- Home

- »

- Pharmaceuticals

- »

-

Europe Antibiotics Market Size, Share, Industry Report, 2030GVR Report cover

![Europe Antibiotics Market Size, Share & Trends Report]()

Europe Antibiotics Market Size, Share & Trends Analysis Report By Drug Class (Cephalosporin, Penicillin), By Type (Branded Antibodies, Generic Antibodies), By Action Mechanism, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-240-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Antibiotics Market Size & Trends

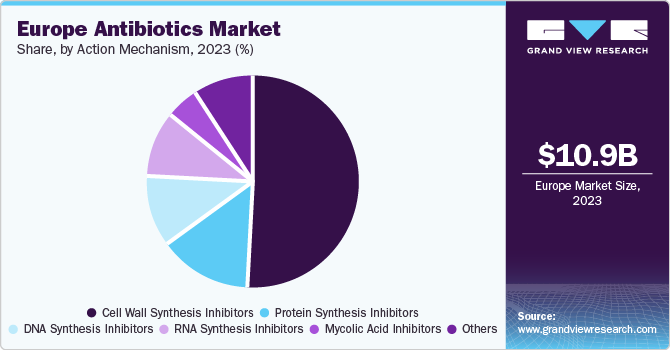

The Europe antibiotics market size was estimated at USD 10.9 billion in 2023 and is projected to grow at a CAGR of 3.28% from 2024 to 2030. The rising incidence of infectious diseases is a primary factor propelling the market growth. For instance, according to the European Centre for Disease Prevention and Control (ECDC), in 2022, Europe registered over 4,500 cases of hepatitis A.

In addition, as per the ECDC report, November 2021, over 65,000 individuals die every year in Europe due to bacterial protection from antimicrobials, and approximately 33,000 people die as a direct outcome of this infectivity. The expansion of developed products and growing partnership activities for introducing developed antibiotics are also anticipated to drive industry growth in Europe during the forecast period.

Companies such as AbbVie, Inc.; Pfizer Inc.; Novartis AG; Merck & Co. Inc.; Teva Pharmaceutical Industries Ltd.; and Lupin Pharmaceuticals Inc. are investing significantly in the research and development of antibiotics.

The development of innovative methods for modern antibiotics to treat infectious diseases and a substantial number of clinical tests are driving the market growth. However, the growth of antibiotic resistance, led by improper use of antibiotics and the time taken for the regulatory authorization, is estimated to inhibit the market growth. On the contrary, innovation of advanced potential molecules and sequence treatments to aid antibiotic-resilient bacterial infections are anticipated to deliver substantial beneficial opportunities for the market participants.

The high prevalence of Chronic Obstructive Pulmonary Disease (COPD) is further anticipated to drive the antibiotics market in the European region. For instance, according to the European Respiratory Society (ERS) 2020 journal, over 36.0 million people suffered from COPD in 2020.

In November 2022, ECDC launched an event, “Preventing Antimicrobial Resistance Together” to mark the 15th European Antibiotic Awareness Day. The event covered the recent antimicrobial policy & resistance activities and stated that keeping antibiotics employed is everyone’s liability. In July 2022, Regulation (EU) 2022/1255 was implemented by Regulation (EU) 2019/6 of the European Parliament. The regulation is aimed to designate antimicrobials retained for medication of specified diseases in humans.

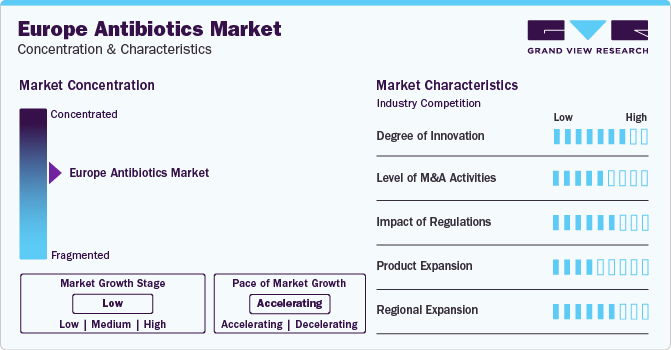

Market Concentration & Characteristics

The market growth stage is low, and the pace of the market growth is accelerating. The development of innovative inventions, combination treatments, and novel methods of activity characterizes the antibiotics market in Europe.

Several companies, including Pfizer Inc., AbbVie, Inc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., and Novartis AG, are engaged in merger and acquisition activities. Through M&A activity, these firms anticipate growing their geographical reach and entering new European countries.

Firms vigorously invest extensive resources in clinical trials and monitoring submissions to attain regulatory authorization for pipeline products. This results in encouraging the price of developing unique antibiotic technologies. The European Medicines Agency (EMA) is crucial in regulating the authorization and monitoring of antibiotics in the EU. Antibiotics are classified as prescription-only medicines in most European countries to prevent misuse and the development of antibiotic resistance.

The market has registered a notable product extension with the launch of new formulations and combinations to reduce infectious diseases. These advances involve enhanced antibiotics with improved efficacy and a wider range of action, adopting the challenge of antibiotic resistance. In addition, there is an emphasis on expanding combination treatments to upgrade treatment conclusions. The market also observes continuing research into fresh methods of activity and formulations to remain ahead of growing microbial strains.

Drug Class Insights

Based on drug class, the pencillin segment led the market with the largest revenue share of 25% in 2023. Penicillin is the leading drug class to be found and is still generally used to aid several diseases, especially those caused by streptococci, and staphylococci, listeria, and clostridium. They enact by both restraining cell wall union or else by preventing the formation of the peptidoglycan layer in treating infections such as skin infection, pharyngitis, gonorrhea, ear fungus, and bronchial cough. These medications symbolize the earliest line of therapy. For instance, according to the ECDA study 2021, Europe's populace weighted mean proportion of utilization of wide-range penicillin’s, cephalosporins, macrolides, and fluoroquinolones to the utilization of thin-range penicillin’s, cephalosporins, and erythromycin locally was over 3.5.

The cephalosporin segment is expected to register at a substantial CAGR over the forecast period. Cephalosporin are subtypes of the beta-lactam group of antibiotics. These drugs turn against gram-negative, and gram-positive microbes, including Klebsiella pneumonia, Bactericides fragilis, and Pseudomonas aeruginosa.

Type Insights

Based on type, the generic antibiotics led the market with the largest revenue share of 81.0% in 2023, and branded antibiotics segment is expected to register at the fastest CAGR during the forecast period. Generic antibiotics dominance is attributable to the reasonability of generic formulations, the availability of many producers leading to the elevated bargaining power of buyers, and a supportive governing framework. Moreover, beneficial administration proposals to uphold generic formulations and easy access to generic drugs drive segment growth.

Furthermore, the initiatives the regulatory bodies take, such as maintaining safety and efficacy, further contribute to the segment’s growth. For instance, in June 2022, Venus Remedies received approval from Venus Pharma, a German subsidiary, to sell its 2g, 1g, and 500mg injections of antibiotics in Spain. The approval is aimed at enhancing the company’s existence in the European market.

Action Mechanism Insights

Based on action mechanism, the cell wall synthesis segment led the market with the largest revenue share in 2023. Cell wall synthesis inhibitors are broadly applied antibiotics, as they are depicted with inclusive-spectrum activity against gram-negative and gram-positive bacteria. These drugs restrain the synthesis of the peptidoglycan layer, which is critical for the cell wall’s operational activity. This segment is anticipated to grow substantially over the forecast period due to increased research initiatives and administration funding.

The RNA synthesis segment is projected to grow at the fastest CAGR over the forecast period. The growth is attributed to the availability of nucleotides and the presence of regulatory elements such as promoters and enhancers. Europe has made significant contributions to the field of RNA synthesis research. European scientists have been at the forefront of discovering and characterizing key components of the RNA synthesis machinery, elucidating the mechanisms of transcription regulation, and investigating the roles of RNA synthesis in various biological processes.

Country Insights

The Europe antibiotics market held 22.0% share in the global antibiotics market in 2023. This is attributable to increasing numbers of patients suffering from infectious diseases and continuous trials conducted by pharmaceutical corporations. In addition, introducing innovative and developed potential molecules and unique grouping therapies to treat antibiotic-resistant bacterial diseases are expected to provide significant valuable opportunities for market participant.

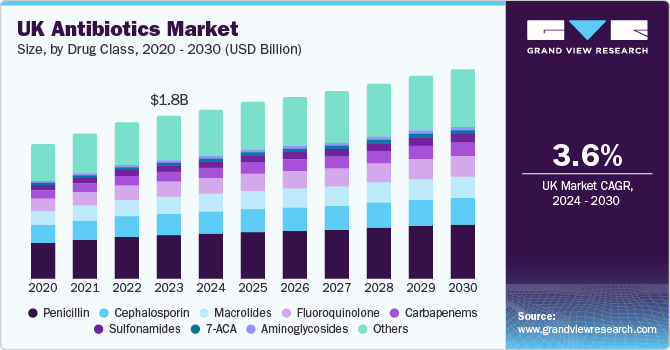

UK Antibiotics Market Trends

The UK antibiotics market is expected to grow over the forecast period due to high incidences of pneumonia. For instance, according to the Medscape UK study article published in November 2022, pneumonia causes major deaths in UK in comparison to any other country in Europe. The study states that every year in the UK over 40,000 individuals die due to pneumonia. Therefore, the prevalence of diseases including pneumonia and rest respiratory infections are driving the antibiotics market in UK.

France Antibiotics Market Trends

France antibiotics market dominated the region in 2023. The antibiotics market in France is expected to grow over the forecast period due to the high demand for outpatient antibiotics prescriptions. Despite numerous consecutive strategies to manage antimicrobial resistance, antibiotic use remains high in the outpatient setting. For instance, according to the National Center for Biotechnology Information (NCBI), study published in May 2022, France held the fourth position in 2019 in terms of largest consumer of antibiotics in the outpatient settings with over 23.0 defined daily dose (DDD) per 1000 populations each day, over 25% higher than the European average.

Germany Antibiotics Market Trends

The antibiotics market in Germany is expected to grow over the forecast period due to the high need for immediate solutions for treating the growing infectious diseases. As per the recent updates from DW, in December 2022, Germany was facing a huge crisis of antibiotics and medicinal tablets, and to overcome this shortage, the president of Germany’s medical associations introduced drug flea markets.

Key Europe Antibiotics Company Insights

Some key companies include Pfizer Inc., AbbVie, Inc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Viatris, Inc., and Novartis AG.

-

Pfizer's antibiotics market includes a wide range of antibiotics used to treat bacterial infection including penicillin, amoxicillin, clavulanate, azithromycin, and levofloxacin

-

Merck & Co. developed and marketed many antibiotics, including penicillin, erythromycin, and cephalosporins. The company's antibiotics are sold in over 100 countries around the world

Key Europe Antibiotics Companies:

- AbbVie, Inc.

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- Lupin Pharmaceuticals, Inc.

- Viatris, Inc.

- Melinta Therapeutics LLC

- Cipla, Inc.

- Shionogi & Co., Ltd.

- KYORIN Pharmaceutical Co., Ltd.

- GSK Plc

- Nabriva Therapeutics PLC

Recent Developments

-

In 2023, LifeArc, Medicines Discovery Catapult, and Innovate UK founded PACE (Pathways to Antimicrobial Clinical Efficiency) to fund and support researchers involved in drug and diagnostics development to tackle antimicrobial resistance (AMR)

-

In November 2023, Sandoz inaugurated a new penicillin production facility at Kundl, Austria

-

In December 2023, Shionogi B.V. signed a distribution agreement with Swedish Orphan Biovitrum AB (SOBI) to promote and commercialize cefiderocol by SOBI with Shionogi B.V. as a marketing authorisation holder

Europe Antibiotics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.3 billion

Revenue forecast in 2030

USD 13.7 billion

Growth rate

CAGR of 3.28% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, type, action mechanism, country

Regional scope

Europe

Country scope

Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

AbbVie, Inc.; Pfizer Inc.; Novartis AG; Merck & Co. Inc.; Teva Pharmaceutical Industries Ltd.; Lupin Pharmaceuticals Inc.; Viatris Inc.; Melinta Therapeutics LLC; Cipla Inc.; Shionogi & Co. Ltd.; KYORIN Pharmaceutical Co. Ltd.; GSK plc.; Nabriva Therapeutics PLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Antibiotics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe antibiotics market report based on drug class, type, action mechanism, and country.

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Cephalosporin

-

Penicillin

-

Fluoroquinolone

-

Macrolides

-

Carbapenems

-

Aminoglycosides

-

Sulfonamides

-

7-ACA

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded Antibiotics

-

Generic Antibiotics

-

-

Action Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Wall Synthesis Inhibitors

-

Protein Synthesis Inhibitors

-

DNA Synthesis Inhibitors

-

RNA Synthesis Inhibitors

-

Mycolic Acid Inhibitors

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The Europe antibiotics market size was estimated at USD 10.9 billion in 2023 and is expected to reach USD 11.3 billion in 2024.

b. The Europe antibiotics market is expected to grow at a compound annual growth rate (CAGR) of 3.28% from 2024 to 2030 to reach USD 13.7 billion by 2030.

b. Based on drug class, the penicillin segment dominated the market with the largest market share of 29.8% in 2023. This high share is attributable to the ease of treating skin infections, pharyngitis, gonorrhea, ear fungus, and bronchial cough.

b. Some of the key players operating in the Europe antibiotics market include AbbVie, Inc.; Pfizer Inc.; Novartis AG; Merck & Co. Inc.; Teva Pharmaceutical Industries Ltd.; Lupin Pharmaceuticals Inc.; Viatris Inc.; Melinta Therapeutics LLC; Cipla Inc.; Shionogi & Co. Ltd.; KYORIN Pharmaceutical Co. Ltd.; GSK plc.; and Nabriva Therapeutics PLC; among others.

b. Key factors that are driving the market growth include increasing numbers of patients suffering from infectious diseases and continuous trials conducted by pharmaceutical corporations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."