- Home

- »

- Advanced Interior Materials

- »

-

Europe Aluminum Die Casting Market, Industry Report, 2030GVR Report cover

![Europe Aluminum Die Casting Market Size, Share & Trends Report]()

Europe Aluminum Die Casting Market Size, Share & Trends Analysis Report By Production Process (Pressure Die Casting), By Application (Transportation, Building & Construction), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-380-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Europe Aluminum Die Casting Market Trends

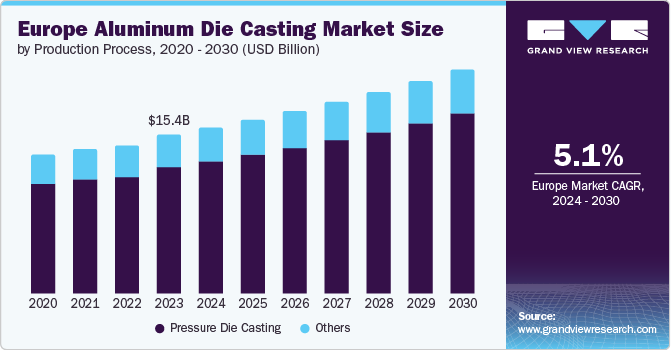

The Europe aluminum die casting market size was estimated at USD 15.43 billion in 2023 and is expected to grow at a CAGR of 5.1% from 2024 to 2030. Growing investments towards the development of the automotive sector coupled with stringent regulations for low emissions are boosting the demand for aluminum die castings in Europe. According to ACEA, the EU car market rose by ~14% in April 2024, on a m-o-m basis, with significant growth in registrations witnessed in Spain, Germany, France, and Italy. The car registrations in the EU reached almost 3.7 million units in 2024, registering a 6.6% increase as of April. These statistics indicate a growth in demand for cars in Europe, which is anticipated to augment vehicle production in the region in the coming months.

Drivers, Opportunities & Restraints

Aluminum is a sustainable material due to its contribution to carbon dioxide (CO2) reduction. It prevents around 70 million tons of unwanted CO2 from mixing into the air. In vehicles, using 100 kg of aluminum can help save 46 liters of fuel per year. As a result, companies are investing in R&D to push the penetration of aluminum in car bodies. The growing penetration of aluminum in vehicle manufacturing is anticipated to act as a major growth driver and opportunity for the market to flourish.

For instance, Alumobility and Hyundai Motor Europe Technical Centre partnered and conducted a theoretical conversion of the Genesis GV70 electric SUV's steel-intensive body to full aluminum. These results were published in a new study and presented at a conference in October 2023 in Germany. The study resulted in achieving a weight reduction by over 110 kg. The 275 kg aluminum body comprised 64% sheet and the remaining was extrusion and casting.

A key challenge that obstructs market growth is the Russia-Ukraine War. This conflict has already disrupted raw material costs in the past two years. Further, as of February 2024, the EU faces pressure to impose a ban on Russian imports, as 9% of the region’s aluminum imports come from Russia. The ban is proposed as part of an expected sanctions package marking two years since Ukraine's invasion. If the ban comes into effect, European and U.S. buyers will have to compete for aluminum from the Middle East, causing a price surge.

Price Trends for Aluminum

On the downstream supply side, due to U.S. Section 232 (anti-dumping duty) on certain aluminum products, import tariffs on China are expected to increase by the end of 2024. From a demand perspective, tariffs on EVs, which is the impact of the rollback of incentives by several European governments for the purchase of EVs, are also likely to increase aluminum prices in the coming quarters. Hence, in 2024, the bullish run on aluminum prices are expected, albeit at a gradual pace for the remaining quarters.

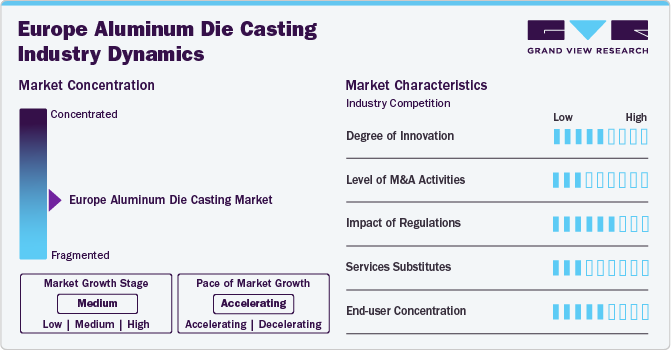

Market Concentration & Characteristics

Europe’s aluminum die-casting market is growing moderately and rapidly. The market is relatively fragmented, characterized by a mix of medium- and small-scale manufacturers across the region. Also, the industry faces high competition amidst growing demand and fluctuations in trade activities between major countries.

The market observes moderate levels of mergers and acquisitions as major players aim to expand their reach and opt for an environmentally friendly approach. For instance, in April 2024, Emirates Global Aluminum acquired Germany-based Leichtmetall Aluminium Giesserei Hannover GmbH. The latter is engaged in aluminum recycling and implements proprietary technology for melting, liquid metal treatment, and casting recycled scrap into high-quality products as per application.

The threat of substitutes is less. However, it is anticipated to become a restraint in the coming years. Although the demand for aluminum is rising, strong competition from other lightweight materials like carbon fiber is anticipated. Carbon fiber offers a significant weight advantage over aluminum and more design freedom, thus contributing to its substantial share in various applications that require lightweight materials.

Production Process Insights

The pressure die casting process segment held the largest revenue share of over 78% in 2023. It is the most widely used technique to form aluminum into parts or components through die casting. It is idle for producing precisely formed aluminum parts with minimum machining and finishing requirements. Pressure die casting is further bifurcated into high-pressure and low-pressure die casting.

The process is used to manufacture complex and precision parts in large quantities, offering an excellent surface finish and dimensional accuracy. Aluminum alloys are the most preferable materials used for producing components via pressure die casting, as they provide results that include corrosion resistance, electrical conductivity, and high-temperature resistance. Some common alloys used in the process include 518, 443, 412, 380, and 390. The parts find various applications in industries such as aerospace, automotive, and consumer electronics for frames, housings, and engine components.

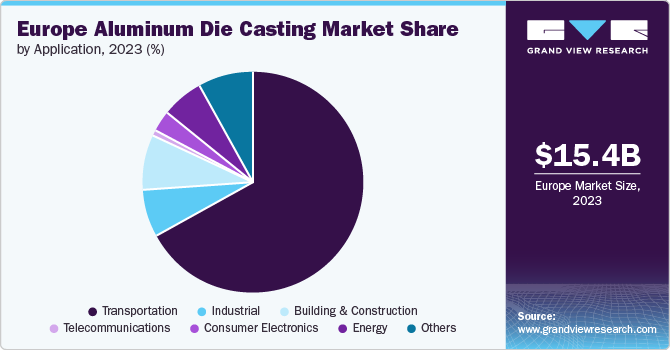

Application Insights

The transportation segment held the largest revenue share of nearly 67% in 2023 of the overall market. The segment comprises general and sports road transportation, heavy vehicles, and aerospace. The growing penetration of aluminum components in vehicles has led to innovations in the industry. One of the innovations is the giga-casting technology that produces large and complicated casting structures through high-pressure die casting.

Giga-casting has witnessed developments in the last few years in terms of adoption by automotive companies. In 2020, Tesla commenced the construction of its first giga-casting facility in Texas, U.S. In 2021, it began giga-casting production for its Model Y, and in 2022, it announced the use of giga-cast parts for Model 3 & Cyber truck. Since 2023, companies including Volkswagen, GM, Ford, XPENG, and Toyota have also announced incorporating giga castings. Building & construction is a vital segment anticipated to register lucrative growth over the coming years. One of the major factors driving the segment is the increasing use of aluminum die castings in buildings owing to their lightweight, high strength, and aesthetic appeal. These are used in roof structures, window frames, bridges, and building frameworks. Growing investments in the construction industry are propelling product demand.

Country Insights

Germany Aluminium Die Casting Market Trends

The Germany aluminium die casting market dominated the Europe market and accounted for the largest revenue share of over 27.0% in 2023. This country’s dominance in the market is attributed to its increasing investments in construction coupled with growing vehicle production, which are expected to fuel demand for aluminum die castings in Germany during the forecast period. The impact of the Russia-Ukraine conflict is likely to subdue mainstream manufacturing activity. However, growth is expected across sectors due to market players finding ways to mitigate the adverse impact.

France Aluminium Die Casting Market Trends

The aluminium die casting market in France is witnessing high growth in the construction industry, which is expected to propel product demand in the country over the coming months. For instance, France is witnessing increased investments in the wake of the upcoming 2024 Paris Olympics, which has a budget of ~USD 4.4 billion (EUR 3.8 billion). The construction funds are expected to be used to reconfigure existing buildings and construct new structures in France.

UK Aluminium Die Casting Market Trends

The UK aluminum die casting market is expected to register slightly sluggish growth amidst the slowdown in vehicle production. For instance, UK vehicle production in the first five months of 2024 reduced by 3.2% on a year-over-year basis, dropping to 399,282 units. Construction spending in Italy is expected to benefit the aluminum die-casting market. The country registered a GDP of 0.9% in 2023. According to the European Commission, the growth is anticipated to be 0.9% and 1.1% in 2024 and 2025, respectively.

Key Europe Aluminum Die Casting Company Insights

Some of the key players operating in the market include FAIST Group, Consolidated Metco, Inc., and Martinrea Honsel.

-

Consolidated Metco, Inc., or ConMet, manufactures aluminum casting components for the commercial vehicle industry. In October 2023, the company established its European headquarters in Stuttgart, Germany, to serve the growing market in the region and provide solutions to commercial vehicle OEMs

-

FAIST Group, headquartered in London, UK, manufactures components and assemblies for various industries. It provides its product offerings through 32 operational sites globally and five business units: industrial, controls & propulsion systems, light metals, truck bodies, and electronics. Aluminum die casting is provided through its industrial and light metals business units

-

Martinrea Honsel Germany GmbH is a subsidiary of Martinrea International Inc. It is a German company specializing in high-pressure die casting, sand casting, permanent mold, rolling, and machining. Earlier known as HONSEL AG, it was renamed to its present name in August 2011

Key Europe Aluminum Die Casting Companies:

- Alucast Ltd

- Consolidated Metco, Inc.

- Druckguss Westfalen GmbH & Co.KG

- FAIST Group

- GF Casting Solutions

- Haworth Castings

- Lupton & Place Ltd.

- Martinrea Honsel

- Metalpres Donati Spa

- Wolf Industries GmbH

Recent Developments

-

In January 2024, LMG Manufacturing opened a new facility in Germany. It has set up a specialized process involving the combination of aluminum die casting with plastic injection molding processes. With the new technology, the company marks a unique selling point across Europe

-

In February 2024, Germany-based Alutech Holding GmbH & Co. KG acquired AE Group AG. The acquisition marks achieving a significant milestone in the economic turnaround for the company

Europe Aluminum Die Casting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.09 billion

Revenue forecast in 2030

USD 21.69 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Production process, application, and region

Regional scope

Europe

Country scope

Germany; France; Italy; Russia; UK; Turkey

Key companies profiled

Alucast Ltd.; Consolidated Metco, Inc.; Druckguss Westfalen GmbH & Co.KG; FAIST Group; GF Casting Solutions; Haworth Castings; Lupton & Place Ltd.; Martinrea Honsel; Metalpres Donati Spa; Wolf Industries GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Aluminum Die Casting Market Report Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe aluminum die casting market report based on the production process, application, and country:

-

Production Process Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Pressure Die Casting

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Industrial

-

Building & Construction

-

Telecommunications

-

Consumer Electronics

-

Energy

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

UK

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The Europe aluminum die casting market size was estimated at USD 15.43 billion in 2023 and is expected to reach USD 16.09 billion in 2024.

b. The Europe aluminum die casting market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 21.69 billion by 2030.

b. Based on application, transportation dominated the Europe aluminum die casting market with a share of over 66.0% in 2023, owing to significant growth across Europe in automotive industry.

b. Some of the key players operating in the Europe aluminum die casting market include Alucast Ltd, Consolidated Metco, Inc., Druckguss Westfalen GmbH & Co.KG, FAIST Group, GF Casting Solutions, Haworth Castings, Lupton & Place Ltd, Martinrea Honsel, Metalpres Donati Spa, Wolf Industries GmbH.

b. The growing penetration of aluminum components in vehicle production is one of the major growth drivers of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."