Epoxy Curing Agents Market Size, Share & Trends Analysis Report By Product, By Application (Paints & Coatings, Electronics, Wind Energy, Construction, Adhesives, Composites), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-383-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Epoxy Curing Agent Market Size & Trends

“2030 Epoxy Curing Agents Market value to reach USD 5,614.50 million”

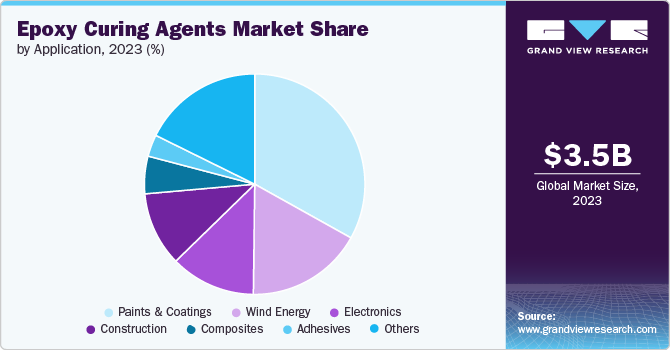

The global epoxy curing agents market size was estimated at USD 3,542.52 million in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. This growth is attributed to the increasing use of epoxy curing agent in various applications such as construction, wind energy, adhesives, coatings, composite and electrical and electronics industries is driving the market.

Epoxy curing agents serve as essential additives used together with epoxy polymers to create high-quality end products. They preserve outstanding adhesive qualities even after the curing process. These agents offer remarkable resistance to chemicals, strong mechanical durability, and electrical insulation capabilities. Curing epoxy resin is exothermic, potentially leading to excessive heat if not adequately managed.

Drivers, Opportunities & Restraints

The sustained growth in wind energy production has prompted higher demand for durable, lightweight, high-performing materials. Consequently, this has led to greater use of resin-curing agents, spurring manufacturers to innovate and create more advanced products. These advanced curing agents offer better flow properties and quicker cure times, contributing to decreased blade production time, reduced weight, and lower costs.

As a result, employing epoxy resins and their curing agents has significantly reduced production, maintenance, and repair costs. The wind energy sector significantly uses composite materials, especially for fabricating rotor blades. The relentless need for advanced composite materials is driven by the necessity to endure extreme forces and environmental stress. Epoxy-based resins are predominantly chosen for crafting wind rotor blades. Leveraging these resins and curing agents, manufacturers can produce blades that are larger, more robust, and lighter, markedly elevating efficiency levels.

Numerous applications within the automotive industry leverage epoxy resins and curing agents. These applications range from protective coatings and adhesives to lightweight composite materials. Epoxy-based coatings are vital in offering unmatched protection against rust and corrosion. Such coatings are utilized in most of today's automobiles, nearly 90%. These coatings undergo a curing process, which enhances their resistance to UV light and other forms of damage. Beyond their role in adhesion, epoxy resins are used to create lightweight composite components, parts for electric and hybrid vehicles, suspension elements, structures that bear loads, and drive shafts. The ability of epoxies to strongly adhere to different materials is notable. With an increasing push towards reducing the weight of vehicles, materials like plastics and aluminum are becoming more prevalent in automotive part construction. This shift is, in effect, boosting the demand for epoxy-curing agents.

The global emphasis on environmental sustainability and reduced carbon footprint fosters the development of eco-friendly epoxy curing agents. The demand for green, sustainable solutions aligns with market trends, offering manufacturers opportunities to meet eco-conscious consumer preferences and regulatory requirements effectively. Robust economic growth in emerging markets presents a substantial opportunity for market expansion. Increasing construction activities and infrastructure development in these regions demand epoxy-curing agents, creating market penetration and growth avenues.

Product Insights & Trends

“Anhydrides emerged as the fastest growing product with a CAGR of 7.0%”

Amine dominated the market and accounted for a revenue share of 52.6% in 2023. Amines are commonly used as curing agents for epoxy resins due to their ability to form a cross-linked, thermoset polymer matrix, which enhances the mechanical and thermal properties of the cured epoxy. This reaction occurs when the amine groups react with the epoxide groups of the epoxy resin, leading to a highly durable and chemically resistant material. The choice of amine, whether aliphatic, cycloaliphatic, or aromatic, affects the curing time, flexibility, and final properties of the epoxy, making them versatile for various applications.

Anhydrides are used as curing agents in epoxy resin systems and serve a critical role in determining the final properties of the cured material. By reacting with the epoxy groups, they help in creating highly cross-linked polymers, resulting in materials that exhibit excellent thermal and chemical resistance. This makes anhydride-cured epoxies suitable for applications requiring high-performance characteristics, including coatings, adhesives, and composites in various industries such as aerospace, automotive, and electronics.

Application Insights & Trends

“Wind Energy emerged as the fastest growing application with a CAGR of 7.4%”

Paints & coatings dominated the market with a market and accounted for a revenue share of 33.1% in 2023. Epoxy curing agents play a critical role in the performance of paints and coatings. These agents facilitate the cross-linking process, turning the liquid epoxy resins into solid and durable finishes. This transformation enhances the mechanical properties, chemical resistance, and durability of the coating, making it suitable for various applications, from industrial flooring to corrosion protection. Different types of curing agents can adjust the cure time, temperature, and final properties of the epoxy coating to meet specific requirements.

In wind energy, epoxy curing agents play a crucial role in enhancing the durability and performance of wind turbine blades. These agents are used in the manufacturing process of the blades, facilitating the epoxy resin to harden, which ultimately contributes to the blade's strength and weather resistance. This is vital, as it ensures the turbines can withstand high winds and harsh environmental conditions, improving their efficiency and lifespan. Using specific curing agents allows for the tailored properties of the composite materials used in blades, optimizing them for their critical role in wind energy generation.

Regional Insights & Trends

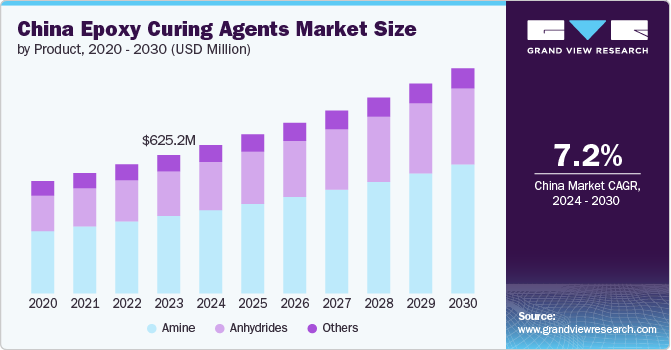

“China emerged as the fastest growing region in Asia Pacific with a CAGR of 7.2% in 2030”

Asia Pacific dominated the market and accounted for a 45.60% share in 2023. This growth is attributed to increasing usage of the product in the electrical and electronics industry. The rising construction activity in emerging economies such as China, India, Japan, South Korea, Australia is expected to further drive the Asia Pacific market.

China Epoxy Curing Agents Market Trends

China dominated the market and accounted for a market share of 38.70% in 2023. This growth is attributed to increasing demand for the product market in the country. The rise in demand is due to the rising construction activity in the country. China’s construction industry is growing leading to rise in demand for the product market in the region.

North America Epoxy Curing Agents Market Trends

The North American market is expected to grow due to growing construction industry in the region. This growth will lead to a rise in demand for the product which is used in the paints and coatings in the region.

Europe Epoxy Curing Agents Market Trends

Europe plays a significant role in the market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for construction activity in the region leading to increased demand for product market.

Key Epoxy Curing Agents Company Insights

Some of the key players operating in the global epoxy curing agent market include

-

BASF SE operates through six business segments, namely chemicals, materials, industrial solutions, surface technologies, nutrition & care, and agricultural solutions. The products offered by the company find application in industries such as agriculture, construction, pharmaceuticals, energy & power, home care & nutrition, automotive & transportation, rubber & plastics, leather & textiles, and personal care & hygiene. The company has a global presence.

-

The company is predominantly owned by the RAG Foundation. The company manufactures polymers. It has five divisions, namely Specialty Additives, Nutrition and Care, Smart Materials, Performance Materials, and Technology and Infrastructure. The company caters to end-use markets such as consumer & personal care, paints & coatings, agriculture, plastics & rubber, construction, pharmaceuticals, electrical & electronics, renewable energies, paper & printing, metal & oil, automotive & mechanical engineering, and food & animal feed. It has set up production facilities at 102 locations in 27 countries.

Huntsman Advanced Materials and Mitsubishi Chemical Company. are some of the emerging market participants in the global concrete bonding agent’s market.

-

Huntsman Advanced Materials is a global manufacturer specializing in organic chemical products. The company's main activities involve producing and distributing various chemicals and formulations, including maleic anhydride, amines, epoxy-based polymer formulations, MDI, textile chemicals, and dyes. These products find applications in multiple industries, such as adhesives, aerospace, personal care and hygiene, automotive, construction, consumer products, digital inks, electronics, power generation, medical, packaging, coatings, synthetic fiber, and textile chemicals. Huntsman has a global presence and reaches its diverse customers through a global network of administrative, research and development, and manufacturing units.

-

Mitsubishi Chemical Group Corp (MCGC) is a manufacturer and distributor of chemicals company. The company offers various products and services, including high-performance chemicals, advanced polymers, high-performance films, advanced moldings and composites, carbon, petrochemicals, methyl methacrylate, industrial gases, and environment and living solutions. Its clientele spans various sectors: mobility, environment and new energy, information technology, electronics and display, medical, food and packaging, bioproducts, healthcare, and labels and films. With a global presence, the company serves customers worldwide.

Key Epoxy Curing Agents Companies:

The following are the leading companies in the epoxy curing agents market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Hexion Inc.

- Olin Corporation

- Huntsman Corporation

- Evonik Industries

- Air Products & Chemicals, Inc.

- Atul Limited

- Mitsubishi Chemical Corporation

- Cardolite Corporation

- Grasim Industries Limited (India) and Aditya Birla Chemicals (Thailand)

- Kukdo Chemical Co., Ltd.

Recent Developments

-

In April 2024, Evonik announced the launch of its new range of curing agents by introducing Ancamine 2844, a groundbreaking hardener for epoxy cures designed explicitly for use in multi-component spray processes. This advanced, high-performance aliphatic amine hardener provides extremely rapid curing and accelerates property development under challenging temperature conditions, both low and high.

-

In December 2023, BASF SE announced the completion of its capacity expansion for essential specialty amines in the U.S. The expansion aimed to produce more key polyether amines and amine catalysts marketed under the Baxxodur and Lupragen brands.

Epoxy Curing Agents Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3,783.41 million |

|

Revenue forecast in 2030 |

USD 5,614.50 million |

|

Growth rate |

CAGR of 6.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Hexion Inc.; Olin Corporation; Huntsman Corporation; Evonik Industries; BASF SE; Air Products and Chemicals, Inc.; Atul Limited; Mitsubishi Chemical Corporation; Cardolite Corporation; Grasim Industries Limited (India) and Aditya Birla Chemicals (Thailand) Pvt. Ltd; and Kukdo Chemical Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Epoxy Curing Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global epoxy curing agent market report product, application, and region.

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Amine

-

Anhydrides

-

Other Products

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Electronics

-

Wind Energy

-

Construction

-

Composites

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global epoxy curing agents market was valued at USD 3542.52 million in 2023 and is expected to reached USD 3,783.41 million in 2024.

b. The global epoxy curing agents market is anticipated to grow at a high CAGR of 6.8% to reach USD 5614.50 million by 2030

b. Asia Pacific dominated the market and accounted for a 45.60% share in 2023. This growth is attributed to increasing usage of the product in the electrical and electronics industry. The rising construction activity in emerging economies such as China, India, Japan, South Korea, Australia is expected to further drive the Asia-Pacific market.

b. Some of the key players operating in the global epoxy curing agents market are BASF SE, Huntsman Advanced Materials and Mitsubishi Chemical Company, among others.

b. This growth of the global epoxy curing agents market is attributed to the increasing use of epoxy curing agent in various applications such as construction, wind energy, adhesives, coatings, composite and electrical and electronics industries is driving the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."