- Home

- »

- Food Additives & Nutricosmetics

- »

-

Europe Amino Acids Market Size And Share, Report, 2030GVR Report cover

![Europe Amino Acids Market Size, Share & Trends Report]()

Europe Amino Acids Market Size, Share & Trends Analysis Report By Type, By Source (Plant-based, Animal Based, Chemical Synthesis), By Grade, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-317-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Europe Amino Acids Market Size & Trends

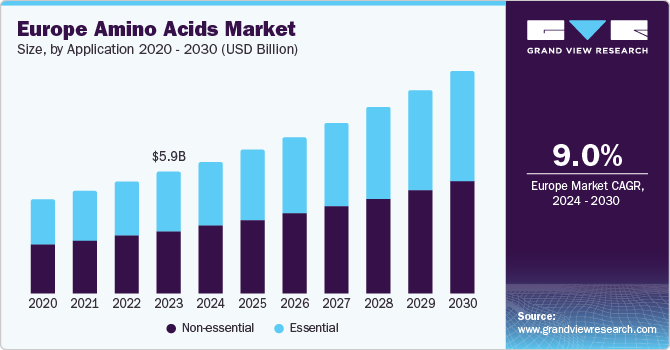

The Europe amino acids market size was estimated at USD 5.9 billion in 2023 and is anticipated to expand at a CAGR of 9.0% from 2024 to 2030. This growth is attributed to the rising health consciousness among consumers and increasing demand for dietary supplements and functional foods. Amino acids are essential in promoting muscle growth, enhancing recovery, and supporting overall health, which aligns with the growing importance of following active and healthy lifestyles. In addition, the aging population in Europe is boosting the demand for amino acids in the pharmaceutical sector, where they are used in treatments for age-related ailments and as ingredients in various medical nutrition products. Furthermore, the personal care and cosmetics industry is experiencing increased demand for amino acids due to their beneficial properties in skin and hair care products.

The Europe amino acids market accounted for 27.6% of the revenue share of the global amino acids market in 2023. The European Food Safety Authority (EFSA) plays a crucial role in setting stringent standards for using amino acids in food and feed, ensuring they are safe for consumption and correctly labeled. For instance, Regulation (EC) No 1333/2008 governs the use of food additives, including amino acids, mandating rigorous evaluation and approval processes. National regulations also come into play; for example, Germany's Federal Institute for Risk Assessment (BfR) sets specific limits on amino acids in dietary supplements to prevent overconsumption.

Type Insights

The non-essential amino acids segment captured the largest revenue share of 51.4% in 2023. Non-essential amino acids, such as glutamine, alanine, and glycine, are widely used in various industries, contributing to its substantial market share. Within the food and beverage sector, non-essential amino acids serve a dual purpose, functioning as flavor enhancers and nutritional supplements. The pharmaceutical and nutraceutical industries leverage the properties of non-essential amino acids to promote gut health, enhance muscle recovery, and improve overall metabolic functions. This broad applicability across sectors boosts the market position of non-essential amino acids.

The essential amino acids segment is projected to experience the fastest CAGR of 9.2% from 2024 to 2030. The rising consumer focus on fitness, muscle building, and overall health is propelling the demand for essential amino acid supplements. Moreover, advancements in biotechnology and increasing research on the health benefits of essential amino acids, such as their role in muscle protein synthesis and recovery, are fuelling their adoption. The pharmaceutical industry also significantly contributes to this growth, utilizing essential amino acids in formulations to treat metabolic disorders and enhance therapeutic outcomes.

Source Insights

The plant-based sources segment dominated the market with a revenue share of 44.2% in 2023. This dominance is driven by the growing consumer preference for sustainable and natural products, reflecting increased awareness of environmental and health benefits associated with plant-based diets. The growing trend of vegetarianism and veganism in Europe has further accelerated the demand for these amino acids. In addition, the plant-based segment benefits from advancements in extraction and processing technologies, which enhance the efficiency and purity of amino acids derived from plant sources. The pharmaceutical and nutraceutical industries also leverage plant-based amino acids for their natural and hypoallergenic properties, appealing to health-conscious consumers seeking clean-label products.

The fermentation segment is projected to register the second-fastest CAGR of 8.7% from 2024 to 2030. The fermentation process is gaining traction due to its efficiency, scalability, and ability to produce high-purity products. This method is particularly advantageous for producing amino acids that are difficult to extract from natural sources or synthetically manufactured. The rise in biotechnological advancements and the development of innovative fermentation techniques are key drivers of growth in this segment. Moreover, the fermentation process is environmentally friendly and sustainable, aligning with the growing consumer preference for green and ethical production methods.

Grade Insights

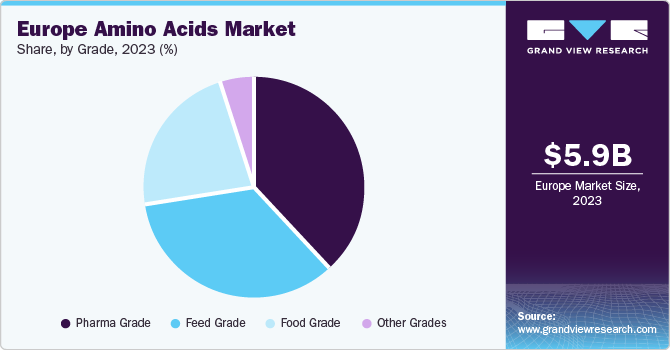

The pharma-grade segment captured a share of 39.2% in 2023. This dominance can be attributed to the ever-growing demand for high-purity amino acids in pharmaceutical applications. These applications include the production of vital drugs, dietary supplements, and nutraceuticals. Stringent regulations governing the quality and safety of pharmaceutical products further solidify the demand for pharma-grade amino acids, ensuring a consistent need within this segment.

The feed-grade segment is expected to grow at a CAGR of 9.3% from 2023 to 2030. This growth is primarily driven by the increasing focus on enhancing livestock health and productivity across Europe. Amino acids play a critical role in animal nutrition as they are the fundamental building blocks of proteins. Supplementation of animal feed with amino acids optimizes protein utilization, improving animal growth performance and better feed conversion ratios. This translates to significant economic benefits for European farmers, fuelling the demand for feed-grade amino acids.

End-use Insights

The food & beverages segment dominated the market with a revenue share of 29.0% in 2023. This dominance will likely continue, driven by the rising consumer interest in functional foods and beverages with enhanced nutritional profiles. Amino acids are crucial in fortifying these products, making them more appealing to health-conscious consumers.

The personal care & cosmetics segment is projected to register the fastest CAGR of 9.6% from 2024 to 2030. This growth can be attributed to the increasing demand for natural and organic ingredients in personal care products. With their natural origins and diverse functional properties, amino acids are perfectly positioned to meet this growing demand, propelling the segment's growth.

Country Insights

Germany Amino Acids Market Trends

The Germany amino acids market accounted for a share of 20.7% of the total regional revenue in 2023. This dominance can be attributed to Germany’s robust pharmaceutical and biotechnology industry, where amino acids find applications in drug development, protein synthesis, and cell culture media. Germany’s strong focus on research and innovation also drives demand for amino acids in academic institutions and research centers.

Russia Amino Acids Market Trends

The amino acids market in Russia is anticipated to grow at a CAGR of 9.8% from 2024 to 2030. Russia’s expanding pharmaceutical and healthcare sectors drive product demand in drug formulations, wound healing, and tissue repair. The animal feed industry in Russia recognizes the importance of amino acids for livestock nutrition, leading to increased adoption. In addition, Russia’s growing interest in sports nutrition and dietary supplements fuels the demand for amino acid-based products.

Key Europe Amino Acids Company Insights

Some of the key players operating in the market include Kyowa Hakko, Ajinomoto, DSM, and Adisseo:

-

Kyowa Hakko Europe GmbH is a global company. Its innovative products, such as L-citrulline and L-glutamine, find applications in sports nutrition, pharmaceuticals, and functional foods across Europe

-

DSM is known for its diverse portfolio, including lysine and threonine. DSM collaborates with local manufacturers and invests in research and development

Key Europe Amino Acids Companies:

- Adisseo France S.A.S

- Kyowa Hakko Europe GmbH

- Ajinomoto

- Archer Daniel Midland (ADM)

- Novus International

- Evonik

- DSM

- Kemin Industries

- Daeang Corporation

- Glanbia Nutritionals

Recent Developments

-

In June 2024, Avril Group formally submitted a proposal to acquire the METEX NØØVISTAGO factory in Amiens, France. Avril's primary objective is to secure the Amiens site's production of amino acids, specifically those produced through fermentation for application in animal nutrition

-

In January 2024, Evonik completed production of the first commercial product from the world's inaugural industrial-scale rhamnolipid biosurfactant plant. Rhamnolipid biosurfactants are a class of bio-based surfactants characterized by a hydrophilic head group comprised of amino acids

-

In September 2023, The European Commission initiated an anti-dumping investigation into Chinese imports of the amino acid, lysine, which is essential for human and animal nutrition

Europe Amino Acids Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.79 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, trends

Segments covered

Type, source, grade, end-use, country

Regional scope

Europe

Country scope

Germany; France; UK; Russia; Italy; Spain; Turkey; Netherlands

Key companies profiled

Adisseo France S.A.S; Kyowa Hakko Europe GmbH; Ajinomoto; Archer Daniel Midland (ADM); Novus International; Evonik; DSM; Kemin Industries; Daeang Corp.; Glanbia Nutritionals

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Amino Acids Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe amino acids market report based on type, source, grade, end-use, country:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Essential

-

Histidine

-

Isoleucine

-

Leucine

-

Lysine

-

Methionine

-

Phenylalanine

-

Threonine

-

Tryptophan

-

Valine

-

-

Non-essential

-

Alanine

-

Arginine

-

Asparagine

-

Aspartic Acid

-

Cysteine

-

Glutamic Acid

-

Glutamine

-

Glycine

-

Proline

-

Serine

-

Tyrosine

-

Ornithine

-

Citrulline

-

Creatine

-

Selenocysteine

-

Taurine

-

Others

-

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plant-based

-

Animal-based

-

Chemical Synthesis

-

Fermentation

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Grade

-

Feed Grade

-

Pharma Grade

-

Other Grades

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Animal Feed

-

Pet Food

-

Pharmaceuticals

-

Vaccine Formulation

-

Personal Care & Cosmetics

-

Dietary Supplements

-

Agriculture

-

Other End-uses

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

UK

-

Russia

-

Italy

-

Spain

-

Turkey

-

Netherlands

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."