- Home

- »

- Advanced Interior Materials

- »

-

Europe Aerosol Container Market Size, Industry Report 2030GVR Report cover

![Europe Aerosol Container Market Size, Share & Trends Report]()

Europe Aerosol Container Market Size, Share & Trends Analysis Report By Material (Aluminum, Steel), By Type (Liquified, Compressed Gas Propellant) By Product, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-712-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Europe Aerosol Container Market Trends

“2030 Europe aerosol container market value to reach USD 2.86 billion”

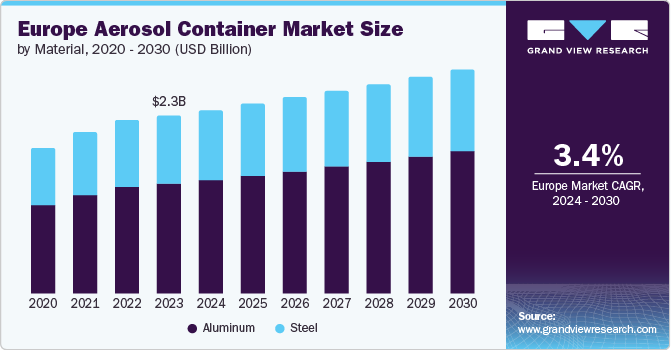

The Europe aerosol container market size was estimated at USD 2.27 billion in 2023 and is projected to grow at a CAGR of 3.4% from 2024 to 2030. The growth can be attributed to continuous cosmetics and personal care innovations, such as hair sprays, deodorants, and dry shampoos. The market is also growing owing to the presence of key market players with strong distribution networks throughout the region. They are deploying more products with aerosol container packaging due to their recyclability and reusability properties, as the containers are made from materials, such as metals and glass, further driving the market growth.

Improvement in the economic condition of the region, with countries, such as the UK and Germany growing, has increased disposable income levels and changed consumers' lifestyles. This has resulted in a rise in demand for aerosol container products. The market growth is also attributable to the growth in sectors, such as healthcare, household care, and personal care, with an increase in the use of innovative aerosol container products.

Material Insights

“The steel segment to witness a growth rate of 2.7%”

The aluminum segment dominated the market and accounted for the highest revenue share of 61.2% in 2023. The growth can be attributed to the material's reusability and recyclability. With the increased focus on sustainability, the preference for aluminum has increased due to its lightweight, corrosion-resistant, and recyclable properties. Aluminum also extends product shelf life due to its barrier properties, expanding its use in end use industries, such as packaging of personal care and healthcare products.

The steel material segment is expected to witness a CAGR of 2.7% from 2024 to 2030 owing to its availability and cost-effectiveness. Steel containers are used in the manufacturing of cost-sensitive products, including household cleaners, industrial sprays, and paints. Furthermore, steel containers provide excellent protection to the packaged products.

Type Insights

“The compressed gas propellant segment to witness a growth rate of 2.7%”

The liquified gas propellant segment dominated the market and accounted for a share of 64.0% in 2023. This can be due to the increased preference for products containing liquified gas propellant, as they provide stable and constant pressure, giving a uniform spray pattern. Furthermore, containers of this propellant have a better product evacuation, allowing the entire product to be used. Due to these properties, there is a high demand for liquified gas propellant containers in the personal care and household segments, which, in return, has contributed to the market growth.

The compressed gas propellant segment held a revenue share of 36.0% in 2023. This is due to the increased use of compressed gas propellants in the food and pharmaceutical industries. Compressed gas propellant is usually used in products that require less pressure, such as whipped cream cans and inhalers. Furthermore, compressed gas propellant's non-flammable and environmentally friendly properties support segment growth.

Product Insights

“The 3-piece cans segment to witness a growth rate of 2.9%”

The 1-piece cans segment dominated the market with a share of 66.5% in 2023. This is due to a rise in the growth of the personal care and household use industries in Europe that use aerosol cans for products, such as deodorants, air fresheners, hair sprays, and mousses. 1-piece cans provide a seamless, leak-proof design that is beneficial for products with higher internal pressures. Therefore, industries having products with high pressure use 1-piece cans rather than 3-piece cans, which are used for products with lower pressure.

The 3-piece cans segment accounted for a share of 33.5% in 2023. 3-piece cans are cost-effective and easily customizable with various shapes and sizes. Furthermore, there is a rise in the use of 3-piece cans in market segments, such as personal care and household, where these cans are used in manufacturing cooking sprays, hair sprays, and shaving creams. Therefore, these factors are responsible for the segment growth.

Application Insights

“The household segment to witness a growth rate of 4.2%”

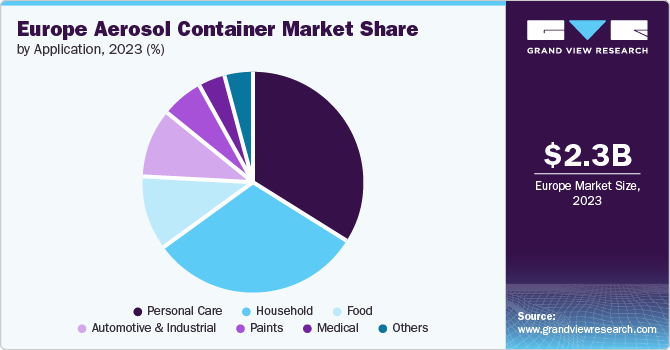

The personal care segment dominated the market with a share of 34.6% in 2023. The growth is due to the rapidly expanding cosmetic industry, which, in turn, has augmented the demand for packaging in segments, such as cosmetics, skincare, and hair care. With a rise in disposable income levels in countries, such as the UK and Germany, there is a rise in personal grooming products, which provide convenience and efficiency. Due to their barrier properties, aerosol containers help enhance products’ shelf life.

The household segment accounted for a revenue share of 31.2% due to a rise in demand for various household products containing aerosol containers, such as food and cleaning sprays. With a change in consumers' lifestyles, the adoption of aerosol containers has increased in the household segment, as the containers are hygienic and convenient for use. Aerosol containers enhance the shelf life of products, which is an important factor in their high demand.

Country Insights

“UK to witness market growth of CAGR 3.8%”

Germany Aerosol Container Market Trends

Germany dominated the Europe aerosol container market with a share of 27.5% in 2023. It is attributable to the rapid urbanization and lifestyle change in the population as there is an increase in the preference for aerosol containers due to their convenience. A rise in demand and extensive R&D activities also contribute to market growth. With increasing product innovation and availability, there is a rise in the application awareness of the segment, which has further contributed to market growth.

UK Aerosol Container Market Trends

The aerosol container market in the UK accounted for a share of 20.1% in 2023. With a growing emphasis on personal hygiene and cleanliness, the demand for aerosol-based products has increased as it provides a clean and efficient application of the product. Furthermore, the market growth is attributed to the recyclability and reusability of these cans.

Europe Aerosol Container Company Insights

Some of the major companies in the aerosol container market in Europe are Ball Corporation, Trivium Packaging, Crown, BWAY Corporation, Nampak Ltd, Toyo Seiken Co. Ltd, CCL Containers, COLEP Packaging, CPMC Holdings Limited, and Guangdong Sihai Iron-Printing & Tin-Making Co., Ltd. Companies in this market focus on offering products in segments, such as personal care, household use, medical, and paint.

-

Ball Corporation provides aluminum packaging options for beverage, personal care, and household product clients. The company provides products, such as beverage cans, bottles, beverage ends & tabs, aerosol cans, and household & personal care bottles

-

Trivium Packaging provides a range of metal packaging with different shaping and opening solutions. Technologies used for shaping are mechanical expansion, impact extrusion, and blow molding, which can be used to manufacture custom-shaped packaging

Key Europe Aerosol Container Companies:

- Ball Corporation

- Trivium Packaging

- Crown

- BWAY Corporation

- Nampak Ltd.

- Toyo Seiken Co. Ltd.

- CCL Containers

- COLEP Packaging

- CPMC Holdings Limited

- Guangdong Sihai Iron-Printing & Tin-Making Co., Ltd.

- Alucon Public Company Limited

- Ds Containers

- Jamestrong Packaging

- ITW SEXTON

- Swan Industries (Thailand) Company Limited

- TUBEX

- G. STAEHLE GMBH U. CO. KG.

- Kian Joo Can Factory Berhad

- Graham Packaging Company

- Massilly Holding S.A.S

- Bharat Containers

- Technocap S.PA.

- LINHARDT

- Montebello Packaging

- Spray Products

Recent Developments

-

In May 2024, Estathé teamed up with Crown and introduced a summer promotion in aluminum cans, a package that can be recycled endlessly

-

In April 2023, Ball Corporation revealed that its Global Aerosol Packaging division achieved ASI certification for Performance and Chain of Custody Standards. Ball's Aerosol division provides diverse recyclable aluminum packaging solutions for personal care, household, and beverage packaging

Europe Aerosol Container Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.34 billion

Revenue forecast in 2030

USD 2.86 billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, product, application, country

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

Ball Corp.; Trivium Packaging; Crown; BWAY Corp.; Nampak Ltd.; Toyo Seiken Co. Ltd.; CCL Containers; COLEP Packaging; CPMC Holdings Ltd.; Guangdong Sihai Iron-Printing And Tin-Making Co., Ltd.; Ds Containers; Jamestrong Packaging; ITW SEXTON; Swan Industries (Thailand) Co., Ltd.; Berry Global, Inc.; TUBEX; G. STAEHLE GMBH U. CO. KG; Kian Joo Can Factory Berhad; Graham Packaging; Massilly Holding S.A.S; Bharat Containers; Technocap S.PA.; LINHARDT; Montebello; Spray Products

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Aerosol Container Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe aerosol container market report based on material, type, product, application, and country:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Steel

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquified Gas Propellant

-

Compressed Gas Propellant

-

-

Product Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

1-piece cans

-

3-piece cans

-

-

Application Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Care

-

Household

-

Automotive & Industrial

-

Food

-

Paints

-

Medical

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."