- Home

- »

- Advanced Interior Materials

- »

-

Europe & Asia Pacific Polypropylene Pipes Market Report, 2030GVR Report cover

![Europe & Asia Pacific Polypropylene Pipes Market Size, Share & Trends Report]()

Europe & Asia Pacific Polypropylene Pipes Market Size, Share & Trends Analysis Report By Product (PP-R, PPR-RCT, PP-B), By Application (Water Plumbing, Food Processing, Chemicals), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-302-8

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

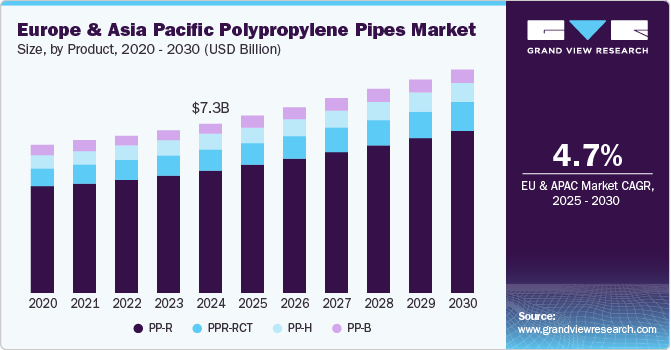

The Europe & Asia Pacific polypropylene pipes market size was estimated at USD 7.29 billion in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2030. This growth is attributed to stable exchange rates, rapid industrialization, and infrastructural development, significantly contributing to economic growth in emerging economies like India and China. In addition, government investments in infrastructure are enhancing demand for piping systems in both residential and commercial sectors. Moreover, the market is further supported by a rise in end-use applications, particularly in industrial processing and water management, which are crucial for urban development and sustainability initiatives.

The polypropylene pipes market encompasses producing and distributing pipes made from polypropylene, a versatile thermoplastic known for its lightweight and chemical-resistant properties. This market is significantly influenced by various sectors, particularly construction and industrial applications, which drive the demand for efficient piping solutions.

In addition, subdued oil prices and moderate inflation rates enhance the purchasing power of consumers and businesses alike, further stimulating demand for polypropylene pipes. Increased government spending on infrastructure projects in both residential and non-residential sectors is expected to play a crucial role in boosting the demand for these piping systems.

Furthermore, establishing new industrial hubs in countries such as Vietnam, Taiwan, and India will augment the need for polypropylene pipes over the coming years. As these economies develop, the demand for reliable and durable piping solutions will likely rise, making polypropylene an essential material in various applications ranging from plumbing to industrial processing. Overall, the combination of economic growth and strategic investments in infrastructure positions the polypropylene pipes market for significant advancements in Europe and Asia Pacific.

Product Insights

The PP-R products segment dominated the market and accounted for the largest revenue share of 72.3% in 2024. This growth is attributed to its superior properties, including high-temperature resistance, elasticity, and corrosion resistance. These characteristics make PP-R pipes ideal for various applications, such as plumbing and industrial processes. Furthermore, the increasing demand for reliable piping systems in residential and commercial sectors and government initiatives to enhance infrastructure further fuel the adoption of PP-R pipes across these regions, ensuring a strong market presence.

The PPR-RCT is expected to grow at a CAGR of 5.3% over the forecast period, owing to its cost-efficiency and low maintenance requirements, which appeal to both industrial and residential applications. In addition, these pipes are favored for their versatility in handling hot and cold water and their suitability for food-grade applications. Furthermore, the rising emphasis on sustainable building practices and the need for efficient piping solutions in rapidly developing economies in Asia Pacific also contribute to the increasing demand for PPR-RCT products, solidifying their market position.

Application Insights

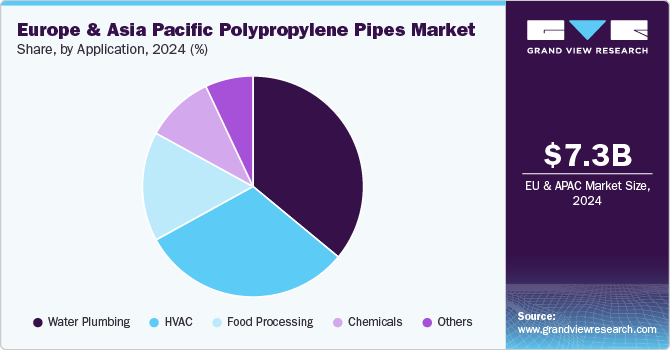

The water plumbing a RCT lication led the market and accounted for the largest revenue share of 35.7% in 2024, driven by the increasing demand for reliable and efficient water supply systems. Furthermore, the properties of polypropylene pipes, including resistance to corrosion and high temperatures, make them suitable for diverse plumbing applications. Moreover, urbanization and population growth further drive the need for modern plumbing solutions, enhancing market prospects.

The food processing application is expected to grow at the fastest CAGR of 4.5% from 2025 to 2030. This growth is attributed to the rising demand for safe and hygienic piping solutions. Polypropylene pipes are favored in this sector for their chemical resistance and ability to maintain product integrity. In addition, the expansion of the food retail sector, coupled with stringent regulations regarding food safety, propels the adoption of polypropylene pipes in processing facilities. Furthermore, technological advancements in food processing equipment enhance the efficiency and reliability of these piping systems, making them an essential component in modern food production environments.

Regional Insights

Asia Pacific Polypropylene Pipes Market Trends

The Asia Pacific polypropylene pipes marketdominated the market and accounted for the largest revenue share of 58.7% in 2024. This growth is attributed to the rapid industrialization and urbanization. In addition, the increasing demand for efficient water management systems and government initiatives promoting infrastructure development significantly boost market prospects. Furthermore, a growing focus on sustainable practices and the adoption of advanced technologies in construction further enhance the demand for polypropylene pipes. Moreover, the region's diverse applications across various industries, including agriculture and manufacturing, also drive market expansion.

The polypropylene pipes market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, primarily driven by extensive industrial development and population growth. The construction sector is flourishing, creating heightened demand for plumbing and wastewater management solutions. In addition, government policies to improve urban infrastructure and ensure clean water supply further support the market. Moreover, the increasing focus on environmental sustainability and the need for durable, cost-effective piping solutions propel the adoption of polypropylene pipes in various applications, including residential and commercial sectors.

Europe Polypropylene Pipes Market Trends

Europe polypropylene pipes market is expected to grow at a CAGR of 4.0% over the forecast period. This growth is attributed to the significant investments in infrastructure and a strong emphasis on environmental regulations. In addition, the region's aging plumbing systems require modernization, driving demand for advanced piping solutions that offer durability and efficiency. Furthermore, stringent EU water quality and safety regulations enhance the appeal of polypropylene pipes for plumbing and HVAC applications. Moreover, the growing trend toward energy-efficient building practices also contributes to increased adoption, as these pipes are ideal for sustainable construction projects.

The polypropylene pipes market in Germany held the largest revenue share of 20.7% in 2024 in the European market, owing to the strong manufacturing sector and commitment to innovation. In addition, the country's use of high-quality standards and advanced technology in construction drives demand for reliable piping solutions. Furthermore, Germany's proactive approach to environmental sustainability encourages using recyclable materials like polypropylene in plumbing systems. Moreover, the increasing need for efficient water management and wastewater treatment facilities further supports market growth as industries seek durable solutions that comply with stringent regulatory requirements.

Key Europe & Asia Pacific Polypropylene Pipes Company Insights

Key companies in the market include Pipelife International GmbH, Aquatherm GmbH, Peštanare, and others. These companies are adopting various strategies to enhance their competitive edge. These include new product launches to meet specific industry needs, strategic collaborations to leverage technological advancements, and mergers and acquisitions to expand market reach. Furthermore, companies focus on sustainability initiatives to promote recycling and reduce raw material costs, ensuring they align with environmental regulations and consumer preferences while enhancing their product offerings.

-

Aquatherm GmbH produces a wide range of products for plant construction and building services applications, including heating, cooling, and potable water systems. With a diverse product line comprising over 17,000 items. The company operates in various segments, focusing on sustainable and efficient piping solutions catering to residential and industrial needs. Its commitment to innovation has established it as a key player in the polypropylene pipes market across 70 countries.

-

Fusion Industries specializes in manufacturing and distributing polypropylene random copolymer (PP-R) pipes and fittings widely used in plumbing, heating, and cooling systems. Fusion Industries focuses on delivering durable and efficient products that meet the demands of modern construction and infrastructure projects. By emphasizing quality and performance, the company has positioned itself as a reliable partner in the growing market for polypropylene piping solutions.

Key Europe & Asia Pacific Polypropylene Pipes Companies:

- Pipelife International GmbH

- Aquatherm GmbH

- Peštan

- Pro Aqua

- Aquatechnik group S.P.A.

- Wavin

- Fusion Industries

- Weltplast

- Bänninger Kunststoff-Produkte GmbH

- Danco plastics

- Ros Turplast

- Aliaxis Group S.A. /N.V.

- Asahi YuKizai Corporation

Europe & Asia Pacific Polypropylene Pipes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.62 billion

Revenue forecast in 2030

USD 9.60 billion

Growth Rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Europe & Asia Pacific

Country scope

UK, France, Germany, Italy, Spain, China, India, Japan, Australia, South Korea

Key companies profiled

Pipelife International GmbH; Aquatherm GmbH; Peštan; Pro Aqua; Aquatechnik group S.P.A.; Wavin; Fusion Industries; Weltplast; Bänninger Kunststoff-Produkte GmbH; Danco plastics; Ros Turplast; Aliaxis Group S.A. /N.V.; Asahi YuKizai Corporation

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe & Asia Pacific Polypropylene Pipes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Europe & Asia Pacific polypropylene pipes market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

PP-R

-

PPR-RCT

-

PP-H

-

PP-B

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Water Plumbing

-

Food Processing

-

HVAC

-

Chemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

France

-

Italy

-

Spain

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."