- Home

- »

- Clinical Diagnostics

- »

-

Enzyme Immunoassay Market Size, Industry Report, 2033GVR Report cover

![Enzyme Immunoassay Market Size, Share & Trends Report]()

Enzyme Immunoassay Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Reagents & Kits, Analyzers/Instruments, Software & Services), By Application (Oncology, Cardiology, Endocrinology), By Specimen, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-290-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Enzyme Immunoassay Market Summary

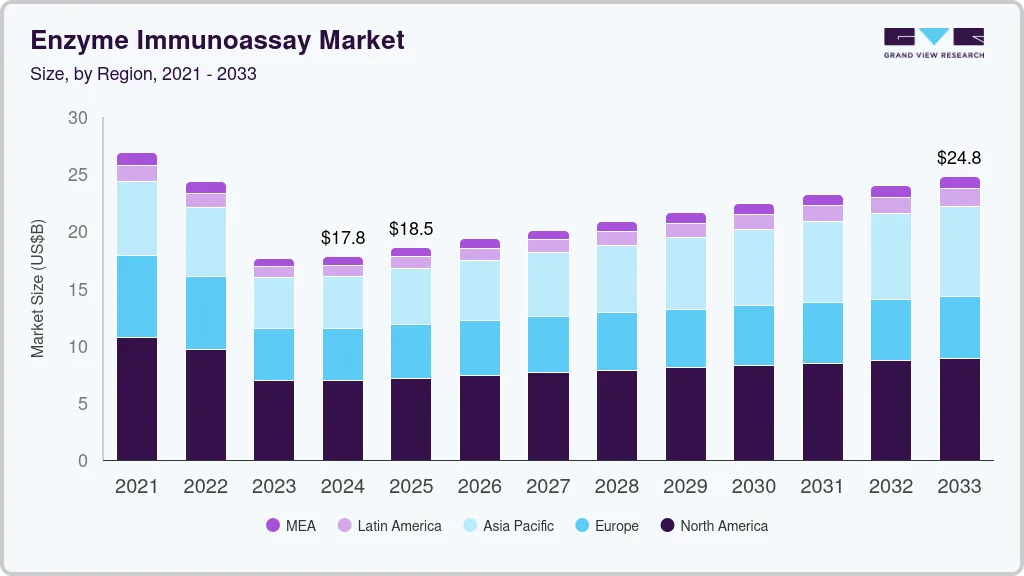

The global enzyme immunoassay market size was valued at USD 17.78 billion in 2024 and is projected to reach USD 24.77 billion by 2033, growing at a CAGR of 3.7% from 2025 to 2033. The industry growth can be attributed to the increasing demand for automation in diagnostic tests, increasing prevalence of chronic and infectious diseases, and growing awareness and use of diagnostic services.

Key Market Trends & Insights

- North America biomarker-based immunoassays market dominated the global market and accounted for the largest revenue share of 38.99% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024.

- By product, the reagents & Kits segment led the market with the largest revenue share of 67.75% in 2024.

- By applications, the infectious disease tetsing segment led the market with the largest revenue share of 27.27% in 2024.

- By specimen, the blood segment led the market with the largest revenue share of 39.99% in 2024.

- By end use, the hospitals segment led the market with the largest revenue share of 31.10% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.78 Billion

- 2033 Projected Market Size: USD 24.77 Billion

- CAGR (2025-2033): 3.7%

- North America: Largest market in 2024

Moreover, the growing geriatric population and increasing healthcare expenditure are also expected to drive the market growth in the coming years. According to the WHO, by the year 2050, the global population aged 60 years and above is projected to double, reaching 2.1 billion individuals. Additionally, the number of people aged 80 years or older is expected to triple from 2020 to 2050, reaching a total of 426 million.Enzyme Immunoassay (EIA) tests are extensively used to diagnose various infectious diseases, such as HIV, hepatitis B and C, tuberculosis, and certain types of influenza. According to WHO, 630, 000 people died from HIV-related causes globally, and 39.0 million people were living with HIV at the end of 2022. Governments and health organizations across the world implement public health campaigns to encourage regular HIV testing as a key strategy in HIV prevention and control. Such initiatives increase the utilization of EIA tests and drive the market.

Technological advancements are one of the significant drivers for the enzyme immunoassay market in the field of diagnostics for infectious diseases such as HIV, hepatitis B and C, tuberculosis, and certain types of influenza. Innovations in EIA technologies have led to improvements in test sensitivity, specificity, and speed, enhancing their utility in clinical settings. For instance, the development of automated EIA systems has significantly reduced manual labor and error rates while also increasing throughput capabilities. Large-scale screening procedures are made possible by this automation, which is particularly advantageous in regions with high disease prevalence and during public health campaigns. Robotic liquid handling systems and integrated assay platforms are examples of automation technologies that improve sample throughput, decrease hands-on time, and streamline the EIA workflow. Labs can efficiently process a large number of samples and satisfy the rising demand for diagnostic testing thanks to high-throughput EIAs.

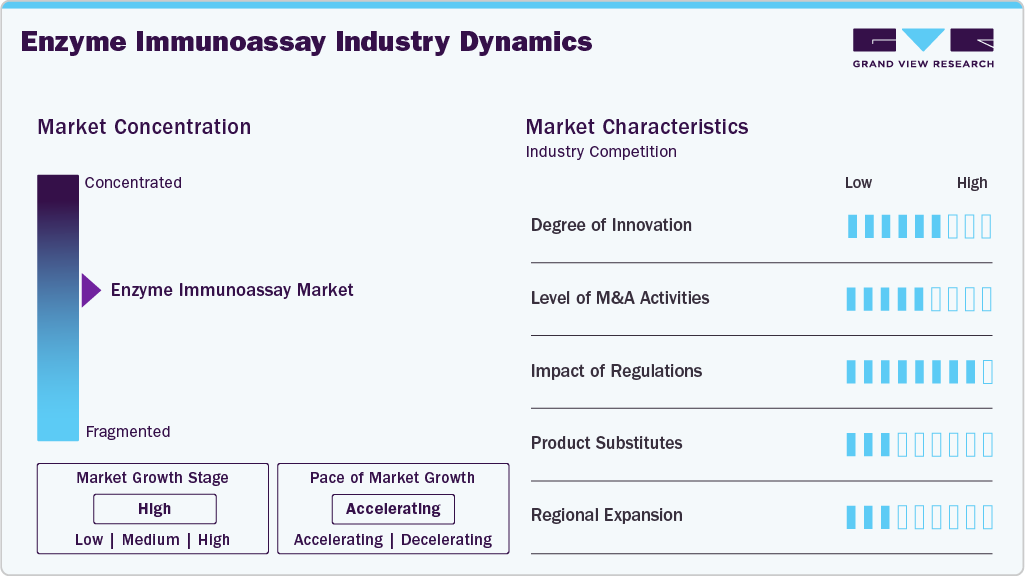

Market Concentration & Characteristics

The high degree of innovation in the enzyme immunoassay industry, driven by advances in scientific research, technology, and regulatory frameworks, has enhanced the capabilities of enzyme immunoassays. These developments have greatly increased the sensitivity, specificity, efficiency, and usability of enzyme immunoassays, which has led to their use in clinical diagnostics and other domains.

Mergers and acquisitions play a crucial role in the global market by driving innovation, expanding market reach, and enhancing product development. Collaborations between academic institutions, research laboratories, and EIA manufacturers can lead to innovative solutions and advancements in immunoassay technologies. Partnerships provide the necessary resources, funding, and expertise to conduct extensive R&D activities. This collaborative effort accelerates the development of new and improved EIA kits and platforms, ensuring better sensitivity, specificity, and faster results.

The impact of regulations can be significant, influencing various aspects from development to market entry, and ongoing compliance. Enzyme immunoassays are widely used in clinical diagnostics and research for the detection and quantification of specific antigens or antibodies. As such, they are subject to a complex regulatory landscape that aims to ensure their safety, efficacy, and reliability. Regulations govern the approval process for new EIA products. In the U.S., the Food and Drug Administration (FDA) requires premarket approval or clearance for most diagnostic tests, including EIAs, under its medical device regulations. This process can be time-consuming and costly, affecting the time it takes for products to reach the market.

The growing incidence of chronic illnesses, biotechnology breakthroughs, and the growing need for more precise and sensitive diagnostic tests are all contributing to the industry’s notable expansion. EIA technologies are becoming essential parts of diagnostic labs as healthcare systems around the world continue to prioritize early and precise disease detection. The shift to fully automated EIA platforms is one important trend. The need for multiplex assays that can identify several analytes from a single sample at once is rising. Gaining a competitive edge in the market can be achieved by creating multiplex EIA products with high specificity and sensitivity.

Regional expansion is a strategic approach to scale operations, penetrate new markets, and leverage opportunities created by regional differences in healthcare needs, regulatory environments, and technological advancements. Because of rising healthcare costs, rising awareness of infectious diseases, and developing healthcare infrastructure, developing nations present substantial growth prospects for EIA products. Businesses can concentrate on finding solutions for particular regional health issues, like dengue in Southeast Asia or tropical diseases in Africa.

Product Insights

The reagents and kits segment contributed the largest share of 67.75% in 2024. Reagents and kits designed for enzyme immunoassays have found applications across a wide range of fields, including clinical diagnostics, pharmaceutical analysis, and food safety testing. This broad applicability has driven their dominance as they cater to a diverse set of needs and requirements. The reagents and kits used in EIAs are made to offer high sensitivity and specificity. This is importrant in detecting and quantifying substances at very low concentrations, making them essential in diagnostics, specifically in identifying markers for various diseases such as HIV, hepatitis, and cancer. Furthermore, key players in the market are launching new reagnets and kits to capture major market share and it expected to support market growth in forecast years. For instance, in February 2021, Agilent Technologies Inc. launched Agilent Dako SARS-CoV-2 IgG enzyme-linked immunosorbent assay kit. It detects IgG antibodies to SARS-CoV-2 in human blood serum or plasma.

The software and services segment is anticipated to register a single-digit CAGR over the forecast period. The increasing complexity of immunoassay tests and the need for accurate, reliable results are pushing laboratories and healthcare facilities toward sophisticated software solutions. These solutions help in data management and ensure the precision of the assay results through advanced algorithms and data analysis techniques. In addition, the growing demand for automation in laboratories to handle high volumes of tests efficiently is another factor contributing to the growth of the software and services segment. Automation requires robust software to integrate different laboratory instruments and manage workflows, thereby driving the demand for specialized software solutions in the enzyme immunoassay market.

Application Insights

Based on application, the infectious diseases testing segment held the largest market share in 2024. The high prevalence and incidence rates of infectious diseases globally drive the demand for effective and efficient diagnostic methods. EIAs have a high preference because of their sensitivity and specificity. In addition, public health initiatives and global health programs focusing on controlling infectious diseases such as HIV, TB, and malaria rely on serological assays, including EIAs, for screening and monitoring the disease burden. EIAs' ability to handle large volumes of samples efficiently and ideal for mass screening purposes, thereby contributing to their dominance in this application segment.

The oncology segment is anticipated to experience significant growth over the forecast period. This is primarily due to the increasing prevalence of cancer worldwide and the need for early detection and monitoring of this disease. According to the American Cancer Society, approximately 1.96 million new cases of cancer were diagnosed in 2023. Due to their high sensitivity and specificity, enzyme immunoassays are a preferred method for the detection of biomarkers associated with various types of cancer. These assays can detect the presence of certain enzymes produced by cancer cells, aiding in the early diagnosis and treatment of the disease. Furthermore, advancements in technology drives the production of more efficient and cost-effective EIA tests, making them accessible to a broader range of healthcare facilities, including those in emerging markets.

Specimen Insights

In terms of specimen, the blood specimen segment held the largest share in 2024. Blood tests are a standard and crucial diagnostic tool across various medical specialties. Given that blood circulates throughout the body, it can carry markers of disease from different organs, making it an ideal specimen for broad-spectrum disease screening and monitoring, including infections, chronic diseases, and hormonal imbalances. Blood-based enzyme immunoassays are highly sensitive and specific. They can detect low levels of antigens and antibodies with a high degree of accuracy. This makes them important in early disease detection and in cases where accurate diagnosis is critical, such as in HIV or hepatitis testing.

The urine specimen segment is anticipated to grow at the fastest CAGR over the forecast period. Urine sampling is a non-invasive method, which makes it more favorable for patients and healthcare providers. This drives its usage, especially for regular monitoring and screening purposes. There is an increasing demand for point-of-care (POC) testing that can be performed outside traditional laboratory settings. Urine-based EIA kits are well-suited for POC testing because they can provide rapid results with minimal equipment. With a growing focus on preventive healthcare and early disease detection, screening programs for various conditions are increasing. Simple and effective urine tests are used in these programs, contributing to the segment's growth.

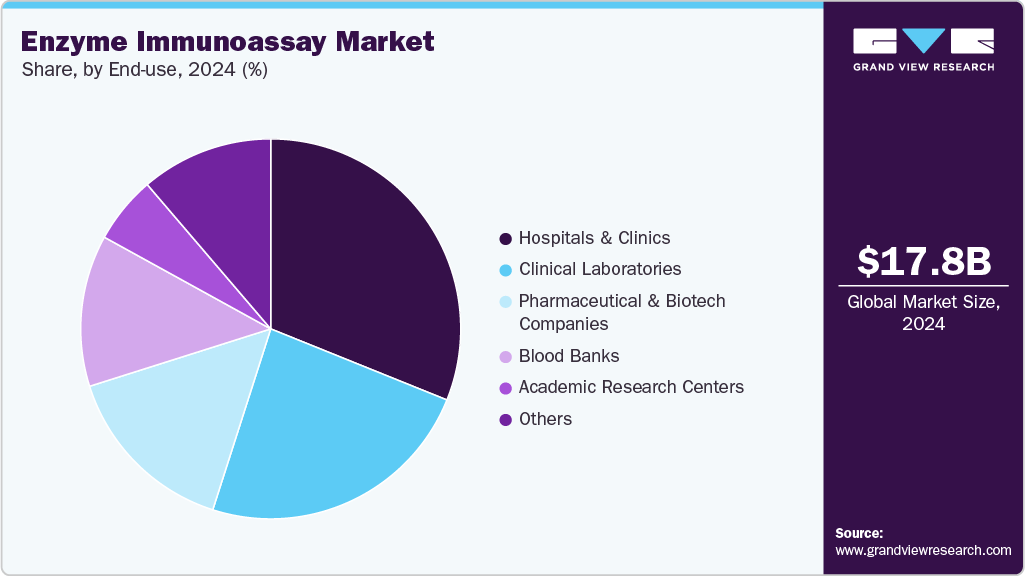

End Use Insights

The hospital segment dominated the global market, holding a 31.10% revenue share in 2024. Hospitals are the main medical facilities where a variety of illnesses are identified and managed. Using EIA technologies extensively, they handle a large number of patient samples for a variety of tests, such as those for autoimmune disorders, infectious diseases, and hormone imbalances. Rapid and accurate diagnostic techniques are essential for hospitals to efficiently manage patient care. These needs are met by EIAs, which offer accurate and timely results that are essential for making well-informed treatment decisions. Hospitals also provides with the infrastructure and financial means to implement the newest diagnostic technologies, such as advanced EIA platform in developed nations. This adoption is motivated by the need for improved patient outcomes, operational efficiency, and diagnostic accuracy.

The clinical laboratories segment is anticipated to grow at the fastest CAGR over the forecast period. There is a growing demand for diagnostic services due to the rising prevalence of chronic diseases and infectious diseases and the need for early disease detection. Clinical laboratories play a crucial role in the diagnosis and management of these conditions through various tests, including enzyme immunoassays. There is a rising awareness among the general population about the importance of preventive healthcare and early diagnosis. Coupled with increasing healthcare expenditure by governments and individuals, this trend supports the growth of diagnostic services, including those offered by clinical laboratories.

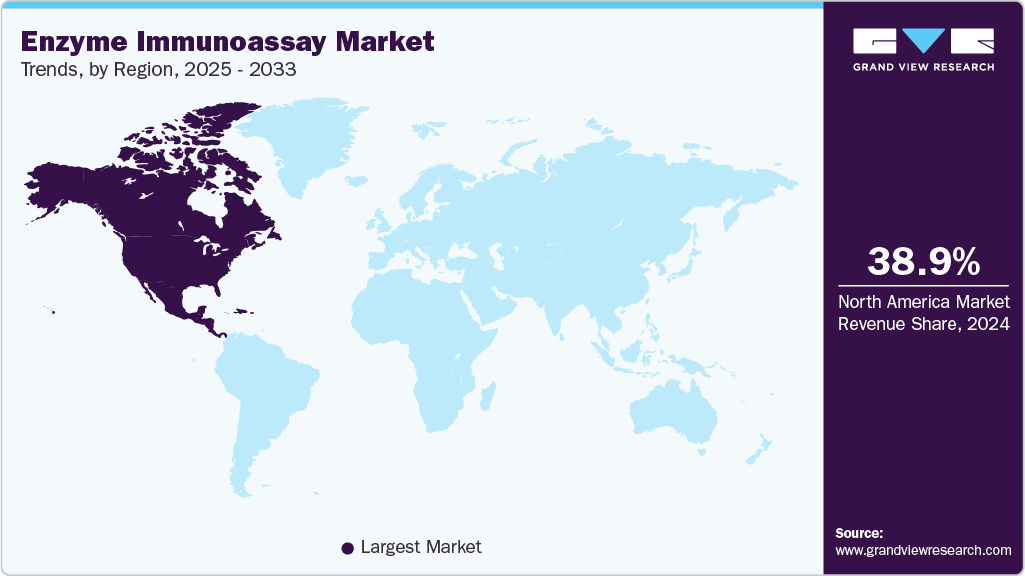

Regional Insights

North America enzyme immunoassay industry accounted for the largest market share of 38.99% in 2024, mainly attributed to the advanced healthcare infrastructure and robust biotechnology research sectors in the U.S. Continuous investments and developments in these areas have led to innovations in EIA technologies, making them more efficient and reliable. Government initiatives in North America aimed at improving healthcare quality and accessibility, along with funding for research and development in the field of diagnostics, have significantly contributed to the growth of the EIA market.

U.S. Enzyme Immunoassay Market Trends

The enzyme immunoassay industry in the U.S. is expected to grow robustly over the forecast period due to presence of large number of market players in the U.S., undergoing various strategic initiatives such as collaborations and new product launches. Furthermore, the increasing prevalence of cardiovascular diseases in the U.S. is one of the major drivers for the U.S. EIA market. The detection of cardiac markers by EIAs is essential for the diagnosis of heart attacks and other cardiovascular diseases. The American Health Association's 2024 Statistics Update states that 931,578 deaths in the United States in 2021 were attributable to cardiovascular disease, which was listed as the underlying cause of death.

Europe Enzyme Immunoassay Market Trends

The Europe enzyme immunoassay industry was identified as a lucrative hub as the region has seen a rise in the number of chronic diseases such as diabetes, cancer, cardiovascular diseases, and infectious diseases. This increase has boosted the demand for effective diagnostic methods, including enzyme immunoassays, for early detection and monitoring of these conditions. Europe has some of the world's leading biotechnology firms and research institutions, which contribute to the development of innovative EIA technologies and products. Moreover, the well-established healthcare infrastructure and a strong focus on research and development in European countries support the adoption of advanced diagnostic methods, which is expected to support market growth.

The enzyme immunoassay industry in the UK held a significant share in 2024. The UK government's investment in research and development is one of the major factors driving the growth of the enzyme immunoassay market in the country. High-quality enzyme immunoassay has become more and more in demand as attention shifts to creating novel products and technologies. Business are pushed to invest in this industry by the government's support in the form of tax breaks, favorable policies, and funding for R&D projects. For example, the UK government announced a clinical trials accelerator program, adjustments to R&D tax credits, and USD 652.9 million in investments for life sciences funding in November 2023.

France enzyme immunoassay industry is expected to grow remarkably over the forecast period. The French government provides support for life sciences research and innovation through funding programs, tax incentives, and infrastructure development. This support encourages investment in healthcare, biotechnology, genomics, and personalized medicine, driving the demand for enzyme immunoassays in these sectors.

The enzyme immunoassay industry in Germany is anticipated to grow significantly over the forecast period. Germany is one of the global leaders in scientific research, with renowned institutions and multiple biotechnology companies actively developing enzyme immunoassay, research tools, and novel therapeutics. This advancement is predicted to support enzyme immunoassays market growth by creating demand for high-quality enzyme immunoassay services.

Asia Pacific Enzyme Immunoassay Market Trends

The Asia Pacific enzyme immunoassay industry held highest CAGR of 6.19% over the forecast peiord. Countries such as China, India, Japan, South Korea, and Singapore, are experiencing rapid industrialization and economic growth. This growth fuels demand across various industries, including pharmaceuticals and biotechnologies, all of which require enzyme immunoassays Asia Pacific governments and private businesses are making large investments in life sciences, pharmaceutical research, and healthcare infrastructure. The demand for enzyme immunoassays, which are crucial in infectious diseases, is increased by this investment. Asia Pacific is home to a large and rapidly growing population, coupled with increasing urbanization. This demographic trend drives the demand for healthcare services, leading to increased pharmaceutical production and research activities and boosting the enzyme immunoassay market.

The enzyme immunoassay industry in China is expected to grow over the forecast period. The Chinese government is actively promoting the development of the domestic pharmaceutical industry, including enzyme immunoassay products. These government initiatives translate into funding for research and development, which can benefit the enzyme immunoassay market. Furthermore, China's aging population is a factor as it creates a greater demand for treatments for chronic and infecticious diseases, a category where enzyme immunoassay are used. This increased need for treatments is expected to fuel the enzyme immunoassay market.

Japan enzyme immunoassay industry is witnessing significant growth over the forecast period. Japan investing significantly in biotechnology research and development. Advancements in biotechnology drive the demand for enzyme immunoassays. For instance, in 2019, the government of Japan funded approximately USD 56 million to promote bio-manufacturing technologies, including the examination and demonstration of bio-manufacturing data linkages.

MEA Enzyme Immunoassay Market Trends

The enzyme immunoassay industry in MEAis expected to grow on the back of increased investments in the healthcare sector, mainly in the development of healthcare infrastructure and capabilities. This trend is expected to fuel the demand for enzyme immunoassays in the region. However, the MEA region is a relatively small market for enzyme immunoassays compared to other regions, and the market growth is limited by factors such as stringent regulatory standards and quality requirements for pharmaceutical and biotechnology products.

Saudi Arabia enzyme immunoassay industry is expected to grow over the forecast period in the wake of significant investments in developing biotechnology and healthcare sectors. With a growing focus on research and innovation in life sciences, there is increasing demand for enzyme immunoassays, which are essential in treatment for chronic and autoimmune diseases.

The enzyme immunoassay industry in Kuwait is anticipated to grow with considerable investments in its healthcare infrastructure, including hospitals and laboratories, which increases the capacity for various diagnostic tests, including EIAs. Kuwait faces challenges with chronic diseases such as diabetes, cardiovascular diseases, and various types of cancer. The demand for EIA tests is driven by the necessity of early diagnosis and treatment of these conditions. With the goal of offering its citizens comprehensive services, the Kuwaiti government devotes a sizeable amount of its budget to healthcare. Spending more on healthcare encourages the use of cutting-edge diagnostic tools, such as EIA.

Key Enzyme Immunoassay Company Insights

The industry players are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Enzyme Immunoassay Companies:

The following are the leading companies in the enzyme immunoassay market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter)

- bioMérieux SA

- QuidelOrtho Corporation.

- Sysmex Corporation

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche AG

- Becton, Dickinson, and Company

- Thermo Fisher Scientific, Inc.

Recent Development

-

In June 2024, Fujirebio introduced the Lumipulse G sTREM2 assay. It is a chemiluminescent enzyme immunoassay (CLEIA) for research use only, capable of quantifying soluble TREM2 (sTREM2) in human cerebrospinal fluid and blood in about 35 minutes. sTREM2 is a biomarker linked to microglial activation - relevant for Alzheimer’s and other neuroinflammatory or neurodegenerative conditions. This adds to Fujirebio’s neuro biomarker test portfolio (alongside GFAP, NfL, pTau) and strengthens its position in neuro biomarker research tools.

-

In July 2024, Fujirebio announced the availability of its Lumipulse G GFAP assay for research use. It is a CLEIA-based enzyme immunoassay that measures glial fibrillary acidic protein (GFAP) in human plasma and serum within ~35 minutes. At launch, it was available in Japan and the USA; rollout to Europe and other regions followed in September 2024.

-

In December 2023, H.U. Group Holdings Inc. launched the Lumipulse G pTau 217, a Plasma assay designed for the fully automated LUMIPULSE G immunoassay platforms. This advanced chemiluminescent enzyme-immunoassay accurately quantifies the levels of Tau protein phosphorylated at threonine 217 in human K2EDTA plasma samples. This process is completed in just 35 minutes.

-

In February 2023, Charles River, a company specializing in life sciences, launched an Enzyme-Linked Immunosorbent Assay (ELISA) kit. This ELISA kit utilizes IgY antibodies to detect and quantify residual host cell protein in biotherapeutics created with Chinese hamster ovary.

-

In June 2022, BIOTEM, a company offering development and production services for custom monoclonal antibodies and immunoassays, announced building a new industrial facility. The new site is located in France. This new facility is dedicated to immunoassay production, allowing BIOTEM to increase its capacity and meet the growing demand for these tests.

-

In September 2021, Thermo Fisher Scientific introduced its new fully-automated analyzers for enzyme assays-named Gallery Enzyme Master and Gallery Plus Enzyme Master. These discrete analyzers automate reagent addition, incubation, and measurement for multiple enzyme assay types, improving consistency, throughput, and user convenience, especially for labs performing various enzyme-based assays.

Enzyme Immunoassay Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.54 billion

Revenue forecast in 2033

USD 24.77 billion

Growth rate

CAGR of 3.7% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application,specimen, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand;South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Siemens Healthineers; Danaher Corporation (Beckman Coulter); bioMérieux SA; QuidelOrtho Corporation.; Sysmex Corporation; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche AG; Becton, Dickinson, and Company; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Enzyme Immunoassay Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global enzyme immunoassay market report based on product, application,specimen end use, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Reagents & Kits

-

Analyzers/Instruments

-

Software & Services

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Therapeutic Drug Monitoring

-

Oncology

-

Cardiology

-

Endocrinology

-

Infectious Disease Testing

-

Autoimmune Diseases

-

Others

-

-

Specimen Outlook (Revenue, USD Billion, 2021 - 2033)

-

Blood

-

Saliva

-

Urine

-

Other Specimens

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospitals

-

Blood Banks

-

Clinical Laboratories

-

Pharmaceutical and Biotech Companies

-

Academic Research Centers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global enzyme immunoassay market size was estimated at USD 17.78 billion in 2024 and is expected to reach USD 18.54 billion in 2024.

b. The global enzyme immunoassay market is expected to grow at a compound annual growth rate of 3.68% from 2024 to 2030 to reach USD 24.77 billion by 2030.

b. North America dominated the enzyme immunoassay market with a share of 38.99% in 2024. This is attributable to the large number of end users, such as hospitals, blood banks, and clinical laboratories in the region.

b. Some key players operating in the enzyme immunoassay market include Siemens Healthineers; Danaher Corporation (Beckman Coulter); bioMérieux SA; QuidelOrtho Corporation.; Sysmex Corporation; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche AG; Becton, Dickinson, and Company; Thermo Fisher Scientific, Inc.

b. Key factors that are driving the market growth include rising incidence of chronic and infectious diseases along with growing demand for point-of-care diagnostics

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.