- Home

- »

- Advanced Interior Materials

- »

-

Europe Air Purifier Market Size, Industry Report, 2030GVR Report cover

![Europe Air Purifier Market Size, Share & Trends Report]()

Europe Air Purifier Market Size, Share & Trends Analysis Report By Technology (HEPA, Activated Carbon), By Application (Commercial, Residential), By Coverage Range, By Sales Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-277-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Europe Air Purifier Market Size & Trends

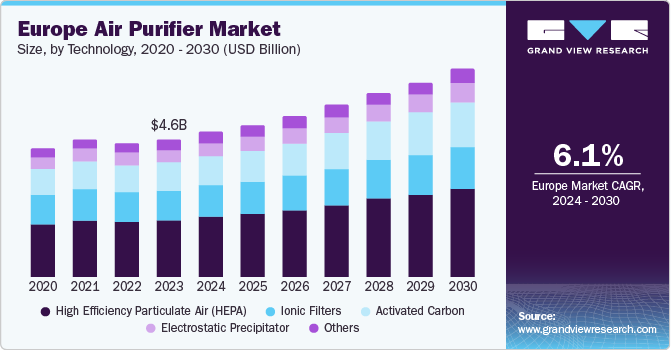

The Europe air purifier market size was estimated at USD 4.6 billion in 2023 and is expected to grow at a CAGR of 6.1% from 2024 to 2030. The market growth is attributed to the critical need for improved air quality in the region. According to the European Environment Agency, 253,000 deaths in Europe could have been avoided if the fine particulate matter (PM2.5) was under the World Health Organization’s recommended number. These figures, coupled with the substantial public health costs associated with air pollution, underscore the urgency for Europeans to seek solutions like air purifiers. Thus, driving the regional market expansion.

The market held a share of 28.7% of the global air purifier market revenue. Due to rising industrialization, urbanization, and number of automobiles, Europe has become one of the most polluted regions across the globe. The European Union initiated stringent rules to reduce the percentage of air pollutants, such as sulfur oxide, nitrogen oxide, volatile organic compounds, and ammonia. Various amendments were introduced to control air pollution in the region; however, the rate at which the pollution decreased is far less than what was desired.

Growing public awareness of the health risks associated with poor air quality is further driving market growth. Consumers are increasingly looking for ways to protect themselves and their families from harmful pollutants, and air purifiers offer a readily available solution. Technological advancements are also playing a significant role in the evolution of the air purifier market. Manufacturers are constantly developing more efficient and innovative products with features like smart controls, High Efficiency Particulate Air (HEPA) filters, and air quality sensors. These advancements offer consumers a wider range of choices and cater to different needs and budgets.

Technology Insights

In 2023, the HEPA technology segment dominated market and accounted for a reveue share of 41.8%. HEPA filters find applications in factories and laboratories, safeguarding workers against respiratory issues. With increasing awareness of declining air quality, HEPA filters have gained prominence in various sectors, including commercial, residential, and industrial applications. The market is expected to witness increased adoption of HEPA filters, attributed to their high quality and reliability in removing airborne particles.

The activated carbon segment is expected to grow at the fastest CAGR of 7.1 % during the forecast period. The effectiveness of activated carbon air purifiers is attributed to the high surface area of the carbon granules and their microporosity, which makes them highly efficient in trapping gases, fumes, and odors. While HEPA filters excel in trapping airborne particles, they are not designed to eliminate gases, odors, and chemicals. As a result, activated carbon filters are often utilized in conjunction with HEPA filters in various air purifiers, creating a combined approach that addresses a broader spectrum of airborne pollutants.

Application Insights

The commercial segment dominated the market with a share of 56.1% in 2023. It is expected to grow at the fastest rate over the forecast period. The technology within commercial air purifiers varies, with some models offering multi-stage filtration systems, including HEPA filters, activated carbon filters, and UV-C light technology. These features collectively target a wide range of pollutants, providing comprehensive air purification. For instance, Honeywell offers smart air purifiers suitable for commercial settings, such as the AirGenius series. These purifiers feature advanced filtration technologies, including HEPA filters and patented QuietClean ifD technology, which captures up to 99.9% of airborne particles. The AirGenius models can be controlled remotely via the Honeywell Home app, allowing for customizable purification settings and scheduling.

Coverage Range Insights

The 250-400 sq. ft. coverage range segment dominated the market and accounted for a revenue share of 40.3 % in 2023. Air purifiers are widely used in commercial kitchens, restaurants, cafes, and museum rooms to maintain the air quality. The air quality in museums or archive rooms is of utmost importance to preserve the documents and artifacts, which might get damaged without proper care or maintenance of air quality. The increasing importance of air quality and rising investments in the commercial kitchens and restaurant industry are anticipated to boost the segment growth over the forecast period.

The below 250 sq. ft. coverage range segment is anticipated to register the fastest CAGR of 6.7% during the forecast period. These types of air purifiers are installed in small spaces, including bedrooms, cars, nurseries, and commercial businesses & offices. Continuous product launches and customized air purifiers for personal vehicles are likely to propel the segment growth in the coming years.

Sales Channel Insights

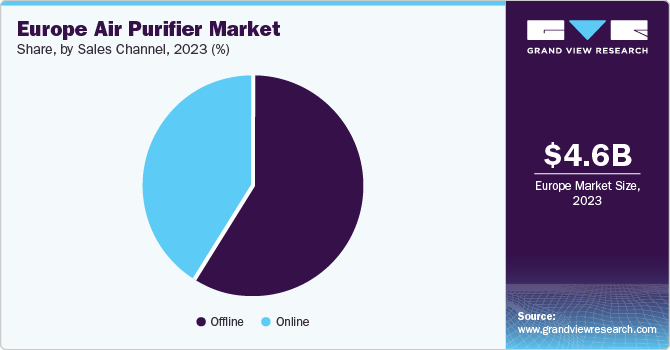

The offline channel segment dominated the market accounting for a revenue share of 56.0% in 2023. In offline stores, consumers can physically check product features while comparing different models and get buying assistance from sales associates. This helps consumers make informed decisions and choose the right product that best suits their needs. The rising number of construction projects of departmental stores, supermarkets, and shopping malls across the world is anticipated to increase consumer access to air purifiers through offline channels. All these factors are expected to drive the offline segment’s growth.

The online channel segment is expected to grow at a CAGR of 6.9% from 2024 to 2030. With the rising usage of Internet, the penetration of online sales channels for daily requirements and luxurious goods has significantly increased. Online retailing giants, such as Amazon, The Home Depot, and eBay, have been launching new initiatives to reach new consumers. These factors will drive the growth of the online segment.

Country Insights

Germany Air Purifier Market Trends

The Germany air purifier market held a revenue share of 17.1% in 2023. Germany’s regulations on air quality are based on the provisions adopted by the European Union. The federal government of Germany monitors air quality control and is responsible for imposing the act on the prevention of harmful effects on the environment caused by noise, air pollution, vibration, or any other similar phenomenon. Thus, the demand for air purifiers is expected to increase in Germany in the coming years.

UK Air Purifier Market Trends

The air purifier market in the UK held a share of over 10.0% in 2023. As air pollution continues to pose health risks, particularly for vulnerable populations, individuals are increasingly seeking solutions to improve indoor air quality. Air purifiers offer a readily available option to mitigate the negative health effects of air pollution. This growing demand, fuelled by public health concerns and rising awareness, presents a significant growth opportunity for the UK market.

Key Europe Air Purifier Company Insights

The market is quite competitive due to the presence of international as well as local players. Companies offer a wide range of products to choose from, along with the flexibility of buying from both offline and online channels. This allows consumers to compare the products based on product performance, technology, and pricing. Companies are competing based on quality, pricing, and reputation.

Key Europe Air Purifier Companies:

- Honeywell International, Inc.

- IQAir

- Koninklijke Philips N.V

- Unilever PLC

- Sharp Electronics Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics

- Panasonic Industry Europe GmbH

- Whirlpool Europe

- Dyson UK

- Carrier

Recent Developments

-

In February 2023, Carrier launched a new air purifier system, which uses activated carbon along with UV to purify the air. It is a new add-up to their Healthy Homes lineup. The new purifier can remove odors, VOCs, and other common harmful indoor gases

Europe Air Purifier Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.9 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, coverage range, sales channel, application, country

Regional scope

Europe

Country scope

Germany; UK; France

Key companies profiled

Honeywell International, Inc.; IQAir; Koninklijke Philips N.V; Unilever PLC; Sharp Electronics Corporation; Samsung Electronics Co., Ltd.; LG Electronics; Panasonic Industry Europe GmbH; Whirlpool Europe; Dyson UK; Carrier

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Air Purifier Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe air purifier market report based on technology, coverage range, sales channel, application, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

High Efficiency Particulate Air (HEPA)

-

Activated Carbon

-

Ionic Filters

-

Electrostatic Precipitator

-

Others

-

-

Coverage Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 250 Sq. Ft.

-

250-400 Sq. Ft.

-

401-700 Sq. Ft.

-

Above 700 Sq. Ft.

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets/Supermarkets

-

Retail Stores

-

Specialty Stores

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Retail Shops (Mercantile)

-

Offices

-

Healthcare Facilities

-

Hospitality

-

Schools & Educational Institutions

-

Laboratories

-

Transport (railway stations, metros, bus stops, airports)

-

Others

-

-

Residential

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

UK

-

Frequently Asked Questions About This Report

b. The Europe air purifier market size was estimated at USD 4.6 billion in 2023 and is expected to reach USD 4.8 billion in 2024

b. The Europe air purifier market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 6.9 billion by 2030

b. The High Efficiency Particulate Air (HEPA) segment dominated the market with a share of 41.8% in 2023. With the increasing awareness of declining air quality, HEPA filters have gained prominence in various sectors, including commercial, residential, and industrial applications

b. Some key players operating in the Europe air purifier market include Honeywell International, Inc.; IQAir; Koninklijke Philips N.V; Unilever PLC; Sharp Electronics Corporation; Samsung Electronics Co., Ltd.; LG Electronics; Panasonic Industry Europe GmbH; Whirlpool Europe; Dyson UK; Carrier

b. Factors such as the increasing need for improved air quality and substantial public health costs associated with air pollution are driving the Europe air purifier market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."