- Home

- »

- IT Services & Applications

- »

-

ESG Software Market Size & Share, Industry Report, 2033GVR Report cover

![ESG Software Market Size, Share & Trends Report]()

ESG Software Market (2026 - 2033) Size, Share & Trends Analysis Report By Deployment Mode, By Type (ESG Reporting & Disclosure Software, Carbon Accounting Software), By Organization Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-370-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

ESG Software Market Summary

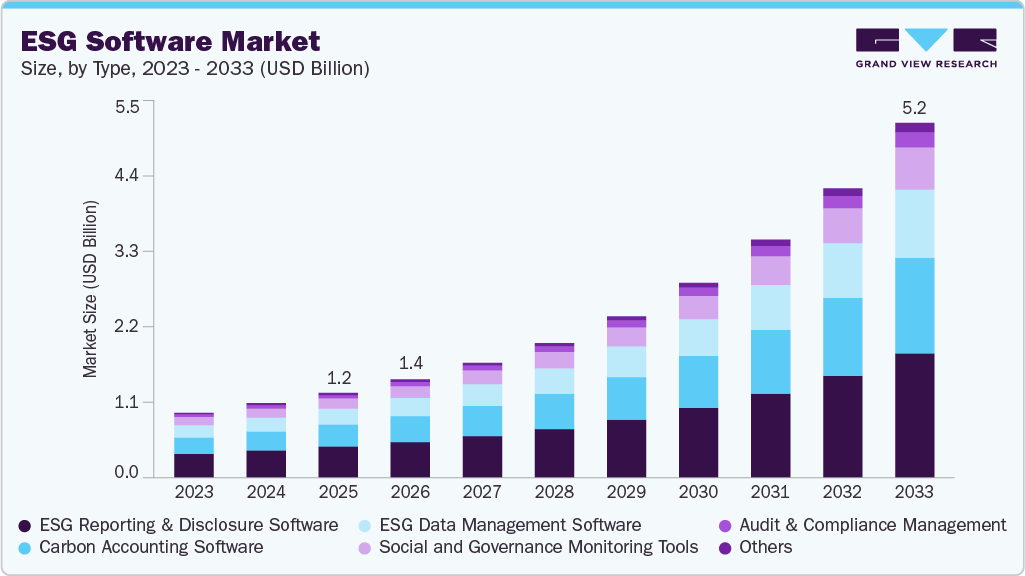

The global ESG software market size was estimated at USD 1.24 billion in 2025 and is projected to reach USD 5.19 billion by 2033, growing at a CAGR of 20.1% from 2026 to 2033. The market is rapidly expanding as organizations increase efforts to embed environmental, social, and governance considerations into their core strategic and operational frameworks.

Key Market Trends & Insights

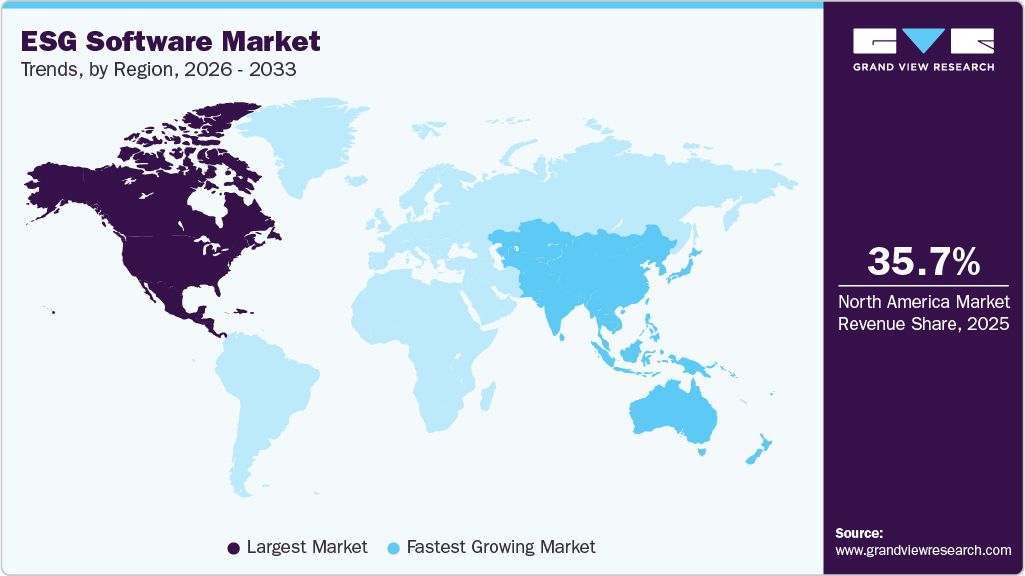

- North America held a 35.7% revenue share of the global ESG software market in 2025.

- The U.S. ESG software industry is experiencing rapid expansion due to escalating regulatory demands, technology-driven automation, and investor expectations for standardized environmental, social, and governance disclosures.

- By type, the ESG reporting & disclosure software segment held the largest revenue share of 36.6% in 2025.

- By organization size, the large enterprises segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.24 Billion

- 2033 Projected Market Size: USD 5.19 Billion

- CAGR (2026-2033): 20.1%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

The shift is driven by mounting regulatory requirements, investor scrutiny, and stakeholder expectations compelling businesses to move beyond fragmented, spreadsheet-based ESG tracking to unified, audit-ready digital platforms. Enterprises across sectors such as financial services, energy, manufacturing, and consumer goods are adopting ESG software to streamline data collection, automate disclosures, and drive measurable sustainability outcomes. Cloud-native ESG platforms are increasingly favored for their scalability, real-time analytics, and integration capabilities with existing ERP, EHS, and GRC systems. For instance, firms are deploying ESG reporting tools that automatically map operational data to frameworks such as GRI, SASB, TCFD, and CSRD, reducing manual reporting burdens while enhancing transparency and compliance readiness.

The ESG software industry is further shaped by the convergence of AI, IoT, and advanced data governance capabilities within ESG software ecosystems. AI-powered solutions are being leveraged to detect ESG data anomalies, forecast emissions trajectories, and assess supplier risks, while IoT sensors provide real-time insights into energy consumption, waste generation, and resource utilization. For instance, manufacturers are integrating ESG platforms with IoT-enabled energy meters and water usage trackers to monitor Scope 1 and 2 emissions at the facility level, while financial institutions are adopting AI models to assess ESG risk exposure across investment portfolios. These capabilities position ESG software not only as compliance tools but also as decision intelligence platforms that enable scenario modeling, materiality mapping, and automated ESG performance scoring.

Moreover, the increasing adoption of ESG solutions by small and mid-sized enterprises (SMEs), supported by the availability of modular, cloud-based, and cost-effective platforms, is expanding the market size. Vendors are incorporating capabilities such as automated double-materiality assessments, value-chain risk modeling, and digital assurance tools to address evolving compliance and performance requirements. This trend is particularly significant as regulatory frameworks such as the European Union’s Corporate Sustainability Reporting Directive (CSRD) become more prominent, increasing the demand for integrated, audit-ready ESG reporting systems. Therefore, as regulatory complexity and stakeholder expectations continue to rise, strategic partnerships increasingly emphasize the growing role of ESG software as a foundation for sustainable, accountable enterprise transformation.

Type Insights

The ESG reporting & disclosure software segment led the ESG software market, accounting for the largest share of 36.6% in 2025, driven by the surge in mandatory sustainability reporting requirements across regions and the increasing need for audit-ready, real-time ESG performance tracking. Organizations are prioritizing platforms that can streamline complex disclosure processes across multiple frameworks, including CSRD, ISSB, GRI, and TCFD, and align reporting with financial metrics. Demand is also being bolstered by the adoption of materiality-mapping tools, integrated stakeholder-engagement modules, and cross-border compliance capabilities that reduce manual burden while enhancing transparency and investor confidence. Furthermore, the rising focus on ESG assurance and the digitization of regulatory filings has positioned ESG disclosure platforms as central to enterprise ESG strategies. As a result, ESG reporting & disclosure software continues to lead the market as the most critical enabler of standardized, accurate, and forward-looking sustainability communication.

The carbon accounting software segment is projected to grow at the fastest CAGR of 21.3% over the forecast period due to intensifying regulatory mandates around Scope 1, 2, and particularly Scope 3 emissions disclosures, along with corporate net-zero targets that require accurate, auditable carbon tracking across global value chains. Companies are increasingly shifting from spreadsheet-based carbon data aggregation to automated, AI-enabled platforms that support real-time emissions tracking, reduction pathway modeling, and integration with procurement and ERP systems. The growth is further fueled by the emergence of carbon pricing schemes, investor pressure for science-based targets, and the need for verifiable emissions data to support ESG-linked financing. Additionally, the adoption of carbon data APIs, lifecycle analysis tools, and blockchain-backed emissions registries is making carbon accounting software indispensable to sustainability strategies across sectors, especially in manufacturing, logistics, and finance.

Deployment Mode Insights

The cloud segment accounted for the largest revenue share in the global ESG software industry in 2025, driven by rising demand for scalable, cost-efficient, and easily deployable platforms that support integrated ESG data management, regulatory compliance, and real-time performance monitoring. Organizations are increasingly adopting cloud-based ESG solutions for their ability to centralize data across global operations, automate materiality assessments, and align reporting with evolving frameworks such as CSRD, TCFD, and ISSB. The growth of software-as-a-service (SaaS) models further accelerates adoption by enabling rapid implementation, seamless updates, and reduced IT overhead.

The on-premises segment is projected to grow at a moderate CAGR over the forecast period, driven by sustained demand for secure, customizable ESG software solutions among organizations operating in highly regulated sectors. These enterprises require full control over ESG data, seamless integration with legacy IT infrastructure, and adherence to strict internal governance and compliance standards that favor self-managed deployment models. On-premises platforms offer enhanced data privacy, greater system configurability, and greater flexibility in internal hosting, making them suitable for institutions navigating complex ESG reporting mandates. For instance, in September 2023, SAP Fioneer introduced its ESG KPI Engine, a comprehensive solution for on-premises, private, or public cloud deployments that enables financial institutions to centrally manage, calculate, and report financed emissions KPIs in line with global regulatory frameworks through a fully auditable, automated architecture. Consequently, this example highlights the strategic value of on-premises ESG solutions for enterprises that prioritize data sovereignty, auditability, and seamless integration with existing infrastructure to meet complex reporting and compliance requirements.

Organization Size Insights

The large enterprise segment accounted for the largest share of the global ESG software market in 2025, driven by complex compliance landscapes, integrated global operations, and the ability to invest in scalable ESG infrastructures. Highly regulated industries such as finance, energy, and manufacturing often require advanced features, including automated materiality frameworks, complex supply‑chain risk analytics, and multi-framework reporting (e.g., CSRD, TCFD, SASB). Additionally, large enterprises gravitate toward platforms that can seamlessly integrate with existing ERP, GRC, and EHS systems while supporting enterprise-grade auditability. For instance, in August 2024, EY expanded its proprietary ESG digital platform, EY ESG Compass, adding modules such as double materiality assessment, EU CSRD performance monitoring, sector‑specific data models, sustainability incentives tracking, Scope‑3 emissions accounting, net‑zero planning, sustainable supply‑chain management, benchmarking, and generative AI use cases, further reinforcing the segment’s strategic alignment with large‑scale enterprise needs and complex ESG reporting demands.

The small- and medium-sized enterprises (SMEs) segment is expected to grow at the fastest CAGR during the forecast period, driven by demand from agile, resource-constrained organizations seeking affordable, scalable ESG solutions. Increasing regulatory mandates, investor expectations, and market access drivers are prompting SMEs to adopt purpose-built platforms that streamline data gathering, automate ESG workflows, and support stakeholder transparency.

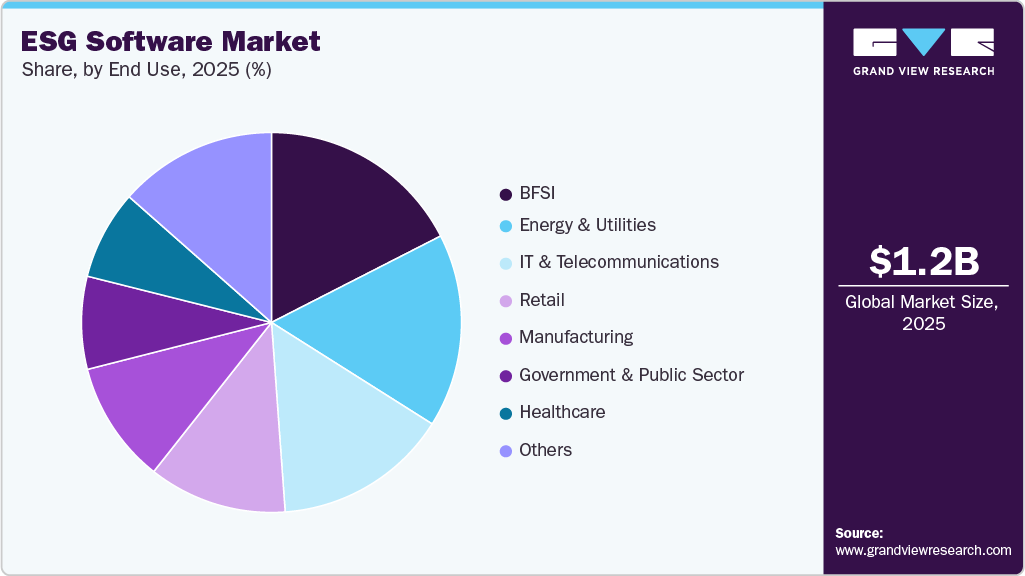

End Use Insights

The BFSI segment accounted for the largest market share of over 17.5% in 2025, driven by regulatory mandates, investor demand for sustainability-aligned financing, and the sector’s need for robust ESG risk reporting capabilities. Financial institutions are increasingly adopting platforms that support emissions tracking, supply chain resilience, and regulatory-aligned disclosures. For instance, in April 2025, ESG Book, in partnership with Boston Consulting Group (BCG) and powered by Google Cloud, introduced LEO, a purpose-built ESG solution designed to streamline sustainability reporting for corporations and financial institutions. LEO features smart pre-fill functionality powered by disclosure data and AI, enabling digital alignment with frameworks such as ISSB and GRI while significantly reducing the time and cost of ESG disclosure. Consequently, such development highlights the sector’s accelerating shift toward intelligent ESG platforms that not only enhance compliance and disclosure accuracy but also serve as critical enablers of sustainable finance and risk-informed decision-making.

The IT and telecommunications segment is expected to register the fastest growth during the forecast period in the global ESG software market, driven by growing pressure to decarbonize digital infrastructure, manage high energy consumption from data centers, and ensure responsible sourcing across global supply chains. Companies in this sector are prioritizing ESG software solutions that enable automated carbon accounting, AI-driven energy optimization, and real-time ESG risk analytics, particularly for Scope 3 emissions and e-waste traceability. Additionally, rising investor scrutiny around ethical AI use, digital inclusion, and data privacy governance is prompting telcos and tech firms to adopt platforms that provide audit-ready, framework-aligned disclosures and facilitate enterprise-wide ESG strategy execution. The segment’s rapid adoption underscores its role as both a high-impact industry and a digital enabler of ESG transformation across other verticals.

Regional Insights

The North America ESG software market accounted for the largest share of 35.7% in 2025, supported by the rapid enforcement of disclosure regulations such as the SEC’s climate-related disclosure rule and California’s Climate Accountability Package, which are driving demand for auditable, real-time ESG reporting platforms. Enterprises across the U.S. and Canada are increasingly adopting ESG solutions that enable Scope 3 emissions tracking, automated CSRD mapping, and AI-powered materiality assessments to align with global frameworks such as ISSB, SASB, and TCFD. Financial institutions are leveraging ESG software to evaluate ESG-linked credit risks, while private equity firms are utilizing these platforms for portfolio-level ESG benchmarking. Additionally, there is growing integration of ESG tools with existing ERP, GRC, and supply chain management systems, particularly among Fortune 500 companies aiming to meet investor-driven ESG targets. These trends reflect North America's leadership in compliance-driven ESG digitization, advanced analytics adoption, and cross-functional ESG integration.

U.S. ESG Software Market Trends

The U.S. ESG software industry is experiencing rapid expansion due to escalating regulatory demands, technology-driven automation, and investor expectations for standardized environmental, social, and governance disclosures. Enterprises are investing heavily in platforms that centralize ESG data, automate materiality assessments, and streamline compliance with frameworks such as the SEC’s climate disclosure rules and CSRD. AI and data analytics are playing an increasingly integral role enhancing reporting precision, reducing manual errors, and enabling predictive insights for ESG performance. U.S.-based sustainability software providers, including Workiva and local startups, are emerging as frontrunners offering tailored tools aligned with domestic regulatory shifts and sophisticated investor needs.

Europe ESG Software Market Trends

The ESG software industry in Europe is anticipated to register significant growth from 2026 to 2033, underpinned by a wave of regulatory reforms and technological innovation. The implementation of the Corporate Sustainability Reporting Directive (CSRD) has expanded mandatory reporting to approximately 50,000 companies, replacing the Non‑Financial Reporting Directive and embedding dual materiality requirements.Concurrently, the Corporate Sustainability Due Diligence Directive (CSDDD) mandates end-to-end monitoring of human rights and environmental risks throughout supply chains.In parallel, the EU Taxonomy Regulation is steering market investment toward activities deemed environmentally sustainable. Consequently, the aforementioned factors are contributing substantially to bolstering the market growth.

The UK ESG software market is poised for accelerated growth from 2026 to 2033, as companies are increasingly integrating ESG reporting tools with enterprise systems such as ERP and CRM, enabling unified performance tracking and enhanced operational visibility. Regulatory alignment is a key driver; the government's planned Sustainability Disclosure Requirements (SDR), including alignment with the upcoming UK Sustainability Reporting Standards (SRS), is prompting software providers to bake built‑in compliance frameworks into their platforms. Another prominent trend is the rise of AI-powered ESG analytics, which are enhancing data reliability, uncovering hidden risk patterns, and reducing manual reporting effort. Simultaneously, public and investor demand for transparency continues to grow, and heightened scrutiny of greenwashing, along with enforcement actions by the Competition and Markets Authority (CMA), are pushing software vendors to include capabilities such as real‑time claims validation, audit trails, and traceable supply chain insights.

The ESG software market in Germany is advancing rapidly under the influence of stringent regulatory mandates such as the EU's Corporate Sustainability Reporting Directive (CSRD) and the national Supply Chain Due Diligence Act (LkSG), which enforce comprehensive reporting on environmental, social, and supply chain risks. Enterprises are increasingly shifting toward cloud-based ESG solutions that deliver real‑time analytics, scalability, and seamless integration with legacy ERP and compliance systems, particularly appealing to industrial sectors like manufacturing and automotive that require operational performance alignment.Additionally, Germany's innovative ecosystem, featuring firms like leadity and Equintel offering CSRD-compliant automation, and Atlas Metrics delivering impact-aligned reporting platforms, reflects a growing domestic capability for tailored ESG solutions.

Asia Pacific ESG Software Market Trends

The Asia Pacific ESG software industry is expected to register the fastest CAGR of 21.8% from 2026 to 2033, driven by expanding regulatory enforcement, rising investor pressure, and the rapid digitalization of ESG practices across emerging economies. Countries such as Singapore, Japan, and Australia are mandating sustainability disclosures, while China is scaling pilot programs for ESG integration in capital markets. Enterprises across sectors are adopting ESG platforms that support automated taxonomy mapping, localized reporting templates, and AI-powered risk scoring to meet region-specific frameworks like BRSR Core in India and ESG Reporting Guidelines 2.0 in Singapore. Additionally, regional tech hubs are fueling innovation in modular, multilingual, and cloud-native ESG tools tailored to SMEs and mid-market enterprises. These developments underscore Asia Pacific’s transition from compliance-led ESG adoption to data-driven sustainability intelligence.

The ESG software market in Japan is poised for robust growth from 2026 to 2033, driven by several notable and country‑specific dynamics. Japanese enterprises are increasingly adopting sustainability management platforms to monitor carbon footprints, optimize resource use, and comply with both global and domestic disclosure mandates. Carbon management solutions led the ecosystem in 2024, while resource management software is emerging as the fastest-growing segment, reflecting rising demand for comprehensive ESG oversight across manufacturing, energy, and mobility sectors. Collectively, these trends are driving the ESG software ecosystem in Japan, characterized by sophisticated carbon and resource-tracking platforms, tailored investor‑grade analytics, and growing alignment with global sustainability norms.

The China ESG software market is projected to expand significantly from 2026 to 2033, driven by a confluence of regulatory momentum, technological innovation, and strategic market shifts. Strong government backing for green finance, evident in the country’s dominance of global green bond issuance and its dual‑carbon targets,has elevated demand for platforms that support transparent ESG metrics and carbon accounting.Chinese enterprises are also leveraging AI and machine learning within ESG solutions to enhance data collection, perform real‑time analytics, and improve reporting accuracy, particularly across fragmented supply chains.

The ESG software market in India is poised for rapid expansion from 2026 to 2033, driven by the increasing enforcement of mandatory sustainability disclosures such as SEBI’s BRSR Core framework, heightened investor scrutiny on ESG compliance, and the growing participation of Indian corporations in global supply chains requiring traceable, auditable ESG data. Enterprises are adopting digital ESG solutions to streamline regulatory reporting, automate value-chain risk mapping, and align with localized ESG taxonomies. The rise of industry-specific ESG templates, support for vernacular languages, and embedded analytics tailored for India’s fragmented SME landscape are further enabling adoption across mid-market segments. Additionally, the integration of ESG modules within ERP systems and the demand for sector-focused solutions in manufacturing, energy, and infrastructure are fostering deeper enterprise-wide ESG alignment. These shifts are positioning India as a key growth hub for ESG software within the Asia Pacific region.

Competitive Insights

Key players operating in the ESG software industry are Benchmark Gensuite Inc.; Diligent Corporation; Enablon SA; and Envizi Pty Ltd. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In December 2025, Clean Energy Ventures partnered with Dasseti, an AI-driven ESG and investment intelligence platform, to enhance and streamline its data collection and reporting processes. Through this collaboration, Harvest will support the collection and validation of financial, impact, and ESG data across Clean Energy Ventures’ entire portfolio. This comprehensive reporting framework enables CEV to closely track the performance and sustainability progress of its investments. Additionally, Harvest will empower CEV to deliver value-added support to portfolio companies while encouraging the adoption of best practices across the portfolio.

-

In August 2025, ILX partnered with Harvest by Dasseti to optimize ESG software across its private credit portfolio. The firm maintains a strong focus on climate finance and alignment with the UN Sustainable Development Goals in developing markets. ILX will leverage Harvest to support more data-driven investment decisions. This will also enhance the quality, consistency, and transparency of its investor reporting.

-

In September 2024, Workiva Inc. partnered with Visual Lease, integrating its ESG Steward tool to better manage real estate and equipment emissions in alignment with GHG Protocol standards.

-

In June 2024, Workiva Inc. launched Workiva Carbon, a carbon accounting and management platform, alongside the acquisition of startup Sustain.Life, to automate emissions tracking across Scope 1, 2 and 3 and support audit-ready reporting.

-

In March 2024, Persefoni AI Inc. formed a partnership with Deloitte Tohmatsu Consulting to offer comprehensive greenhouse gas emissions management and disclosure-from conceptualization to implementation, supported by the launch of Persefoni Pro, a generative-AI guided version aimed at streamlining supply chain emissions data collection for SMEs.

Key ESG Software Companies:

The following key companies have been profiled for this study on the ESG software market.

- Benchmark Gensuite Inc.

- Diligent Corporation

- Enablon SA

- Envizi Pty Ltd

- Dasseti

- Intelex Technologies Inc.

- IsoMetrix Software (Pty) Ltd

- LogicManager Inc.

- Nasdaq Inc.

- Novisto Inc.

- Persefoni AI Inc.

- Refinitiv Ltd

- SAP SE

- Sphera Solutions Inc.

- Workiva Inc.

ESG Software Market Report Scope

Report Attribute

Details

Market size in 2026

USD 1.44 billion

Revenue forecast in 2033

USD 5.19 billion

Growth rate

CAGR of 20.1% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, type, organization size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Benchmark Gensuite Inc.; Diligent Corporation; Enablon SA; Envizi Pty Ltd; Dasseti; Intelex Technologies Inc.; IsoMetrix Software (Pty) Ltd; LogicManager Inc.; Nasdaq Inc.; Novisto Inc.; Persefoni AI Inc.; Refinitiv Ltd; SAP SE; Sphera Solutions Inc.; Workiva Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global ESG Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the ESG software market report based on deployment mode, type, organization size, end use, and region:

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premises

-

Cloud

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

ESG Reporting & Disclosure Software

-

Carbon Accounting Software

-

ESG Data Management Software

-

Social and Governance Monitoring Tools

-

Audit & Compliance Management

-

Others

-

-

Organization Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

Small and Medium Sized Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Energy and Utilities

-

Manufacturing

-

Healthcare

-

Retail

-

IT and Telecommunications

-

Government and Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The ESG software market is rapidly expanding as organizations are increasing efforts to embed environmental, social, and governance considerations into core strategic and operational frameworks. The shift is driven by mounting regulatory requirements, investor scrutiny, and stakeholder expectations compelling businesses to move beyond fragmented, spreadsheet-based ESG tracking to unified, audit-ready digital platforms.

b. Some key players operating in the ESG software market include Benchmark Gensuite Inc., Diligent Corporation, Enablon SA, Envizi Pty Ltd, Dasseti, Intelex Technologies Inc., IsoMetrix Software (Pty) Ltd, LogicManager Inc., Nasdaq Inc., Novisto Inc., Persefoni AI Inc., Refinitiv Ltd, SAP SE, Sphera Solutions Inc., Workiva Inc. and Others

b. The global ESG software market size was estimated at USD 1.24 billion in 2025 and is expected to reach USD 1.44 billion in 2026.

b. The global ESG software market is expected to grow at a compound annual growth rate of 20.1% from 2026 to 2033 to reach USD 5.19 billion by 2033.

b. The cloud segment accounted for the largest revenue share in the global ESG software market in 2025, driven by rising demand for scalable, cost-efficient, and easily deployable platforms that support integrated ESG data management, regulatory compliance, and real-time performance monitoring.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.