Europe Animal Health Market Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceuticals), By Animal Type (Production, Companion), By Distribution Channel, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-280-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Animal Health Market Size & Trends

The Europe animal health market size was estimated at USD 16.5 billion in 2023 and it is projected to grow at a CAGR of 8.0% from 2024 to 2030. An increase in the number of pet owners, growing pet humanization, unceasing demand for meat and milk leading to a rise in livestock population, increase in the expenditure on veterinary medicines and other animal health products, growing awareness about animal welfare, government initiatives directed toward the wellbeing of animals, and growing availability of animal health solutions have driven the market growth in Europe.

Europe’s animal health market accounted for a 26.5% share (second-largest) of the global animal health industry in 2023. In recent years, the total population of production and companion animals has been on the rise. According to the FEDIAF 2023 report, 91 million households in the European Union region own a pet (46%), with around 127 million cats, 104 million dogs, and other pets. This population develops a huge demand for all sorts of animal health products including biologics, pharmaceuticals, diagnostics, equipment & disposables, medicinal feed activities, and other health-related solutions.

Aspects such as increasing investment in R&D leading to new product launches, growth in the adoption of companion animals, increasing collaboration by major companies operating in the industry, and constantly rising research activities and manufacturing efforts in veterinary medicines and reagents have been fueling the market growth in Europe.

Product Insights

Pharmaceuticals led the market with the largest revenue share of 43.8% in 2023. Offerings such as parasiticides, anti-infective products, anti-inflammatory products, and analgesics are some of the pharmaceutical products used for animal health. A few more vital aspects that have created this scenario include consistent developments in veterinary drugs and growing awareness among pet owners, animal caretakers and farmers regarding the availability of animal health products and more. The overall increase in mindfulness related to animal health coupled with new product launches by key companies operating in the market have driven the market growth in the region.

In addition, the revenue generated through the sale of other animal health products such as hormone therapy products, anesthetics and others are expected to grow at a CAGR of 11.2% from 2024 to 2030. The demand for hormone therapy products is mainly driven by livestock owners, as hormone therapy drugs are commonly used to improve the quality of the meat.

Animal Type Insights

The production animals segment dominated the market with the largest revenue share of 65.7% in 2023. The global livestock population has been growing unceasingly and Europe holds a large share of this number. Livestock farming has been adopting different modern practices such as precision farming techniques, biosecurity of animals and more. Adoption of a proactive approach and implementation of measures such as annual vaccinations, and regular doses of antibiotics have also become part of livestock farming. These aspects have been contributing to the upsurge in demand for animal health products for production animals.

The companion animal segment is expected to experience a CAGR of 8.4% from 2024 to 2030. This growth can be attributed to the growing adoption of companion animals in the region. According to data published by the European Pet Food Industry Federation, the annual sales volume of pet food products was 10.5 million tons in 2023.

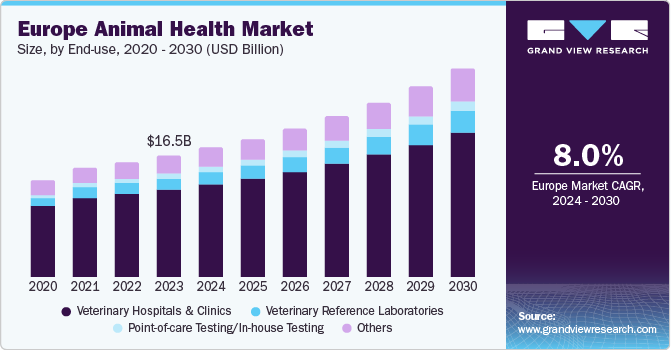

End-use Insights

Based on end-use, veterinary hospitals & clinics led the market with the largest revenue share of 72.1% in 2023. This can be attributed to multiple factors such as easier accessibility to veterinary hospitals & clinics, quicker access to test results, reduced time spent during tests and treatments, and a wide range of diagnostic as well as other solutions provided by the veterinary hospitals & clinics.

The point-of-care testing/in-house testing segment is projected to grow at a CAGR of 12.4% from 2024 to 2030. Animal health solutions delivered through point-of-care testing/in-house testing include serum amyloid A (SAA), T4 tests, NH3 tests, phenobarbital, hemoglobin, and fibrinogen tests. The point-of-care testing assists pet parents in identifying health issues before they turn into life-threatening health conditions or severe diseases.

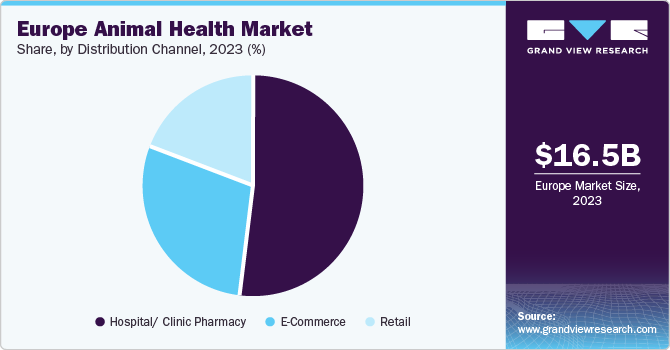

Distribution Channel Insights

The hospital/clinic pharmacies segment led the market with the largest revenue share of 52.3% in 2023. This is primarily due to the convenience and accessibility offered by hospital/clinic pharmacies, innovative and advanced scientific products delivered by the pet hospitals, increasing number of people adopting companion pets, numerous readmissions, and increasing number of incidences related to diseases leading to growing need for veterinary pharmaceuticals.

On the other hand, the revenue generated through e-commerce platforms is expected to grow at a significant CAGR of 9.9% from 2024 to 2030. E-commerce platforms have been providing value-added services such as express deliveries, return and refunds, and enhanced customer assistance. In addition, detailed product descriptions and reviews of previous buyers are provided by these platforms to assist customers in the online shopping experience.

Country Insights

UK Animal Health Market Trends

The UK animal health market held an 18.5% share of the Europe animal health market in 2023. Several factors contributed to this dominating scenario including a sudden rise in pet ownership during the COVID-19 pandemic. In addition, an increase in new product launches and collaborations is expected to fuel market growth in upcoming years.

Poland Animal Health Market Trends

The Poland animal health market is expected to experience a CAGR of 10.6% from 2024 to 2030. This growth can be attributed to a variety of drivers such as high milk consumption and dairy farming in the country, enhancements in economic conditions, and growing inclination of researchers to conduct clinical trials for animal health products.

Key Animal Health Company Insights

Some key companies in the Europe animal health market include Ceva, Vetoquinol S.A., Boehringer Ingelheim International GmbH, and others. To develop a competitive advantage, key companies in the industry are implementing strategic initiatives such as heavy investments in R&D, collaborations, partnerships, expansions in terms of manufacturing and more.

-

Ceva, one of the prominent innovative health solutions providers from France, operates in four different business areas including companion animals, poultry, swine and ruminants. The key products offered by this organization are associated with cardiology, reproduction, dermatology, and vaccination. It has a strong presence in nearly 110 countries across the globe

-

Boehringer Ingelheim International GmbH is a German developer and manufacturer of vaccines, pharmaceuticals, and other animal healthcare products. It also provides platforms for diagnostics and monitoring. The four key business areas of this company are consumer healthcare, prescription medicines, biopharmaceuticals, and animal health

Key Europe Animal Health Companies:

- Ceva

- Vetoquinol S.A.

- Boehringer Ingelheim International GmbH

- Virbac

- B. Braun Vet Care

- Dechra Pharmaceuticals PLC

- Bimed Inc.

- Zoetic Inc.

- Elanco

- IDEXX Laboratories, Inc.

- MSD Animal Health

Recent Developments

-

In January 2024, Ceva Santé Animale (Ceva) announced the acquisition of Scout Bio, known as a pioneer in biotechnology-based therapies for pets. This strategic move represents vital advancement for Ceva in terms of innovation, specifically related to monoclonal antibodies and developments in gene therapy

-

In October 2023, Bimeda inaugurated a cutting-edge facility worth USD 4.3 million, which includes the AgTechUCD Innovation Center and the UCD Bimeda Herd Health Hub, situated at UCD Lyons Farm in Ireland

Europe Animal Health Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 28.4 billion |

|

Growth rate |

CAGR of 8.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, animal type, end-use, distribution channel |

|

Country scope |

Germany; France; Italy; Spain; Switzerland; Netherlands; Russia; Sweden; UK; Poland; Ireland |

|

Key companies profiled |

Ceva; Vetoquinol S.A.; Boehringer Ingelheim International GmbH; Virbac; B. Braun Vet Care; Dechra Pharmaceuticals PLC; Bimeda, Inc.; Zoetis Inc.; Elanco; IDEXX Laboratories, Inc.; MSD Animal Health |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Animal Health Market Report Segmentation

This report forecasts revenue growth at a regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe animal health market report based on product, animal type, end-use, distribution channel and country.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicinal Feed Additives

-

Diagnostics

-

Consumables, reagents and kits

-

Instruments and devices

-

-

Equipment & Disposables

-

Critical Care Consumables

-

Anesthesia Equipment

-

Fluid Management Equipment

-

Temperature Management Equipment

-

Rescue & Resuscitation Equipment

-

Research Equipment

-

Patient Monitoring Equipment

-

-

Others

-

Veterinary Telehealth

-

Veterinary Software

-

Livestock Monitoring

-

-

-

Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Production Animals

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Veterinary Reference Laboratories

-

Point-of-care Testing/In-house Testing

-

Veterinary Hospitals & Clinics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

France

-

Italy

-

Spain

-

Switzerland

-

Netherlands

-

Russia

-

Sweden

-

UK

-

Poland

-

Ireland

-

Frequently Asked Questions About This Report

b. The Europe animal health market size was estimated at USD 16.5 billion in 2023 and is expected to reach USD 17.6 billion in 2024

b. The Europe animal health market is expected to grow at a compound annual growth rate of 8.0% from 2024 to 2030 to reach USD 28.4 billion by 2030

b. The pharmaceuticals segment dominated the market with a share of 43.8% in 2023. The overall increase in mindfulness related to animal health coupled with the new product launches by the key companies operating in the market are driving the segment growth.

b. Some key players operating in the Europe animal health market include Ceva; Vetoquinol S.A.; Boehringer Ingelheim International GmbH; Virbac; B. Braun Vet Care; Dechra Pharmaceuticals PLC; Bimeda, Inc.; Zoetis Inc.; Elanco; IDEXX Laboratories, Inc.; MSD Animal Health

b. Factors such as an increase in the number of pet owners, growing pet humanization, and unceasing demand for meat and milk leading to a rise in livestock population are driving the Europe animal health market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."