Europe Advanced Wound Care Market Size, Share & Trends Analysis Report By Product (Moist, Antimicrobial, Active), By Application (Chronic Wounds, Acute Wounds), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-229-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

EU Advanced Wound Care Market Trends

The Europe advanced wound care market size was estimated at USD 2.82 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. This growth can be attributed to the increasing prevalence of chronic diseases such as diabetes, the high proportion of the geriatric population, and the availability and accessibility to treatment options. The high incidence of chronic diseases such as diabetes, atherosclerosis, and venous insufficiency can affect the healing ability of an individual. According to the article published by CARE Hospitals in January 2024, due to poor blood circulation, blood thickening, and low immunity among diabetes patients, healing can be a difficult and time-consuming process. In addition, according to an article published by the National Library of Medicine in July 2021, approximately 58 million adults in Europe had diabetes, and this number is estimated to reach 66.7 million by 2045. This rising prevalence of diabetes is expected to drive the growth of this market.

Wound treatments are expected to become more important in Europe due to the rising proportion of the geriatric population. According to the statistics published by Eurostat in February 2024, around one-fifth of the total population in Europe, accounting for approximately 448.8 million, was aged 65 and over by January 2023. Therefore, the low healing ability of this age group and patients with chronic diseases is expected to boost the healthcare infrastructure and innovation in the region.

The rising demand for the development of cost-effective and more efficient treatment options is further expected to drive market growth. This has led to an increasing emphasis on R&D investments and the development of technologically advanced products in the region. For instance, in June 2022, the medical technology company Smith+Nephew announced an investment of over USD 100 million in the development of a research and development facility for its wound management franchise in the UK. The facility is expected to help the company develop a more innovative portfolio and gain a competitive advantage.

Market Concentration & Characteristics

The market growth stage is medium and the pace of growth is accelerating. Europe's advanced wound care market is characterized by a high degree of innovation due to the increasing emphasis on technological advancements to accelerate the healing process and facilitate earlier closure of the injury. For instance, in 2019, the startup Grapheal, focusing on developing solutions to speed up the healing of chronic injuries using next-generation bandages, was established in France. The company also received funding of over USD 2.0 million to advance the development of embedded biosensing technology for monitoring injuries and availing digital COVID-19 testing in 2021. The emergence of such startups in the region is further expected to boost innovation in the advanced wound caremanagement field.

The Europe advanced wound care market is also characterized by a low level of merger and acquisition (M&A) activities by the leading players. The increasing demand for technologically advanced solutions is driving mergers and acquisitions in this area. For instance, in August 2023, Quantum Genomics SAS entered into exclusive merger talks with Vistacare Medical SAS to enter into the wound management sector.

The advanced wound care market in Europe is also subject to regulatory scrutiny. Regulations such as Medical Device Regulation (MDR) (EU) 2017/745 and, for the UK, the UK Medical Devices Regulations (UK MDR) 2002 oversee the regulatory requirements related to medical products and devices. The manufacturers need to receive certifications such as the CE mark that ensure the safety and quality of these solutions to enter the European region.

There are a number of product substitutes for advanced wound care products which can include home remedies, Ayurveda, and traditional dressing. However, these treatments can provide temporary relief to patients in the healing process and might not be suitable for some chronic injuries. According to a study published by the National Library of Medicine in February 2023, botanicals such as Achillea millefolium, aloe vera, althaea officinalis, calendula officinalis, and Matricaria chamomilla have significant healing abilities.

End-user concentration is a significant factor in the Europe advanced wound care industry. There are a number of end-user industries driving demand for these solutions, such as hospitals and clinics, due to the increasing number of surgeries and incidence of injuries. The availability of products and distributors can further help increase access of patients to treatments and further drive their demand. For instance, in June 2021, Schülke & Mayr GmbH (schülke) and Bactiguard entered a distribution agreement to provide wound care solutions to German hospitals.

Product Insights

The moist wound care product segment dominated the market and accounted for a revenue share of 70.9% in 2023. This can be attributed to its ability to maintain a moist environment around the affected areas and facilitate tissue re clinical trials ration and a better healing process. The increasing incidence of burn injuries is expected to drive the segment’s growth. According to the Management of Burns & Scalds procedural document published by the National Health Service in January 2024, approximately 250,000 people in the UK receive burn injuries every year, and about 16,000 patients are admitted to hospitals for specialist burn treatments. This high prevalence of burn injuries is expected to drive the growth of this segment.

The active wound care product segment is expected to register the fastest CAGR from 2024 to 2030. The increasing incidences of chronic and acute injuries and emphasis on the development of innovative treatment options can be attributed to the growth of this segment. Various public and private players in the region are carrying out various research studies to develop more suitable treatment options. For instance, a study to evaluate the efficacy of Kerecis Omega3 Wound, the first fish skin substitute on severe diabetic foot ulcers was conducted from October 2019 to August 2023 in the European countries. This study is expected to lead to the development of more cost-effective and advanced treatment options for European countries.

Application Insights

The chronic wounds segment accounted for the largest revenue share in 2023. The high prevalence of chronic injuries, including diabetic foot ulcers, venous leg ulcers, and others that cannot be healed in less than three months, are driving the segmental growth. The prevalence of chronic diseases, sports injuries, and increasing expenditure on the development of advanced technologies for treatment are the major growth drivers for this segment. For instance, in February 2023, the EU research project FORCE REPAIR was launched, which aimed at developing smart wound dressing with 3D printable biological scaffolds. This solution can help mitigate inflammation, reduce the risk of undesired infection, and relieve skin tension. Such developments are likely to add to segment growth.

The acute wounds segment is expected to register the fastest CAGR from 2024 to 2030. The increasing number of surgeries, such as cosmetic surgeries, is expected to foster the growth of this segment over the forecast period. For instance, according to the International Society of Aesthetic Plastic Surgery, a total of 130,372 surgical procedures were performed in the UK in 2022 compared to 77,924 non-surgical procedures. This rising number of surgical procedures is expected to drive the demand for acute care and foster segmental growth over the forecast period.

End-use Insights

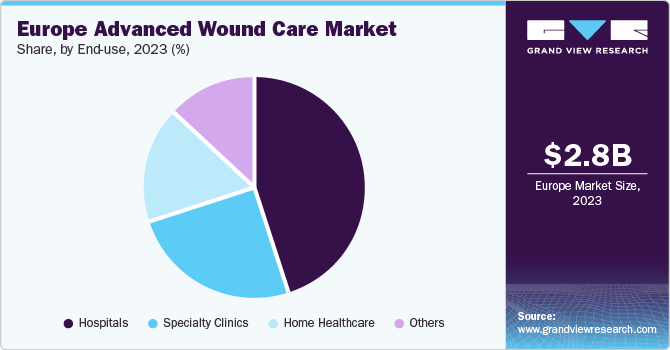

The hospital segment dominated the market in 2023 with the largest revenue share. Hospitals are considered a preferable option for various treatments. In addition, the increasing prevalence of chronic diseases, number of accidents, and thus, increased number of hospital admissions are expected to drive the growth of this segment. According to the data published by the ONISR, approximately 3,728 injury accidents were recorded by police forces in January 2022 in France, which is higher than the previous year (3,508 accidents).

The home healthcare segment is projected to grow at the fastest CAGR from 2024 to 2030. The presence of innovative and easy-to-operate treatment options that can be carried out by patients from the comfort of their homes is expected to drive the growth of this segment. For instance, in January 2022, ACCEL-HEAL, an innovative wearable electrical stimulation device, was launched in France that helps reduce pain and accelerate the healing process in patients. It offers a 12-day therapy that can be carried out by patients from the comfort and convenience of their homes.

Country Insights

Europe registered a significant share of 26.2% in the global advanced wound care market owing to the presence of key players in the region and the launch of technologically advanced products. In addition, increasing efforts by various public and non-profit organizations are also driving the growth of this market. For instance, the European Wound Management Association (EWMA), a non-profit organization, helps create awareness regarding wound management and reduce the misuse of antibiotics in wound care. The presence of such organizations in the region is expected to further drive market growth.

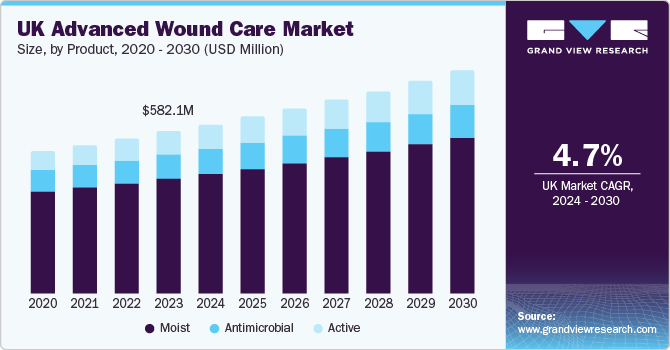

UK Advanced Wound Care Market Trends

The UK dominated the Europe advanced wound care market and accounted for a 21.6% share in 2023. The increasing expenditure on wound management and the presence of a well-established healthcare system in the country are expected to drive its demand in the country. For instance, according to the study published by the National Library of Medicine in December 2020, the management of wounds costs the UK approximately USD 5.7 billion annually.

Germany Advanced Wound Care Market Trends

The growth of the advanced wound care market in Germany is driven by technological advancements in wound care and new product launches. For instance, in June 2023, JeNaCell, an Evonik company, launched the wound dressing epicite balance in Germany. It is designed to assist in the treatment of chronic injuries with low to medium exudation, including venous leg ulcers, diabetic foot ulcers, and others.

Key Europe Advanced Wound Care Company Insights

Some of the key market players include ConvaTec Group PLC, Smith & Nephew PLC, Mölnlycke Health Care AB, B. Braun Melsungen AG, and 3M.

-

Smith+Nephew.is a global medical technology company engaged in the development of solutions to repair, regenerate, and replace soft and hard tissue. The company has an Advanced Wound Care (AWC), Advanced Wound Bioactives (AWB), and Advance Wound Devices (AWD) portfolio designed to manage exudate and infection, protect the skin, prevent pressure injuries, and improve overall patient outcomes.

-

ConvaTec Group PLC is a global medical product and technology company that provides chronic care solutions. The company offers antimicrobial, foam, single-use disposable negative pressure therapy, advanced tissue technologies, and other solutions for the treatment of different types of injuries.

URGO; Medline Industries, Inc.; Coloplast Group; and PAUL HARTMANN AG are some of the other participants in the Europe advanced wound care market.

-

PAUL HARTMANN AG is a Germany-based company engaged in the development and manufacturing of healthcare and medical products. The company is mainly engaged in four areas, including wound management, incontinence management, infection management, and others. The wound management portfolio of the company includes high & super absorbent dressings, silicone foams, advanced wound care dressings, post-surgical dressings, and other solutions.

-

URGO is a global company based in France engaged in the development and manufacturing of innovative wound care solutions. The company offers a range of advanced wound care dressings with support and partnerships with healthcare professionals to improve patient outcomes and accelerate healing.

Key Europe Advanced Wound Care Companies:

- ConvaTec Group PLC

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- B. Braun Melsungen AG

- 3M

- URGO

- Integra LifeSciences

- Medline Industries, Inc.

- Coloplast Group

- PAUL HARTMANN AG

Recent Developments

-

In October 2023, Smith+Nephew announced the opening a new surgical innovation and training center in Munich. The hub is also expected to connect healthcare professionals and research and development teams to facilitate the testing and validation of new technologies.

-

In January 2023, a Swedish-based startup, Amferia, received funding of approximately USD 1.48 million for the launch of its innovative wound care dressing built with hydrogel to fight infections and antibiotic-resistant bacteria.

-

In May 2022, Winner Medical introduced its advanced wound care solutions, such as the transparent film dressing, CMC dressing, bordered silicone foam dressing with SAF, and other products during the EWMA exhibitions.

Europe Advanced Wound Care Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.93 billion |

|

Revenue forecast in 2030 |

USD 3.80 billion |

|

Growth rate |

CAGR of 4.4% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, country |

|

Country scope |

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway |

|

Key companies profiled |

ConvaTec Group PLC; Smith & Nephew PLC; Mölnlycke Health Care AB; B. Braun Melsungen AG; 3M; URGO; Coloplast Corp; Integra LifeSciences; Medline Industries, Inc.; Coloplast Group; PAUL HARTMANN AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Advanced Wound Care Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe advanced wound care market report based on product, application, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Moist

-

Foam Dressings

-

Hydrocolloid Dressing

-

Film Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Other Advanced Dressings

-

-

Antimicrobial

-

Silver

-

Non-silver

-

-

Active

-

Biomaterials

-

Skin-substitute

-

Growth Factors

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The Europe advanced wound care market size was estimated at USD 2.82 billion in 2023 and is expected to reach USD 2.93 billion in 2024.

b. The Europe advanced wound care market is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030 to reach USD 3.8 billion by 2030.

b. In terms of product, the moist segment dominated the market with the largest market share of 70.9% in 2023. This high share is attributable to its ability to maintain a moist environment around the affected areas and facilitate tissue regeneration and a better healing process.

b. Some key players operating in the Europe advanced wound care market include ConvaTec Group PLC; Smith & Nephew PLC; Mölnlycke Health Care AB; B. Braun Melsungen AG; 3M; URGO; Coloplast Corp; Integra LifeSciences; Medline Industries, Inc; Coloplast Group; and PAUL HARTMANN AG.

b. Key factors that are driving the market growth include the increasing prevalence of chronic diseases such as diabetes, the increasing proportion of the geriatric population, and the increasing availability and accessibility to treatment options.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."