- Home

- »

- Advanced Interior Materials

- »

-

Equipment As A Service Market Size & Share Report, 2030GVR Report cover

![Equipment As A Service Market Size, Share & Trends Report]()

Equipment As A Service Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment (Air Compressor, Pump), By End-use (Construction, Mining), By Financing Models, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-041-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Equipment As A Service Market Summary

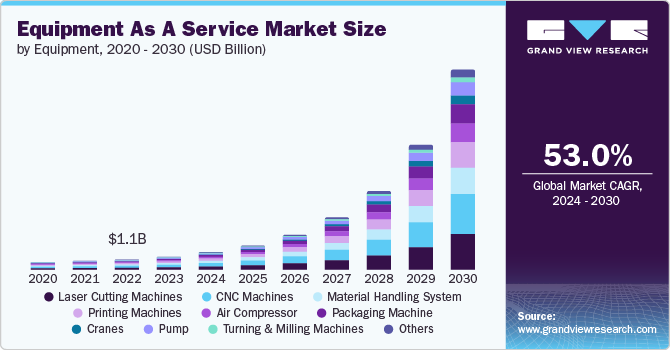

The global equipment as a service market size was estimated at USD 1,509.1 million in 2023 and is projected to reach USD 27,804.4 million by 2030, growing at a CAGR of 53.0% from 2024 to 2030. The relatively new concept of "Equipment as a Service" is comparable to the already well-known "Software as a Service" or “Machine as a Service” business model.

Key Market Trends & Insights

- The North America Equipment as a Service market held the largest global revenue share of 36.7% in 2023.

- The U.S. equipment as a service market is estimated to grow at a CAGR of 51.2% from 2024 to 2030.

- In terms of equipment, the laser cutting machine segment led the market and accounted for 15.5% of the global revenue share in 2023.

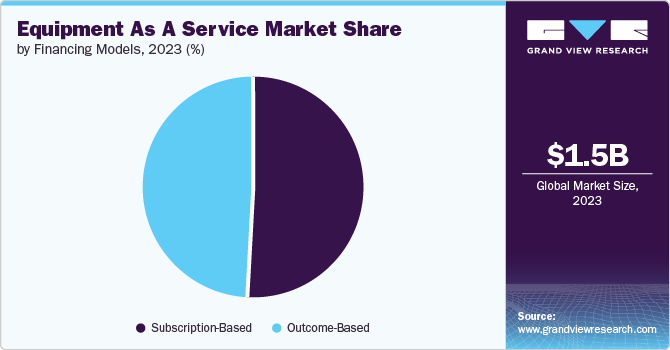

- Based on financing models, the subscription-based financing models segment led the market and accounted for 50.7% of the global revenue share in 2023.

- On the basis of end use, The manufacturing end use segment led the market and accounted for 39.1% of the global revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,509.1 million

- 2030 Projected Market Size: USD 27,804.4 million

- CAGR (2024-2030): 53.0%

- North America: Largest market in 2023

In this strategy, the vendor rents out equipment while also monitoring, maintaining, or repairing it as needed to keep it in better operating order and increase client uptime. During the projection period, it is predicted that increasing consumer adoption of cutting-edge technologies, together with increased equipment uptime and efficiency provided by EaaS, will fuel market expansion.

The main objective of Industry 4.0 is to maximize machine uptime, which is done by adopting EaaS models. EaaS increases equipment uptime and efficiency, lowering costs and labor for planned and unexpected maintenance and providing consumers with cutting-edge technologies and pricing structures while also fostering market growth. For instance, Advantech's Machine APM/M2I-31A is an end-to-cloud intelligent equipment management solution for industrial infrastructure equipment. Air compressors, injection molding machines, electric motors, pumps, vulcanizing equipment, and steam turbines are modified using this approach. Moreover, it enables edge device connectivity, data collecting, and equipment monitoring.

In several industries in the U.S., it has been a common procedure to switch from one-time sales of capital goods (CapEx) to recurring income streams created on equipment usage or output (OpEx). One outstanding example is the widely recognized Rolls-Royce design that has completely changed the way the business sells aircraft turbines. This model is referred to as "power-by-the-hour" since customers are only charged for the actual hours that the aircraft turbine is actually in use. Due to the numerous advantages offered by OpEx, the aforementioned factors will increase demand for equipment-as-a-service (EaaS) in the U.S.

Drivers, Opportunities & Restraints

IIoT, 5G, Cloud, Big Data, and AI technological advancements have given rise to numerous digital service solutions that are either implementing EaaS models or enabling them from the start. Various IIoT solutions that allow equipment to automatically exchange asset performance data and provide transparency on asset usage are great examples of EaaS. For instance, Siemens provides the sensors and controllers required to link machines to the edge utilizing digital transformation technology through its equipment-as-a-service approach for the edge's hardware and software.

The increasing automotive production is expected to positively influence the demand for CNC and laser-cutting machines over the forecast period. Automotive production is a multi-stage, complex manufacturing that requires high levels of accuracy and performance. Due to the augmented manufacturing of more efficient auto parts, the automotive industry has increased the demand for CNC and laser-cutting machines. Many essential vehicle parts, such as carbon composite materials, body parts, body sheets, frames, and other internal and external automotive parts, are created using metal CNC and laser cutting machines in the automotive industry.

The implementation of equipment-as-a-service involves integrating advanced technologies such as IoT sensors, data analytics, and connectivity features into existing equipment. Furthermore, the company has to develop the necessary infrastructure to support real-time monitoring, data processing, and communication, which requires significant networking mechanisms, hardware, and software infrastructure. The cost associated with the upgradation of equipment and infrastructure can be substantial, which can limit the number of companies that can provide equipment-as-a-service.

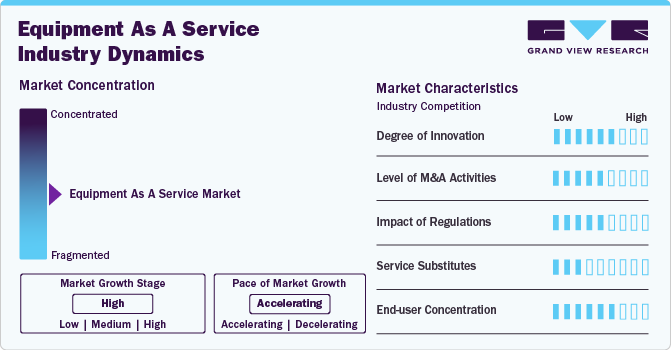

Market Concentration & Characteristics

The market growth stage of the equipment-as-a-service is robust, with acceleration evident across the market. This dynamism is driven largely by swift advancements in technology, spurring an environment rich in innovation. In addition, key participants in the market are employing both organic and inorganic strategies to solidify their global standing. These strategies include introducing new products, expanding into new territories, engaging in mergers and acquisitions, and forming strategic partnerships.

In addition, product innovation has also contributed to the rise of EaaS models. The focus of new equipment is on the entire production process used by the customer. For instance, laser manufacturers can improve the customer's overall process by giving them the opportunity to draw or categorize produced products. Hence, optimizing the entire flow is more important than concentrating on specific process phases. Owing to this, providers can scale these processes as they accumulate more performance data, which benefits the customer by significantly increasing process stability.

The equipment as a service (EaaS) market is witnessing significant trends that are reshaping the manufacturing industry. A number of equipment manufacturers are shifting from a product-selling business model to an output-based model, wherein their equipment is leased out to consumers based on a manufacturing-based selling or outsourcing model. In the manufacturing-based model, consumers pay based on per-unit output, while in the outsourcing model, machines or equipment are rented out to consumers based on per-hour utilization.

Industry 4.0 is leading to the development of smart equipment, which can be connected through the Internet and monitored remotely. This enables providers of equipment-as-a-service to manage manufacturing equipment and provide customers with valuable data insights. As businesses worldwide become highly aware of the benefits of equipment as a service, they are increasingly adopting this model to meet their manufacturing equipment requirements.

Equipment Insights

The laser cutting machine equipment segment led the market and accounted for 15.5% of the global revenue share in 2023. With its pricing and marketing strategy, which includes Equipment as a Service (EaaS), also known as Machine as a Service (MaaS), and pricing models for services, the equipment manufacturing sector is undergoing a fundamental paradigm shift. Due to the intense competition among manufacturers, the major companies in the laser cutting industry are concentrating on lowering the cost of these equipment by implementing EaaS models, thereby driving market expansion.

For instance, Munich Re Group and TRUMPF Group formed a strategic alliance in October 2020 to provide a cutting-edge service for laser cutting machines. Customers can utilize a full-service laser machine without acquiring or leasing any equipment owing to the jointly created "pay-per-part concept." Customers instead pay a predetermined fee for each cut sheet metal component; in other words, they only pay for what they require. This enables customers to increase the flexibility of their production processes and respond to market developments more quickly.

Over the forecast period, market expansion is anticipated to be fueled by rapid industrialization and rising demand for automation in material handling systems, which will raise the demand for equipment as a service. For instance, Arnold Machine provides a Machine-as-a-Service (MaaS) program that enables users to enhance their manufacturing capabilities and technology without having to make a financial investment. Also, this program enables consumers to purchase high-end, high-performing equipment without requiring capital expenditures, which stimulates market growth.

In the coming years, demand for EaaS models will be driven by factors such as the expanding use of variable-speed systems, low maintenance costs, efficient operation, and retrofitting for existing systems. Demand for air compressors is being driven by these and other factors in several important end use industries. For instance, BASF Coatings uses KAESER KOMPRESSOREN's EaaS model named Sigma Air Utility, whereby the firm will supply compressed air for paint and coating manufacturing based on usage. Furthermore, to give end users an assured and dependable compressed air supply under a flexible arrangement, Atlas Copco's AIRPlan contract-based air scheme incorporates energy-efficient air compressors and planned maintenance, owing to full after-sales service support.

The CNC machines equipment segment is expected to grow at a CAGR of 58.9% over the forecast period. In the coming years, there will be a significant demand for CNC machines due to the growth in demand for telecom connectivity, medical devices, and equipment used in semiconductor fabrication. The provision of EaaS to manufacturers of CNC machines has significant advantages, including assuring risk minimization and long-term profitability. For instance, Heller provides the cutting-edge HELLER4Use Pay-per-Use model, which enables customers to modify the capabilities of the HELLER machining centers to meet the needs of the moment. Without any initial investment or financial commitment, this implies the user's production plant will have unexpected flexibility.

End-use Insights

The manufacturing end use segment led the market and accounted for 39.1% of the global revenue share in 2023. Industrial businesses are up against more competition on a worldwide scale in the current business environment. Increased sales of new machinery are challenging to achieve because unpredictable market conditions provide little opportunity for ineffective operations or ignoring untapped revenue sources. EaaS models are required in the manufacturing sector due to the new pay-per-unit-produced business models or pay-per-use that enable providers to create specialized, user-friendly solutions that satisfy the business objectives of their partners.

Equipment as a Service is a delivery model for the material handling end use that combines hardware, software, and services. As a result, current dynamics in the material handling market, which necessitate various actions from manufacturers, such as the need for automation and concurrent push to collect and store the amount of data required to support advanced analytics by incorporating EaaS models, are thus driving market expansion.

As software vendors switched to a subscription model for their goods, they first gained scale in the IT industry. Among the most prominent applications of the paradigm are content consumption (such as Spotify and Netflix) and mobility (such as TIER Mobility and Care by Volvo). As-a-service models have already started to show up in industrial settings at the level of specific production parts. For instance, in 2020, Trumpf and Munich Re collaborated to offer the use of laser cutting equipment as a service.

The construction end use segment is expected to grow at a CAGR of 44.6% over the forecast period. The construction industry is inherently a large user of natural resources. The construction is contributing largely to a better sustainable industry by promoting a sustainable supply chain and upholding the principles of the circular economy (such as recyclability, reparability, and responsible sourcing), and also by renting out equipment as a service. For instance, Volvo Construction Equipment (Volvo CE) suggests that an EaaS arrangement could significantly benefit users of construction-related equipment by offering the financial freedom, cost-effective use, and flexibility that are trademarks of Pay As You Go pricing models.

Financing Models Insights

The subscription-based financing models segment led the market and accounted for 50.7% of the global revenue share in 2023. EaaS reduces risks through regular revenue or expenses, predictable subscription pricing, and flexible contracts. Under traditional ownership, a new machine, for instance, can take longer than ten years to buy because it is bought outright as an investment. If the equipment is instead made available on a pay-per-use basis, the customer will know exactly how much money they can anticipate making over the course of the contract, which will spur market growth in the coming years. For instance, the International Energy Agency suggests that services for charging electric vehicles as a service include infrastructure installation to efficiency monitoring and maintenance in exchange for a subscription fee.

The EaaS concept has several advantages for manufacturers. It opens up new markets, provides a new, predictable revenue stream, facilitates forecasting and controlling service schedules, and eventually enables larger profits. This technique enables manufacturers to stand out from the competition and draw in risk-averse customers who are uncomfortable with big capital investments. For instance, subscription services like Netflix and Amazon Prime are very popular in the consumer products industry. Moreover, Heidelberger Druckmaschinen AG offers subscription models Smart and Plus, where the customer pays a set subscription fee for a predetermined base print volume under the "pay-per-outcome" concept. A further imprint price per page is charged if the user prints more than the base volume that was agreed upon.

Pricing under a subscription model is connected to discrete units of output supplied and is dependent on either the value offered or the units consumed. Pricing in an outcome-based model is determined by performance or results. Therefore, it is crucial to make investments in systems that allow for accurate outcomes and cost estimations, which will increase demand for EaaS models based on both funding methods.

Outcome-based financing models segment is expected to witness a CAGR of 51.4% over the forecast period. Business outcomes are the main focus of outcome-based financing models, where a consumer pays for a specific, measurable business result or value obtained from used services. For instance, Hitachi Rail, which is developing brand-new trains in the UK, will be compensated when its customers finish their trips and achieve a number of key performance measures, including fleet availability, onboard temperature, and maintenance. As a result, Hitachi owns and operates the trains in this instance, and the UK's Network Rail System pays Hitachi for "on-time service."

Regional Insights

“Globally, North America dominated the market in 2023, and it accounted for 36.7% market share in 2023.”

The North America Equipment as a Service market held the largest global revenue share of 36.7% in 2023. According to the Associated General Contractors (AGC) of America, Inc., construction spending was 8.2% higher in January 2022 than it was in January 2021, demonstrating the rapid growth of the industry in this region. The EaaS model applied in manufacturing offers potential for the construction industry as well. This enables businesses to lease equipment and pay for extra services like preventative maintenance and other services based on the equipment's production. This would make it possible for consumers in the construction industry to rent the most cutting-edge equipment without having to make a significant investment in it.

U.S. Equipment As A Service Market Trends

U.S. equipment as a service market is estimated to grow at a CAGR of 51.2% from 2024 to 2030. The flourishing manufacturing and construction industries play a significant role in the economic growth of the U.S. According to the information published by the National Institutes of Standards and Technology of, the country, which will drive the equipment as a service market.

Equipment as a service market in Canada held over 12% share of the North America market in 2023. The implementation of equipment as a service model in the Canadian construction industry can assist companies in avoiding initial equipment purchase costs and using this money for further improving their processes. Above factors will drive the market growth.

Asia Pacific Equipment As A Service Market Trends

The equipment as a service market in Asia Pacific is expected to grow at the fastest CAGR of 56.8% over the forecast period. This growth can be attributed to the presence of developing economies, such as China and India, and the significant technological and infrastructural developments in the region.

China equipment as a service market held over 44% share of the Asia Pacific region in 2023. China has been actively engaged in various digital transformation initiatives in different industries, and there has been an increasing focus on the development of Industry 4.0, especially in the manufacturing sector. EaaS can support these initiatives by providing access to advanced manufacturing equipment at low initial investment, driving the equipment as a service market in China.

The equipment as a service market in India is expected to grow at a rate of 58.1% due to an increase in production and exports in the automotive industry, which is further expected to fuel the demand for equipment such as CNC machines.

Europe Equipment As A Service Market Trends

Equipment as a service market in Europe was the second-largest regional market, and it was valued at USD 464.8 million in 2023. The growth of equipment as a service market in Europe is expected to be driven by increasing investments in technological advancements in various sectors, rising demand for innovations in production processes, surging number of infrastructure development projects, and increasing industrial output, along with the presence of key companies dealing in equipment as a service market.

Germany equipment as a service market held over 33% share of the Europe market in 2023. Germany has played a key role in building quality infrastructures. The government of the country emphasizes sustainable development using eco-friendly solutions.

Equipment as a service market in France is expected to grow at a rate of 54.2%. The availability of laser cutting machines, pumps, Computer Numerical Control (CNC) machines, and material handling systems as a service in the country can further contribute to the growth of the market in France.

Central And South America Equipment As A Service Market Trends

The equipment as a service market in Central and South America is expected to grow significantly over the forecast period. The subscription-financing model has gained traction in Central and South America as the digital movement has expanded and intensified. More people than ever before have access to the Internet, consumer spending is rising consistently, and interest in subscription-based products is rising, all of which are expected to fuel market growth in this region over the projected period.

Brazil equipment as a service market is likely to hold over 70% share of the Central and South America region in 2023, the market driven by the country's large and diverse economy, expanding manufacturing sector, and increasing adoption of e-commerce.

Middle East & Africa Equipment As A Service Market Trends

The equipment as a service market in the Middle East & Africa is witnessing significant growth propelled by the region's expanding economy, increasing industrialization, and adoption of digital technologies.

Saudi Arabia equipment as a service market is expected to grow at a lucrative rate of 43.8% owing to increasing emphasis on the economic reforms aiming at the development of the country that can increase the demand for various equipment, and implementation of EaaS can help in availing these at lower costs.

Key Equipment As A Service Company Insights

Some of the key players operating in the market include TRUMPF; Atlas Copco; KAESER KOMPRESSOREN; Heidelberger Druckmaschinen AG; SMS group GmbH; Arnold Machine; Uteco; AB Volvo.

-

TRUMPF operates through two business divisions, namely machine tools and laser technology. Alongside the two business divisions, the company also manages its activities in the areas of EUV, photonic components, and financial services in separate business fields.

-

Atlas Copco is one of the leading industrial companies engaged in the provision of compressors, vacuum solutions, air treatment systems, assembly systems, industrial power tools, and power & flow solutions. The company operates its business in four areas: compressor technique, industrial technique, vacuum technique, and power technique. The compressor air treatment equipment market products are provided through the compressor segment

Exone, Siemens, Heller Maschinenfabrik GmbH, DMG MORI, and Hilti are some of the emerging market participants.

-

ExOne offers 3D printing machines to industries working in additive manufacturing, 3D printing, related products and materials, and services to industrial customers. The company's business consists of selling and manufacturing its 3D printing machines and products, which account for the majority of its revenue. Machines are individually tailored to customer requirements.

-

DMG MORI has set up several centers that focus on innovations and tailor-made technology financing designed by professionals that enable cost-effective and efficient manufacturing investments. It also provides peripherals such as tool wagons and tool cabinets, pallet handling, pallet pool, and tool handling systems.

Key Equipment As A Service Companies:

The following are the leading companies in the equipment as a service market. These companies collectively hold the largest market share and dictate industry trends.

- TRUMPF

- Atlas Copco

- KAESER KOMPRESSOREN

- Heidelberger Druckmaschinen AG

- SMS group GmbH

- Arnold Machine

- Uteco

- AB Volvo

- Exone

- Siemens

- Heller Maschinenfabrik GmbH

- DMG MORI

- Hilti

- SK LASER

- Tamturbo turbo compressors

- Metso Outotec

Recent Developments

-

In October 2023, Uteco signed an equity agreement with Gap to offer valuable solutions and a complete portfolio of end-to-end products and services to its customers from the manufacturing industry.

-

In April 2023,Heidelberger Druckmaschinen AG collaborated with the Munich Re Group to implement the equipment as a service model. This strategic development by Heidelberger Druckmaschinen AG is expected to further expand its equipment as a service model. It is anticipated to enhance the digital business model of both companies.

Equipment As A Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,169.6 million

Revenue forecast in 2030

USD 27,804.4 million

Growth rate

CAGR of 53.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, financing models, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; U.K.; China; Japan; India; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

TRUMPF; Atlas Copco; KAESER KOMPRESSOREN; Heidelberger Druckmaschinen AG; SMS group GmbH; Arnold Machine; Uteco; AB Volvo; Exone; Siemens; Heller Maschinenfabrik GmbH; DMG MORI; Hilti; SK LASER; Tamturbo turbo compressors; Metso Outotec

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Equipment As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels, and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global equipment as a service market based on equipment, financing models, end-use, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Air Compressor

-

Pump

-

Power Tools

-

Ground Power Units

-

Laser Cutting Machines

-

Printing Machines

-

CNC machines

-

Material handling system

-

Packaging Machine

-

Excavators

-

Cranes

-

Turning and milling machines

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Air Compressor

-

Pump

-

Power Tools

-

Ground Power Units

-

Excavators

-

Cranes

-

Material Handling

-

Mining

-

Air Compressor

-

Pump

-

Ground Power Units

-

Excavators

-

Cranes

-

Manufacturing

-

Air Compressor

-

laser cutting machines

-

CNC machines

-

Turning and milling machines

-

Packaging

-

Packaging Machine

-

Printing Machines

-

-

Financing Models Outlook (Revenue, USD Million, 2018 - 2030)

-

Subscription-Based

-

Outcome-Based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global Equipment as a Service market size was estimated at USD 1,509.1 million in 2023 and is expected to reach USD 2,169.6 million in 2024.

b. The Equipment as a Service market is expected to grow at a compound annual growth rate of 43.0% from 2024 to 2030 to reach USD 27,804.4 million by 2030.

b. The laser cutting machine equipment segment led the market and accounted for 15.5 % of the global revenue share in 2023. Due to the intense competition among manufacturers of laser cutting machine, the major companies in the laser cutting industry are concentrating on lowering the cost of these equipment by implementing EaaS models, thereby driving market expansion.

b. Some of the key players operating in the Equipment as a Service market include TRUMPF; Atlas Copco; KAESER KOMPRESSOREN; Heidelberger Druckmaschinen AG; SMS group GmbH; Arnold Machine; Uteco; AB Volvo; Exone; Siemens; Heller Maschinenfabrik GmbH; DMG MORI; Hilti; SK LASER; Tamturbo turbo compressors; Metso Outotec.

b. Increasing consumer adoption of cutting-edge technologies, coupled with increased equipment uptime & efficiency provided by EaaS, will drive the market expansion over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.