Environmental Monitoring Market Size, Share & Trends Analysis Report By Product, By Sampling Method (Active, Continuous, Intermittent), By Component, By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-585-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Environmental Monitoring Market Trends

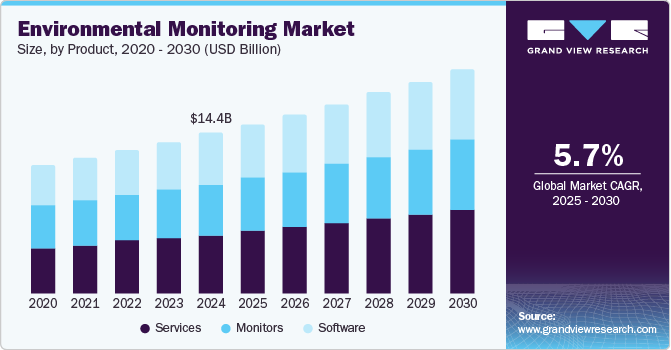

The global environmental monitoring market size was valued at USD 14.4 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. A key growth driver for this market is the increasing demand for effective management and monitoring of natural resources that carry enormous value, such as water, land, fossil fuels, metals, minerals, material sources, and others. In addition, growing awareness regarding the impact of climate change, attempts by nations to limit the environmental footprint of activities such as forestry, mining, agriculture, fishing, and quarrying, and a rise in the number of businesses adopting sustainability goals are anticipated to influence the growth of this market.

Environmental monitoring products and services are extensively used in industrial and government applications such as particulate detection, biological detection, chemical detection, temperature sensing, noise measurement, moisture detection, pollution monitoring, water conservation, and more. Increasing stringent regulations related to environmental standards are encouraging multiple businesses and agencies to use advanced environmental monitoring products.

Advancements in sensor technology, rising availability and use of environmental sensors, use of environmental monitors in consumer electronics, utilization of modern technologies such as the Internet of Things (IoT) and nanotechnology, ease of availability, growing accessibility to environmental data, and cost-effectiveness of product offerings are adding to the growth opportunities for this market.

Proactive initiatives and the participation of government authorities associated with environmental monitoring are contributing to the growth of this market. For instance, in September 2024, the State Council of the People’s Republic of China announced that its technologically advanced and comprehensive environmental monitoring network of nearly 33,000 stations, overseen directly by the ministry of Ecology and environment, has enhanced its pollution control abilities.

Product Insights

The monitors segment dominated the global industry for environmental monitoring, with a revenue share of 31.4% in 2024. The emergence of next-generation products such as water-resistant, dustproof, data-logging sensors equipped with wireless technology has influenced the growth of this segment. Increasing use of such monitors in industries such as transportation for consignment temperature monitoring, retail for warehouse environment monitoring, and other businesses for compliance adherence applications is expected to drive demand for this segment in the approaching years.

The services segment is expected to experience the fastest CAGR during the forecast period owing to increasing demand from industries such as oil & gas, manufacturing, healthcare, agriculture, transportation & logistics, critical infrastructure management, and others. Availability of end-to-end environmental monitoring services, facilitated by expert professionals and teams of service provider organizations, ease of use, and increasing legal compliance regulations and requirements are adding to the growth of this segment.

Sampling Method Insights

Based on sampling method, the continuous monitoring segment held the largest revenue share of the global industry owing to features associated with it, such as real-time data analysis and insights sharing, assurance of effective compliance adherence, use of advanced technology for enhanced outcomes, and focus of multiple organizations on enhancing facility comfort by adopting continuous monitoring technologies. Tools for continuous environmental monitoring are equipped with advanced sensors, intelligent system support, and abilities to identify and record even the slightest of changes in elements such as temperature, amount of pollution, and more.

The active monitoring segment is anticipated to experience a significant market revenue share in 2024. Often, active monitoring lacks the ability to record changes or contaminations after the sample is collected. However, active environmental monitoring is preferred in large- or medium-sized enterprises to ensure air quality maintenance. It is widely used to identify potential environmental issues and prevent them from furthering.

Component Insights

Particulate matter entails liquid droplets and microscopic solids, which might cause problems if inhaled. This poses greater safety concerns and a need for environmental monitoring in numerous industries, such as energy and power, construction, manufacturing, forestry, food processing, paints and coatings, fashion and textile, chemicals, transport, etc. If not monitored and maintained at a determined level, particulate matter may harm factory workers, site supervisors, and other employees.

The biological segment is projected to experience substantial growth from 2025 to 2030 owing to increasing awareness regarding the benefits associated with biomonitoring and its increasing application in areas such as freshwater ecosystem management, occupational health, and public health monitoring. Characteristics such as targeted assessment abilities and community engagements are likely to fuel the growth of this market during the forecast period.

Application Insights

Based on application, the air pollution segment dominated the global environmental monitoring industry in 2024. In recent years, air pollution has become one of the key challenges worldwide due to the increasing number of motor vehicles, household combustion devices, industrial wastes, and growing incidents of forest fires worldwide. According to the World Health Organization, 99% of the global population breathes air that contains high levels of pollutants. This has increased governments' focus on introducing stringent air pollution regulations. The presence of compliance adherence requirements, growing awareness regarding the intensity of impact caused by air pollution, increasing availability of solutions and services focused on air pollution, and rise in concerns regarding public health caused by particulate matter, nitrogen dioxide, sulfur dioxide, and carbon monoxide.

Water pollution segment is expected to experience a significant CAGR of 6.3% from 2025 to 2030. The oil spills in the ocean, marine accidents, littering near water surface water bodies, emission of wastewater in live water sources, and ocean pollution have increased water pollution levels. Increasing use of environmental monitoring products and services in areas such as ocean clean-ups, government initiatives, river cleaning projects by organizations, wastewater management in the manufacturing industry, critical infrastructure management, and more is projected to drive the growth of this segment in approaching years.

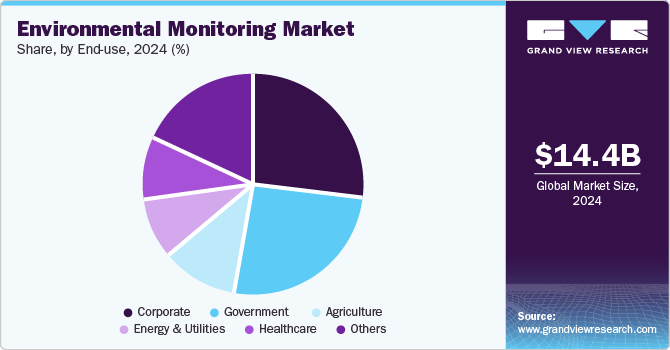

End-use Insights

Based on end-use, corporate segment held the largest revenue share of the global environmental monitoring market in 2024. Stringent regulatory compliance requirements, indoor air quality management, employee well-being, and operational efficiencies are some of the key growth drivers for this segment. In addition, sustainability initiatives embraced by the corporate industry, the significance of environmental monitoring in the pharmaceutical or food production sector, and measures regarding crisis management are projected to drive demand.

The government sector is anticipated to experience a CAGR of 7.2 % from 2025 to 2030 owing to the large number of environmental monitoring initiatives embraced by multiple governments, attempts to reduce carbon emissions, and the existing network of agencies related to crisis management, disaster relief, weather monitoring, earth observance, space and aviation administration, air and water territory management, and critical infrastructure development and control.

Regional Insights

North America environmental monitoring market dominated the global industry with revenue share of 35.5% in 2024. The presence of multiple key companies in the region, an increasing number of natural calamities such as hurricanes, a large number of forest fire incidents observed in the area, stringent regulatory scenarios and strict laws associated with pollution control, and the existence of multiple manufacturing facilities in North America have driven the growth of this regional industry.

U.S. Environmental Monitoring Market Trends

The U.S. environmental monitoring market held the largest revenue share of the regional industry in 2024 due to growing demand from industries including chemical, manufacturing, ocean clean up, crisis management, public healthcare, etc. Regulations regarding air, water, noise, and soil pollution, increasing awareness regarding the impacts of climate change, and growing demand for sustainability assistance are expected to generate an upsurge in demand for this market.

Europe Environmental Monitoring Market Trends

Europe is the lucrative global environmental monitoring market region in 2024. Europe’s target is to reduce greenhouse gas emissions by at least 55% and become a carbon-neutral continent by 2050; regulations introduced around these targets increasing focus on controlling and reducing air pollution and raising awareness regarding the significance of environmental monitoring in manufacturing facilities are some of the key growth drivers for this market.

Germany environmental monitoring market dominated the regional industry in 2024 owing to presence of strong manufacturing industry in the country, rising stringency of regulations associated with environmental footprint, waste water management and air quality, availability of numerous monitoring products and technologies in the region, and significant growth in companies adopting continuous monitoring methods.

Asia Pacific Environmental Monitoring Market Trends

Asia Pacific environmental monitoring market is projected to experience fastest CAGR of 7.7 % from 2025 to 2030. Rapid industrialization in the region, increasing infrastructural developments, advancements in technology and real time data analysis abilities of newly developed environmental monitoring products, robust manufacturing industry in countries such as China, Japan, India and others are driving growth for this market

China dominated the regional industry in 2024 owing to increasing government participation in environmental monitoring, rising need for efficient management of natural resources, presence of large enterprises operating in manufacturing industries, and increasing demand from industries such as food processing, chemical, paints & coatings. Regulations and proactive government involvement.

Key Environmental Monitoring Company Insights

Some of the key companies in the environmental monitoring market include 3M, Agilent Technologies, Thermo Fisher Scientific Inc., Emerson Electric Co., and others. To address growing demand and the competitive market scenario, the major market participants have adopted strategies such as innovation, new launches, expansions, and more.

-

3M, a prominent organization in healthcare, consumer goods and worker safety industry, offers range of environmental monitoring products and solutions including clean-trace hygiene monitoring and management system, 3m evm environmental monitors, 3m environmental scrub sampler, and more.

Key Environmental Monitoring Companies:

The following are the leading companies in the environmental monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Agilent Technologies Inc.

- Danaher Corporation

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- HORIBA Group

- Siemens

- Teledyne Technologies Incorporated

- Thermo Fisher Scientific Inc.

Recent Developments

-

In May 2024, Thermo Fisher Scientific, one of the prominent companies in the science and technology innovations industry, announced that it has commenced manufacturing air quality monitoring systems in its facility in India. This is expected to fortify India’s effort to increase manufacturing industry operations.

Environmental Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 15.2 billion |

|

Revenue forecast in 2030 |

USD 20.1 billion |

|

Growth rate |

CAGR of 5.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, component, sampling method, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

3M; Agilent Technologies Inc.; Danaher Corporation; Emerson Electric Co.; General Electric Company; Honeywell International Inc.; HORIBA Group; Siemens; Teledyne Technologies Incorporated; Thermo Fisher Scientific Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Environmental Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global environmental monitoring market report based on product, component, sampling method, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Monitors

-

Indoor

-

Outdoor

-

Portable

-

-

Software

-

Services

-

-

Sampling Method Outlook (Revenue, USD Billion, 2017 - 2030)

-

Active Monitoring

-

Continuous Monitoring

-

Intermittent Monitoring

-

Passive Monitoring

-

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Temperature

-

Moisture

-

Biological

-

Chemical

-

Particulate Matter

-

Noise

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Air Pollution

-

Water Pollution

-

Soil Pollution

-

Noise Pollution

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Government

-

Corporate

-

Energy & Utilities

-

Healthcare

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."