Europe Artificial Intelligence Market Size, Share & Trends Analysis Report By Solution, By Technology (Deep Learning, Machine Learning, NLP, Machine Vision, Generative AI), By Function, By End-use, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-288-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Europe Artificial Intelligence Market Trends

The Europe artificial intelligence market was estimated at USD 66.4 billion in 2024 and is projected to grow at a CAGR of 33.2% from 2025 to 2030. This expansion is fueled by several factors, including the increasing adoption of AI in healthcare for tasks like disease diagnosis and drug development. The convergence of AI with other emerging technologies like blockchain and the Internet of Things (IoT) promises further innovation. In addition, the growing availability of big data provides fertile ground for AI applications, as these algorithms thrive on vast amounts of data for learning and improvement. Advancements in computing power and cloud infrastructure further enable efficient processing of AI tasks.

Across various industries like advertising, manufacturing, finance, and transportation, the demand for automation and optimization drives the adoption of AI technologies. Substantial investments and partnerships between tech companies, research institutions, and governments foster innovation and propel market growth. The market accounted for a share of 23.2% of the global market’s revenue in 2024. The European Union (EU) has shaped the global AI landscape by introducing the AI Act. This landmark legislation establishes the first-ever comprehensive legal framework for AI development and deployment.

The Act prioritizes the responsible use of AI across the European market and beyond. Its core objective is to ensure AI systems adhere to fundamental rights, prioritize safety considerations, and operate within a robust ethical framework. The Act addresses the potential risks of powerful and impactful AI models. It provides clear and actionable requirements and obligations for developers and deployers of AI systems, fostering responsible innovation within specific use cases. The most concerning applications, such as those designed to manipulate human behavior or exploit vulnerabilities, are prohibited entirely.

High-risk AI systems, encompassing areas like autonomous vehicles and medical devices, are still permissible but face strict regulations. These regulations emphasize rigorous testing, data quality documentation, and a clearly defined human oversight structure to mitigate potential risks. Another significant regulation includes the General Data Protection Regulation (GDPR), which has considerably impacted the development and use of AI in Europe. The GDPR has raised concerns about data privacy, which can affect the data availability for AI applications.

Solution Insights

The software segment captured the largest revenue share of 35.0% in 2024 due to the high demand for AI solutions across various industries, including manufacturing, retail, healthcare, and finance. Software components of AI systems include core technologies like augmented and virtual reality (AR/VR), deep learning, machine learning (ML), and natural language processing (NLP), which are used to process large amounts of data. These technologies enable AI-integrated machines to recognize human-like speech and solve problems based on previous experiences. The software segment's growth is also driven by the increasing availability of big data and advancements in computing power and cloud computing infrastructure, which enable more efficient and powerful processing of AI applications.

The services segment is predicted to experience the fastest CAGR of 43.4% from 2025 to 2030. This rapid growth can be attributed to the increasing need for services that support the development and deployment of AI applications. These services include consulting, system integration, and maintenance services, which are crucial for organizations to implement and manage AI technologies effectively. The growth of the services segment is also driven by the increasing investments in AI technologies across various sectors, such as healthcare, automotive, finance, and manufacturing. Furthermore, government initiatives supporting AI innovation, such as the European Union’s AI strategy, catalyze market growth by providing funding initiatives and regulatory frameworks to promote ethical AI deployment.

Technology Insights

The deep learning segment dominated the market by capturing a revenue share of 26.0% in 2024 due to its wide range of applications across various industries, including healthcare, automotive, and manufacturing. For instance, deep learning algorithms in healthcare are used for diagnosing diseases, predicting patient outcomes, and personalizing treatment plans. In the automotive industry, it is integral for developing autonomous vehicles. The increasing availability of big data, advancements in computing power, and improvements in cloud computing infrastructure also drive the segment growth. These factors enable more efficient and powerful processing of deep learning applications.

The machine vision segment is predicted to experience the fastest growth at a CAGR of 40.3% from 2025 to 2030 due to its rising adoption across diverse industries. In manufacturing, it automates inspection, quality control, and robot guidance. The automotive sector leverages machine vision for object detection and navigation in autonomous vehicles. Healthcare utilizes it for disease diagnosis through advanced medical imaging. Moreover, advancements in AI and ML enhance the accuracy and reliability of these systems, further fueling growth. In addition, the rising demand for automation and stricter quality control measures are expected to propel market growth.

End-use Insights

The advertising and media segment held the largest revenue share, accounting for 17.4% in 2024. This dominance can be attributed to the increasing use of AI in media and advertising for tasks such as content curation, social media advertising, virtual assistant, search engine marketing, sales & marketing automation, and analytics platforms. Social media platforms leverage AI as a core component to deliver targeted advertising. This allows marketers on platforms like Facebook, LinkedIn, Instagram, and Snapchat to utilize AI's capabilities for demographic and behavioral targeting. The growth of the advertising & media segment is also driven by the increasing investments in AI technologies across the sector and advancements administered in the fields of marketing, research, innovation, and technology.

Healthcare is predicted to experience the fastest CAGR of 40.2% from 2025 to 2030. The current surge in healthcare data aggregation, stemming from an array of origins, including electronic health records (EHRs), wearable biometric devices, and medical imaging scans, underscores a pivotal moment for AI-driven solutions. These solutions hold immense promise in distilling actionable insights and enhancing clinical decision-making processes within the healthcare domain. Concurrently, the shortage of healthcare workers is driving the adoption of AI and ML technologies. Government initiatives, the impact of COVID-19 pandemic, and rise in technological collaborations and M&A activities have further contributed to market growth and accelerated the adoption of AI in healthcare.

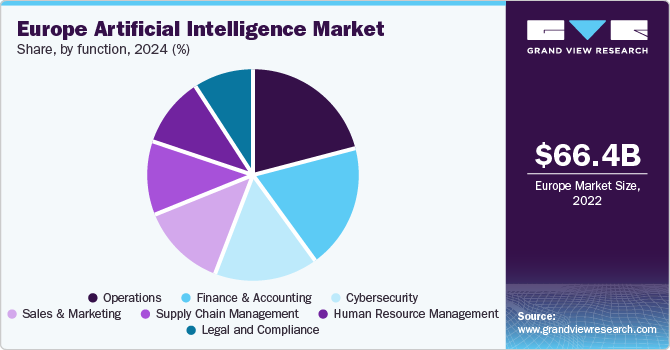

Function Insights

The operations segment held the largest share of 20.7% in 2024. This dominance can be attributed to the increasing use of AI in operations for tasks, such as process automation, supply chain management (SCM), quality control, and predictive maintenance. AI is crucial to today's operational processes, enabling organizations to improve efficiency, reduce costs, and make more informed decisions. The growth of the operations segment is also driven by the increasing investments in AI technologies across various sectors and advancements in ML and deep learning technologies. These technologies enable AI-integrated systems to learn from data, identify patterns, and make decisions with minimal human intervention.

The sales and marketing segment is predicted to register the fastest CAGR of 39.4% from 2025 to 2030 due to the increasing use of AI in marketing and sales for tasks, such as customer segmentation, sales forecasting, customer relationship management (CRM), and marketing campaign optimization. AI technologies, such as ML and NLP, are used to analyze customer data, predict customer behavior, and personalize marketing messages. The growth of the sales and marketing segment is also driven by the increasing availability of customer data, advancements in AI technologies, and the growing need for personalized marketing strategies.

Country Insights

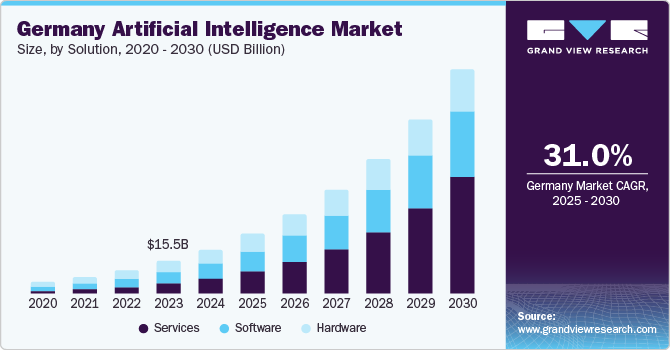

Germany Artificial Intelligence Market Trends

The artificial intelligence market in Germany held the largest revenue share of 32.3% in 2024. This dominance can be attributed to Germany's strong industrial base, particularly in the automotive and manufacturing sectors, where AI is widely used for tasks, such as predictive maintenance, quality control, and supply chain optimization. Germany is home to several leading AI companies and research institutions that drive innovation in AI technologies. The country's robust economy and supportive government policies, such as the AI strategy of the German Federal Government, are also contributing to market growth. Despite these strengths, Germany faces challenges, such as a shortage of skilled AI professionals and concerns about data privacy.

France Artificial Intelligence Market Trends

The artificial intelligence market in France is predicted to experience the fastest CAGR of 35.5% from 2025 to 2030. This rapid growth can be attributed to France's strong commitment to AI research and development, as evidenced by the French government's AI strategy, which includes significant investments in AI research and innovation. France is home to a dynamic AI startup ecosystem, exemplified by companies like Mistral.ai, which are at the forefront of AI research, particularly in healthcare. These firms leverage AI for tasks like assisted diagnosis and drug discovery. However, robust data privacy regulations and ethical considerations regarding AI deployment remain critical areas of focus.

Key Europe Artificial Intelligence Company Insights

The market indicates a diverse and dynamic structure. With the presence of a strong technological base and supportive government policies in Europe, many AI companies have established their operations in close proximity. Some key players operating in this market include Microsoft Corporation and Google Inc.

-

Microsoft Corporation offers a range of products and solutions for the AI industry, including AI services, ML tools, and cloud computing services. Microsoft has been a major player in this market, especially in sectors, such as healthcare, manufacturing, and retail

-

Google Inc. specializes in Internet-related services and products, including AI. Google has been a significant player in the Europe AI market, particularly in areas, such as search engines, advertising technologies, and cloud computing

Key Europe Artificial Intelligence Companies:

- Aleph Alpha

- Mistral AI

- Helsing GmbH

- DeepL

- Synthesia

- Pixis

- Microsoft Corporation

- Google Inc.

- IBM

- Oracle Corporation

Recent Developments

-

In February 2024, Microsoft unveiled a strategic collaboration with Mistral AI, a French start-up specializing in large language models (LLM) for generative AI applications, to bolster Mistral AI’s global market presence and foster innovation in European AI

-

In November 2023, German AI startup Aleph Alpha secured USD 500 million in funding from a consortium led by Bosch, SAP, and Hewlett Packard Enterprise, fueling its development of generative AI technologies

-

In September 2023, Saab announced a strategic collaboration and financial commitment to Helsing, with their USD 79.5 investment securing a 5 percent ownership stake in Helsing GmbH. This partnership is anticipated to revolutionize electronic warfare and surveillance capabilities for fighter aircraft, sensors, and command and control applications, spanning various operational domains

Europe Artificial Intelligence Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 370.3 billion |

|

Growth rate |

CAGR of 33.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Solution, technology, end-use, function, country |

|

Country scope |

Germany; France; UK |

|

Key companies profiled |

Aleph Alpha; Mistral AI; Helsing GmbH; DeepL; Synthesia; Pixis; Microsoft Corp.; Google Inc.; IBM; Oracle Corp. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Europe artificial intelligence market report based on solution, technology, end-use, function, and country:

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Accelerators

-

Processors

-

Memory

-

Network

-

-

Software

-

Services

-

Professional

-

Managed

-

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Deep Learning

-

Machine Learning

-

Natural Language Processing (NLP)

-

Machine Vision

-

Generative AI

-

-

Function Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cybersecurity

-

Finance and Accounting

-

Human Resource Management

-

Legal and Compliance

-

Operations

-

Sales and Marketing

-

Supply Chain Management

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Healthcare

-

Robot Assisted Surgery

-

Virtual Nursing Assistants

-

Hospital Workflow Management

-

Dosage Error Reduction

-

Clinical Trial Participant Identifier

-

Preliminary Diagnosis

-

Automated Image Diagnosis

-

-

BFSI

-

Risk Assessment

-

Financial Analysis/Research

-

Investment/Portfolio Management

-

Others

-

-

Law

-

Retail

-

Advertising & Media

-

Automotive & Transportation

-

Agriculture

-

Manufacturing

-

Others

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

Germany

-

France

-

UK

-

Frequently Asked Questions About This Report

b. The Europe artificial intelligence market size was estimated at USD 66.4 billion in 2024.

b. The Europe artificial intelligence market is expected to grow at a compound annual growth rate of 33.2% from 2024 to 2030 to reach USD 370.34 billion by 2030

b. The software segment held the highest market share of 35.9% in 2023, it is attributed to the high demand for AI solutions across various industries, including manufacturing, retail, healthcare, and finance

b. Some key players operating in the Europe AI market include Aleph Alpha, Mistral AI, Helsing GmbH, DeepL, Synthesia, Pixis, Microsoft Corporation, Google Inc., IBM, Oracle Corporation

b. Factors such as the increasing adoption of AI in healthcare for tasks like disease diagnosis and drug development are driving the regional market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."