Environmental Testing Market Size, Share & Trends Analysis Report By Sample (Soil, Air), By Technology (Rapid, Conventional), By Target-tested (Chemical, Biological), By End-use (Government, Industrial), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-020-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Report Overview

The global environmental testing market size was estimated at USD 11.07 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. Public concern over environmental degradation has increased as a result of growing industrial activity and pollution in global economies, which is likely to drive industry expansion. In 2020, the COVID-19 pandemic affected the world economy in every corporate sector. This loss was the result of significant disruptions in their respective supply chains and industrial activities brought on by various precautionary lockdowns and other restrictions enforced by international regulating organizations.

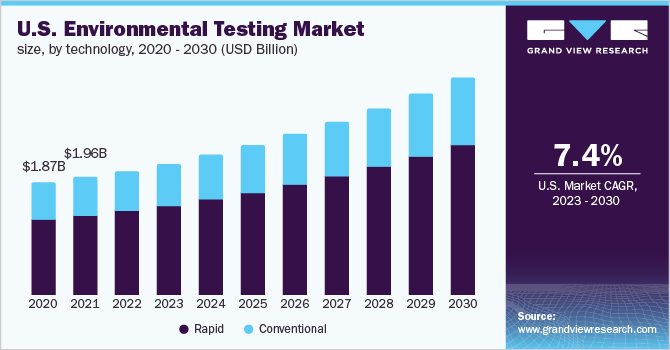

The market in the U.S. is being driven by the government’s growing investments in high-tech testing tools or services to maintain hygienic and environmental standards. In addition, the U.S. market will be driven by government measures to safeguard the environment, strict regulations over pollution control, and active engagement to track changes in environmental conditions. Contaminants are found and evaluated during environmental testing services utilizing a variety of tools. Chemicals that unintentionally enter the environment as a result of human activity are known as environmental pollutants. Some of these pollutants, such as radionuclides and trace elements, are very stable and thus, are difficult to degrade.

The demand for wastewater management will increase due to the rising global temperatures, growing awareness of the need to decrease carbon footprints, and the rapid depletion of freshwater resources. In addition, in the years to come, the industry share may be supported by the privatization of testing services and the rising need for third-party testing. Businesses and governments have been compelled to set up additional environmental testing service stations due to the increasing pollution levels brought on by rapid industrialization and urbanization. Moreover, it has made it possible for businesses to efficiently assess baseline environmental norms and trends to support the creation of laws and regulations.

Technology Insights

The rapid technology segment accounted for the maximum share of more than 67.00% of the global revenue in 2022. Rapid methods minimize labor-intensive operations and cost per test. In addition, with rapid methods, one can achieve significant efficiency and possible cost savings. The benefits offered by rapid products are greater accuracy, increased sample throughput and automation, precision, and sensitivity. Over the forecast period, it is anticipated that the demand for mass spectroscopy in environmental testing will increase due to the growing global awareness about the presence of chemical substances in the environment.

In addition, the adoption of the Stockholm Convention, which aims to eliminate the effects of persistent organic pollutants on the environment and health, is expected to increase the demand. Conventional testing methods require more time as compared to rapid testing. It is also labor-intensive and has a high cost per test. Various conventional methods include the culture plate method, biological oxygen demand, and chemical oxygen demand, among others.

Regulations specify these pollutants, as well as the methods used to detect them, and the maximum amount of contaminant allowed in a sample. In the culture plate method, which has a low, flat bottom, cells, molds, and other organisms can grow on a thin layer of nutrient solution. A method for separating a strain from a microorganism, such as bacteria, is striking. To identify, research, or test the organism, samples can be taken from the colonies and a microbiological culture can be created on a different plate.

Sample Insights

The wastewater/effluent sample segment accounted for the maximum share of more than 30.40% of the global revenue share in 2022. Wastewater treatment is required to preserve public health and the environment, as well as to keep industrial processes running smoothly. Most regulatory authorities require regular analytical testing of wastewater effluents at various treatment stages. For instance, the requirements of the MCERT standard for wastewater effluents treated sewage effluents, and untreated sewage effluents sampling and chemical testing. The soil sample segment includes the testing of polluted sites, sediment, sludge, building materials, and compost, among other things.

Soil testing is used to quickly characterize the intrinsic fertility state of soils as well as forecast plant nutrient requirements. The water sample segment accounted for a significant revenue share in 2022. Water testing regularly might help keep track of any changes in water quality over time. If this happens, it’s critical that the monitoring be done at regular intervals from the same location. The growing demand for clean water is expected to create demand for environmental testing services for water during the forecast period. The air sample segment also accounted for a considerable revenue share in 2022. The market is likely to be boosted by the increased demand for air quality services to monitor air pollution and take action to mitigate air pollution.

Target-tested Insights

The chemical target-tested segment accounted for the largest revenue share of more than 24.50% in 2022. Industries require chemical analysis for a variety of reasons. Over the projected period, the environmental testing market is anticipated to grow as people around the world become more aware of the need to eliminate chemical pollution in water, air, and soil. The biological target-tested segment also accounted for a considerable revenue share in 2022. Biological testing techniques are standardized trials that assess the toxicity of a substance or material on living things.

In the coming years, it is projected that there will be an increase in demand for tests to determine the presence of biological agents and assess the contamination produced by them. The temperature target-tested segment had a steady growth in 2022. Growing demand for testing the temperature of the water, air, wastewater, etc. is anticipated to boost the demand for temperature testing, thereby fueling the segment growth. The particulate matter target-tested segment also witnessed significant growth in the past due to high consciousness regarding air pollution and its adverse impact on health and the environment.

End-use Insights

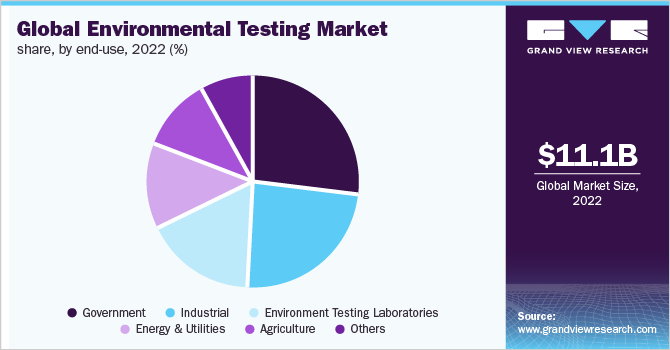

The government end-use segment accounted for the largest revenue share of 27.0% in 2022. Governments conduct environmental testing through their forestry departments, geology departments, and municipal authorities. The systems used by these departments are not only used to monitor the aforementioned environmental parameters but also help in educating and alerting users in the event of spikes in pollution levels. The industrial end-use segment accounted for a significant revenue share in 2022 due to the increased usage of indoor environment testing systems by the pharmaceutical, healthcare, and chemical industries. This is done to comply with demanding manufacturing regulations by regional governments for ensuring safe operating conditions for the workforce.

The environmental testing laboratories end-use segment also had significant growth in 2022. The rising requirements for clean water owing to rapid urbanization & industrialization and the depleting freshwater supplies are expected to drive the segment growth over the projected period. The energy & utilities end-use segment will witness rapid growth in the future. Feasibility studies, regulatory and social studies, strategic environmental approvals and designs, and oil & gas and power generation infrastructure engineering project plans and their evaluation are all part of environmental testing for the energy & utilities sector.

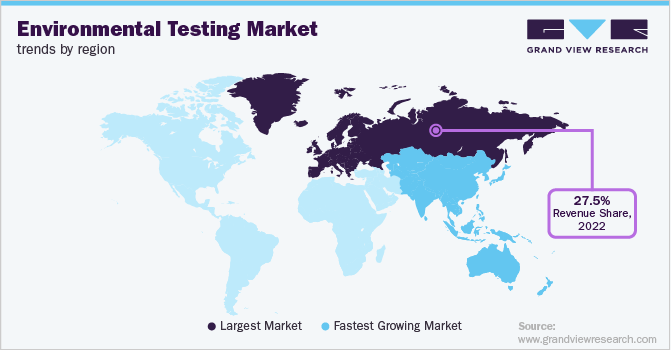

Regional Insights

Europe accounted for the second-largest revenue share of 27.5% in 2022. The development of new environmental policies and the revision of current ones by regional governments is anticipated to drive the market. Throughout the projection period, it is also expected that supportive government initiatives and the desire for the construction of waste-handling infrastructure would further fuel market demand. Asia Pacific is projected to emerge as the fastest-growing region from 2023 to 2030 due to the increased emphasis by nations on the implementation of environmental testing systems to enhance living conditions and control & lower pollution levels.

As part of efforts to combat global climate change, countries in the Asia Pacific region have been concentrating more on pollution reduction in recent years. North America held a significant share in 2022. The region is anticipated to be driven by the U.S. EPA’s strict pollution monitoring and control rules, as well as growing concerns about global warming and environmental pollution. Furthermore, it is projected that the deployment of environmental testing systems in North America will be influenced by robust company internal policies addressing safe working conditions and pollution monitoring, as well as the consistent availability of financial resources.

For instance, mining companies have to undergo strict procedures for environmental safety during exploration, mining, and mine closures. This is conducted under the Organization of Supervision and Environmental Assessment (OEFA). The Central & South America region is expected to register a strong CAGR over the forecast period. Owing to the need to ensure public safety and protect people’s health & the environment from potential waste disposal risks, and the presence of various environmental protection agencies in the area, the market is anticipated to grow rapidly over the projected period.

Key Companies & Market Share Insights

Service providers in the industry are employing a variety of methods, including acquisitions, mergers, joint ventures, new product development, and geographical growth, to gain higher market share and meet changing technical demand from the end-use industries, such as metals & mining, water & wastewater, and construction. The outbreak and the spread of the COVID-19 pandemic have highlighted the requirement for sustainable development at the global level as environmental degradation increases the risks of the spread of pandemics. Investors have started paying increased attention to the Environmental, Social, and Governance (ESG) indices of companies, while government regulations have become highly stringent in terms of quality and safety, along with environmental protection. Some prominent players in the global environmental testing market include:

-

SGA SA

-

Eurofins Scientific

-

Intertek Group plc

-

Bureau Veritas

-

ALS Ltd.

-

TUV SUD

-

Asure Quality

-

Merieux NutriSciences

-

Microbac Laboratories, Inc.

-

R J Hill Laboratories Ltd.

-

Symbio Laboratories

Environmental Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 11.78 billion |

|

Revenue forecast in 2030 |

USD 20.16 billion |

|

Growth rate |

CAGR of 7.8% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, sample, target-tested, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; China; Japan; India; Australia; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

SGA SA; Eurofins Scientific; Intertek Group plc; Bureau Veritas; ALS Ltd.; TUV SUD; Asure Quality; Merieux NutriSciences; Microbac Laboratories, Inc.; R J Hill Laboratories Ltd.; Symbio Laboratories |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Environmental Testing Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global environmental testing market report on the basis of technology, sample, target-tested, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Rapid

-

Mass Spectrometer Testing

-

Molecular Spectroscopy Testing

-

Chromatography Testing

-

Acidity/Alkalinity Testing

-

Turbidity Testing

-

PCR Testing

-

Immunoassay Testing

-

Others

-

-

Conventional

-

Culture Plate Method

-

Biological & Chemical Oxygen Demand (BOD & COD)

-

Dissolved Oxygen Determination (DOD)

-

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Wastewater/Effluent

-

Soil

-

Water

-

Air

-

Noise

-

Others

-

-

Target-tested Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Biological

-

Temperature

-

Particulate Matter

-

Moisture

-

Noise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Industrial

-

Environment Testing Laboratories

-

Energy & Utilities

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global environmental testing market size was estimated at USD 11.07 billion in 2022 and is expected to reach USD 11.798 billion in 2023

b. The global environmental testing market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 20.16 billion by 2030

b. Asia Pacific accounted for the largest environmental testing market with a revenue share of 32.1% in 2022. This is due to government funding programs, and advanced technologies for the production of jackets. The demand for military and civilian protection is rising, however, as a result of the rising violence and threats around the world. This will also result in an increase in the use of bulletproof jackets in the defense sector.

b. Some key players operating in the environmental testing market include SGA SA, Eurofins Scientific, Intertek Group plc, Bureau Veritas, ALS Limited, TUV SUD, Asure Quality, Merieux NutriSciences, and among others.

b. Key drivers driving the environmental testing market growth include growing industrial activity and pollution in developing economies have heightened public awareness of environmental deterioration, which adds to the expansion of the sector.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."