- Home

- »

- Animal Health

- »

-

Equine Imaging Services Market Size, Industry Report, 2030GVR Report cover

![Equine Imaging Services Market Size, Share & Trends Report]()

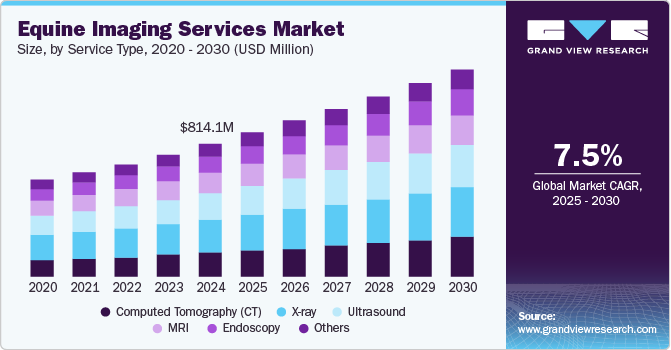

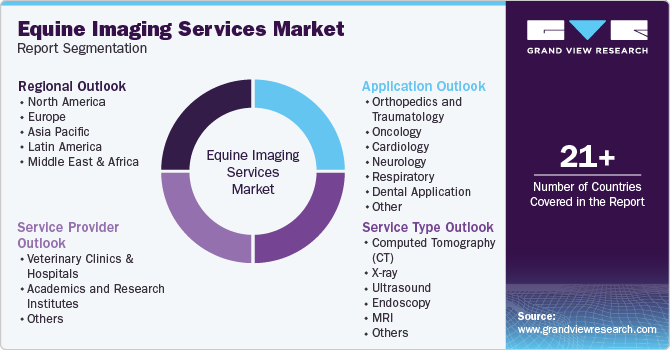

Equine Imaging Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Computed Tomography (CT), X-ray, Ultrasound, Endoscopy, MRI, Others), By Application, By Service Provider, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-503-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Equine Imaging Services Market Trends

The global equine imaging services market size was estimated at USD 814.05 million in 2024 and is expected to grow at a CAGR of 7.51% from 2025 to 2030. The market growth is primarily driven by several factors, such as the rising need for early disease diagnosis coupled with the growing equine population; increasing initiatives and investments by government organizations, animal welfare associations, veterinary industry key players to tackle zoonosis, technological advancements in equine imaging services; and increase in installation of advanced equine Imaging systems in veterinary hospitals. For instance, in August 2024, Melbourne-based startup XREq developed a groundbreaking add-on for existing X-ray machines, enabling advanced imaging comparable to MRI and CT scans with reduced radiation. Targeting the equine market, this technology addresses the high demand for detailed imaging in thoroughbred healthcare, offering cost-effective and accessible solutions for local veterinary clinics and horse breeders.

Additionally, the growing expansion of veterinary hospitals is expected to drive the equine imaging services market. For instance, in September 2024, CVS' Ayres Vets opened a modern, 6,000 sq. ft. facility in Newcastle Quays, North Shields, following a £2 (USD 2.44) million investment. The practice now offers advanced diagnostic services, including a new CT scanner, digital x-ray, ultrasound, and an in-house lab, enhancing its capabilities to diagnose and treat complex conditions. Modern facilities with advanced diagnostic tools, such as CT scanners, digital X-rays, ultrasound, and in-house laboratories, enable accurate and timely diagnosis of complex conditions. This improves patient outcomes, attracts more clients, and increases the demand for specialized diagnostic equipment and services, fueling growth of the equine imaging services industry.

Service Type Insights

The X-ray segment dominated the market with a revenue share of 25.17% in 2024. This can be attributed to a rising prevalence of musculoskeletal issues, imaging technology advancements, quick and efficient diagnostics, a focus on bone health, cost-effectiveness, and specialized applications within equine veterinary practice. Similarly, a growing development of digital radiology solutions contributes to segment growth. For instance, in April 2024, MiREYE Imaging launched veterinary X-ray machines in the U.S., which use AI for X-ray diagnostic imaging.

The Computed Tomography (CT) segment is expected to grow at a lucrative CAGR of 8.80% during forecast periods. The increasing availability of CT scanners in veterinary clinics has made this advanced imaging technique more accessible to equine practitioners. Improvements in technology, such as cone-beam CT systems, have facilitated the use of CT in smaller practices, expanding the reach of this diagnostic tool beyond large referral centers. For instance, in October 2024, Colorado State University’s Johnson Family Equine Hospital installed a state-of-the-art Qalibra CT scanner, enabling high-resolution, 3D imaging of equine head and limb injuries without general anesthesia in most cases. This advanced technology enhances diagnostic options, including bone and some soft tissue evaluations, offering faster and more precise care for equine patients.

Application Insights

The orthopedics and traumatology segment held the largest market share in 2024. Horses are particularly susceptible to various orthopedic conditions due to their physical structure and the demands placed on them during activities such as racing, jumping, and other forms of exercise. Common issues include osteoarthritis, tendon injuries, and developmental orthopedic diseases. Accurate imaging is crucial for diagnosing these conditions effectively. Conditions such as osteochondrosis and angular limb deformities are common in young horses, with estimates suggesting that 10% to 50% of growing foals may be affected depending on various factors like breed and management practices.

Furthermore, the growing launch of advanced veterinary imaging systems specifically designed for orthopedic imaging is expected to drive segment growth. For instance, in January 2025, Veheri launched a teleradiology platform offering equine, small animal, and exotic veterinary imaging services. The platform provides expert-reviewed X-ray, CT, and MRI reports with fast turnaround times (under 12 hours) and multilingual capabilities, streamlining diagnostics for equine imaging professionals.

The dental application segment is expected to grow at a CAGR of 8.49% over the forecast period. The demand for equine dental imaging services is growing due to the increasing recognition of dental diseases' impact on equine health, especially in performance and older horses. Advanced imaging, like radiographs and CT scans, helps diagnose conditions like fractures, caries, and tooth resorption, enabling precise treatments. For example, diagnostic imaging is crucial for detecting issues such as infundibular cemental caries, which can lead to complications if untreated, driving the need for specialized imaging services in veterinary practices.

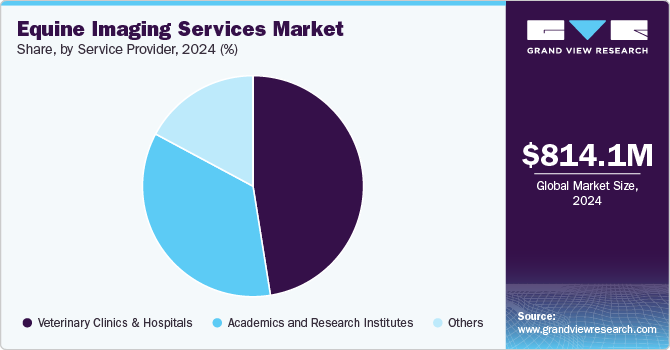

Service Provider Insights

The veterinary hospital & clinic segment dominated the market in 2024 and is expected to grow at a CAGR of 7.48% over the forecast period. The demand for equine imaging services in veterinary hospitals and clinics has surged due to the need for precise diagnostics and effective treatment of complex conditions like fractures, dental diseases, and lameness. Advanced imaging techniques such as radiographs, CT, and MRI allow for detailed assessments, improving outcomes and streamlining workflows. By enabling early detection and accurate diagnosis, these imaging modalities allow for timely interventions. This proactive approach can lead to quicker recovery times for horses, as conditions can be addressed before they worsen. For instance, equine dental imaging helps detect issues like fractures or caries, enabling timely interventions to prevent further complications. Additionally, the increase in the installation of advanced imaging instruments, such as high-resolution radiography, CT scans, and MRI, in veterinary hospitals and clinics is driving segment growth.

The academics and research institutes segment is estimated to witness the fastest CAGR during the forecast period. Academics and research institutes are increasingly installing advanced equine imaging systems to enhance diagnostic capabilities, support veterinary education, and conduct pioneering research into equine diseases. These systems, such as high-resolution CT and MRI scanners, enable detailed studies of soft tissues, bones, and neurological conditions, improving early diagnosis and treatment outcomes. As a result, their adoption is expected to drive growth in the equine imaging service market by advancing clinical practices, training programs, and research innovations. For instance, in December 2024, The Royal Veterinary College (RVC) installed a state-of-the-art Qalibra Exceed CT scanner in its Equine Referral Hospital, enhancing diagnostic capabilities for head, neck, and limb issues in horses. This advanced scanner allows for improved imaging of hard-to-reach areas, such as the head, upper neck, and pelvis, aiding in the diagnosis of conditions like headshaking, lameness, and neurological disorders. Its speed, large bore, and ability to scan standing sedated horses significantly improve the quality of images and diagnostic accuracy.

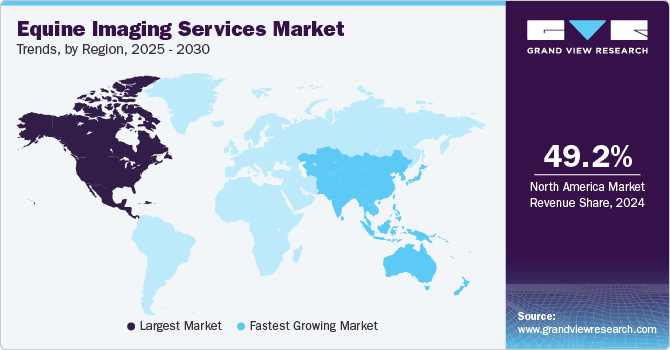

Regional Insights

The North America equine imaging services industry held the largest revenue share of 49.17% in 2024. The growing strategic initiatives such as acquisition of veterinary hospitals is expected to drive the North America market. For instance, in January 2024, Altano Group acquired Moore Equine, a leading Canadian equine clinic, strengthening its global network and enhancing access to advanced veterinary care. The partnership emphasizes modern equine imaging services, education, and knowledge-sharing, driving innovation and quality care in North America's equine veterinary market. Additionally, expanded capacities and specialized wards for horses enhance service scope and accessibility, further boosting the market.

U.S. Equine Imaging Services Market Trends

The equine imaging services industry in the U.S. is growing due to the growing introduction of advanced equine imaging technologies in the U.S. These innovations enhance diagnostic accuracy and reduce the need for general anesthesia, attracting more veterinary practices and improving service quality, especially for equine athletes. This trend is expanding the market for advanced imaging services across the U.S. For instance, in June 2024, Virginia Equine Imaging, a leading equine sports medicine clinic in The Plains, Virginia, introduced the Asto CT Equina Standing CT Scanner, the first dual-axis fan-beam CT system designed for imaging both limbs and the head/neck of sedated standing horses. This advanced technology improves diagnostic precision and treatment planning without general anesthesia, enhancing the clinic's ability to provide exceptional care for equine athletes. The addition solidifies Virginia Equine Imaging's position at the forefront of equine healthcare innovation.

Europe Equine Imaging Services Market Trends

Europe's equine imaging services industry held the second-largest share in 2024, owing to the increasing adoption of advanced technologies like standing CT and MRI scanners for equine diagnostics. For instance, in March 2024, The Dick Vet Equine Hospital in Scotland became the first in the region to offer both standing CT and MRI scans for equine patients, enhancing diagnostic capabilities for lameness and foot problems. This addition of dual imaging modalities reflects a growing trend in Europe’s market, where advanced technologies like CT and MRI are being integrated to provide more accurate, faster, and less invasive diagnostic solutions for horses.

The equine imaging services market in Germany is growing as major players are implementing strategies, including mergers & collaborations, to expand their product lines and produce high-value products, which is anticipated to increase demand for veterinary diagnostic kits in Germany. GVG Diagnostics GmbH, for instance, represents reliability, innovation, & excellence.

Asia Pacific Equine Imaging Services Market Trends

The Asia Pacific equine imaging services industry is estimated to grow at the fastest CAGR of 9.94% in 2024. The expansion of the livestock industry and the growing popularity of equestrian sports in countries like China and Australia are driving demand for comprehensive veterinary imaging services. This trend is linked to more horse owners seeking advanced healthcare solutions. Furthermore, countries such as China & India are anticipated to have strong growth potential, with the number of industrial facilities in the region increasing. Increasing R&D investment by market players in developing value-added products is expected to boost regional market growth. For instance, in July 2024, SK Telecom launched its AI veterinary diagnostic tool, 'X Caliber,' in Malaysia, Thailand, and Vietnam, partnering with key regional players to meet Southeast Asia's growing pet care demand.

India's equine imaging services market is growing rapidly due to increasing interest in equine sports and veterinary care advancements. With initiatives like the launch of equine eco-tourism at ICAR-National Research Centre in February 2024 and the development of specialized mobile apps like Mare-USG, there is a growing focus on equine health and diagnostics. Adopting advanced imaging technologies, such as ultrasound and MRI, in veterinary clinics is becoming more prevalent to address equine health concerns and injuries, contributing to the market's expansion.

Latin America Equine Imaging Services Market Trends

The Latin America equine imaging services industry is driven by rising awareness of equine health and advancements in veterinary diagnostics. Increasing adoption of advanced imaging technologies, including MRI and CT scans, is enhancing the diagnosis and treatment of equine injuries, especially in countries with established equestrian sports like Brazil and Argentina. The market is also supported by a growing number of veterinary clinics offering specialized imaging services and partnerships with global providers of equine imaging equipment, contributing to improved care for equine athletes and recreational horses in the region.

The equine imaging services market in Brazil is expected to grow during the forecast period. The increasing prominence of equine sports events and the participation of Brazilian athletes in global competitions, including the Olympics, is driving growth in Brazil's market. As equine sports like show jumping, dressage, and eventing gain popularity, there is a rising demand for advanced diagnostic services to ensure optimal health and performance of competition horses. For example, Brazil's focus on developing world-class equine sports facilities and veterinary care has led to greater integration of advanced imaging technologies, such as MRI and standing CT scans, to enhance the diagnosis and treatment of equine injuries.

Middle East & Africa Equine Imaging Services Market Trends

The Middle East & Africa equine imaging services industry is anticipated to expand steadily over the forecast period due to rising demand for advanced equine healthcare, increasing participation in equine sports, and government investments in veterinary infrastructure. For instance, in December 2024, Salam Equine Hospital, located in Buraidah, Saudi Arabia, represents a significant advancement in equine healthcare with its state-of-the-art facilities and focus on research and innovation. It aims to set global standards in equine medicine by offering comprehensive services, including advanced imaging, surgery, and reproductive techniques. The hospital has partnered with leading international institutions and prioritizes horse safety, intensive care, and ongoing research in veterinary care. This development reflects the growing demand for sophisticated equine imaging and veterinary services in the Middle East and North Africa (MEA) region, positioning Saudi Arabia as a leader in veterinary innovation.

The equine imaging services market in the UAE is growing significantly due to the growing equine sports programs in the UAE, supported by significant investments and government backing. With initiatives like the Longines Nations Cup and the President's Cup attracting global participation, there is an increasing need for precise diagnostics and treatment, pushing the adoption of advanced imaging technologies in the UAE. This trend is exemplified by the rise in equine veterinary clinics offering cutting-edge imaging services to enhance performance and injury recovery for elite athletes.

Key Equine Imaging Services Company Insights

The market is competitive due to the presence of a wide range of players, from equine hospitals & clinics to veterinary academics and research institutes such as the University of Edinburgh's Dick Vet Equine Hospital, Cornell University College of Veterinary Medicine, etc. These involve implementing cutting-edge and efficient equine imaging services to promote horse healthcare outcomes, diagnostic accuracy, efficiency, and cost reduction. Existing market players keep executing strategic initiatives such as joint ventures, mergers, and acquisitions and introducing new products and product upgrades to strengthen their position in the market. For example, In March 2024, Prisma Imaging entered into a partnership with Triple Ring Technologies. This partnership aims to develop a cutting-edge equine CT imaging system enabling high-quality scans of conscious, sedated horses. This innovative system integrates motion tracking, X-ray imaging, and advanced reconstruction algorithms, enhancing safety and precision in equine veterinary diagnostics.

Key Equine Imaging Services Companies:

The following are the leading companies in the equine imaging services market. These companies collectively hold the largest market share and dictate industry trends.

- Surrey Hills Equine Veterinary Practice

- Moore Equine P.C.

- Daniel Equine Services

- Cornell University College of Veterinary Medicine

- Hagyard Equine Medical Institute

- Mid-Atlantic Equine Medical Center

- Royal Veterinary College's Equine Referral Hospital.

- Rainbow Equine Hospital Limited

- Chine House Veterinary Hospital Ltd

- National Research Center on Equines.

Recent Developments

-

In January 2025, Tennessee Equine Hospital East, opening in Shelbyville, Tennessee, will expand advanced equine imaging and ambulatory services across the region. This addition reflects the growing demand for accessible, high-quality equine diagnostics and care, strengthening the hospital network's commitment to innovative imaging solutions for horse owners.

-

In December 2024, The Royal Veterinary College (RVC) introduced a state-of-the-art CT scanner at its Equine Referral Hospital, enabling advanced imaging for horses. This technology allows detailed evaluation of previously inaccessible regions, such as the head, neck, limbs, pelvis, and joints, enhancing early diagnosis and treatment of lameness, trauma, and neurological issues.

-

In October 2024, Colorado State University's Johnson Family Equine Hospital installed an advanced Qalibra CT scanner, enabling high-resolution 3D imaging of equine heads and lower limbs without general anesthesia. This technology broadens diagnostic capabilities for bone and some soft tissue injuries, offering faster, more detailed evaluations to enhance equine care.

Equine Imaging Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 880.48 million

Revenue Forecast in 2030

USD 1.26 billion

Growth rate

CAGR of 7.51% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, application, service provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Surrey Hills Equine Veterinary Practice; Moore Equine P.C.; Daniel Equine Services; Cornell University College of Veterinary Medicine; Hagyard Equine Medical Institute; Mid-Atlantic Equine Medical Center; Royal Veterinary College's Equine Referral Hospital; Rainbow Equine Hospital Limited; Chine House Veterinary Hospital Ltd; National Research Center on Equines

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Equine Imaging Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global equine imaging services market report based on service type, application, service provider, and region:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Computed Tomography (CT)

-

X-ray

-

Ultrasound

-

Endoscopy

-

MRI

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics and Traumatology

-

Oncology

-

Cardiology

-

Neurology

-

Respiratory

-

Dental Application

-

Other

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Clinics & Hospitals

-

Academics and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global equine imaging services market size was estimated at USD 814.05 million in 2024 and is expected to reach USD 880.48 million in 2025.

b. The global equine imaging services market is expected to grow at a compound annual growth rate of 7.51% from 2025 to 2030 to reach USD 1,264.7 million by 2030.

b. North America equine imaging services market held the largest revenue share of 49.17% in 2024. The growing strategic initiatives, such as the acquisition of veterinary hospitals, are expected to drive the North America equine imaging services market. For instance, in January 2024, Altano Group acquired Moore Equine, a leading Canadian equine clinic, strengthening its global network and enhancing access to advanced veterinary care. The partnership emphasizes modern equine imaging services, education, and knowledge-sharing, driving innovation and quality care in North America's equine imaging market.

b. Some key players operating in the equine imaging services market include Surrey Hills Equine Veterinary Practice, Moore Equine P.C., Daniel Equine Services, Cornell University College of Veterinary Medicine, Hagyard Equine Medical Institute, Mid-Atlantic Equine Medical Center, Royal Veterinary College's Equine Referral Hospital., Rainbow Equine Hospital Limited, Chine House Veterinary Hospital Ltd, National Research Center on Equines.

b. Key factors that are driving the market growth include the rising need for early disease diagnosis coupled with the growing equine population; increasing initiatives and investments by government organizations, animal welfare associations, and key players in the veterinary industry to tackle zoonosis; technological advancements in equine imaging services; and an increase in the installation of advanced equine imaging systems in veterinary hospitals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.