- Home

- »

- Homecare & Decor

- »

-

Entertainment Furniture Market Size & Share Report, 2030GVR Report cover

![Entertainment Furniture Market Size, Share & Trends Report]()

Entertainment Furniture Market Size, Share & Trends Analysis Report By Product (TV Stands, Entertainment Centers, Media Consoles), By Distribution (Offline, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-463-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Entertainment Furniture Market Trends

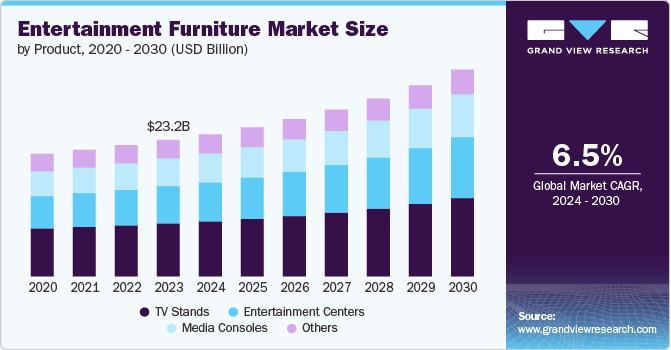

The global entertainment furniture market size was estimated at USD 23.17 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030.The market is driven by rising consumer demand for home entertainment systems, fueled by the increasing popularity of streaming services, larger and more advanced TVs, and the growing gaming industry. As more consumer invest in home theaters and gaming setups, there is growing demand for furniture such as TV stands, media consoles, and entertainment centers.

Technological advancements in entertainment systems, such as larger 4K and OLED TVs, smart home integration, and high-end gaming consoles, drive the market by increasing the need for furniture that accommodates these modern devices. Consumers seek TV stands, media consoles, and storage units that not only support larger screens but also organize multiple electronic components like sound systems, gaming consoles, and streaming devices. The rise of smart furniture, with features like built-in charging ports, LED lighting, and hidden cable management, caters to tech-savvy consumers looking for multifunctional and aesthetically pleasing setups that enhance their entertainment experience.

The shift toward smaller, multifunctional living spaces, particularly in urban areas, favor the market by increasing demand for compact, space-saving designs that offer both functionality and style. As more people live in apartments or homes with limited space, seek entertainment furniture that maximizes storage while maintaining a sleek and modern appearance. Multifunctional furniture, such as TV stands with built-in shelving, media consoles with hidden compartments, and modular units that can be rearranged, appeals to consumers looking for versatile solutions that optimize space without compromising on aesthetics or convenience.

Sustainability is emerging as a key trend in the market, driven by eco-conscious consumers seeking environmentally responsible options. There is growing demand for furniture made from sustainable materials such as reclaimed wood, bamboo, and recycled metals, alongside designs that minimize environmental impact. Manufacturers are responding with products that feature low-VOC finishes, reduced carbon footprints, and certifications like FSC (Forest Stewardship Council). In addition, modular and multifunctional designs that extend the lifespan of furniture are gaining popularity, as they align with the principles of reducing waste and promoting long-term use, further supporting the sustainability movement.

Product Insights

The TV stands segment led the market with the largest revenue share of 38.83% in 2023. The demand for TV stands is driven by several factors, including the growing popularity of home entertainment systems and streaming services, which has led to an increase in TV ownership. Consumers seek functional furniture that complements their living spaces while providing storage solutions for media devices, gaming consoles, and accessories. Modern TV stands with built-in cable management, adjustable shelves, and aesthetic appeal are particularly in demand, as they offer both organization and style. In addition, the trend toward minimalist and space-saving designs, especially in urban areas with limited living space, boosts the need for compact, multifunctional TV stands.

The entertainment centers segment is expected to grow at the fastest CAGR of 6.5% from 2024 to 2030. The growth of entertainment centers is fueled by the increasing integration of home theater systems, gaming consoles, and streaming devices into entertainment. Consumers are seeking comprehensive solutions that offer storage, organization, and style, which entertainment centers provide by accommodating various electronic devices, media collections, and accessories. The shift toward open-concept living spaces also drives demand for multifunctional furniture that can serve as both a focal point and a practical unit for entertainment needs. In addition, the rise of smart homes and connected devices has led to greater interest in entertainment centers that feature cable management and tech-friendly designs, making them a staple in modern households.

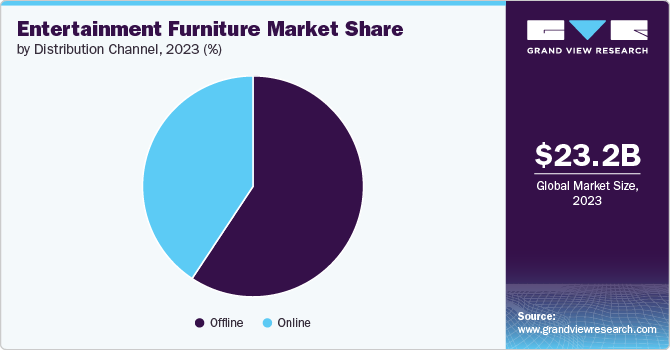

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 58.3% in 2023. Sales of entertainment furniture through offline channels are driven by the need for consumers to physically experience products before purchasing, allowing them to assess quality, comfort, and functionality firsthand. Showrooms provide a tactile experience that helps customers visualize how the furniture will fit into their homes. Personalized in-store assistance, immediate product availability, and the ability to compare different models side-by-side also enhance the shopping experience. Furthermore, offline channels often appeal to consumers seeking customized solutions or premium products, as they can engage with design experts and explore a wider range of finishes, materials, and configurations in person.

The online segment is expected to grow at the fastest CAGR of 7.5% from 2024 to 2030. The growing sale of entertainment furniture through online channels is driven by several key factors, including the convenience of shopping from home, access to a broader product selection, and competitive pricing. E-commerce platforms leverage advanced digital tools such as virtual room planners and augmented reality to enable consumers to visualize how furniture will look in their spaces. In addition, online channels offer detailed product descriptions, customer reviews, and easy comparison features that enhance the decision-making process. The ability to quickly access and compare multiple brands and models, coupled with efficient delivery options and promotional offers, further drives the appeal of purchasing entertainment furniture online.

Regional Insights

North America dominated the entertainment furniture market with the largest revenue share of 30.62% in 2023. Increased consumer spending on home entertainment systems, including high-definition TVs and gaming setups, is boosting the need for functional and stylish furniture solutions. Trends such as the rise of open-concept living spaces and the growing popularity of smart home technologies further contribute to the market's expansion. Major players in the region, such as IKEA, Ashley Furniture, and La-Z-Boy, offer a diverse range of products that cater to varying consumer preferences, from sleek modern designs to traditional styles.

U.S. Entertainment Furniture Market Trends

The entertainment furniture market in the U.S. accounted for a market share of around 70% in 2023 in the North American market. The market is characterized by a blend of established players and innovative newcomers, each striving to meet the diverse preferences of a growing audience. As lifestyles continue to shift towards home-centric entertainment, the U.S. entertainment furniture sector is poised for sustained growth, driven by an ongoing quest for both convenience and elegance in home furnishings.

Asia Pacific Entertainment Furniture Market Trends

The entertainment furniture market in Asia Pacific accounted for revenue share of 19.80% in 2023. Key countries contributing to this expansion include China, India, Japan, South Korea, and Australia. These nations are experiencing heightened demand for entertainment furniture as consumers seek modern, multifunctional solutions to enhance their home entertainment setups. The region's diverse market dynamics and varying consumer preferences are shaping the competitive landscape, with both global and local brands vying to capture market share through innovative designs and tailored offerings.

Europe Entertainment Furniture Market Trends

The entertainment furniture market in Europe is expected to grow at the fastest CAGR of 5.9% from 2024 to 2030. The market is thriving as consumers increasingly prioritize stylish and functional solutions for their home entertainment setups. Key players driving this growth include IKEA, which is known for its extensive range of versatile furniture, as well as other prominent brands such as Habitat, BoConcept, and Maisons du Monde. These companies are responding to the rising demand for modern entertainment centers that blend technology with design, catering to diverse consumer preferences across the region. The market is characterized by a focus on high-quality materials, innovative features, and customized solutions, reflecting broader trends in European home décor and lifestyle.

Key Entertainment Furniture Company Insights

The competitive landscape in the global market is characterized by a mix of global and regional players, each striving to differentiate their offerings. Key players include IKEA, Ashley Furniture, La-Z-Boy, and Sauder, who dominate with their extensive product portfolios, strong distribution networks, and brand recognition. These companies focus on providing a wide range of styles, from affordable mass-market options to premium designs, catering to diverse consumer preferences. There is also a growing presence of smaller, niche brands that emphasize sustainability, custom designs, and smart features to attract eco-conscious and tech-savvy consumers

Key Entertainment Furniture Companies:

The following are the leading companies in the entertainment furniture market. These companies collectively hold the largest market share and dictate industry trends.

- Inter IKEA Systems B.V.

- Ashley Furniture

- La-Z-Boy

- Williams-Sonoma, Inc.

- Sauder Woodworking Co.

- Bush Furniture

- Urban Ladder

- Basset Furniture

- SEI Furniture

- Riverside Furniture Corporation

Recent Developments

-

In February 2024, IKEA announced the launch of a new AI-powered assistant through OpenAI's GPT Store, aimed at enhancing customer interactions and streamlining the shopping experience. This innovative tool leverages advanced AI technology to provide personalized recommendations, answer product inquiries, and assist with design planning, reflecting IKEA's commitment to integrating cutting-edge technology into its business operations. The introduction of this AI assistant is expected to bolster IKEA's customer service capabilities and drive greater engagement with its extensive product range.

-

In July 2024, Ashley Furniture Industries unveiled plans for an $80 million expansion in Lee County, Mississippi, which is set to create 500 new jobs. This strategic investment aims to enhance the company’s manufacturing capabilities and bolster its supply chain efficiency. The expansion underscores Ashley Furniture’s commitment to scaling its operations and strengthening its presence in the U.S. market, while simultaneously contributing to local economic growth through job creation and infrastructure development.

Entertainment Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.10 billion

Revenue forecast in 2030

USD 35.09 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; & Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Inter IKEA Systems B.V.; Ashley Furniture; La-Z-Boy; Williams-Sonoma, Inc.; Sauder Woodworking Co.; Bush Furniture; Urban Ladder; Basset Furniture; SEI Furniture; Riverside Furniture Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Entertainment Furniture Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global entertainment furniture market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

TV Stands

-

Entertainment Centers

-

Media Consoles

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global entertainment furniture market was estimated at USD 23.17 billion in 2023 and is expected to reach USD 24.10 billion in 2024.

b. The global entertainment furniture market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 35.09 billion by 2030.

b. North America dominated the entertainment furniture market with a share of around 26% in 2023. The entertainment furniture market in North America is driven by increasing consumer demand for high-quality, technologically advanced furniture that enhances home entertainment experiences, coupled with rising disposable incomes and a growing focus on home theater and media room design.

b. Key players in the entertainment furniture market are Inter IKEA Systems B.V.; Ashley Furniture; La-Z-Boy; Williams-Sonoma, Inc.; Sauder Woodworking Co.; Bush Furniture; Urban Ladder; Basset Furniture; SEI Furniture; and Riverside Furniture Corporation

b. Key factors that are driving the entertainment furniture market growth include advancements in technology, increased home entertainment spending, growing urbanization, demand for stylish and multifunctional designs, and rising disposable incomes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."