- Home

- »

- Organic Chemicals

- »

-

Ethyl Acetate Market Size, Share & Growth Report, 2030GVR Report cover

![Ethyl Acetate Market Size, Share & Trends Report]()

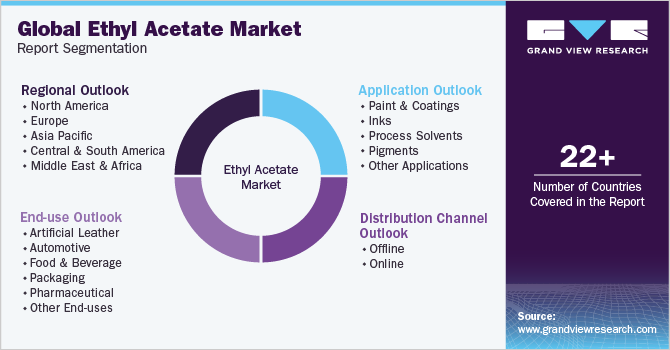

Ethyl Acetate Market Size, Share & Trends Analysis Report By Application (Paint & Coatings, Inks), By End-use (Artificial Leather, Automotive), By Distribution Channel (Online, Offline), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-566-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Report Overview

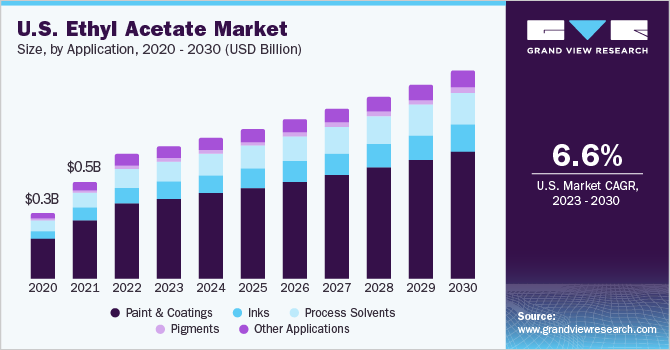

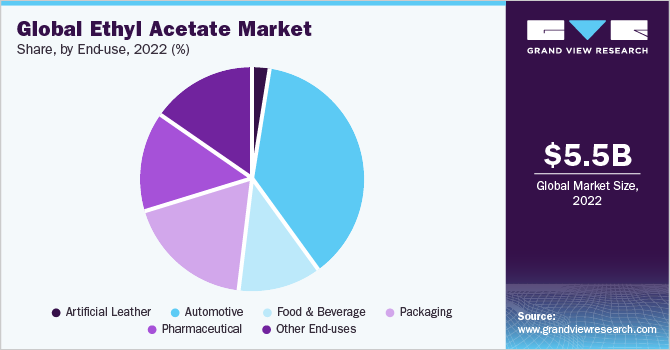

The global ethyl acetate market size was estimated at USD 5.48 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The growth of the market is attributed to the flourishing food & beverage and automotive industry along with the growing preference for flexible packaging solutions across the globe. In the packaging industry, flexible packaging solutions are witnessing the highest demand owing to their several benefits including low cost & weight, increased flexibility, easy recyclability, and improved shelf life.

Ethyl acetate solvents find application in car care products within the automotive sector. In addition, they are employed in chromatographic separation processes in the pharmaceutical industry. Furthermore, these solvents enhance the flavor of food and beverage products. The increasing demand for environmentally friendly and convenient packaging solutions is driving the demand for flexible packaging. This is expected to have a positive impact on the demand for solvent-based printing inks, which, in turn, is expected to fuel the product demand over the forecast period.

Solvents play a vital role in the production of synthetic leather. Given that volatile organic compounds (VOCs) are utilized in the footwear and leather manufacturing sectors, ethyl acetate is projected to have widespread usage in synthetic leather production methods. The stringent enforcement of governmental regulations on natural leather production, coupled with the rising demand for cruelty-free leather accessories like belts and apparel, is likely to fuel the market growth over the forecast period.

Application Insight

The paints & coatings application segment dominated the market with a revenue share of 59.3% in 2022. This is attributed to its advantages, such as quick drying, viscosity control, low VOC content, and enhanced adhesion. Ethyl acetate acts as a solvent, effectively dissolving and dispersing key components like pigments, resins, and additives in paint and coating formulations. Also, it helps control the viscosity of the formulation, ensuring optimal consistency for smooth application and uniform coverage on surfaces.

The product is compatible with various resins, binders, and additives used in different types of paints and coatings, making it suitable for a wide range of applications. Its presence can enhance the stability and shelf life of paint and coating formulations, minimizing issues like settling or separation over time.Process solvents was the second-largest application segment and is predicted to grow at a CAGR of 6.9% during the forecast period. Ethyl acetate is commonly employed for solvent extraction and separation processes in industries like pharmaceuticals and chemicals. It helps extract desired compounds from raw materials and facilitates the separation of different components. In the pharmaceutical industry, ethyl acetate serves as a process solvent for various stages of drug synthesis and purification. It aids in the isolation and purification of active pharmaceutical ingredients (APIs) and contributes to the preparation of pharmaceutical intermediates.

Distribution Channel Insight

The offline distribution channel segment dominated the market with a revenue share of 78.0% in 2022 as it enables manufacturers to establish direct relationships with the end-users, thereby enabling a close understanding of the client's specific needs and ensuring timely supply. Direct sales often allow for customized solutions, where the manufacturer tailors the product's specifications to meet the exact requirements of the end-users.

The online distribution channel segment is predicted to grow atthe fastest CAGR of 7.0% over the forecast period as it enables sellers to reach a wider customer base beyond their local or regional markets, potentially increasing sales opportunities. Online platforms provide efficient communication channels, allowing buyers to inquire about products, pricing, and delivery details in real time.

End-use Insight

The automotive segment dominated the market with a revenue share of 37.2% in 2022. The growth is attributed to the growing sales of passenger vehicles along with the increasing adoption of electric vehicles (EVs) globally. The product is used in the auto refinishing process that involves repairing and refurbishing automobiles & other transportation vehicles. It is also used as an auto thinner, as it is a common ingredient found in varnishes, lacquers, and thinners that coat surfaces. Packaging was the second-largest segment and is expected to grow at a CAGR of 6.7% over the forecast period. Ethyl acetate is utilized in the production of flexible packaging materials, such as plastic films and pouches.

Its ability to dissolve and disperse polymer resins contributes to the formulation of effective coating solutions that enhance packaging durability and barrier properties. The product also serves as a solvent in solvent-based printing inks used for packaging materials. It aids in achieving vibrant and durable printed designs on surfaces like paper, cardboard, and plastic. The food & beverage segment is expected to grow at a significant CAGR over the forecast period. Ethyl acetate serves as a flavor enhancer in the food and beverage industry. It imparts fruity and pleasant notes to a range of products, including confectioneries, baked goods, candies, chewing gum, and beverages like coffee and tea. In addition, it is used to extract natural aromas and flavors from botanical sources, such as fruits, herbs, and spices. These extracts are then incorporated into food and beverage formulations to enhance sensory experiences.

Regional Insights

Asia Pacific emerged as the dominating region with a revenue share of 48.0% in 2022. The region is among one of the largest producers and consumers of ethyl acetate led by China, India, and Japan. Asia Pacific is considered to be one of the fastest-growing regions in the world in terms of economic progress, industrialization, and growth of major end-use sectors. China and India are the major countries contributing to the growth of the regional market. Europe was the second-largest region and is expected to grow at the highest CAGR of 7.4% over the forecast period. The region has the presence of major industrial economies including Germany, France, and the UK that have a continuously growing number of suppliers and manufacturers of food products and beverages, automobiles, chemical products, and packaging solutions.

The presence of several major automobile manufacturing units in the region is expected to drive product demand in the coming years. High demand for paints & coatings in furniture, automotive, and other industries in various countries including Saudi Arabia, Kuwait, and UAE is predicted to fuel the product demand. In addition, the food & beverages sector in the Middle East region has been developing with several growth opportunities for international investors. Reliance on food trade, changing consumer preferences & lifestyles, and strategic geographic position are expected to fuel the growth of the food & beverages industry in the region.

Key Companies & Market Share Insights

The key players are engaged in continuous innovations to increase the consumer base, along with the development of cost-effective products. These companies are also involved in adopting several strategic initiatives, such as mergers & acquisitions and new product launches, to gain a competitive edge. For instance, in February 2023, Celanese Corp. introduced a range of enhanced sustainable options for several acetyl chain materials, incorporating mass balance bio-content. These new alternatives, labeled as ECO-B, align with the innovative bio-based solutions previously introduced to cater to engineered materials customers.Some of the prominent players in the global ethyl acetate market include:

-

Celanese Corporation

-

Daicel Corporation

-

Eastman Chemical Company

-

INEOS

-

IOL

-

Jiangsu SOPO (Group) Co., Ltd.

-

Jubilant Pharmova Limited

-

KAI CO. LTD.

-

Linde PLC

-

Sasol Limited

-

SHOWA DENKO KK

-

Sipchem

-

Solvay

-

Yip's Chemical Holdings Limited

Ethyl Acetate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.84 billion

Revenue forecast in 2030

USD 9.29 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; Sweden; Norway; China; India; Japan; South Korea; Australia; Singapore; Malaysia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; Kuwait

Key companies profiled

Celanese Corp.; INEOS; Eastman Chemical Company; Solvay; Sasol Ltd.; SHOWA DENKO KK; IOL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ethyl Acetate Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the ethyl acetate market report on the basis of application, end-use, distribution channel, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paint & Coatings

-

Inks

-

Process Solvents

-

Pigments

-

Other Applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Artificial Leather

-

Automotive

-

Food & Beverage

-

Packaging

-

Pharmaceutical

-

Other End-uses

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

Malaysia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ethyl acetate market size was valued at USD 5.48billion in 2022 and is expected to reach USD 5.84 billion in 2023.

b. The global ethyl acetate market is forecast to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030 to reach USD 9.29 billion by 2030.

b. Asia Pacific accounted for the highest revenue share of 48.0% in 2022. This is attributed to the rising urbanization and research & development for creation of technologically advanced products at an affordable rate.

b. Some prominent players in the ethyl acetate market include Solvay, Eastman Chemical Company, Sasol Limited, and INEOS

b. Growing investments in the construction, pharmaceuticals, and automotive sector are likely to drive the ethyl acetate market growth. There has also been a significant rise in the production of sustainable packaging products such as flexible packaging due to increasing environmental concerns, which is anticipated to propel the demand for solvent-based printing inks in the packaging industry over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."