Europe Automotive Collision Repair Market Size, Share & Trends Analysis Report By Vehicle (Light-duty, Heavy-duty), By Product (Consumables, Spare Parts), By Service Channels, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-296-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The Europe automotive collision repair market size was estimated at USD 84.02 billion in 2023 and is projected to grow at a CAGR of 0.9% from 2024 to 2030. Advanced Driver Assistance Systems (ADAS), including sensors, cameras, and radar systems, are standard in modern vehicles. Repairing and calibrating these systems after a collision requires specialized skills and equipment, driving the demand for skilled technicians and high-tech repair facilities.

Rising automobile insurance subscriptions and technological progress in the automotive industry are driving the market growth. This growth is due to the increasing incidence of road accidents, leading to a higher demand for repair services. In addition, the market benefits from automobile retailers offering Do-It-Yourself (DIY) kits to consumers who repair their vehicles independently at home, without professional assistance.

Germany's automotive repair and maintenance sector is experiencing rapid growth due to increased research and development investments in automobile components for both Original Equipment Manufacturers (OEMs) and aftermarket sectors. Automotive collision repair technology plays a significant role in helping companies streamline their assessment and repair procedures, enabling them to reduce repair cycle times by swiftly identifying issues and implementing solutions more efficiently. This technology aids businesses in optimizing their appraisal and repair processes, leading to enhanced operational efficiency and quicker resolution of repair-related challenges within the automotive collision repair industry.

In January 2021, APRA Europe, the Automotive Parts Remanufacturers Association Europe, and FIRM, the International Federation of Engine Remanufacturers, announced their merger. The merger of APRA Europe and FIRM unites over 1000 companies and about two-thirds of the European automotive remanufacturing industry's workforce. This consolidation strengthened the remanufacturing sector by establishing a cohesive platform to advocate for, link, and safeguard the interests of remanufacturers, core dealers, wholesalers, suppliers, and researchers in the automotive remanufacturing domain.

Market Concentration & Characteristics

The Europe automotive collision repair industry is fragmented in nature, and the growth stage of the industry is low. However, the pace of industry growth is accelerating. The industry exhibits significant innovation driven by advancements in auto parts fabrication and technological progress. Innovations like computerized measurement for frame straightening and alignment technology enhance repair precision, reflecting a continuous drive for innovation within the sector.

The industry has seen notable mergers and acquisitions among key players such as 3M. These strategic moves aim to strengthen market positions, expand product portfolios, and enhance competitiveness in the automotive collision repair sector. In February 2023, 3M announced a strategic investment in Repairify, Inc., renowned for its programming, remote scanning asTech device, and calibration services, which aims to accelerate and expand its proprietary technology, tools, and service offerings across Europe.

Stringent road and vehicle safety standards in Europe shape the market landscape. These regulations ensure the safety of drivers, passengers, and pedestrians and significantly influence the demand for repair services and genuine OEM spare parts. Compliance with these stringent standards becomes important for automotive manufacturers, service providers, and suppliers as it directly impacts their market acceptance and competitiveness. The emphasis on safety norms within the industry fosters innovation and technological advancements and enhances consumer trust and confidence in the products and services offered.

The availability of service substitutes like Do It Yourself (DIY) repair kits offered by automobile retailers has significantly impacted the automotive collision repair sector by providing consumers with alternative options for addressing minor damages independently. This trend has led to a noticeable shift in consumer behavior and choices, as more individuals opt to undertake minor repairs instead of seeking professional help immediately. DIY repair kits have empowered consumers by giving them a sense of control over their vehicle maintenance and repair processes, allowing them to save time and money on minor damages that do not require extensive expertise.

Vehicle Insights

Based on vehicle, light-duty vehicle held the highest market share of 80.76% in 2023. Growing urbanization and population density in many European cities have increased demand for compact and efficient transportation solutions, favoring light-duty vehicles such as passenger cars and small commercial vehicles. Advancements in automotive technology, including electric and hybrid powertrains, have made light-duty vehicles more appealing due to their lower emissions and reduced environmental impact, aligning with stringent emissions regulations in Europe. Light-duty vehicles' convenience, affordability, and versatility make them a preferred choice for individual consumers and businesses, further driving their market share growth.

Heavy-duty vehicles are expected to witness significant CAGR during the forecast period. The rise of electric and autonomous vehicles, shared mobility services, and digitalization drives the segment growth. Similarly, advancements in vehicle materials, repair techniques, and digital tools are transforming the market, driving efficiencies, improving customer experiences, and enhancing repair quality.

Product Insights

Based on product, spare parts held the highest market share in 2023. The increasing complexity of modern vehicles, stringent regulatory requirements regarding vehicle safety and emissions, and the need for regular maintenance and servicing have all contributed to the increased demand for spare parts across various vehicle categories. The shift towards sustainable practices and circular economy principles has increased the demand for remanufactured and recycled spare parts, offering cost-effective and eco-friendly alternatives to consumers and businesses. The emphasis on sustainability and reducing carbon footprints has prompted automotive aftermarket players to expand their offerings in remanufactured parts, further driving the growth of the spare parts segment.

Paints & coatings are expected to witness the fastest CAGR over the forecast period. Factors such as the escalating traffic congestion in urban areas leading to minor vehicle damages, the increasing demand for minor paint touch-ups, and the growing customer preference for an authentic and aesthetic look of vehicle restorations are propelling the market for this segment.

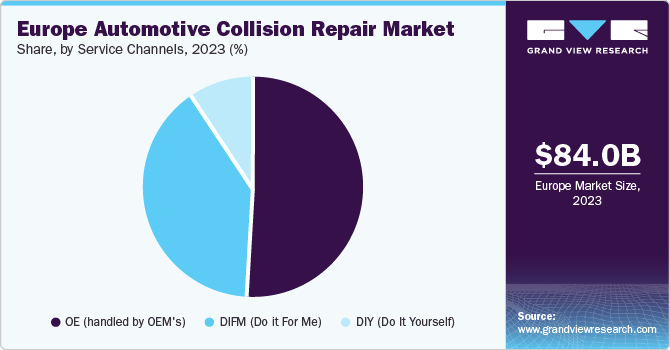

Service Channels Insights

Based on service channels OE (handled by OEM's) held the highest market share in 2023. OEM service channels often offer comprehensive service packages encompassing regular maintenance, repairs, software updates, and diagnostics, providing vehicle owners with a convenient and holistic solution. This integrated approach enhances customer satisfaction, creates long-term loyalty, and grows the business. The expansion of vehicle leasing and subscription models, particularly in urban areas, has boosted the demand for OEM service channels, as leasing companies and fleet operators prioritize authorized servicing to maintain vehicle value, reliability, and safety.

DIY (Do It Yourself) is expected to witness the fastest CAGR over the forecast period. The availability of affordable and high-quality aftermarket parts and tools and an increase in DIY-friendly vehicle designs that prioritize accessibility and user-friendliness have further led to the growth of this segment. The shift towards remote work and flexible schedules has given individuals more time to dedicate to DIY automotive projects, contributing to the segment's expansion as consumers embrace a hands-on approach to vehicle care and customization.

Country Insights

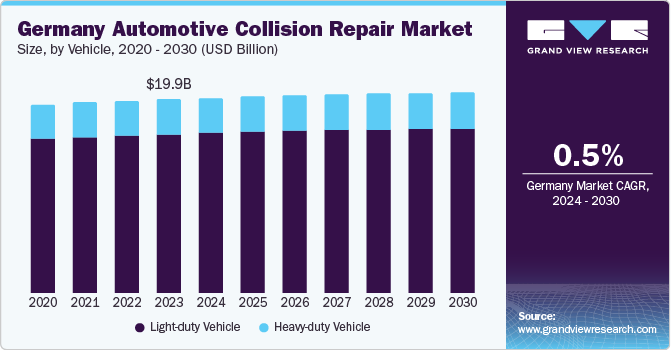

Germany Automotive Collision Repair Market Trends

Germany accounted for a significant market share of 23.65% in 2023. Germany's robust automotive industry, technological advancements, high standards of vehicle safety, and well-established network of collision repair facilities are driving the market. Major automotive manufacturers and suppliers in Germany contribute to a highly skilled workforce and access to innovative solutions, further enhancing the overall driving experience and safety standards.

France Automotive Collision Repair Market Trends

France is expected to witness the fastest CAGR over the forecast period. Advancements in automotive technology, such as ADAS and autonomous driving features, are leading to more complex and expensive repairs, driving growth in the market.

Key Europe Automotive Collision Repair Company Insights

Some key companies operating in the market are Automotive Technology Products LLC, 3M Company, and Continental AG.

-

Automotive Technology Products LLC, or ATP, plays a significant role in the automotive collision repair sector. As part of the automotive aftermarket industry, ATP provides a range of components essential for collision repair. The company offers products like crash parts, paints, sealants, abrasives, and finishing compounds used in the repair process.

-

Continental AG specializes in components such as tires, brake systems, vehicle electronics, automotive safety features, powertrain elements, and chassis components. The company's expertise spans from providing cutting-edge tire technology for enhanced safety and performance to developing advanced brake systems that ensure efficient vehicle control.

Key Europe Automotive Collision Repair Companies:

- 3M Company

- Automotive Technology Products LLC

- Continental AG

- Denso Corporation

- Faurecia (Groupe PSA)

- Honeywell International, Inc.

- International Automotive Components (IAC) Group

- Magna International, Inc.

- Robert Bosch GmbH

- Tenneco, Inc.

Recent Developments

-

In January 2024, BASF's Coatings Division partnered with industry partners, such as associations and work providers, to create a unified certification standard for the automotive refinishing industry. This effort aims to meet the increasing demand for sustainable accident repairs by defining a standard set of criteria. These criteria will help body shops improve sustainability efforts, ensure compliance with changing legal requirements such as CO2 emission reporting, and foster industry-wide adherence.

-

In January 2023, Crash Champions acquired European Collision, a management services organization (MSO) with four repair centers in the Nashville and Atlanta metropolitan areas. This strategic acquisition represented a significant step in Crash Champions' expansion plan. It introduced advanced I-CAR Gold Class repair facilities and prestigious OEM and EV certifications to its network, enhancing its service capabilities and market presence.

Europe Automotive Collision Repair Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 89.45 billion |

|

Growth rate |

CAGR of 0.9% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle, product, service channels, country |

|

Regional scope |

Europe |

|

Country scope |

Germany; UK; France |

|

Key companies profiled |

3M Company; Automotive Technology Products LLC; Continental AG; Denso Corporation; Faurecia (Groupe PSA); Honeywell International, Inc.; International Automotive, Components (IAC) Group; Magna International, Inc.; Robert Bosch GmbH; Tenneco, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Automotive Collision Repair Market Report Segmentation

This report forecasts revenue growth at region and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Europe automotive collision repair market report based on vehicle, product, service channels, and country:

-

Vehicle Outlook (Revenue, USD Billion, 2017 - 2030)

-

Light-duty Vehicle

-

Heavy-duty Vehicle

-

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Paints & Coatings

-

Consumables

-

Spare Parts

-

-

Service Channels Outlook (Revenue, USD Billion, 2017 - 2030)

-

DIY (Do It Yourself)

-

DIFM (Do it For Me)

-

OE (handled by OEM's)

-

-

Country Outlook (Revenue, USD Billion, 2017 - 2030)

-

Germany

-

UK

-

France

-

Frequently Asked Questions About This Report

b. The Europe automotive collision repair market size was estimated at USD 84.02 billion in 2023 and is expected to reach USD 84.99 billion in 2024

b. The Europe automotive collision repair market is expected to grow at a compound annual growth rate of 0.9% from 2024 to 2030 to reach USD 89.45 billion by 2030

b. Germany accounted for a significant market share of 23.7% in the Europe automotive collision repair market in 2023. Germany's robust automotive industry, technological advancements, high standards of vehicle safety, and a well-established network of collision repair facilities these factors are driving the market.

b. Some key players operating in the Europe automotive collision repair market include 3M Company, Automotive Technology Products LLC, Continental AG, Denso Corporation, Faurecia (Groupe PSA), Honeywell International, Inc., International Automotive, Components (IAC) Group, Magna International, Inc., Robert Bosch GmbH, Tenneco, Inc.

b. Factors such as increasing incidence rate of road accidents and growing number of vehicles on the road are driving the regional market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."