- Home

- »

- Medical Devices

- »

-

Europe Anesthesia Needles And Syringes Market, Report, 2030GVR Report cover

![Europe Anesthesia Needles And Syringes Market Size, Share & Trends Report]()

Europe Anesthesia Needles And Syringes Market Size, Share & Trends Analysis Report By Product (Anesthesia Needles, Anesthesia Syringes), By Safety Features (NRFit, Traditional), By End Use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-459-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

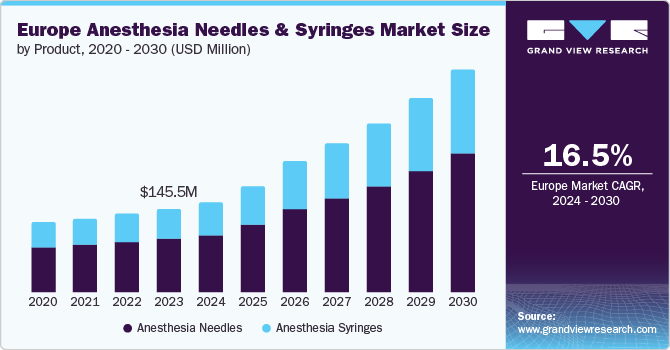

The Europe anesthesia needles and syringes market size was estimated at USD 145.52 million in 2023 and is projected to grow at a CAGR of 16.5% from 2024 to 2030. The increasing number of surgical procedures and the rising geriatric population, which often requires anesthesia for various medical interventions, are the major factors for market growth. In addition, the ongoing trend of adopting minimally invasive surgeries, which typically demand specialized needles and syringes, can further propel the market growth.

According to a report on gov.ie, in 2022, 39,347 cataract surgeries were conducted in Ireland. This was followed by 20,537 cesarean section surgeries and 12,830 hip replacement surgeries. As surgical interventions become common, there is a growing need for sophisticated syringe systems that ensure accurate and safe administration of anesthesia drugs.

The increasing need for regional anesthesia is expected to drive the demand for anesthesia syringes and needles in the coming decade. The use of regional anesthesia in surgeries is projected to rise substantially due to its various benefits compared to general anesthesia. Some advantages of regional anesthesia over general anesthesia include lower cost, better environmental impact, and reduced incidence of vomiting & nausea. These benefits are anticipated to drive the demand for regional anesthesia.

The study published by the European Journal of Anaesthesiology and Intensive Care in August 2023 found that the highest increase in the use of regional anesthesia was seen in the UK, Iberia, Italy, and Ireland over the last five years. In addition, the same study also reported that the highest increase in regional anesthesia use was seen for lower and upper limb surgery as well as postoperative pain. Thus, such a growing adoption of regional anesthesia is anticipated to support the market growth over the forecast period.

The increasing number of surgical procedures is anticipated to boost the demand for anesthesia needles and syringes. The anesthetic needles and syringes are used in various surgical procedures, such as lower abdominal, pelvic, rectal, or lower extremity surgery. Moreover, spinal anesthesia is widely used in multiple spinal surgeries. Epidural anesthesia is commonly used during childbirth or labor. In 2022, Sweden (19.1%), Denmark (20.1%), and Finland (19.6%) had the highest proportion of cesarean sections. Cesarean sections involve the use of several types of anesthesia, such as spinal and epidural anesthesia. Therefore, the increased adoption of cesarean sections and gynecological procedures is expected to drive market growth in the coming years.

The growing elderly population is anticipated to improve the demand for anesthetic needles and syringes. This is due to the higher prevalence of surgeries and medical procedures requiring anesthesia among older individuals. According to the data published by the Nordic Council and the Nordic Council of Ministers, around 20% of the population in the Nordic region was aged 65 or over in 2022, and this figure is expected to increase to 25% by 2040. This increase in the aging population is expected to lead to a higher number of surgeries due to the higher risk of chronic diseases among the elderly.

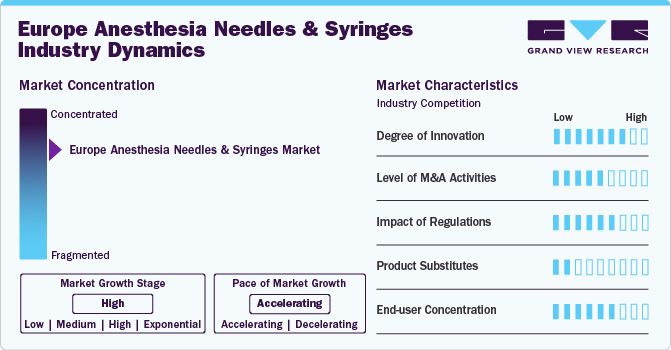

Market Concentration & Characteristics

The industry growth stage is high, with an accelerating pace. Technological advancements in anesthesia delivery systems and needle designs are enhancing the effectiveness and safety of anesthesia administration. Innovations such as safety-engineered syringes, ultra-thin needles, and smart syringes with integrated technology are driving the market growth. These advancements help in reducing patient discomfort, improving accuracy, and minimizing complications, thus driving the adoption of newer products. In February 2022, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. launched the TE9 ultrasound system in the UK market. The TE9 ultrasound system’s large 21.5” high-definition touchscreen and advanced imaging capabilities provide clinicians with detailed & precise visualization of patient anatomy.

Mergers and acquisitions can lead to synergies, such as reduced costs, increased revenue, or improved operational efficiency, thereby helping companies diversify their product and tool offerings and reach more customers. Companies in the European region have developed promotional strategies such as M&A to increase market growth over the forecast period. In April 2022, Medline Industries, LP acquired Asid Bonz, a German medical device supplier, to expand its product offering in the anesthesia sector and increase its customer base in Germany.

The anesthesia needles and syringes market in Europe is also subject to increasing regulatory scrutiny to ensure their safety, efficacy, and quality before they can be marketed & used in the healthcare system. As a result, governments in the European region are developing regulations to govern the manufacture and use of anesthesia needles and syringes. These regulations could have a significant impact on the anesthesia needles and syringes market. In Ireland, the Health Products Regulatory Authority (HPRA) is the national body responsible for regulating medical devices, including anesthesia needles and syringes. The HPRA oversees the implementation of the MDR and ensures that all medical devices placed on the market in Ireland comply with the relevant regulations. The HPRA conducts market surveillance activities to monitor the safety and performance of anesthesia needles & syringes in use. This includes post-market surveillance, where manufacturers are required to collect and analyze data on the safety of their products after they have been placed on the market.

Treating patients with minimal pain and discomfort has always been paramount in healthcare practices. Even though anesthesia needles and syringes are well accepted by patients to date, the effectiveness and practicality of such techniques in general are not without limitations. Techniques such as iontophoresis, transdermal drug delivery, jet injectors, and computerized control local anesthesia delivery systems are other substitute procedures that allow minimum mechanical trauma in patients. This has led to the adoption of different products and techniques and has provided a wider scope for healthcare practice. According to an article of the National Center for Biotechnological Information, published in March 2023, a study was conducted on the efficacy and safety of needle-free jet injectors-assisted intralesional treatments in dermatology, and it found the results to be significantly effective. However, the high cost of these treatment procedures and products might hinder the adoption of other product substitutes.

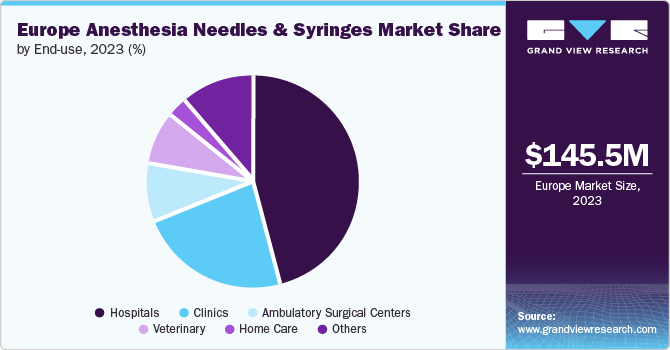

End users such as hospitals, clinics, ambulatory surgical centers, veterinary, home care, and others require a steady supply of anesthesia needles and syringes for various procedures, from routine surgeries to complex operations, which drives the demand for these products. As per a report by UK Pet Food, in 2024, 17.2 million households, or 60% of homes in the UK, have one of the UK’s 36 million nonaquatic pets. Veterinary clinics and animal hospitals frequently perform a variety of surgeries and diagnostic procedures that require precise and reliable anesthesia delivery systems. This increased procedural volume necessitates a steady supply of specialized anesthesia needles and syringes designed to accommodate the unique requirements of different animal species.

Product Insights

Anesthesia needles dominated the market and accounted for a revenue share of 64.22% in 2023. Segment growth can be attributed to innovations such as enhanced needle designs that offer greater precision, reduced pain, and increased safety. Advancements in needle bevel designs and the introduction of safety-engineered needles can help lower complications & improve patient outcomes. The development of pain management techniques, including regional anesthesia for targeted pain relief, can fuel the demand for specialized needles. In addition, the growing prevalence of chronic pain conditions necessitates frequent use of peripheral nerve blocks and other anesthesia techniques, boosting the demand for specialized needles. According to a 2024 report by The British Pain Society, around 8 million adults experience moderate to severely disabling chronic pain. In addition, the report estimates that 43% of UK adults, or nearly 28 million people, live with some level of chronic pain.

The anesthesia syringes segment is anticipated to grow at the fastest CAGR during the forecast period. Advancements in drug delivery systems and syringe technologies can boost the demand for specialized anesthesia syringes. Features such as precise dosage control, minimized dead space, and compatibility with various anesthesia drugs improve their functionality in clinical environments. In addition, the evolution of anesthesia administration techniques, such as target-controlled infusion and computer-assisted drug delivery, influences the demand for advanced anesthesia syringes.

Advancements in drug delivery systems and syringe technologies can boost the demand for specialized anesthesia syringes. Features such as precise dosage control, minimized dead space and compatibility with various anesthesia drugs improve their functionality in clinical environments. In addition, the evolution of anesthesia administration techniques, such as target-controlled infusion and computer-assisted drug delivery, influences the demand for advanced anesthesia syringes. Syringes that facilitate precise drug titration and controlled delivery align with the evolving trends in anesthesia management. In August 2023, Mindray unveiled innovative upgrades to its A Series Anesthesia Systems, enhancing patient safety and operational efficiency.

Safety Features Insights

The traditional segment dominated the market and accounted for a share of 96.71% in 2023. Segment growth can be attributed to the growing awareness about the complications associated with needlestick injuries. Implementing safety mechanisms can help reduce the likelihood of such injuries, improving overall safety in medical settings. Moreover, healthcare facilities can adopt policies requiring devices with safety features to protect staff and patients. These protocols contribute to the demand for traditional safety features in medical products. Traditional safety features provide a cost-effective solution that balances safety and affordability, making them a viable choice for facilities needing to manage budgets while addressing safety concerns. In addition, these features are typically designed for ease of use, requiring minimal extra training for healthcare professionals, which supports their ongoing adoption in clinical environments.

The NRFit segment is anticipated to grow at the fastest CAGR during the forecast period. The NRFit safety features segment includes connectors designed to enhance safety and prevent errors in neuraxial anesthesia procedures. NRFit connectors are specifically designed to prevent misconnections between neuraxial and non-neuraxial systems, which is essential for avoiding potentially hazardous errors and ensuring accurate anesthesia administration. This safety feature promotes their use in medical settings. In addition, by eliminating incorrect connections and lowering the risk of cross-contamination, NRFit connectors improve patient safety during procedures. This emphasis on reducing risks is expected to drive the demand for NRFit-compatible products.

End-use Insights

The hospitals segment dominated the market and accounted for a revenue share of 46.08% in 2023. This growth can be attributed to the high volume of surgical and diagnostic procedures performed in these settings. Hospitals require a steady supply of anesthesia needles and syringes for various procedures, from routine surgeries to complex operations, driving the demand for these products. The need for multiple sizes and types to accommodate patient needs and procedural requirements further supports the segment’s dominance. As per a report by gov.uk, in the UK, during the fiscal year ending in 2023, there were more than 516,073 hospital admissions for cataract surgery, equating to a rate of 4,679 (with a confidence interval of 4,663 to 4,694) per 100,000 population. The sheer volume of these procedures necessitates a constant supply of reliable and effective anesthesia delivery systems. Moreover, as surgical procedures become more complex and specialized, the need for advanced and precise anesthesia delivery systems grows. Hospitals require a range of anesthesia needles and syringes to manage diverse and intricate procedures effectively.

The ambulatory surgical centers segment is anticipated to grow at the fastest CAGR during the forecast period. This can be attributed to the increasing preference for outpatient procedures and surgeries. As medical interventions increasingly shift to these outpatient settings, there is a growing need for specialized anesthesia equipment tailored to this healthcare setting. ASCs seek products that streamline procedures and optimize resource use. Therefore, anesthesia needles and syringes that are easy to handle, enable rapid drug delivery, and require minimal preparation are particularly valuable. In addition, ASCs aim to provide cost-effective care without compromising quality. Manufacturers serving this segment must offer anesthesia needles and syringes that balance affordability with high standards, aligning with the value-based care approach adopted by ASCs. These factors collectively drive the ASC segment growth within the market.

Country Insights

The number of surgical procedures performed in Europe is increasing partly due to an aging population and the prevalence of chronic diseases. This rise in surgeries drives the demand for anesthesia products, including needles and syringes. Continuous innovations in anesthesia delivery and pain management, such as safety-enhanced devices, boost the market growth. These advancements aim to improve patient comfort, reduce the risk of needlestick injuries, and enhance the precision of drug administration.

The UK anesthesia needles and syringes market dominated the Europe region with a share of 42.89% in 2023. This can be attributed to the expansion of healthcare infrastructure, including new hospitals and surgical centers, contributing to the higher demand for these essential devices. According to the UK Parliament, from the financial year 2022/2023, the total health expenditure of the UK reached USD 273.84 billion. In addition, stringent regulatory standards and a focus on minimizing HAIs have led to advancements in needle and syringe technology, such as the integration of safety features and improved ergonomics, which further fuel market growth. Anesthesia needles and syringes must meet relevant International Organization for Standardization (ISO) standards, which provide guidelines on the quality, safety, and performance of these medical devices. Common standards include ISO 13485 for quality management systems and ISO 80369 for small-bore connectors used in healthcare applications.

In the UK, the NHS is the primary provider of healthcare services, funded through general taxation. The NHS covers most medical procedures, including surgeries that require anesthesia. This coverage extends to the necessary medical supplies, including anesthesia needles & syringes. Since these items are considered essential for surgical and pain management procedures, they are fully reimbursed under NHS funding.

The Ireland anesthesia needles and syringes market is expected to grow at a CAGR of 16.23% in the coming years. Ireland’s demographic shift toward an older population result in a higher prevalence of age-related medical conditions requiring surgical intervention, and this has played a significant role in market growth. Anesthesia plays a critical role in these procedures, leading to an increased demand for needles and syringes used in anesthesia. The overall population growth contributes to a higher number of medical procedures performed annually. As more individuals seek medical care, the demand for anesthesia equipment, including needles and syringes, proportionally rises. According to the Central Statistics Office, the number of people aged 65 and above is estimated to have increased by over 40% between 2013 and 2023, from 569,000 to 806,000. It is expected to double to 1.6 million by 2051.

The Denmark anesthesia needles and syringes market is expected to grow at a CAGR of 13.36% during the forecast period. The number of surgical procedures in Denmark is relatively high, driven by elective and emergency surgeries. The robust healthcare system, coupled with a population that has access to healthcare services, ensures that the demand for anesthesia needles and syringes remains steady, mainly for procedures requiring precise administration of anesthetics, which rely heavily on specialized needles and syringes.

Key Europe Anesthesia Needles And Syringes Company Insights

Some of the key companies in the anesthesia needles and syringes market in Europe include BD (Becton, Dickinson & Corporation), B. Braun SE, SolM, GBUK Group Ltd., Vygon (UK) Ltd. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

SolM is a manufacturer of needles and syringes. In 2003, the company successfully patented its first safety-engineered device. Its product line includes syringes, needles, medication preparation, blood collection devices, oral dispensers, animal health, infusion, homecare, and personal protective equipment. Its products are offered under the brand names SOL-CARE, SOL-M, SOL-GUARD, and SOL-VET.

-

GBUK Group Ltd. specializes in designing, manufacturing, and supplying premium medical devices & equipment. It delivers innovative solutions across a range of medical fields. NRFit Slip Syringe. is a product of GBUK Group Ltd. which is intended for administering medication or anesthetics through the neuraxial route; this product is made without natural rubber latex.

Key Europe Anesthesia Needles And Syringes Companies:

- BD (Becton, Dickinson & Corporation)

- B. Braun SE

- SolM

- GBUK Group Ltd.

- Vygon (UK) Ltd

Recent Developments

-

In July 2024, GBUK Group Ltd. acquired Care & Independence (C&I), a rapidly expanding UK-based provider of patient handling and mobility devices.

Europe Anesthesia Needles And Syringes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 155.69 million

Revenue forecast in 2030

USD 388.81 million

Growth Rate

CAGR of 16.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, safety features, end use, country

Regional scope

Europe

Country scope

UK, Ireland, Denmark, Finland, Iceland, Norway, Sweden.

Key companies profiled

BD (Becton, Dickinson & Corporation), B. Braun SE, SolM, GBUK Group Ltd., Vygon (UK) Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Anesthesia Needles and Syringes Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe anesthesia needles and syringes market report based on product, safety features, end-use, and countries:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Anesthesia Needles

-

Anesthesia Syringes

-

-

Safety Features Outlook (Revenue, USD Million, 2018 - 2030)

-

NRFit

-

Traditional

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Veterinary

-

Home Care

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Ireland

-

Denmark

-

Finland

-

Iceland

-

Norway

-

Sweden

-

-

Frequently Asked Questions About This Report

b. The Europe anesthesia needles and syringes market size was estimated at USD 145.52 million in 2023 and is expected to reach USD 155.69 million in 2024.

b. The Europe anesthesia needles and syringes market is expected to grow at a compound annual growth rate of 16.48% from 2024 to 2030 to reach USD 388.81 million by 2030.

b. UK dominated the Europe anesthesia needles and syringes market with a share of 42.89% in 2023. This is attributable due to the expansion of healthcare infrastructure, including new hospitals and surgical centers, contributes to the higher demand for these essential devices. Stringent regulatory standards and a focus on minimizing HAIs have led to advancements in needle and syringe technology, such as the integration of safety features and improved ergonomics, further fuel market growth.

b. Some key players operating in the Europe anesthesia needles and syringes market include BD; B. Braun SE; Vygon (UK) Ltd; SolM; GBUK Group Ltd.

b. Key factors that are driving the market growth include increasing number of surgical procedures and the rising geriatric population, which often requires anesthesia for various medical interventions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."