of several players and high competitive rivalry. The European Commission has adopted a policy framework for biobased, compostable plastics, and biodegradable plastics. It aims to regulate the sourcing, labeling, use, and trade-off of products. The commission also intends to prevent discrepancies at the national level and further fragmentation of the market by establishing a shared understanding across the European Union on the manufacturing and use of these plastics.

The threat of substitutes is likely to remain low as bioplastics for a key alternative to conventional plastics. Growing concerns about the non-degradability of plastics have fostered the adoption of biobased and compostable plastics.

Application Insights

Packaging dominated the market accounting for a revenue share of 62.39% in 2023. In the packaging sector, bioplastics are primarily used for food and beverage packaging. Fresh food is packed in bioplastic bottles, jars, and other containers. PLA plastics offer a high-gloss finish and are preferred in making durable single-use bottles. Polylactic acid is easily biodegradable and does not emit harmful gases when burned, unlike goods made of petroleum. They will therefore likely continue to have a very high need for packaging during the projection period.

The automotive & transportation segment is projected to expand at the fastest CAGR from 2024 to 2030 due to the rising use of plastic alternatives in the booming automotive industry. Apart from being environmentally sustainable, bioplastics are also durable, UV-resistant, and lightweight. Moreover, technical advancements and high penetration of electric vehicles have increased the growth opportunity for the segment.

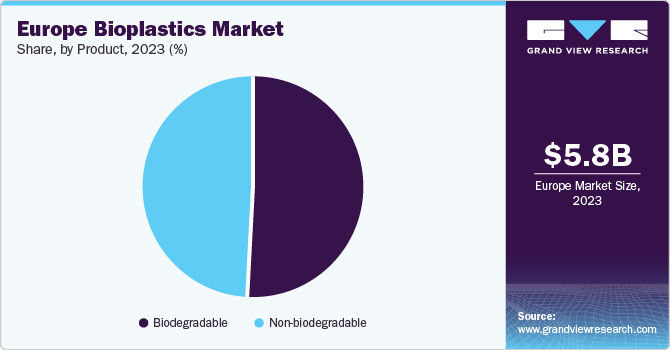

Product Insights

Biodegradable products accounted for the largest revenue share of 51.59% in 2023. The segment growth can be attributed to the future policy framework for biodegradable plastics, as part of the EU’s Green Deal and Circular Economy Action Plan. It has the potential to play a crucial part in enabling innovation, developing a circular bioeconomy, and attracting new investments.

The non-biodegradable segment is projected to expand at a significant CAGR during the forecast period. The segment is anticipated to develop over the forecast period owing to the increasing end-user demands, along with the growing player inclination towards sustainable products. Arkema, TORAY INDUSTRIES, INC., Braskem, and BASF SE are some of the manufacturers engaged in offering the above-mentioned products.

Country Insights

Rest of Europe was the largest consumer of bioplastics in Europe in 2023 and held a revenue share of 52.36%. This is due to continuous innovations and green initiatives in Italy, Spain, and Poland. For instance, in October 2023, Medarrch, an Italian design company launched 3D-printed bioplastic furniture using eco-materials including corn sugar, and renewable and non-petroleum derivates.

Germany Bioplastics Market Trends

Germany held a significant revenue share in 2023 owing tothe presence of a large number of research & development and production facilities. The country is engaged in exporting bioplastics to neighboring countries. The establishment of standards for bioplastics, such as EN 13432, are favoring market growth. Furthermore, Germany is the manufacturing hub of Europe and the largest manufacturer and exporter of automobiles in the region. The demand for bioplastics in the automotive sector is fueling the country’s growth.

Key Europe Bioplastics Company Insights

The market is highly competitive owing to the presence of several players. Sabic, BASF SE, and Avantium N.V. are some of the mature players in the industry. To sustain the market position, the players are adopting strategic initiatives, mergers & acquisitions, and partnerships.

Key Europe Bioplastics Companies:

- BASF SE

- Carbios

- Biome Bioplastics

- Braskem S.A.

- Novamont S.P.A.

- Sabic

- Teijin Limited

- Toray Industries, Inc.

- Total Corbion PLA

- Avantium N.V.

Recent Developments

-

In May 2023, BASF SE launched a coating grade ecovio 70 PS14H6 biodegradable polymer that caters to the food and beverage packaging industry, expanding its ecovio portfolio for extrusion coating. It is food-contact approved, has superior barrier properties, and offers temperature stability.

-

In June 2023, Avantium N.V. and SCG Chemicals Public Company Limited (“SCGC”) collaborated to develop CO2-based polymers and scale up bioplastic production capacity to 10 million tonnes per annum.

-

In April 2023, Sabic launched the first mono-material pasta packaging circular polymer to expand its Trucircle portfolio using bio-based feedstock. The sustainable material comprises 30% post-consumer recycled (PCR) content.

Europe Bioplastics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.75 billion |

|

Revenue forecast in 2030 |

USD 18.84 billion |

|

Growth rate |

CAGR of 18.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Product, application, country |

|

Country Scope |

Germany; UK; France; Rest of Europe |

|

Key companies profiled |

BASF SE; Biome Bioplastics; Carbois; Braskem S.A.; Novamont S.P.A.; Sabic; Teijin Limited; Toray Industries, Inc.; Total Corbion PLA; Avantium N.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Bioplastics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe bioplastics market report based on product, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biodegradable

-

Polylactic Acid

-

Starch Blends

-

Polybutylene Adipate Terephthalate (PBAT)

-

Polybutylene Succinate (PBS)

-

Others

-

-

Non-biodegradable

-

Polyethylene

-

Polyethylene Terephthalate

-

Polyamide

-

Polytrimethylene Terephthalate

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Agriculture

-

Consumer goods

-

Textile

-

Automotive & Transportation

-

Building & Construction

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

U.K.

-

France

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe bioplastics market was valued at USD 5.82 billion in the year 2023 and is expected to reach USD 6.75 billion in 2024.

b. The Europe bioplastics market is expected to grow at a compound annual growth rate of 18.3% from 2024 to 2030 to reach USD 18.84 billion by 2030.

b. Based on product segment, biodegradable emerged as a dominating segment in the market with a share of over 50% in 2023 due to the growing awareness about environmental sustainability and developing bioeconomy.

b. The key market players in the Europe bioplastics market includes BASF SE; Biome Bioplastics; Carbois; Braskem S.A.; Novamont S.P.A.; Sabic; Teijin Limited; Toray Industries, Inc.; Total Corbion PLA; Avantium N.V.

b. The key factor driving the Europe bioplastics market is the rising demand for sustainable and flexible packaging solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."