- Home

- »

- Petrochemicals

- »

-

Ethylene Glycols Market Size, Share & Growth Report, 2030GVR Report cover

![Ethylene Glycols Market Size, Share & Trends Report]()

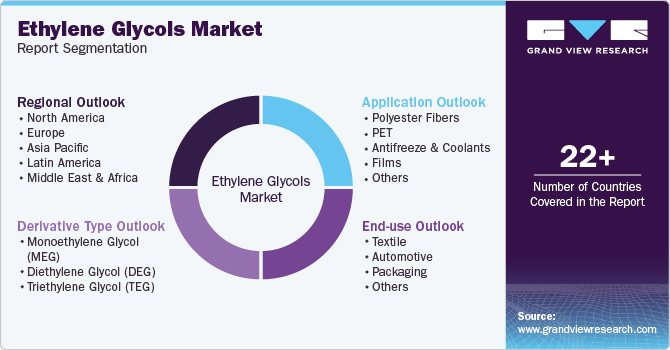

Ethylene Glycols Market (2024 - 2030) Size, Share & Trends Analysis Report By Derivative (MEG, DEG, TEG), By Application (Polyester Fibers, PET, Antifreeze & Coolants), By End Use (Automotive, Textile), By Region, And Segment Forecasts

- Report ID: 978-1-68038-049-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ethylene Glycols Market Summary

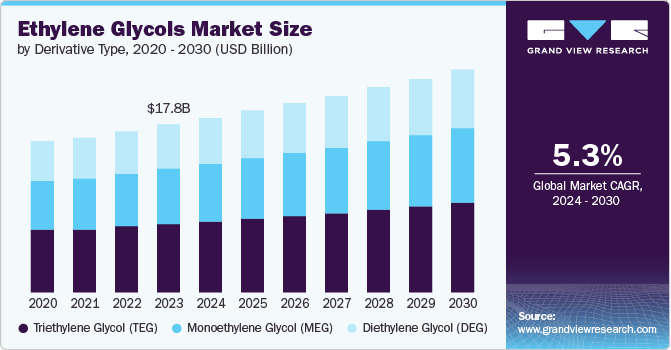

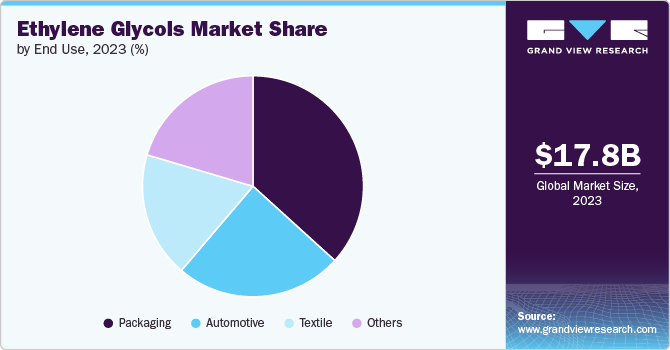

The global ethylene glycols market size was valued at USD 17.76 billion in 2023 and is projected to reach USD 23.56 billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030. Market growth worldwide can be attributed to the rising demand from the textile and automotive industries, increasing PET resin production, technological advancements, renewable energy initiatives, and the utilization effect. Furthermore, innovation has led to improved market productivity and product quality, fostering connections with end-user industries where ethylene glycol serves as a key feedstock material, driving market growth.p>

Key Market Trends & Insights

- North America ethylene glycols market dominated the global ethylene glycols market with a revenue share of 40.5% in 2023.

- The ethylene glycols market in the U.S. dominated the North America ethylene glycols market with a revenue share of 41.0% in 2023.

- By derivative type, triethylene glycol (TEG) derivative segment dominated the market with a revenue share of 41.0% in 2023.

- By application, PET application segment dominated the ethylene glycols market with a revenue share of 44.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 17.76 Billion

- 2030 Projected Market Size: USD 23.56 Billion

- CAGR (2024-2030): 5.3%

- North America: Largest market in 2023

Industry growth is primarily driven by the surge in demand for PET packaging, which is attributed to the advantageous properties of polyethylene terephthalate (PET) such as clarity, strength, and recyclability. Moreover, the increasing demand for polyester fibers in textile and industrial applications is expected to boost the demand for ethylene glycol. The textile industry, in particular, is a significant driver of growth, as ethylene glycol is used to manufacture polyester fibers for apparel, home textiles, and industrial textiles.

The automotive industry is another key driver of growth, as the increasing production and sales of passenger cars, particularly in developing regions such as Asia Pacific, enhance the demand for ethylene glycol in automotive applications such as coolants and antifreeze. Furthermore, the growth of ethylene glycol-based coolant and antifreeze products is driven by the growth of the automotive industry, as well as the push for HVAC products in commercial and industrial buildings. The transmission of ethylene glycol in wind turbines and solar panels due to elevated renewable energy plans is also responsible for market expansion.

The market is also driven by advancements in production technology, which have improved efficiency and reduced manufacturing costs. The increasing adoption of bio-based ethylene glycol, which is more sustainable to nature, is another key factor driving growth. Companies are investing in partnerships and advanced technology to meet customer needs, which has resulted in new product development and enhanced production techniques. Overall, the Ethylene Glycols Market is driven by a combination of factors, including growing demand from various industries, technological advancements, and the increasing focus on sustainability.

Derivative Type Insights

The Triethylene Glycol (TEG) derivative segment dominated the market with a revenue share of 41.0% in 2023. TEG has emerged as a dominant player in various industries, including plastics, chemical production, and natural gas processing, due to its unique properties. Its low volatility, high boiling point, and moisturizing regulating properties make it an ideal choice for specific applications such as natural gas dehydration and hygroscopic processes.

The Monoethylene Glycol (MEG) derivative segment is expected to register the fastest CAGR of 4.5% in the forecast period. MEG is a versatile and highly sought-after chemical with a wide range of applications. Its use spans industries such as polyester fibers, antifreeze, and packaging materials. Notably, MEG is recognized for its environmental safety, being non-toxic, non-flammable, biodegradable, and free from hazardous emissions. This makes it an attractive choice for companies prioritizing sustainability and environmental responsibility.

Application Insights

The PET application segment dominated the ethylene glycols market with a revenue share of 44.1% in 2023. Polyethylene Terephthalate (PET) is a highly sought-after material in various industries, including packaging, textiles, and automotive. Its popularity stems from its durability, excellent moisture resistance, and high chemical resistance. PET fibers are widely used in the textile industry for clothing materials, driving demand for ethylene glycol. Its versatility and benefits make it an attractive choice for companies seeking reliable and high-quality materials.

Polyester Fibers are expected to register the fastest CAGR of 4.1% in the forecast period. Polyester fibers, derived from PET, boast numerous desirable characteristics, including high strength, durability, and resistance to stretching and shrinkage. These benefits make them an attractive choice for various applications. In addition, polyester fibers are generally cheaper than natural fibers, such as cotton or wool, which enhances their value proposition. This affordability and accessibility make them a popular choice among textile manufacturers.

End Use Insights

The packaging segment dominated the ethylene glycols market with a revenue share of 35.7% in 2023. The consumer goods industry has experienced significant growth, driven by changes in consumer lifestyles. As a result, there is a growing demand for PET packaging solutions. Ethylene glycol is a key component in the production of PET resins, which are used in packaging applications such as bottles, containers, and films. Its flexibility and suitability for packaging purposes make it an attractive choice. Furthermore, the trend towards eco-friendly packaging solutions is driving consistent demand for ethylene glycol.

The automotive segment is expected to register a significant growth of 4.2% over the forecast period. Market growth is significantly driven by factors the increased demand for antifreeze in the automotive sector, driven by the global sales of automobiles and regular consumption from aftermarket and OEM industries. Ethylene glycol is a key component in the production of high-quality antifreeze liquids, which are used to prevent engine coolants from freezing in cold climates and maintain engine temperature.

Regional Insights

North America ethylene glycols market dominated the global ethylene glycols market with a revenue share of 40.5% in 2023. The region is dominated by key players such as Dow Chemicals, Exxon Mobil Corp, and LyondellBasell Industries, who have a strong presence and extensive experience. The region’s demand for ethylene glycol is driven by the growth of end-use industries including textiles, automotive, and packaging, with a vibrant market outlook.

U.S. Ethylene Glycols Market Trends

The ethylene glycols market in the U.S. dominated the North America ethylene glycols market with a revenue share of 41.0% in 2023. The manufacturing and use of ethylene glycol have seen significant advancements in production technology, especially in the U.S. The country has embraced a culture of learning and innovation through research, leading to the development of modern technologies that advance production and product quality. Moreover, the country’s large industrial infrastructure, especially in plastics, textile, and automobile industries, drives the use of ethylene glycol.

Europe Ethylene Glycols Market Trends

Europe ethylene glycols market was identified as a lucrative region in the global ethylene glycols market in 2023. European companies, strategically located near international markets, have established a broader export footprint, leveraging strong trade connections with key regions. The region’s well-developed automotive, textile, and chemical industries drive demand for ethylene glycol products, allowing European companies to capture a significant market share.

The ethylene glycols market in Germany held a substantial market share in 2023. Germany’s thriving automobile industry, renowned for its high-quality products and sophisticated engineering, drives demand for ethylene glycol in applications such as coolants and heat transfer fluids. This focus on automotive excellence contributes to Germany’s market growth. Moreover, according to the World Bank, the country imports ethylene glycol from various countries, including Belgium, the Netherlands, China, and the UK, further solidifying its position in the market.

Asia Pacific Ethylene Glycols Market Trends

Asia Pacific ethylene glycols market is expected to register the fastest CAGR of 4.5% in the global ethylene glycols market over the forecast period. The Asia Pacific region is characterized by rapid industrialization and urbanization, driving demand for ethylene glycol in various forms. Industries such as automotive, textiles, and others utilize ethylene glycol, fueling industrial growth and demand. In addition, increased disposable income in many countries leads to increased consumption of commodities incorporating ethylene glycol, including fashion apparel, automotive, and antifreeze solutions.

The ethylene glycol market in China is expected to grow rapidly in the coming years. China is a major manufacturing hub, particularly in textiles and automobiles. Its industrial production requires a large amount of ethylene glycol for making polyester fibers and PET resins.

Key Ethylene Glycols Company Insights

Some key companies in the ethylene glycols market include Exxon Mobil Corporation; Dow Inc.; SABIC; China Petrochemical Corporation; Shell Chemicals; and Reliance Industries Limited; among others. Market leaders are driving growth through strategic initiatives, including joint ventures, mergers, capacity expansions, collaborations, new product launches, and alliances, to enhance their market presence and competitiveness.

-

Exxon Mobil Corporation is a multinational oil and gasoline business enterprise. Exxon Mobil is involved in diverse elements of exploration, production, refining, and distribution of oil and natural gas. Exxon Mobil produces ethylene glycols through its chemical production centers globally. The company’s superior technologies and operational expertise allow it to provide exquisite ethylene glycols efficiently and sustainably.

-

Dow Inc. is a leading international chemical organization with a strong focus on generating high-quality ethylene glycols for various industrial applications. The organization’s dedication to sustainability, research, and development underscores its dedication to presenting innovative solutions at the same time as minimizing environmental impact.

Key Ethylene Glycols Companies:

The following are the leading companies in the ethylene glycols market. These companies collectively hold the largest market share and dictate industry trends.

- Exxon Mobil Corporation

- Dow Inc.

- SABIC

- China Petrochemical Corporation

- Shell Chemicals

- Reliance Industries Limited

- Huntsman International LLC

- LOTTE Chemical CORPORATION

- KUWAIT PETROLEUM CORPORATION

- LyondellBasell Industries Holdings B.V.

Recent Developments

-

In March 2024, Dow Inc. announced its investment plan to expand ethylene derivatives capacity in the U.S., including carbonate solvents, a key raw material for lithium-ion batteries. The company successfully completed capacity expansions in the U.S. Gulf Coast and Europe, which went online in the past two years.

-

In January 2024, SABIC made the final investment decision for the SABIC Fujian Petrochemical Complex in China, which is a mixed-feed steam cracker expected to produce up to 1.8 million tons of ethylene annually. The complex was under construction and aimed to be completed by 2026.

Ethylene Glycols Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.49 billion

Revenue forecast in 2030

USD 23.56 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Derivative type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, South Africa, and Saudi Arabia

Key companies profiled

Exxon Mobil Corporation; Dow Inc.; SABIC; China Petrochemical Corporation; Shell Chemicals; Reliance Industries Limited; Huntsman International LLC; LOTTE Chemical CORPORATION; KUWAIT PETROLEUM CORPORATION; LyondellBasell Industries Holdings B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ethylene Glycols Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ethylene glycols market report based on derivative type, application, end use, and region.

-

Derivative Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Monoethylene Glycol (MEG)

-

Diethylene Glycol (DEG)

-

Triethylene Glycol (TEG)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyester Fibers

-

PET

-

Antifreeze and Coolants

-

Films

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Textile

-

Automotive

-

Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.