Enterprise Performance Management Market Size, Share & Trends Analysis Report By Offering (Solution, Services), By Deployment, By Enterprise Size, By Function, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-257-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

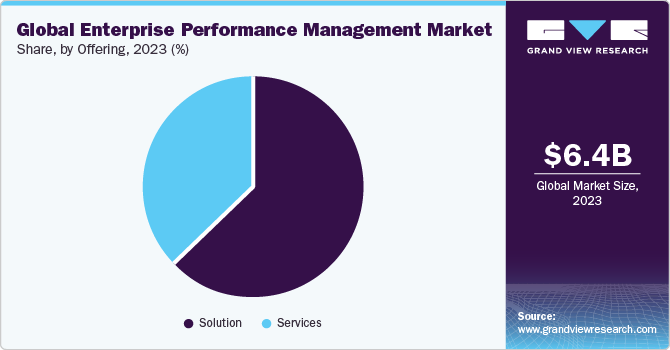

The global enterprise performance management market size was estimated at USD 6.37 billion in 2023 and is projected to grow at a CAGR of 8.5% from 2024 to 2030. The increasing adoption of digital transformation initiatives and the rising volume and complexity of business data are the key factors driving the market growth. It helps effectively plan, measure, and manage an organization's performance to achieve its strategic goals. EPM’s integrated approach combines various functional areas involving financial planning, budgeting, forecasting, performance reporting, and analytics to provide a holistic view of an organization's performance.

For instance, in November 2023, Jedox, a globally renowned adaptable planning and performance management platform provider entered into a strategic partnership with Fincons Group. The collaboration between both companies is expected to deliver innovative solutions to finance teams in countries such as Italy, Switzerland, France, Germany, Belgium, the UK, and the U.S. by fostering growth and profitability in these regions.

By aligning an organization's strategic objectives with its operational activities, EPM helps businesses make informed decisions, allocate resources optimally, and monitor performance against predefined targets. The other key offerings of enterprise performance management that are mainly considered are risk management and workforce planning.

Companies worldwide embrace digital transformation initiatives to enhance operational efficiency, streamline business processes, and gain a competitive edge. EPM solutions play a crucial role in this transformation by providing organizations with better visibility, control, and optimization of their financial and operational performance. The increasing volume and complexity of business data have led to a higher demand for advanced analytics capabilities in EPM solutions.

These capabilities help organizations make data-driven decisions, improve forecasting accuracy, and identify areas for optimization and cost reduction. Further, businesses operating in highly regulated industries such as finance and healthcare need robust EPM solutions to ensure compliance with various regulatory requirements. EPM systems help organizations maintain regulatory compliance by automating processes, providing real-time monitoring, and generating accurate reports.

Moreover, EPM relies heavily on accurate and reliable data. In case the data used for performance measurement and decision-making needs to be completed, consistent, or accurate, the insights generated are expected to be misleading, leading to incorrect decisions and poor performance outcomes. The EPM often involves collecting, storing, and analyzing sensitive data, probably increasing the risk of cyber threats involving data breaches or cyberattacks. Inadequate security measures are expected to compromise the confidentiality, integrity, and availability of critical data, potentially leading to severe consequences for the organization.

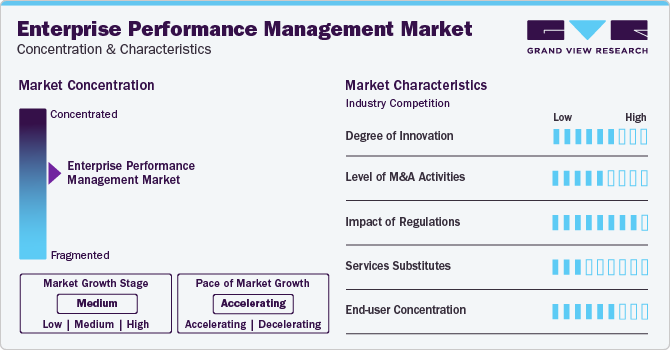

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The enterprise performance management market is characterized by a high degree of innovation as players are integrating cloud-based infrastructure and shifting towards transparent business strategies. For instance, in May 2023, IBM Corporation released its new offering, IBM Corporation Hybrid Cloud Mesh, to assist organizations in regaining control over their multicloud infrastructure. This innovative solution is designed to simplify the management and integration of diverse cloud environments, enabling enterprises to optimize their cloud strategies. Emerging technologies such as artificial intelligence and cloud computing are increasingly integrated into enterprise performance management systems, enabling enhanced automation and real-time monitoring, optimizing the organization's performance.

The market is developing and has a slightly concentrated nature, featuring several regional and global players. The merger and acquisition activity in the EPM market is medium, owing to factors such as market consolidation, technology integration, geographic expansion, and diversification. It is due to several factors, including the desire to gain a new customer base, strengthen their EPM services portfolio, and increase their market presence.

Deployment Insights

The on-premises segment held the largest revenue share in 2023. The on-premises segment in enterprise performance management refers to deploying and managing EPM solutions within an organization’s infrastructure, typically on-site at their premises. The on-premises EPM systems allow organizations to tailor their solutions according to their specific needs. This seamless integration with existing IT infrastructure and other business applications ensures a cohesive and efficient workflow.

The cloud-based segment is expected to witness the fastest CAGR during the forecast period. The scalability of cloud-based EPM systems with growing business needs and without significant investment in hardware installation is one of the key factors driving the segment's growth. Organizations can avoid high upfront costs associated with on-premise software and hardware installations by utilizing a cloud-based solution. For instance, according to BI-Surveys, 89% of Oracle Cloud EPM users are planning users, notably higher than the overall survey average of 69%. It suggests that Oracle Cloud EPM provides extensive planning capabilities and a range of applications catering to various Enterprise Performance Management (EPM) processes.

Enterprise Size Insights

The large enterprises segment led the market in 2023 and is projected to grow at a significant CAGR from 2024 to 2030. In large enterprises, EPM is vital in streamlining operations, enhancing decision-making, and ensuring compliance. Large enterprises often deal with a higher level of complexity, including diverse business units, multiple geographies, a wide range of products or services, and dynamic regulatory challenges. The regulatory landscapes are becoming increasingly complex and require compliance adherence, which poses substantial challenges for organizations.

Compliance management applications within enterprise performance management are crucial in addressing these challenges by offering features such as compliance monitoring, regulatory intelligence, and automated compliance assessments. These applications enable organizations to evaluate their compliance position, identify potential gaps and weaknesses, and implement necessary controls and measures to rectify compliance shortcomings and manage associated risks more efficiently. The EPM solutions offer scalability and adaptability to cater to these complexities, providing a unified view of the organization's performance.

The SME segment is expected to witness the fastest CAGR during the forecast period. EPM solutions can bring numerous advantages to SMEs, including improved financial management, enhanced decision-making, scalability, better resource allocation, streamlined operations, and increased competitiveness. With the adoption of EPM, SMEs can optimize their performance and drive growth in a dynamic business environment, eventually contributing to market growth over the forecast period.

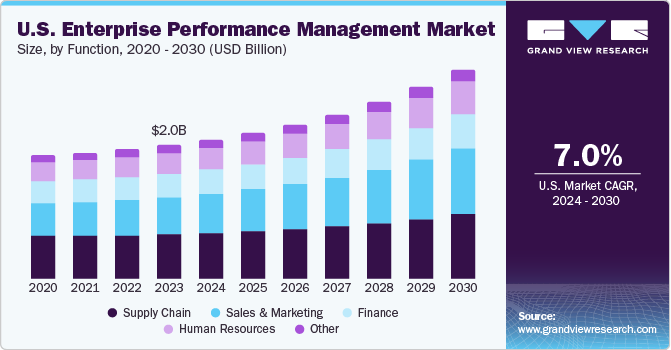

Function Insights

The supply chain segment dominated the market in 2023 and is projected to grow at a significant CAGR over the forecast period. By leveraging EPM solutions, supply chain companies can optimize operations, reduce delays, and improve overall customer satisfaction. It results in increased customer loyalty and a competitive edge, driving the market growth.

The sales and marketing segment is expected to witness the fastest CAGR during the forecast period, owing to increasing competition among the enterprises in the market. EPM solutions enable sales and marketing teams to set performance targets, track progress, and measure the effectiveness of their strategies. It helps identify areas for improvement and make data-driven decisions to achieve their goals, such as increasing revenue or market share. The EPM solutions streamline the process of managing sales incentives and commissions, ensuring fair compensation for sales representatives while aligning their efforts with business goals.

Vertical Insights

The IT & telecom segment dominated the market in terms of revenue share in 2023 and is projected to grow at a significant CAGR from 2024 to 2030. EPM solutions enable IT and telecom companies to set performance targets, track progress, and measure the effectiveness of their strategies. This helps identify areas for improvement and make data-driven decisions to achieve their goals, such as improving customer satisfaction or expanding market share ultimately contributing to the expansion of the enterprise performance management market.

The manufacturing segment is expected to witness the fastest CAGR during the forecast period. By leveraging EPM, manufacturing companies are able to allocate resources, improve product quality, and maintain a competitive edge in their respective markets. EPM plays a crucial role in the manufacturing industry by optimizing operational efficiency, enhancing decision-making, and driving overall business performance. EPM involves the integration of various processes, such as planning, budgeting, forecasting, and performance analysis, to help manufacturers streamline their operations and achieve their strategic goals.

Offering Insights

Based on the offering, the segment is bifurcated into solution and services. The solution segment held the largest revenue share of 62.5% in 2023 and is expected to retain its dominance over the forecast period. The exponential growth in data volume and complexity is expected to drive the growth of the EPM market. According to statistics by explodingtopics, around 328.7 million terabytes of data are generated globally daily, with the U.S. alone having 2,700 data centers.

The services segment is anticipated to witness the fastest CAGR during the forecast period. Many organizations operate in complex IT environments with several software applications and platforms. The services segment in enterprise performance management encompasses a wide array of offerings designed to support organizations in optimizing their business operations and enhancing decision-making capabilities. These services typically include consulting, implementation, integration, and support solutions tailored to address the unique challenges faced by companies operating in complex IT environments.

Regional Insights

North America dominated the market in 2023 and is projected to grow at a significant CAGR over the forecast period, owing to the evolving regulatory compliance requirements, rising data-driven decision-making, and increasing adoption of digital transformation initiatives. The businesses facing numerous regulatory compliance requirements related to financial reporting, risk management, and data privacy are efficiently managed by EPM solutions, driving the regional market growth.

U.S. Enterprise Performance Management Market Trends

The U.S. dominated the market with a revenue share of 79.7% in 2023 and is projected to maintain its dominance over the forecast period due to the increasing volume and complexity of data generated by organizations across various sectors. For instance, an article published by Oracle in February 2021 stated that the U.S.-based mobility service provider Lyft Inc. was able to reduce the time required for closing its books, specifically in the revenue aspect of the ledger, by more than 50% within four months of successful integration of Oracle Fusion Accounting Hub.

Europe Enterprise Performance Management Market Trends

Europe is expected to witness lucrative growth over the forecast period, due to the increasing digital transformation of SMEs and large enterprises and the growth of digital ecosystems in the region. The market expansion is also propelled by organizations' growing reliance on digital technologies. These technologies are being utilized to foster innovation, revolutionize business operations, and deliver novel products and services to customers. Consequently, organizations are transforming their processes and strategies, driving the market's growth.

The UK enterprise performance management market is expected to grow at a significant CAGR over the forecast period due to the rising emphasis on strategic planning and performance improvement and cloud-based EPM adoption driving the adoption of EPM. UK businesses recognize the value of EPM in enhancing their strategic planning and performance management capabilities. By leveraging EPM tools, organizations are aligning their strategies, budgets, and operations, ultimately driving growth and efficiency. The adoption of cloud-based EPM solutions is rising in the UK due to their scalability, flexibility, and cost-effectiveness. Cloud-based EPM systems enable organizations to access advanced performance management tools and technologies without significant upfront investments in hardware and infrastructure.

The market for enterprise performance management in Germany held a considerable revenue share in 2023, owing to cost reduction optimization and collaboration and integration by the organizations. The German companies are seeking ways to reduce costs and improve operational efficiency. The EPM solutions are helping them identify areas for cost savings, streamline processes, and optimize resource allocation, leading to enhanced profitability. EPM solutions in Germany often focus on fostering collaboration and integration across various departments and functions. By breaking down silos and promoting cross-functional communication, EPM systems are helping organizations make more informed decisions and drive better overall performance.

Asia Pacific Enterprise Performance Management Market Trends

The Asia Pacific enterprise performance management (EPM) market encompasses a variety of tools and solutions designed to help organizations in this region optimize their financial and operational performance. These tools assist companies in streamlining their business processes, enhancing decision-making capabilities, and improving overall efficiency. The market caters to the unique needs of Asia Pacific enterprises, providing tailored solutions to address their specific challenges and requirements.

The China Enterprise Performance Management market is expected to grow at a significant CAGR over the forecast period, owing to the integration of AI and big data and a focus on cybersecurity. Integrating AI and Big Data technologies with EPM solutions is expected to drive innovation and provide Chinese organizations with advanced analytics capabilities, enabling them to make data-driven decisions and optimize performance. As cyber threats evolve, Chinese organizations increasingly prioritize cybersecurity in their EPM systems, leading to the growth of specialized EPM solutions that address cybersecurity concerns.

The enterprise performance management market in Japan is expected to grow significantly over the forecast period due to government initiatives and increased focus on compliance. The Japanese government is promoting digital transformation across various industries through initiatives involving the Society 5.0 vision and the Digital Japan strategy. These initiatives are expected to increase investments in technology and the adoption of EPM solutions to improve organizational performance and efficiency. Furthermore, the stringent regulatory requirements and the need for transparency in various industries are pushing Japanese organizations to adopt EPM systems to ensure compliance and maintain a robust governance structure.

Middle East & Africa Enterprise Performance Management Market Trends

The EPM solutions help businesses in the MEA streamline their operations, make informed decisions, and boost overall efficiency. The market caters to the diverse needs of enterprises across the region, providing customized solutions that address their distinct challenges and demands. For instance, as per Oracle Customer References, the MTN Group, a prominent telecommunications company, serves approximately 300 million customers by providing cellular, internet, and mobile money transfer services across 23 African and Middle Eastern nations. Through its adoption of Oracle Cloud, the enterprise has successfully reduced the time required for budget preparation by half, significantly enhancing its operational efficiency.

The Saudi Arabia enterprise performance management market is expected to grow significantly over the forecast period due to the increasing competition among organizations and government initiatives. The highly competitive business environment in Saudi Arabia is turning enterprises to EPM solutions to gain a competitive edge by improving operational efficiency, reducing costs, and enhancing their overall performance. For instance, the Saudi Arabian government's Vision 2030 initiative aims to diversify the economy and reduce the country's dependence on oil. It has led to increased investments in technology and the adoption of EPM solutions to improve organizational performance and efficiency across various sectors.

Key Enterprise Performance Management Company Insights

Some of the key market players include Oracle;SAS Institute Inc.; SAP; and IBM Corporation.

-

The Oracle Corporation is a multinational computer technology corporation providing the Oracle EPM suite of software solutions with some popular Oracle EPM software products, including Oracle Hyperion, Oracle Planning and Budgeting Cloud Service, and Oracle Enterprise Performance Reporting Cloud Service. For instance, in March 2021, the U.S. telecom company Datavail completed the upgrade of their EPM to Oracle EPM 11.2. It was one of the major updates by Oracle Corporation of their 2015 release of Hyperion EPM 11.1.2.4.

-

IBM is a multinational organization that provides diverse products and services, including EPM software solutions involving IBM Planning Analytics, IBM Enterprise Cost Management, IBM Profitability and Cost Management, IBM Profitability and Resource Optimization, IBM Business Process Management, and IBM Operational Decision Management. In November 2020, IBM introduced IBM Cloud for Telecommunications, a flexible, hybrid cloud system tailored to meet the telecommunications sector's unique demands, allowing telecom companies to effectively modernize their applications and infrastructure to harness the potential of 5G and edge technologies.

Unicorn Systems a.s. and OneStream are some of the other market participants.

-

OneStream Software is one of the major leading modern, intelligent Corporate Performance Management (CPM) solutions provider. OneStream EPM software solutions include OneStream XF Platform, OneStream XF MarketPlace, OneStream XF Workflow, OneStream XF Data Quality, OneStream XF Financial Data Quality Management (FDQM), and OneStream XF Disclosure Management. In August 2022, OneStream announced a strategic alliance with EPM Global Pte. Ltd. to revolutionize CPM processes for complex, international organizations worldwide.

-

Workday, Inc. is a cloud-based Enterprise Performance Management (EPM) software solution provider. Some key Workday EPM software solutions include Workday Adaptive Planning, Workday Financial Management, Workday Project Management, Workday Workforce Planning, and Workday Reporting and Analytics.

Key Enterprise Performance Management Companies:

The following are the leading companies in the enterprise performance management market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle

- SAP

- IBM Corporation

- SAS Institute Inc.

- Anaplan, Inc.

- Unicorn Systems a.s.

- Epicor Software Corporation

- Workday, Inc.

- OneStream

- Board International

- Wolters Kluwer N.V.

- Jedox

Recent Developments

-

In December 2023, OneStream announced a partnership with KPMG Spain to assist Spain-based enterprises in driving financial transformation and reducing business complexities. Additionally, as a part of this partnership, both organizations would offer advanced comprehensive solutions leveraging each other's expertise.

-

In April 2023, Oracle launched a new version of EPM Automate, featuring the addition of several new commands. These include several new commands allowing users to optimize account reconciliation, enterprise data management, enterprise profitability and cost management, profitability and cost management, tax reporting, transfer consolidation journals across closed environments, and financial consolidation.

Enterprise Performance Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.73 billion |

|

Revenue forecast in 2030 |

USD 10.99 billion |

|

Growth rate |

CAGR of 8.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, deployment, enterprise size, function,vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Oracle; SAP; IBM Corporation; SAS Institute Inc.; Anaplan, Inc.; Unicorn Systems a.s.; Epicor Software Corporation; Workday, Inc.; OneStream; Board International; Wolters Kluwer N.V., |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase option |

Global Enterprise Performance Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest vertical trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global enterprise performance management market research report based on the offering, deployment, enterprise size, function, vertical, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Services

-

Solution

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Finance

-

Human Resources

-

Supply Chain

-

Sales and Marketing

-

Other

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail & Consumer

-

Government & Education

-

Healthcare

-

Manufacturing

-

Telecom and IT

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise performance management market size was estimated at USD 6.37 billion in 2023 and is expected to reach USD 6.73 billion in 2024

b. The global enterprise performance management market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 10.99 billion by 2030

b. The solution segment held the largest revenue share of 62.5% in 2023 and is expected to retain its dominance over the forecast period. The exponential growth in data volume and complexity is driving the demand for enterprise performance management solution

b. Some key players operating in the enterprise performance management market include Oracle; SAP; IBM Corporation; SAS Institute Inc.; Anaplan, Inc., Unicorn Systems a.s., Epicor Software Corporation, Workday, Inc., OneStream, Board International, Wolters Kluwer N.V.

b. The increasing adoption of digital transformation initiatives and the rising volume and complexity of business data are the key factors driving market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."