ESG Investing Market Size, Share, & Trends Analysis Report By Type (ESG Integration, Impact Investing, Sustainable Funds, Green Bonds), By Investor Types, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-357-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

ESG Investing Market Size & Trends

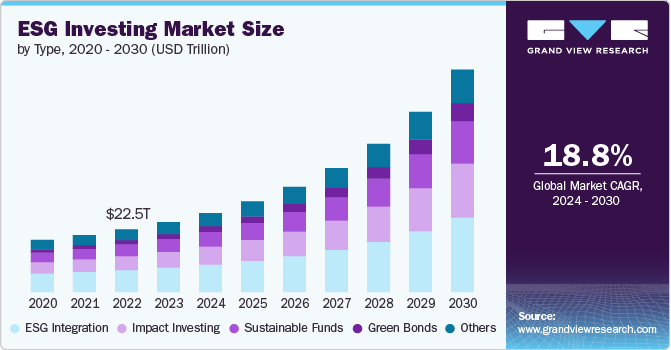

The global ESG investing market size was estimated at USD 25.10 trillion in 2023 and is projected to grow at a CAGR of 18.8% from 2024 to 2030. Over the past decade, there has been a significant increase in public awareness regarding environmental and social issues. Climate change protests, natural disasters, and social justice movements highlighted the urgent need for sustainable practices. Investors are becoming more conscious of their investment choices' impact on the world. This heightened awareness has translated into a greater demand for investment options that align with personal values and contribute positively to environmental sustainability and social equity.

The availability of information about companies' ESG practices has improved significantly. Investors can now access detailed reports, ratings, and analyses that provide insights into a company's environmental impact, social initiatives, and governance practices. This transparency enables investors to make more informed decisions and choose investments that align with their values. The proliferation of ESG data providers and rating agencies has also played a crucial role in standardizing and disseminating this information, making it easier for investors to compare and evaluate ESG performance across different companies and sectors.

Type Insights

Based on type, the ESG integration segment led the market with the largest revenue share of 35.0% in 2023. Companies are increasingly adopting sustainability initiatives and improving their ESG practices in response to investor demands and regulatory pressures. As more companies enhance their ESG disclosures and performance, it becomes easier for investors to integrate ESG factors into their investment strategies. Corporate commitment to sustainability reduces risks and opens up new opportunities for value creation. This proactive approach by companies supports the ESG integration segment by providing a broader and more reliable set of ESG data for investors to analyze.

The green bonds segment is anticipated to grow at the fastest CAGR during the forecast period. International collaboration and developing global standards for green bonds contribute to the market’s growth. Organizations such as the International Capital Market Association (ICMA) and the Climate Bonds Initiative (CBI) have established guidelines and standards that help ensure the integrity and transparency of green bonds. These standards facilitate cross-border investments and provide a framework for evaluating and certifying green bonds. Global collaboration enhances investor confidence and promotes the scalability of the green bond market.

Investor Types Insights

Based on investor types, the institutional investor segment led the market with the largest revenue share 55.7% in 2023. Institutional investors are acutely aware of the long-term environmental, social, and governance risks. Climate change, resource scarcity, regulatory changes, and social unrest can significantly impact companies' financial performance. By integrating ESG factors into their investment decisions, institutional investors can better identify and mitigate these risks, thereby protecting their portfolios from potential losses. For example, investing in companies with strong environmental practices reduces exposure to regulatory penalties and environmental liability risks.

The retail investor segment is anticipated to grow at a significant CAGR during the forecast period. The rise of user-friendly investment platforms and financial technology has made ESG investing more accessible to retail investors. Online brokerage firms and investment apps offer a variety of ESG-focused funds and portfolios, allowing retail investors to incorporate ESG criteria into their investment strategies easily. These platforms often provide tools and features that help investors evaluate the ESG performance of their investments, making it simpler to track and manage their ESG investments. The convenience and accessibility of these platforms lower the barriers to entry for retail investors, encouraging more participation in the global market.

Application Insights

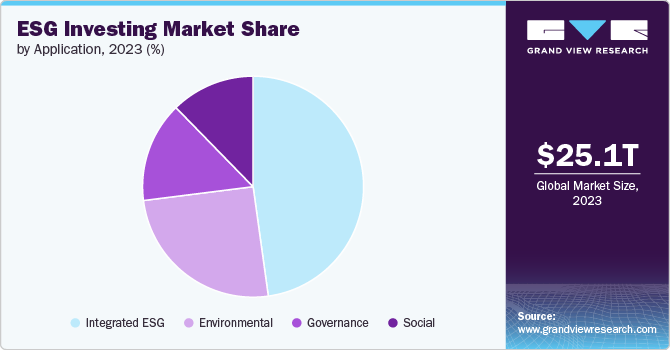

Based on application, the environmental segment led the market with the largest revenue share of 25.2% in 2023. There is a growing market demand for environmentally friendly products and services. Consumers increasingly favor companies that display a commitment to sustainability and environmental stewardship. This shift in consumer preferences drives businesses to adopt green practices and develop sustainable products, creating investment opportunities in these areas. Companies that align with these consumer trends are often better positioned to capture market share and achieve long-term growth, making them attractive to ESG investors.

The integrated ESG segment is anticipated to grow at the fastest CAGR of 19.2% during the forecast period. Integrated ESG applications improve decision-making by providing a centralized platform that aggregates and analyzes ESG data alongside financial data. This integration enables investors to evaluate the financial implications of ESG factors more effectively and make more strategic investment decisions. Advanced analytics and scenario planning features within these applications help investors understand the potential long-term impacts of ESG factors on their investments, leading to more informed and forward-looking strategies.

Regional Insights

North America dominated the ESG investing market with the revenue share of 36.2% in 2023. There is a significant rise in demand for ESG investments among institutional and retail investors in North America. Investors are becoming more aware of the importance of sustainability and the potential for long-term value creation through ESG-focused portfolios. Institutional investors, such as pension funds and asset managers, are integrating ESG criteria into their investment strategies to meet the expectations of beneficiaries and clients who prioritize ethical and sustainable investing.

U.S. ESG Investing Market Trends

The ESG investing market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. Technological advancements are playing a crucial role in driving this market. Innovations in data analytics, artificial intelligence (AI), and blockchain technology enable better assessment and integration of ESG factors into investment decisions. These technologies facilitate the collection, analysis, and reporting of ESG data, providing investors with deeper insights into companies' sustainability performance.

Europe ESG Investing Market Trends

The ESG investing market in Europe is anticipated to grow at a significant CAGR from 2024 to 2030. Europe has some of the world's most stringent and comprehensive regulatory frameworks for ESG investing. The European Union (EU) has implemented several regulations that mandate corporate transparency and accountability in ESG matters. Key initiatives include the EU Taxonomy for Sustainable Activities, the Sustainable Finance Disclosure Regulation (SFDR), and the Corporate Sustainability Reporting Directive (CSRD). These regulations require companies to provide detailed disclosures on their environmental and social impacts, enabling investors to make informed decisions.

Asia Pacific ESG Investing Market Trends

The ESG investing market in Asia Pacific is expected to grow at a significant CAGR of 21.5% from 2024 to 2030. The Asia Pacific region is experiencing significant economic growth and development, leading to increased interest in sustainable and responsible investment. Rapid industrialization and urbanization have brought about environmental challenges and social issues that must be addressed. As a result, investors are looking for opportunities that offer financial returns and contribute to sustainable development. ESG investments provide a way to support economic growth while addressing critical environmental and social issues, making them attractive to regional investors.

Key ESG Investing Company Insight

Key players operating in the global market include Acer Inc.; Cisco Systems, Inc.; Dell Inc.; Fujitsu; BlackRock; BNP Paribas Asset Management; Goldman Sachs Asset Management; J.P. Morgan Asset Management; Morgan Stanley Investment Management; Northern Trust Asset Management; PIMCO; State Street Global Advisors; UBS Group; and Vanguard Group. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key ESG Investing Companies:

The following are the leading companies in the ESG investing market. These companies collectively hold the largest market share and dictate industry trends.

- BlackRock

- BNP Paribas Asset Management

- Goldman Sachs Asset Management

- J.P. Morgan Asset Management

- Morgan Stanley Investment Management

- Northern Trust Asset Management

- PIMCO

- State Street Global Advisors

- UBS Group

- Vanguard Group

Recent Developments

-

In June 2024, BlackRock, an asset management firm, launched a range of climate transition-aware exchange-traded funds (ETFs) in Europe while distancing itself from ESG investing in the U.S. The new iShares MSCI Climate Transition Aware UCITS ETFs, classified as Article 8 under the EU's Sustainable Finance Disclosure Regulation, aim to expose investors to companies leading the transition to a low-carbon economy

-

In October 2023, ClearBridge Investments and Franklin Templeton introduced a new value equity fund named the FTGF ClearBridge Global Sustainability Improvers Fund. This innovative fund aims to invest in companies that are actively improving their Environmental, Social, and Governance (ESG) practices rather than focusing solely on those with already robust ESG profiles

ESG Investing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 28.36 trillion |

|

Market Value forecast in 2030 |

USD 79.71 trillion |

|

Growth rate |

CAGR of 18.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Market value in USD trillion and CAGR from 2024 to 2030 |

|

Report coverage |

Market value forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, investor types, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key Companies Profiled |

Acer Inc.; Cisco Systems, Inc.; Dell Inc.; Fujitsu; BlackRock; BNP Paribas Asset Management; Goldman Sachs Asset Management; J.P. Morgan Asset Management; Morgan Stanley Investment Management; Northern Trust Asset Management; PIMCO; State Street Global Advisors; UBS Group; Vanguard Group |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global ESG Investing Market Report Segmentation

This report forecasts market value growth at global, regional, and country levels and provides an analysis of the latest application trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ESG investing market report based on type, investor types, application, and region.

-

Type Outlook (Market Value, USD Trillion, 2018 - 2030)

-

ESG Integration

-

Impact Investing

-

Sustainable Funds

-

Green Bonds

-

Others

-

-

Investor Types Outlook (Market Value, USD Trillion, 2018 - 2030)

-

Institutional Investors

-

Retail Investors

-

Corporate Investors

-

-

Application Outlook (Market Value, USD Trillion, 2018 - 2030)

-

Environmental

-

Social

-

Governance

-

Integrated ESG

-

-

Regional Outlook (Market Value, USD Trillion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ESG investing market size was estimated at USD 25.10 trillion in 2023 and is expected to reach USD 28.36 trillion in 2024.

b. The global ESG investing market is expected to grow at a compound annual growth rate of 18.8% from 2024 to 2030 to reach USD 79.71 trillion by 2030.

b. ESG integration segment dominated the market in 2023 with a market share of over 35%. Companies are increasingly adopting sustainability initiatives and improving their ESG practices in response to investor demands and regulatory pressures.

b. Some key players operating in the ESG investing market include Acer Inc.; Cisco Systems, Inc.; Dell Inc.; Fujitsu; BlackRock; BNP Paribas Asset Management; Goldman Sachs Asset Management; J.P. Morgan Asset Management; Morgan Stanley Investment Management; Northern Trust Asset Management; PIMCO; State Street Global Advisors; UBS Group; and Vanguard Group.

b. The increasing public awareness about environmental and social issues drives growth of the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."