- Home

- »

- Plastics, Polymers & Resins

- »

-

Ethylene Vinyl Acetate Copolymer Market Size Report, 2030GVR Report cover

![Ethylene Vinyl Acetate Copolymer Market Size, Share & Trends Report]()

Ethylene Vinyl Acetate Copolymer Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Film, Foam, PV Cells), By End-use (Consumer Goods, Medical & Healthcare), And Segment Forecasts

- Report ID: GVR-4-68038-988-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ethylene Vinyl Acetate Copolymer Market Summary

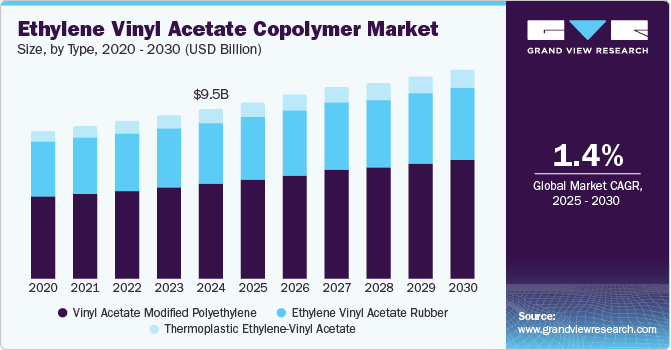

The global ethylene vinyl acetate copolymer market size was valued at USD 9.45 billion in 2024 and is projected to reach USD 10.58 billion by 2030, growing at a CAGR of 1.4% from 2025 to 2030. This growth is attributed to the increasing applications in packaging, footwear, and automotive industries are significant contributors, as ethylene vinyl acetate (EVA) properties enhance product durability and flexibility.

Key Market Trends & Insights

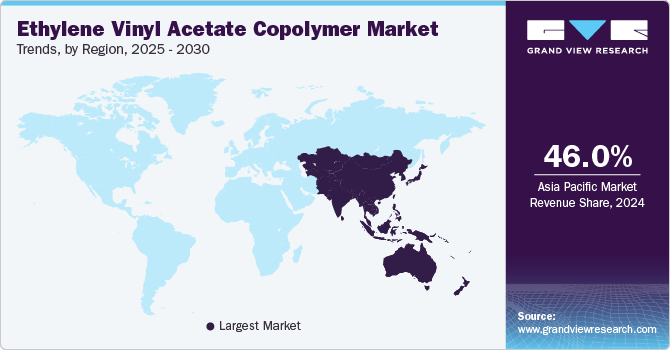

- The Asia Pacific ethylene vinyl acetate copolymer market dominated the global market and accounted for the largest revenue share of 46.0% in 2024.

- North America ethylene vinyl acetate copolymer market is expected to grow significantly over the forecast period.

- Based on type, the vinyl acetate-modified polyethylene led the market and accounted for the largest revenue share of 56.1% in 2024.

- Based on application, the film segment dominated the market and accounted for the largest revenue share of 35.1% in 2024.

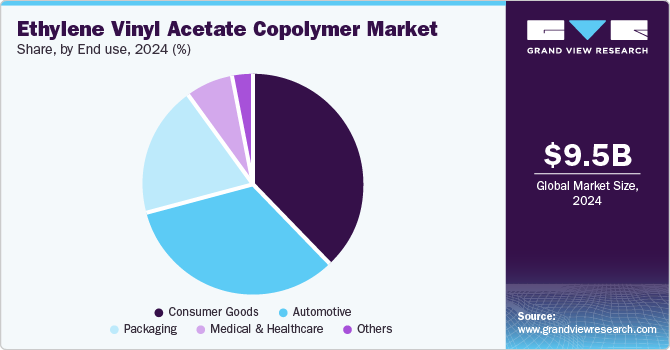

- Based on end use, the consumer goods dominated the market and accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.45 Billion

- 2030 Projected Market Size: USD 10.58 Billion

- CAGR (2025-2030): 1.4%

- Asia Pacific: Largest market in 2024

In addition, the rising demand for sustainable solutions in packaging and construction, alongside the expansion of the renewable energy sector, particularly in solar technology, fuels market growth. Furthermore, regulatory pressures for environmentally friendly materials further support this trend, positioning EVA as a versatile choice across various sectors.

EVA copolymers are produced from a combination of vinyl acetate monomer and ethylene, resulting in an elastomeric polymer renowned for its high coefficient of friction, low seal initiation temperatures, and impressive toughness. The healthcare sector is a primary driver of market growth as the demand for versatile solutions in adhesives, sealants, and coatings rises, particularly in developing economies. In addition, the automotive industry's expansion, with increased production of vehicles utilizing EVA in components like bumpers and molded parts, significantly contributes to market dynamics.

Moreover, technological advancements and a heightened focus on sustainability are shaping the EVA market trends. Its applications in footwear, packaging, and renewable energy solutions underscore its importance as industries seek flexible and durable materials. The photovoltaic sector is witnessing a surge in EVA demand due to its role in encapsulating solar cells, ensuring effective light transmission while protecting against environmental damage. This trend aligns with the growing adoption of solar energy.

Furthermore, manufacturers respond to environmental concerns by developing bio-based alternatives to traditional EVA derived from fossil fuels. These sustainable options utilize renewable resources such as sugarcane or cassava. The healthcare industry is also expanding its use of EVA due to its flexibility and biocompatibility, finding applications in medical devices like drug delivery systems and blood bags. In packaging, EVA's superior barrier properties enhance the shelf life of food and pharmaceuticals, further driving its adoption across various sectors. The rising demand across multiple industries and a shift towards sustainable practices positions the EVA market for continued growth.

Type Insights

The vinyl acetate-modified polyethylene led the market and accounted for the largest revenue share of 56.1% in 2024. This growth is attributed to its advantageous properties, such as low molecular weight and excellent barrier capabilities. These characteristics make VAMPE particularly suitable for packaging applications in consumer goods, food, and beverages. In addition, its versatility allows it to be used in various products, including foam blister packs, insulation foams, and tapes. Furthermore, as industries increasingly prioritize effective moisture and gas barriers, demand for VAMPE continues to rise, significantly contributing to market expansion.

Thermoplastic ethylene-vinyl acetate is expected to grow at a CAGR of 1.4% over the forecast period, owing to its unique combination of flexibility, durability, and ease of processing. This segment is particularly favored in applications requiring lightweight materials, such as automotive components and packaging solutions. In addition, the increasing demand for sustainable and efficient materials across diverse industries further enhances TEVA's appeal. Furthermore, its application in solar energy solutions, which is an encapsulant for photovoltaic modules, also boosts its market presence. As renewable energy initiatives expand globally, the demand for TEVA is expected to accelerate, driving significant growth in this segment.

Application Insights

Film applications segment dominated the market and accounted for the largest revenue share of 35.1% in 2024 attributed to its versatile properties, such as high transparency, flexibility, and excellent barrier characteristics. These attributes make EVA films ideal for various applications, including packaging, agriculture, and construction. In addition, the increasing demand for sustainable and eco-friendly packaging solutions has further propelled market growth. Furthermore, as industries focus on reducing their carbon footprint, EVA films are increasingly favored for their ability to provide effective moisture and gas barriers while complying with food safety regulations, enhancing their appeal across multiple sectors.

The photovoltaic cells application segment is expected to grow at a CAGR of 1.9% over the forecast period. This growth is primarily fueled by the rapid expansion of the solar energy sector. EVA is a crucial encapsulant in photovoltaic panels, protecting solar cells from environmental damage while ensuring optimal light transmission. In addition, the growing global emphasis on renewable energy sources and government incentives for solar installations drive this trend. Furthermore, as more residential and commercial projects incorporate solar technology, the need for high-quality EVA films will continue to rise, solidifying their importance in enhancing the efficiency and longevity of solar panels.

End Use Insights

Consumer goods dominated the market and accounted for the largest revenue share in 2024, owing to its excellent properties, such as flexibility, durability, and adhesion. These attributes make EVA ideal for various applications, including packaging for food and beverages, which require effective moisture and gas barriers. In addition, the rising consumer preference for sustainable and eco-friendly materials pushes manufacturers to adopt EVA in their products. Furthermore, as e-commerce continues to expand, the demand for reliable packaging solutions further propels the growth of EVA in consumer goods.

Packaging is expected to grow at a CAGR of 1.5% over the forecast period attributed to versatility and performance characteristics. EVA's exceptional barrier properties, transparency, and flexibility make it a preferred choice for various packaging applications. In addition, the increasing focus on sustainable packaging solutions is also a key driver, as companies seek materials that minimize environmental impact while maintaining product integrity. Furthermore, as global consumption patterns shift towards more packaged goods, particularly in food and healthcare, the need for effective and reliable packaging solutions using EVA continues to grow, enhancing its market presence.

Regional Insights

North America ethylene vinyl acetate copolymer market is expected to grow significantly over the forecast period, driven by strong footwear, packaging, and automotive demand. In addition, the presence of key manufacturers and ongoing technological advancements enhance market dynamics. Furthermore, there is a growing emphasis on sustainability and innovation in applications such as solar energy and medical devices, further propelling the demand for EVA products. This combination of factors positions North America as a crucial region for EVA growth.

The ethylene vinyl acetate copolymer market in Canada is expected to witness substantial growth supported by increasing investments in renewable energy and sustainable packaging solutions. In addition, the rising demand for EVA across various applications, including medical devices and consumer goods packaging, reflects industries' efforts to adopt eco-friendly materials that comply with regulatory standards. Furthermore, as Canadian companies prioritize sustainability and innovation in their product offerings, the EVA market is expected to experience significant expansion, aligning with global trends toward environmentally responsible practices.

Asia Pacific Ethylene Vinyl Acetate Copolymer Market Trends

The Asia Pacific ethylene vinyl acetate copolymer market dominated the global market and accounted for the largest revenue share of 46.0% in 2024 attributed to rapid industrialization and a booming manufacturing sector, particularly in countries such as China and India. In addition, the increasing demand for EVA in diverse applications such as footwear, packaging, and automotive components is a key factor. Furthermore, the region's focus on renewable energy projects, especially solar energy, enhances EVA's role as an encapsulant for photovoltaic cells, solidifying its market presence and driving further expansion.

The ethylene vinyl acetate copolymer market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024 attributed to rapid industrialization and a strong chemical sector. The country's expanding manufacturing capabilities contribute to the high demand for EVA products across various applications, including packaging and automotive components. Furthermore, government initiatives promoting renewable energy bolster the demand for EVA in solar applications, enhancing its market dynamics.

Southeast Asia Ethylene Vinyl Acetate Copolymer Market Trends

The Southeast Asia ethylene vinyl acetate copolymer market is expected to grow at a CAGR of 2.4% over the forecast period, owing to the expansion of consumer goods and packaging industries. In addition, economic development and increased foreign investments propel the need for durable and flexible materials. Furthermore, as e-commerce continues to rise in the region, the demand for effective packaging solutions utilizing EVA is also increasing. This trend contributes significantly to market growth, positioning Southeast Asia as a vital player in the global EVA landscape.

Europe Ethylene Vinyl Acetate Copolymer Market Trends

The Europe ethylene vinyl acetate copolymer market had a significant revenue share in 2024 attributed to stringent regulations promoting sustainable materials and an increased focus on recycling initiatives. In addition, the automotive sector's shift towards lightweight materials significantly boosts EVA demand. Furthermore, the growing healthcare sector also requires high-performance EVA for medical applications, contributing to overall market growth. As European industries adapt to environmental challenges while seeking innovative solutions, EVA's versatility positions it as a key material across various regional sectors.

Key Ethylene Vinyl Acetate Copolymer Company Insights

Some of the key companies in the market include Exxon Mobil Corp., Dow Inc., LyondellBasell Industries Holdings B.V., and others. These companies adopted various strategies, including new product launches, focused on sustainable and innovative solutions, such as eco-friendly EVA formulations for packaging and solar applications to enhance the competitive viability. In addition, strategic collaborations with end-user industries aim to expand market reach and leverage technological advancements. Furthermore, mergers and acquisitions are being pursued to consolidate market share and enhance production capabilities, while investments in research and development ensure continuous improvement and adaptation to evolving consumer demands.

Exxon Mobil Corporation manufactures a wide range of chemical products, including EVA resins, which are utilized in various applications such as packaging, automotive components, and consumer goods. The company operates in multiple segments, including upstream exploration and production, downstream refining and marketing, and chemical manufacturing, positioning itself as a key player in producing high-performance materials like EVA.

Eastman Chemical Company produces EVA resins that are widely used in applications such as adhesives, films, foams, and medical packaging. The company operates in several segments, including Additives & Functional Products, Advanced Materials, and Chemical Intermediates. Their focus on innovation and sustainability drives the development of advanced EVA formulations tailored for diverse industries, reinforcing their position in the global EVA market.

Key Ethylene Vinyl Acetate Copolymer Companies:

The following are the leading companies in the ethylene vinyl acetate copolymer market. These companies collectively hold the largest market share and dictate industry trends.

- Exxon Mobil Corp.

- Dow Inc.

- LyondellBasell Industries Holdings B.V.

- Eastman Chemical Company

- Arkema

- Borealis AG

- Celanese Corp.

- INEOS

- Total

- LG Chem

- Braskem

- Dairen Chemical Corp.

- Lotte Chemical Corp.

Recent Developments

-

In May 2024, INEOS successfully acquired LyondellBasell’s Ethylene Oxide and Derivatives (EO&D) business, including production facilities in Bayport, Texas. This strategic move enhances INEOS's presence in the largest global market, the U.S. market, and complements its existing operations in Louisiana. The Bayport facility produces high-purity ethylene oxide, crucial for manufacturing ethylene vinyl acetate copolymer (EVA) and other derivatives, supporting various applications in the packaging and automotive sectors. This acquisition positions INEOS for growth in the evolving chemical landscape.

Ethylene Vinyl Acetate Copolymer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.84 billion

Revenue forecast in 2030

USD 10.58 billion

Growth rate

CAGR of 1.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Southeast Asia, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, India, China, South Korea, Australia, Brazil, Argentina, Kuwait, Saudi Arabia, South Africa, UAE

Key companies profiled

Exxon Mobil Corp.; Dow Inc.; LyondellBasell Industries Holdings B.V.; Eastman Chemical Company; Arkema; Borealis AG; Celanese Corp.; INEOS; Total; LG Chem; Braskem; Dairen Chemical Corp.; Lotte Chemical Corp.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

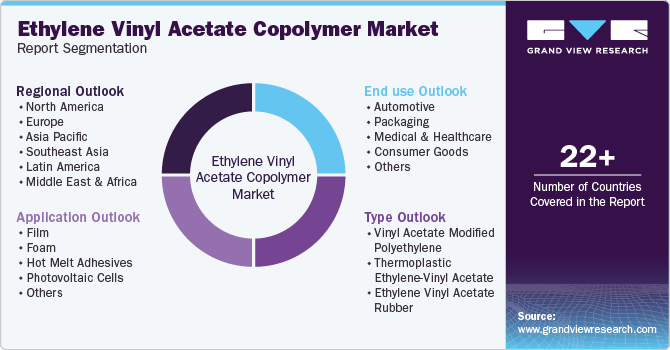

Global Ethylene Vinyl Acetate Copolymer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global ethylene vinyl acetate copolymer market report based on type, application, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Vinyl Acetate Modified Polyethylene

-

Thermoplastic Ethylene-Vinyl Acetate

-

Ethylene Vinyl Acetate Rubber

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Film

-

Foam

-

Hot Melt Adhesives

-

Photovoltaic Cells

-

Others

-

-

End use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Packaging

-

Medical & Healthcare

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

India

-

Japan

-

China

-

South Korea

-

-

Southeast Asia

-

Malaysia

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Kuwait

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.