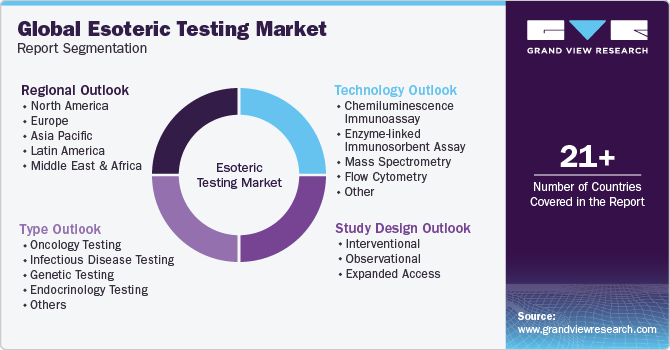

Esoteric Testing Market Size, Share & Trends Analysis Report By Type (Oncology Testing, Infectious Disease Testing), By Technology (Chemiluminescence Immunoassay), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-272-6

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Esoteric Testing Market Size & Trends

The global esoteric testing market size was estimated at USD 22.06 billion in 2023 and is projected to grow at a CAGR of 11.81% from 2024 to 2030. The market growth is attributed to the increasing demand for early disease diagnosis, and rising prevalence of cancer aided by high demand for safer diagnostic options. According to the National Center for Biotechnology Information (NCBI), it is projected that around 1.95 million cancer cases will be diagnosed, and 609,820 cancer deaths are expected to occur in the U.S in 2023. Lucrative growth potential in currently available esoteric testing options and high demand for technologically advanced and affordable tests are the factors expected to drive the market growth in coming years. Moreover, incorporating advanced esoteric testing technologies in independent and reference laboratories is anticipated to drive market expansion.

Esoteric tests play a crucial role in identifying particular genetic markers and biomarkers to develop personalized treatment plans. For instance, in February 2023, F. Hoffmann-La Roche Ltd announced extending its collaboration with Janssen to advance personalized healthcare by focusing on companion diagnostics. Thus, a rising preference for personalized medicine treatment worldwide is anticipated to boost product demand in the coming years.

The growing preference among surgeons and patients for esoteric tests, due to technological advancements such as real-time polymerase chain reaction, next-generation sequencing, and others, is anticipated to be a key driver for the rising demand for advanced diagnosis. Examples of esoteric diagnostics are genetic testing for uncommon illnesses, specialized tests for unusual infections, and advanced biomarker assays. In contrast to standard blood or urine testing, esoteric diagnostics are usually outsourced to reference labs equipped with the necessary equipment and personnel. These tests can be very helpful in specific therapeutic settings or scientific investigations owing to their high specificity and effectiveness, even though there is usually less demand due to high cost.

The growing trend toward personalized treatment has led to a significant increase in the need for esoteric tests. To identify targeted therapies specific to each patient, these specialized tests examine each patient's genetic composition, protein profiles, and biomarkers. Targeted and customized testing strategies are becoming increasingly necessary as personalized medicine and precision diagnostics become widespread due to increased awareness. An increase in initiatives undertaken by the government to provide various facilities, such as reimbursement for diagnostic tests, is another major factor anticipated to drive the market. Many healthcare institutions are working with laboratories to integrate different esoteric tests.

Moreover, over the last few years, esoteric testing procedures have become more and more covered by policies offered by government and private insurance providers. Hence, supportive reimbursement and regulatory policies also act as key drivers of market growth. This is attributed to Medicare and Medicaid's increased reimbursement for various esoteric tests. Additionally, private insurers are collaborating with esoteric labs to offer patients affordable tests, which lower patients' out-of-pocket costs and increase access to esoteric tests, thereby driving market growth.

Market Concentration & Characteristics

The global esoteric testing industry is characterized by a high degree of innovation, with new technologies and methods being developed and introduced regularly. It has become a popular option as an esoteric test that provides safe and accurate results. As a result, market players are investing in innovative technologies and procedures to keep up with the demand.

The market is also characterized by the leading players' moderate merger and acquisition (M&A) activity. Several market players, such as Laboratory Corporation of America Holdings, OPKO Health, Inc., Quest Diagnostics Inc., and Sonic Healthcare Limited, are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

The esoteric testing market is also subject to increasing regulatory scrutiny. Companies invest substantial resources in clinical trials and submissions to obtain regulatory approval for pipeline products. This may result in increasing the cost of developing novel esoteric testing technologies. As a result, governments worldwide are developing regulations to govern the development and control cost of testing. These regulations could have a significant impact on the market, affecting the development and adoption of products.

The field of esoteric testing, which deals with diagnostics for various diseases, including cancer, is still relatively new and constantly evolving. As a result, plenty of alternative products are available to meet patients' diverse testing needs. With such a wide range of substitutes, patients can be assured that their specific requirements will be met and receive the most accurate and effective diagnosis.

The end-user concentration factor is crucial for any company operating in the esoteric testing space. By understanding the unique demands of each industry and tailoring their testing solutions accordingly, businesses can position themselves for success in this dynamic and ever-evolving market.

Type Insights

Based on type, the oncology segment led the market and accounted for 28.03% of the global revenue in 2023. The dominance can be attributed to the rising incidence of cancer and the high demand for esoteric tests for diagnosis. In December 2022, a research paper published by the Indian Council of Medical Research estimated that the number of cancer cases in India is expected to rise from 14.6 lakh in 2022 to 15.7 lakh in 2025. Thus, increasing prevalence is expected to boost the adoption rate of esoteric testing in cancer patients, thereby driving segment growth.Furthermore, growing awareness about the need for early diagnosis of cancer is expected to impel demand for cancer related esoteric tests. Several programs and initiatives are being undertaken by private and public organizations for cancer treatment as well as increasing life expectancy.

The genetic testing segment is expected to register the fastest CAGR of 12.18% over the forecast period. The growth of the segment is attributed to improvements in genomic methods, rising awareness of personalized medicine, and a rising demand for genetic tests aided with rising awareness for early diagnosis among population. As per the NCBI statistics for 2023, there were around 76,326 current genetic tests on genetic testing registry (GTR), where 76,083 were used for clinical and 243 for research purposes in 2022. Thus, rising genetic testing volume is projected to propel segment growth during the forecast period. Moreover, the rising prevalence of genetic disorders and the rising need for screening is further anticipated to fuel market growth. For instance, newborn screening programs in the U.S. screen children for over 60 disorders, according to the American Association for Clinical Chemistry. Such initiatives further propels the demand for effective diagnostics.

Technology Insights

Chemiluminescence immunoassay dominated the market with the largest revenue share in 2023. This dominance of the segment is attributed to the high adaptability of the tests in detecting hormones, proteins, antibodies, and nucleic acids. Furthermore, it supports multiplexing, which permits the simultaneous measurement of multiple analytes. In addition, the segment's growth is further driven by key advantages related to chemiluminescence immunoassays, like high reagent stability and conjugate stability, full compatibility with immunology assay protocols, quick analytical signal acquisition, and reduced incubation time. Therefore, all of the aforementioned factors contribute to this segment's growth.

Enzyme-linked immunosorbent assay (ELISA) is expected to register the fastest CAGR during the forecast period. ELISA-based assays enables the detection and measurement of particular proteins and antibodies in a sample, making it a commonly used diagnostic tool.Moreover, it is anticipated that the growing availability of technologically advanced tests and analyzers would boost the utilization of these products for a variety of diagnostics applications. The market for ELISA analyzers is being propelled by the growing requirement for technological improvements and automation. ELISA analyzers are a commonly used diagnostic tool that can identify and measure particular proteins and antibodies in a sample which further fuels the growth of the market.

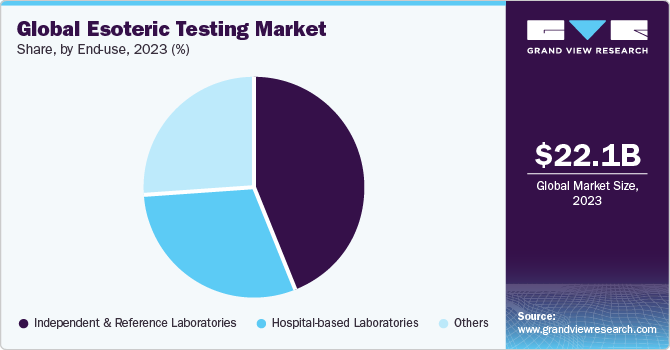

End-use Insights

The Independent and reference laboratories segment led the market with the largest revenue share in 2023. This dominance can be attributed to the increasing number of independent laboratories, high esoteric testing volumes, and growing laboratory automation. To perform and analyze the results of esoteric testing, highly skilled personnel, advanced equipment, and materials are typically needed. Since it would not be economical for physician and office hospitals laboratories to perform the tests in-house, they are usually outsourced to independent, specialized clinical reference laboratories.

Hospital-based laboratories are anticipated to grow at the fastest rate over the forecast period, owing to the increasing hospitalization of patients with cancer, infections, and toxicology. Esoteric testing helps physicians in diagnosing these diseases early. For instance, according to the CDC Report 2023, around 10.3 million people with infectious and parasitic diseases visited emergency departments in the U.S. in 2019. Additionally, the growing use of esoteric testing and the growing integration of advanced clinical care, research & development capabilities, and comprehensive testing is anticipated to drive growth of the market.

Regional Insights

North America esoteric testing market accounted for a 31.22% share in 2023. The government support for high-quality healthcare, availability of reimbursements, high buying power, and the rising incidence of infections and chronic diseases such as cancer are all important factors in this region's growth. The U.S. accounted for the largest share of the North American region in 2023. This can be attributed to the market being anticipated to grow due to well-established healthcare infrastructure, high purchasing power, and an increase in the rate of esoteric testing adoption.

U.S. Esoteric Testing Market Trends

The esoteric testing market in the U.S. is expected to grow over the forecast period due to healthcare infrastructure's development, coupled with the rising prevalence of diabetes, and favorable environment for the expansion of the market in the country.

Europe Esoteric Testing Market Trends

The esoteric testing market in Europe is identified as a lucrative region in this industry. The growth of the market in the country is attributed to an increasing prevalence of prevalence of target diseases aided with an increase in research funding and the local presence of key market players.

The UK esoteric testing market is expected to grow over the forecast period due to the presence of well-established healthcare infrastructure, high disposable income, and rising awareness pertaining to early diseases diagnosis.

The esoteric testing market in France is expected to grow over the forecast period, attributed to increased awareness about the importance of early disease diagnosis and technological advancements, which have led to more patients seeking out esoteric testing.

Germany esoteric testing market is expected to grow over the forecast period due to the rising number of initiatives being undertaken by government to help spread awareness regarding diagnosis and innovative diagnostic solutions.

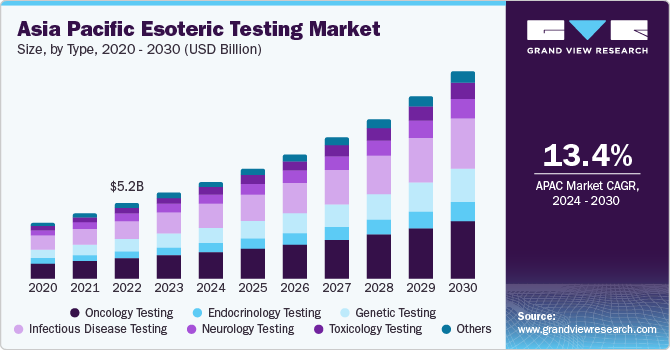

Asia Pacific Esoteric Testing Market Trends

The esoteric testing market in Asia Pacificis anticipated to witness significant growth over the forecast period. There are opportunities for growth due to the rise in patient numbers and the growing number of established healthcare providers in developing nations like India and China. Furthermore, improvement in healthcare utilization is due to increased government support for the diagnosis and treatment of chronic diseases. China’s healthcare system is witnessing a high demand for testing due to increased healthcare spending and high disposable income. Furthermore, a rise in the number of government programs aimed at providing diagnostic services, a sharp rise in the market for enzyme-linked immunoassay (ELISA) and reverse transcription polymerase chain reaction (RT-PCR) tests, and a rise in public awareness about early disease diagnosis is expected to boost the market in China.

China esoteric testing market is expected to grow over the forecast period due the growing focus on improving healthcare R&D aided with development of novel technologies.

The esoteric testing market in Japan is anticipated to experience growth over the forecast period, driven by several key factors. Japan's well-established healthcare system, coupled with a high adoption of advanced diagnostic tests and therapies, forms the backbone of its growth potential. This environment encourages the use of esoteric testing for effective diagnosis and management of diabetes, a prevalent condition that requires regular monitoring.

Latin America Esoteric Testing Market Trends

The esoteric testing market in Latin America was identified as a lucrative region in this industry. Technological advancements and the increasing awareness regarding preventive healthcare solutions in the region are anticipated to fuel market growth.

Brazil esoteric testing market is expected to grow over the forecast period due to the rising prevalence of target diseases aided with the rising use of POC diagnostics.

MEA Esoteric Testing Market Trends

The esoteric testing market MEA was identified as a lucrative region in this industry. The market in this region is driven by the high prevalence of cancer and diabetes, aided with improvements in healthcare infrastructure.

Saudi Arabia esoteric testing market is expected to grow over the forecast period owing to the rising prevalence of target diseases and the growing need for better diagnostics.

Key Esoteric Testing Company Insights

Some of the leading players operating in the esoteric testing market include Laboratory Corporation of America Holdings, BioReference Laboratories, and the Mayo Foundation for Medical Education and Research. Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are investing heavily in advanced technology and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Athena Esoterix, Stanford Health Care are some of the emerging market participants in the esoteric testing market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Esoteric Testing Companies:

The following are the leading companies in the esoteric testing market. These companies collectively hold the largest market share and dictate industry trends.

- Laboratory Corporation of America Holdings

- OPKO HEALTH, INC.

- Quest Diagnostics Incorporated

- Sonic Healthcare Limited

- H.U. Group Holdings, Inc.

- Kindstar Globalgene Technology, Inc.

- Stanford Health Care

- Mayo Foundation for Medical Education and Research

- ARUP Laboratories

- Athena Esoterix

- ACM Global Laboratories

- Healius Limited.

Recent Developments

-

In July 2023, Thermo Fisher Scientific introduced two new next-generation sequencing-based research tools for preimplantation genetic testing-aneuploidy (PGT-A).

-

In June 2022, CB Trial Laboratory, the central laboratory co-managed by BML and Labcorp Drug Development, was expanded by Labcorp, enhancing its drug development capabilities and central laboratory presence in Japan. LabCorp intends to enhance its companion diagnostics portfolio through the proposed laboratory expansion, provide more advanced biomarker and esoteric test services, and strengthen its integration with clinical development services.

-

In March 2022, Thyrocare launched four regional processing labs in Ranchi, Raipur, Nagpur, and Ahmedabad. Additionally, two more labs in Vishakhapatnam and Jaipur. It operates a centralized processing laboratory for esoteric tests.

Esoteric Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 24.55 billion |

|

Revenue forecast in 2030 |

USD 47.98 billion |

|

Growth rate |

CAGR of 11.81% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/ billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, Technology, End-use, Region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Laboratory Corporation of America Holdings; OPKO HEALTH, INC.; Quest Diagnostics Incorporated; Sonic Healthcare Limited; H.U. Group Holdings, Inc. Kindstar Globalgene Technology, Inc.; Stanford Health Care; Mayo Foundation for Medical Education and Research; ARUP Laboratories; Athena Esoterix; ACM Global Laboratories |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Esoteric Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global esoteric testing market report based on type, technology, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology Testing

-

Infectious Disease Testing

-

Genetic Testing

-

Endocrinology Testing

-

Toxicology Testing

-

Neurology Testing

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemiluminescence Immunoassay

-

Enzyme-linked Immunosorbent Assay

-

Mass Spectrometry

-

Real Time Polymerase Chain Reaction

-

Flow Cytometry

-

Other

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-based Laboratories

-

Independent and Reference Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global esoteric testing market size was estimated at USD 22.06 billion in 2023 and is expected to reach USD 24.55 billion in 2024.

b. The global esoteric testing market is expected to grow at a compound annual growth rate of 11.81% from 2024 to 2030 to reach USD 47.98 billion by 2030.

b. North America dominated the esoteric testing market with a share of 31.22% in 2023. This is attributable to rising government support for high-quality healthcare, availability of reimbursements, high buying power, and the rising incidence of infections and chronic diseases such as cancer.

b. Some key players operating in the esoteric testing market include Laboratory Corporation of America Holdings; OPKO HEALTH, INC.; Quest Diagnostics Incorporated; Sonic Healthcare Limited; H.U. Group Holdings, Inc., Kindstar Globalgene Technology, Inc.; Stanford Health Care; Mayo Foundation for Medical Education and Research; ARUP Laboratories; Athena Esoterix; ACM Global Laboratories.

b. Key factors that are driving the market growth include the increasing demand for early disease diagnosis, rising prevalence of cancer aided with high demand for safer diagnostic options.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."