Epilepsy Monitoring Devices Market Size, Share & Trends Analysis Report By Product (Wearable Devices, Conventional Devices), By End-use (Neurology Centers, Diagnostic Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-345-5

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Epilepsy Monitoring Devices Market Trends

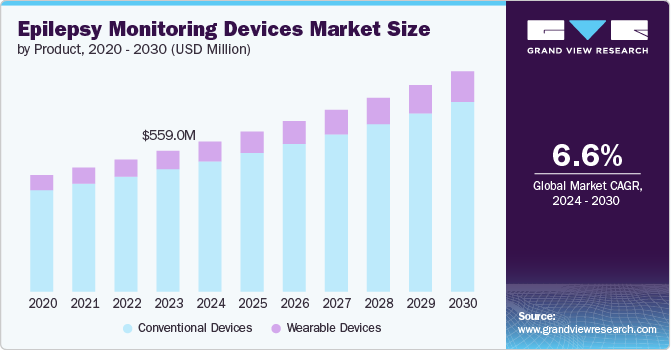

The global epilepsy monitoring devices market size was estimated at USD 559.0 million in 2023 and is projected to grow at a CAGR of 6.6% from 2024 to 2030. The market is driven by several factors, such as the increasing prevalence of epilepsy, advances in technology, growing demand for ambulatory monitoring, rising use of wearable devices, and growing government initiatives.

Further, the increasing need for improved diagnosis and treatment, growing competition, and growing importance of telemedicine are also some of the primary factors fueling the market growth. The prevalence of epilepsy is increasing globally, with a significant number of people affected worldwide.

Epilepsy is a neurological disorder that affects an estimated 50 million people worldwide, making it one of the most common chronic conditions globally, according to the World Health Organization (WHO). According to the same report, around 80% of people with epilepsy live in low- and middle-income countries (LMIC), where access to quality healthcare is often limited. The condition is characterized by recurring seizures, which can have a significant impact on a person's quality of life. Effective diagnosis and treatment of epilepsy require advanced monitoring devices that can detect and track seizures in real-time.

In the U.S. alone, over 3 million individuals are estimated to be living with epilepsy. Further, in 2021, about 2.9 million U.S. adults 18 and older reported having active epilepsy, as per the U.S. Centers for Disease Control and Prevention.

The advancement of wearable technology and data analytics has revolutionized the field of epilepsy monitoring devices. The introduction of smartwatches and fitness trackers equipped with seizure detection algorithms has enabled the continuous monitoring of a patient's physiological data, including heart rate, movement, and electrodermal activity. This allows for detecting potential seizure episodes in real-time, providing patients and healthcare providers with timely and accurate information to make informed decisions about treatment and management. For instance, in February 2024, Empatica Inc., a pioneering company in continuous, non-invasive, and discreet monitoring for neurological conditions, announced the launch of EpiMonitor. This latest innovation in wearable epilepsy monitoring solutions is designed for adults and children aged 6 and above, offering cutting-edge technology that provides unparalleled convenience and accuracy in detecting and managing seizures.

Furthermore, growing government initiatives such as funding and investments for epilepsy research are expected to fuel the market's growth over the forecast period. For instance, Epilepsy Research Institute UK announced that the UK government has invested over USD 1.89 million in grant funding into Epilepsy Research UK through its Medical Research Charities Early Career Researchers Support Fund. The charity received USD 1.35 million in 2022-23 and USD 562,010.5 in 2021-22. Further, in March 2024, the British Epilepsy Association announced a USD 48.66 million investment into research for cancer, dementia, and epilepsy.

Product Insights

Conventional devices dominated the market in 2023 due to their ease of use, low cost, and high accuracy. They are also affordable compared to advanced or innovative technologies, making them accessible to a broader range of healthcare facilities and patients.The conventional devices segment includes video electroencephalography (EEG), video-EEG (vEEG), and long-term monitoring devices. According to the research studies published in National Institutes of Health (NIH) journals, ambulatory EEG systems that are part of the conventional device segment are preferred for long-term monitoring as they are comfortable for patients and easy for clinicians to interpret results.

The wearable devices product segment is poised to be the fastest-growing segment in the market, driven by the increasing adoption of wearable technology and the need for more convenient and cost-effective monitoring solutions. The increasing adoption of wearable technology has led to a surge in the development of wearable epilepsy monitoring devices. These devices use advanced sensors and algorithms to detect and monitor seizure activity, providing patients valuable insights into their condition. Wearable devices are also more user-friendly and easier to use, making them more appealing to patients with difficulty using traditional monitoring devices.

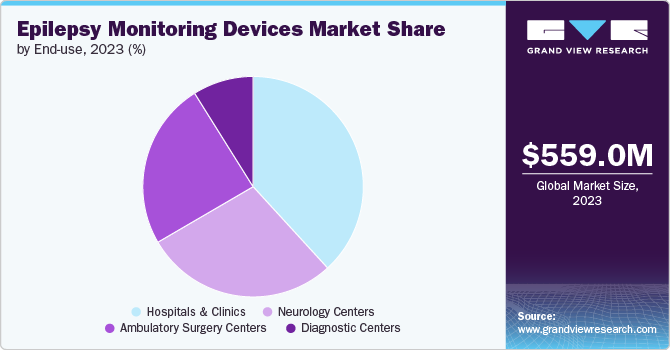

End-use Insights

The hospitals & clinics segment holds the largest share of the market for several reasons. Hospitals and clinics provide high-acuity care, which requires advanced monitoring technologies to manage complex medical conditions like epilepsy. Epilepsy monitoring devices help healthcare professionals to quickly identify and respond to changes in the patient's condition, reducing the risk of complications and improving outcomes. Further, hospitals & clinics already have established infrastructure for monitoring patients, including electronic health records, patient monitoring systems, and medical imaging equipment. Epilepsy monitoring devices can be easily integrated into this existing infrastructure, making it easier to implement and use.

The ambulatory surgery centers segment is the fastest-growing end-use segment in the market due to several key factors. Ambulatory surgery centers offer a convenient and cost-effective alternative to traditional hospital settings for patients requiring epilepsy monitoring procedures. These centers provide:

-

Outpatient surgical care.

-

Allowing patients to undergo monitoring procedures without needing overnight hospital stays.

-

Reducing healthcare costs and increasing accessibility to care.

Regional Insights

The North America epilepsy monitoring devices market is expected to experience significant growth over the forecast period, driven by the increasing prevalence of epilepsy, advancements in technology, and growing demand for non-invasive monitoring solutions. Key players in the North American market include Medtronic, GE Healthcare, and Masimo. These companies are investing heavily in research and development to improve the accuracy and effectiveness of their devices. In recent years, there has been a shift towards miniaturization of devices, allowing for greater patient comfort and increased mobility. In addition, advancements in artificial intelligence (AI) and machine learning (ML) are being used to improve seizure detection and prediction.

U.S. Epilepsy Monitoring Devices Market Trends

The epilepsy monitoring devices market in the U.S. focuses on personalized care and remote patient monitoring. The Centers for Medicare & Medicaid Services (CMS) implemented reimbursement policies that cover wearable seizure detection devices, making these technologies more accessible to patients. For instance, In February 2024, AmeriHealth Caritas Pennsylvania revealed the development of clinical policies to facilitate informed coverage decisions for the Embrace 2 watch, a device designed for seizure detection. The organization's policies are grounded in guidelines from reputable industry sources, including the CMS, state regulatory agencies, the American Medical Association (AMA), medical specialty professional societies, and peer-reviewed professional literature. Increased awareness among healthcare professionals and patients regarding the benefits of early detection and monitoring of epileptic seizures further drives demand for these devices in the U.S.

Europe Epilepsy Monitoring Devices Market Trends

The epilepsy monitoring devices market in Europe is witnessing increased awareness and adoption of advanced monitoring technologies. Governments in the region established regulatory frameworks to facilitate the approval and commercialization of novel medical devices, such as the European Union's Medical Device Regulation (MDR). This has encouraged developing and introducing innovative epilepsy monitoring solutions tailored to the European healthcare landscape.

Asia Pacific Epilepsy Monitoring Devices Market Trends

The epilepsy monitoring devices market in Asia Pacific is the fastest-growing region, with a CAGR of 8.0% over the forecast period owing to the increasing prevalence of epilepsy, growing awareness about the condition, and advancements in technology. Japan, China, and India are among the key countries driving the growth of the Asia Pacific epilepsy monitoring device market. Japan is a significant market due to its high prevalence of epilepsy, while China's large population and growing middle class are contributing to an increasing demand for healthcare services. India is also experiencing a significant surge in the adoption of epilepsy monitoring devices, driven by government initiatives to improve healthcare infrastructure and increase awareness about the condition.

Key Epilepsy Monitoring Devices Company Insights

The epilepsy monitoring device market is highly competitive, with multiple players vying for dominance. The market is characterized by intense competition among established players, new entrants, and emerging companies. The key companies have a strong presence in the market, with a wide range of products and solutions catering to different market segments. Companies focus on developing innovative products that offer better accuracy, convenience, and ease of use.

Further, new entrants in the market include Empatica Inc. and Neurava, among others. These companies are focused on developing innovative products that address specific market needs.

Key Epilepsy Monitoring Devices Companies:

The following are the leading companies in the epilepsy monitoring devices market. These companies collectively hold the largest market share and dictate industry trends.

- NIHON KOHDEN CORPORATION

- Medtronic

- GE Healthcare

- Koninklijke Philips N.V.

- Compumedics Limited

- Natsu Medical

- Cadwell Industries, Inc.

- BrainScope Company, Inc.

- Seer Medical

- Stratus

Recent Developments

-

In June 2024, researchers from the University of Southern California (USC) developed a new artificial intelligence (AI) system to accurately detect/identify epileptic seizures, including rare and complex cases, even in young children. This advancement can improve the diagnosis and management of epilepsy, particularly for patients with atypical or hard-to-detect seizure patterns.

-

In February 2024, Empatica Inc., a pioneering company in continuous, noninvasive, and discreet monitoring for neurological conditions, announced the launch of EpiMonitor. This latest wearable epilepsy monitoring solution is designed for both adults and children aged 6 and above. It offers unparalleled convenience and accuracy in detecting and managing seizures.

-

In October 2023, NeuroPace, a commercial-stage medical device company, announced enhancements to its RNS System for epilepsy management, including the nSight Platform, Simple Set Programming, and Tablet Remote Monitor. These features simplify the experience for clinicians and patients, ultimately improving patient care and outcomes.

Epilepsy Monitoring Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 595.9 billion |

|

Revenue forecast in 2030 |

USD 874.4 billion |

|

Growth rate |

CAGR of 6.6% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

NIHON KOHDEN CORPORATION; Medtronic; GE Healthcare; Koninklijke Philips N.V.; Compumedics Limited; Natsu Medical; Cadwell Industries, Inc.; BrainScope Company, Inc.; Seer Medical; Stratus |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Epilepsy Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global epilepsy monitoring devices market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearable Devices

-

Conventional Devices

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Neurology Centers

-

Diagnostic Centers

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global epilepsy monitoring devices market size was estimated at USD 559.0 million in 2023 and is expected to reach USD 595.9 million in 2024.

b. The global epilepsy monitoring devices market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 874.4 million by 2030.

b. The hospitals & clinics segment holds the largest share in the end use of the epilepsy monitoring devices market for several reasons. Hospitals and clinics provide high-acuity care, which requires advanced monitoring technologies to manage complex medical conditions like epilepsy.

b. Some of the key players operating in the global epilepsy monitoring devices market include NIHON KOHDEN CORPORATION, Medtronic, GE Healthcare, Koninklijke Philips N.V., Compumedics Limited, Natsu Medical, Cadwell Industries, Inc., BrainScope Company, Inc., Seer Medical, and Stratus.

b. The global epilepsy monitoring devices market is driven by a several factors such as increasing prevalence of epilepsy, advances in technology, growing demand for ambulatory monitoring, rising use of wearable devices, government initiatives, development of new devices, need for improved diagnosis and treatment, increasing competition, and growing importance of telemedicine.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."