Enterprise Governance, Risk And Compliance Market Size, Share & Trends Analysis Report By Component (Software, Services), By Application (ESG, EHS), By Organization Size (SMEs, Large Enterprises), By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-670-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

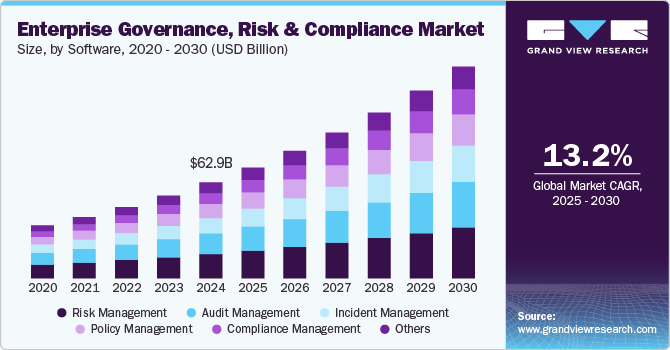

The global enterprise governance, risk and compliance market size was estimated at USD 62.92 billion in 2024 and is anticipated to grow at a CAGR of 13.2% from 2025 to 2030. The growth of this market can be attributed to the benefits of implementing enterprise governance, risk and compliance (eGRC), which include stability, optimization, transparency, reduced costs, and consistency, among others. Additionally, the presence of companies such as Oracle, Microsoft, SAP SE, and Software AG, which offer unique solutions, has resulted in a wide range of products available in the market, driving its growth.

The integration of AI and ML technologies within eGRC platforms has revolutionized how companies manage risk and compliance. AI-powered tools can detect emerging risks by analyzing large datasets, identifying patterns, and providing predictive insights. For example, AI can be used to automatically assess credit risks, identify fraud, or highlight potential regulatory violations. Machine learning algorithms can also be used to improve compliance monitoring, continuously adapting to new regulations and evolving threats.

These technologies enhance the efficiency and accuracy of eGRC tools, helping businesses stay proactive in managing risks. For instance, in April 2024, LogicGate, a U.D.-based risk management platform, unveiled its AI Governance Solution, designed to help organizations effectively manage and govern AI technology across all levels. This solution enables enterprises to adopt AI while ensuring compliance, agility, and competitive edge swiftly. The offering aims to help businesses maximize AI benefits while maintaining security and governance.

As regulations become more stringent across industries globally, companies are investing heavily in eGRC solutions to ensure they meet the growing compliance demands. Laws such as the GDPR, Sarbanes-Oxley, and others require organizations to track, manage, and report on compliance metrics, prompting the adoption of eGRC tools to streamline processes and minimize the risk of non-compliance.

With the increasing frequency and sophistication of cyberattacks, businesses are prioritizing cybersecurity and data protection. eGRC solutions help organizations manage their security risks more effectively by identifying vulnerabilities, automating risk assessments, and ensuring policies and controls are in place to prevent breaches. This trend is particularly pronounced in industries such as finance, healthcare, and manufacturing, which handle sensitive data.

Component Insights

The software segment dominated the market and accounted for a revenue share of nearly 65.0% in 2024. Cloud adoption is a significant factor accelerating the growth of the eGRC software market. As organizations increasingly move to cloud-based infrastructure, they need scalable and flexible eGRC solutions that can integrate seamlessly with cloud environments. Cloud-based eGRC software offers cost-effective deployment, real-time collaboration, and continuous updates, making it an attractive choice for businesses seeking efficiency and scalability.

The services segment is expected to grow at a significant CAGR of 13.8% over the forecast period. Many businesses are outsourcing eGRC operations to managed service providers (MSPs) to reduce internal resource burdens and ensure that governance and compliance tasks are handled by experts. Managed services offer ongoing risk assessments, real-time compliance monitoring, and response strategies, which help organizations stay agile and compliant in a fast-changing regulatory landscape.

Software Insights

The risk management segment accounted for the largest revenue share of nearly 25.0% in 2024. Organizations are more aware of the need to address operational risks, such as fraud, supply chain disruptions, and internal process inefficiencies. Risk management software helps enterprises assess risks across various operational domains, providing them with insights into potential vulnerabilities and enabling them to adopt proactive measures.

The compliance management segment is expected to grow at a significant CAGR of 15.6% over the forecast period. Compliance management systems are evolving to integrate with other applications such as risk management, auditing, and finance, providing a holistic approach to compliance. By offering a unified platform, these solutions allow companies to monitor compliance across multiple departments, ensuring greater alignment with corporate objectives and regulatory expectations.

Services Insights

The consulting segment accounted for the largest revenue share of over 38.0% in 2024. As companies increasingly turn to automation to streamline their eGRC operations, consulting services are in demand to advise on the integration of automated compliance and risk management tools. Consultants provide expertise on how to effectively leverage technology to enhance reporting, auditing, monitoring, and documentation, improving efficiency and reducing the likelihood of human error. This shift towards automation is particularly valuable for organizations looking to scale their operations while maintaining compliance and minimizing risk.

The integration segment is expected to grow at a significant CAGR over the forecast period. As businesses accumulate vast amounts of data from multiple sources, the need for a centralized platform to manage governance, risk, and compliance has become more critical. Integration services play a vital role in consolidating data from disparate systems into a unified view, allowing organizations to have a comprehensive understanding of their risk landscape. This centralized data hub enables better decision-making, more accurate reporting, and improved risk mitigation strategies.

Application Insights

The ESG segment accounted for a largest revenue share of over 30.0% in 2024. As stakeholders, including investors, customers, and employees, place greater emphasis on sustainability, businesses are increasingly expected to adopt environmentally responsible practices. Companies are integrating ESG factors into their governance frameworks to ensure they meet sustainability goals, reduce their environmental footprint, and promote social responsibility. This shift is driving demand for eGRC solutions that support ESG reporting, risk management, and compliance.

The EHS segment is expected to grow at a significant CAGR over the forecast period. Ensuring the health and safety of employees is a significant priority for organizations, particularly in high-risk industries such as manufacturing, construction, and chemicals. EHS software helps companies proactively identify and mitigate health and safety risks, reducing the likelihood of workplace accidents, injuries, and illnesses. These platforms support the tracking of safety incidents, near misses, and hazardous exposures, helping businesses take corrective actions and implement preventive measures to protect employees.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share of nearly 68.0% in 2024. As large enterprises expand into new global markets, they encounter a more diverse and complex set of regulatory and compliance requirements. Operating across various jurisdictions with different laws, labor standards, and tax regulations increases the risk of non-compliance. eGRC solutions enable large organizations to manage compliance and risk in multiple regions simultaneously, ensuring consistent adherence to local laws, industry standards, and corporate policies.

The SMEs segment is expected to grow at a significant CAGR over the forecast period. As SMEs embrace digital transformation, they face new risks related to cybersecurity, data privacy, and digital business models. eGRC platforms help SMEs manage these risks by providing tools to assess digital vulnerabilities, implement security protocols, and ensure compliance with digital-related regulations. These solutions facilitate the smooth adoption of digital tools while safeguarding SMEs from potential risks associated with digital transformation.

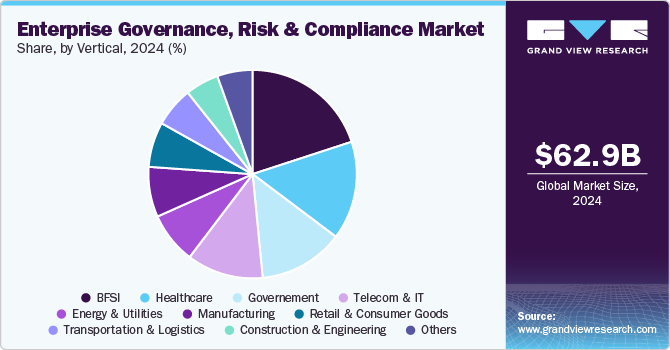

Vertical Insights

The BFSI segment accounted for a largest revenue share of over 20.0% in 2024. Financial institutions face various types of risks, including credit risk, market risk, operational risk, liquidity risk, and cybersecurity threats. As financial products and services become more complex, the potential for exposure to risks increases. eGRC solutions allow BFSI institutions to identify, assess, and mitigate these risks in real time, ensuring they comply with risk management frameworks and maintain operational stability. Moreover, fraud risks, including money laundering, insider trading, and fraudulent transactions, are a significant concern for the BFSI sector. eGRC solutions help in automating fraud detection, monitoring transactions for suspicious activities, and ensuring that all necessary compliance procedures are followed to mitigate the risk of financial crimes.

The telecom & IT segment is expected to grow at a significant CAGR over the forecast period. Telecom and IT companies manage vast amounts of sensitive data, including personal, financial, and corporate information. As cyberattacks and data breaches become more frequent and sophisticated, maintaining strong cybersecurity practices has become critical. Moreover, telecom and IT companies rely heavily on third-party vendors and service providers for various functions, such as software development, cloud services, network infrastructure, and customer support. This creates a risk of exposure to third-party breaches, non-compliance, and operational inefficiencies.

Regional Insights

The enterprise governance, risk and compliance market in North America held the largest revenue share of over 34.0% in 2024. The integration of artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and big data analytics in eGRC solutions is becoming more prominent. These technologies enable real-time risk monitoring, predictive analytics, and the automation of routine compliance tasks, improving efficiency and reducing human errors. AI and ML capabilities help organizations identify emerging risks, automate risk assessments, and enhance decision-making processes.

U.S. Enterprise Governance, Risk And Compliance Market Trends

The U.S. eGRC industry is expected to grow significantly at a CAGR of 10.7% from 2025 to 2030. Key regulations like Sarbanes-Oxley (SOX), Health Insurance Portability and Accountability Act (HIPAA), Gramm-Leach-Bliley Act (GLBA), Dodd-Frank Act, and industry-specific rules continue to increase pressure on organizations to maintain compliance. With businesses facing fines, reputational damage, and even legal actions for non-compliance, there is a growing demand for eGRC solutions that automate compliance processes, simplify reporting, and ensure continuous adherence to regulatory requirements.

Europe Enterprise Governance, Risk And Compliance Market Trends

The eGRC market in Europe is anticipated to register a considerable growth from 2025 to 2030. As sustainability and corporate responsibility become more important to stakeholders, European businesses are under increasing pressure to meet ESG standards. Regulations such as the EU Taxonomy for sustainable activities and the Non-Financial Reporting Directive (NFRD) require organizations to disclose ESG-related metrics, and failure to comply can result in reputational damage and financial consequences. eGRC solutions are increasingly incorporating ESG capabilities, allowing companies to track, report, and ensure compliance with ESG standards, thus driving demand for these solutions in Europe.

The UK enterprise governance, risk and compliance market is expected to grow rapidly in the coming years. The U.K. has stringent regulations aimed at preventing financial crime, including anti-money laundering (AML) and know your customer (KYC) laws. As financial crime risks become more sophisticated, financial institutions and other sectors are leveraging eGRC solutions to manage these challenges. These platforms provide tools to monitor transactions, assess potential risks, and ensure compliance with AML regulations.

The enterprise governance, risk and compliancemarket in Germany held a substantial market share in 2024 owing to the country’s strong manufacturing and industrial base, particularly in sectors such as automotive, engineering, and chemicals. The country adopts Industry 4.0 principles, which involve the integration of digital technologies into manufacturing processes.

Asia Pacific Enterprise Governance, Risk And Compliance Market Trends

The Asia Pacific eGRC market is growing significantly at a CAGR of 15.8% from 2025 to 2030. The financial services sector in APAC is highly regulated, and institutions must comply with a wide range of local and international financial regulations, such as Basel III, Anti-Money Laundering (AML), and Know Your Customer (KYC) requirements. Regulatory technology (RegTech) has emerged as a critical enabler of compliance, leveraging eGRC solutions to streamline reporting, audit trails, and risk management processes. The rapid growth of RegTech in countries like Singapore, Hong Kong, and Australia is influencing the demand for eGRC solutions that can provide real-time compliance monitoring and reporting in line with global regulatory requirements.

The enterprise governance, risk and compliancemarket in Japan is expected to grow rapidly in the coming years. Japan’s supply chains, particularly in industries such as automotive, electronics, and manufacturing, are highly complex and interconnected, often spanning multiple countries. Thus, Japanese businesses are increasingly adopting eGRC solutions to manage third-party and supply chain risks, assess vendor compliance, and track supplier performance.

The China enterprise governance, risk and compliance market held a substantial market share in 2024. China’s "Digital China" strategy aims to accelerate the adoption of AI, big data, blockchain, and cloud computing. With this digital transformation comes a higher complexity in governance, risk, and compliance requirements. Organizations adopting digital technologies face increased risks related to data security, third-party compliance, and automation governance.

Key Enterprise Governance, Risk And Compliance Company Insights

Key players operating in the eGRC industry are Oracle, Genpact, MetricStream, NAVEX Global, Inc., and Maclear Global. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2025, IBM partnered with e&, a UAE-based technology group, to implement a comprehensive AI and Generative AI governance solution to strengthen compliance, oversight, and ethical standards within its AI ecosystem. Leveraging IBM's watsonx.governance platform and IBM Consulting's expertise, the initiative is designed to enhance AI governance, risk management, and regulatory compliance across e&'s operations.

-

In October 2024, Thomson Reuters acquired Materia, a U.S.-based startup specializing in AI-driven assistants for tax, audit, and accounting professionals. The acquisition aims to strengthen Thomson Reuters' AI capabilities by enhancing automation in research and workflows, improving compliance with financial regulations. By integrating Materia’s technology, the company seeks to help professionals better manage risks related to financial reporting and regulatory compliance, reinforcing its commitment to innovation in the financial sector.

-

In September 2024, Oracle introduced the Oracle Financial Crime and Compliance (FCCM) Management Monitor Cloud Service, designed to give banks, fintechs, and financial institutions a centralized view of their compliance efforts. The solution enhances risk management by enabling faster detection of potential issues and helping organizations proactively combat financial crime while reducing compliance costs. Advanced reporting features allow institutions to generate customized, visually rich reports that are aligned with AML and regulatory requirements.

Key Enterprise Governance, Risk And Compliance Companies:

The following are the leading companies in the enterprise governance, risk and compliance market. These companies collectively hold the largest market share and dictate industry trends.

- FIS

- Genpact

- IBM

- Maclear Global

- MetricStream

- Microsoft

- NAVEX Global, Inc.

- Oracle

- RSA Security LLC

- SAI360 Inc.

- SAP SE

- SAS Institute Inc.

- Software GmbH

- Thomson Reuters

- Wolters Kluwer N.V.

View a comprehensive list of companies in the Enterprise Governance, Risk And Compliance Market.

Enterprise Governance, Risk And Compliance Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 72.42 billion |

|

Revenue forecast in 2030 |

USD 134.86 billion |

|

Growth rate |

CAGR of 13.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report services |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, software, services, application, organization size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

FIS; Genpact; IBM; Maclear Global; MetricStream; Microsoft; NAVEX Global, Inc.; Oracle; RSA Security LLC; SAI360 Inc.; SAP SE; SAS Institute Inc.; Software GmbH; Thomson Reuters; Wolters Kluwer N.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Enterprise Governance, Risk And Compliance (eGRC) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Enterprise Governance, Risk and Compliance (eGRC)market report based on component, software, services, application, organization size, vertical, and region.:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Software Outlook (Revenue, USD Billion, 2018 - 2030)

-

Audit Management

-

Compliance Management

-

Risk Management

-

Policy Management

-

Incident Management

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integration

-

Consulting

-

Support

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Director Board

-

EHS

-

ESG

-

Legal Services

-

Others

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Construction & Engineering

-

Energy & Utilities

-

Government

-

Healthcare

-

Manufacturing

-

Retail & consumer goods

-

Telecom & IT

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise governance, risk and compliance market size was estimated at USD 62.92 billion in 2024 and is expected to reach USD 72.42 billion in 2025.

b. The global enterprise governance, risk and compliance market is expected to grow at a compound annual growth rate of 13.2% from 2025 to 2030 to reach USD 134.86 billion by 2030.

b. The risk management software segment dominated the EGRC market, with a share of nearly 25.0% in 2024. Organizations are more aware of the need to address operational risks, such as fraud, supply chain disruptions, and internal process inefficiencies. Risk management software helps enterprises assess risks across various operational domains, providing insights into potential vulnerabilities and enabling them to adopt proactive measures.

b. The software segment dominated the global EGRC market and accounted for the largest revenue share, nearly 65.0%, in 2024 due to increasing cloud adoption. As organizations move to cloud-based infrastructure, they need scalable and flexible eGRC solutions that can integrate seamlessly with cloud environments.

b. Consulting services led the global enterprise governance, risk, and compliance market and accounted for a maximum revenue share of more than 38.0% in 2024; owing to companies increasingly turn to automation to streamline their eGRC operations, consulting services are in demand to advise on the integration of automated compliance and risk management tools.

b. The large enterprise segment led the global enterprise governance, risk & compliance market with a revenue share of nearly 68.0% of the overall revenue share in 2024.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Methodology segmentation & scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Enterprise Governance, Risk And Compliance (eGRC) Variables, Trends & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Industry Opportunities

3.4. Enterprise Governance, Risk And Compliance (eGRC) Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Enterprise Governance, Risk And Compliance (eGRC) Market: Component Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Enterprise Governance, Risk And Compliance (eGRC): Component Movement Analysis, USD Billion, 2024 & 2030

4.3. Software

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Services

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Enterprise Governance, Risk And Compliance (eGRC) Market: Software Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Enterprise Governance, Risk And Compliance (eGRC): Software Movement Analysis, USD Billion, 2024 & 2030

5.3. Audit Management

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Compliance Management

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. Risk Management

5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.6. Policy Management

5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.7. Incident Management

5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.8. Others

5.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Enterprise Governance, Risk And Compliance (eGRC) Market: Services Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Enterprise Governance, Risk And Compliance (eGRC): Services Movement Analysis, USD Billion, 2024 & 2030

6.3. Integration

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. Consulting

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.5. Support

6.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Enterprise Governance, Risk And Compliance (eGRC) Market: Application Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Enterprise Governance, Risk And Compliance (eGRC): Application Movement Analysis, USD Billion, 2024 & 2030

7.3. Director Board

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. EHS

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5. ESG

7.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6. Legal Services

7.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.7. Others

7.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Enterprise Governance, Risk And Compliance (eGRC) Market: Organization Size Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Enterprise Governance, Risk And Compliance (eGRC): Organization Size Movement Analysis, USD Billion, 2024 & 2030

8.3. Small & Medium Enterprise

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4. Large Enterprise

8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 9. Enterprise Governance, Risk And Compliance (eGRC) Market: Vertical Estimates & Trend Analysis

9.1. Segment Dashboard

9.2. Enterprise Governance, Risk And Compliance (eGRC): Verticals Movement Analysis, USD Billion, 2024 & 2030

9.3. BFSI

9.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4. Construction & Engineering

9.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5. Energy & Utilities

9.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6. Government

9.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.7. Healthcare

9.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.8. Manufacturing

9.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.9. Retail & consumer goods

9.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.10. Telecom & IT

9.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.11. Transportation & Logistics

9.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.12. Others

9.12.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 10. Enterprise Governance, Risk And Compliance (eGRC) Market: Regional Estimates & Trend Analysis

10.1. Enterprise Governance, Risk And Compliance (eGRC) Share, By Region, 2024 & 2030, USD Billion

10.2. North America

10.2.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.2.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.2.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.2.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.2.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.2.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.2.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.2.8. U.S.

10.2.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.2.8.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.2.8.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.2.8.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.2.8.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.2.8.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.2.8.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.2.9. Canada

10.2.9.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.2.9.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.2.9.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.2.9.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.2.9.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.2.9.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.2.9.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.2.10. Mexico

10.2.10.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.2.10.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.2.10.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.2.10.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.2.10.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.2.10.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.2.10.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.3. Europe

10.3.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.3.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.3.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.3.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.3.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.3.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.3.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.3.8. UK

10.3.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.3.8.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.3.8.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.3.8.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.3.8.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.3.8.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.3.8.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.3.9. Germany

10.3.9.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.3.9.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.3.9.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.3.9.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.3.9.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.3.9.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.3.9.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.3.10. France

10.3.10.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.3.10.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.3.10.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.3.10.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.3.10.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.3.10.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.3.10.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.3.11. Italy

10.3.11.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.3.11.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.3.11.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.3.11.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.3.11.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.3.11.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.3.11.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.3.12. Spain

10.3.12.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.3.12.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.3.12.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.3.12.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.3.12.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.3.12.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.3.12.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.4. Asia Pacific

10.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.4.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.4.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.4.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.4.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.4.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.4.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.4.8. China

10.4.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.4.8.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.4.8.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.4.8.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.4.8.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.4.8.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.4.8.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.4.9. India

10.4.9.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.4.9.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.4.9.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.4.9.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.4.9.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.4.9.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.4.9.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.4.10. Japan

10.4.10.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.4.10.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.4.10.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.4.10.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.4.10.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.4.10.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.4.10.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.4.11. Australia

10.4.11.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.4.11.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.4.11.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.4.11.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.4.11.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.4.11.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.4.11.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.4.12. South Korea

10.4.12.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.4.12.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.4.12.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.4.12.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.4.12.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.4.12.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.4.12.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.5. Latin America

10.5.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.5.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.5.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.5.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.5.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.5.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.5.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.5.8. Brazil

10.5.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.5.8.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.5.8.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.5.8.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.5.8.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.5.8.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.5.8.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.5.9. Argentina

10.5.9.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.5.9.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.5.9.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.5.9.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.5.9.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.5.9.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.5.9.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.6. Middle East & Africa

10.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.6.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.6.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.6.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.6.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.6.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.6.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.6.8. Saudi Arabia

10.6.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.6.8.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.6.8.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.6.8.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.6.8.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.6.8.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.6.8.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.6.9. UAE

10.6.9.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.6.9.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.6.9.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.6.9.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.6.9.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.6.9.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.6.9.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

10.6.10. South Africa

10.6.10.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

10.6.10.2. Market estimates and forecast by component,2018 - 2030 (Revenue, USD Billion)

10.6.10.3. Market estimates and forecast by software,2018 - 2030 (Revenue, USD Billion)

10.6.10.4. Market estimates and forecast by services,2018 - 2030 (Revenue, USD Billion)

10.6.10.5. Market estimates and forecast by application,2018 - 2030 (Revenue, USD Billion)

10.6.10.6. Market estimates and forecast by organization size,2018 - 2030 (Revenue, USD Billion)

10.6.10.7. Market estimates and forecast by vertical,2018 - 2030 (Revenue, USD Billion)

Chapter 11. Competitive Landscape

11.1. Recent Developments & Impact Analysis by Key Market Participants

11.2. Company Categorization

11.3. Company Market Share Analysis

11.4. Company Heat Map Analysis

11.5. Strategy Mapping

11.5.1. Expansion

11.5.2. Mergers & Acquisition

11.5.3. Partnerships & Collaborations

11.5.4. New Product Launches

11.5.5. Research And Development

11.6. Company Profiles

11.6.1. FIS

11.6.1.1. Participant’s Overview

11.6.1.2. Financial Performance

11.6.1.3. Product Benchmarking

11.6.1.4. Recent Developments

11.6.2. Genpact

11.6.2.1. Participant’s Overview

11.6.2.2. Financial Performance

11.6.2.3. Product Benchmarking

11.6.2.4. Recent Developments

11.6.3. IBM

11.6.3.1. Participant’s Overview

11.6.3.2. Financial Performance

11.6.3.3. Product Benchmarking

11.6.3.4. Recent Developments

11.6.4. Maclear Global

11.6.4.1. Participant’s Overview

11.6.4.2. Financial Performance

11.6.4.3. Product Benchmarking

11.6.4.4. Recent Developments

11.6.5. MetricStream

11.6.5.1. Participant’s Overview

11.6.5.2. Financial Performance

11.6.5.3. Product Benchmarking

11.6.5.4. Recent Developments

11.6.6. Microsoft

11.6.6.1. Participant’s Overview

11.6.6.2. Financial Performance

11.6.6.3. Product Benchmarking

11.6.6.4. Recent Developments

11.6.7. NAVEX Global, Inc.

11.6.7.1. Participant’s Overview

11.6.7.2. Financial Performance

11.6.7.3. Product Benchmarking

11.6.7.4. Recent Developments

11.6.8. Oracle

11.6.8.1. Participant’s Overview

11.6.8.2. Financial Performance

11.6.8.3. Product Benchmarking

11.6.8.4. Recent Developments

11.6.9. RSA Security LLC

11.6.9.1. Participant’s Overview

11.6.9.2. Financial Performance

11.6.9.3. Product Benchmarking

11.6.9.4. Recent Developments

11.6.10. SAI360 Inc.

11.6.10.1. Participant’s Overview

11.6.10.2. Financial Performance

11.6.10.3. Product Benchmarking

11.6.10.4. Recent Developments

11.6.11. SAP SE

11.6.11.1. Participant’s Overview

11.6.11.2. Financial Performance

11.6.11.3. Product Benchmarking

11.6.11.4. Recent Developments

11.6.12. SAS Institute Inc.

11.6.12.1. Participant’s Overview

11.6.12.2. Financial Performance

11.6.12.3. Product Benchmarking

11.6.12.4. Recent Developments

11.6.13. Software GmbH

11.6.13.1. Participant’s Overview

11.6.13.2. Financial Performance

11.6.13.3. Product Benchmarking

11.6.13.4. Recent Developments

11.6.14. Thomson Reuters

11.6.14.1. Participant’s Overview

11.6.14.2. Financial Performance

11.6.14.3. Product Benchmarking

11.6.14.4. Recent Developments

11.6.15. Wolters Kluwer N.V.

11.6.15.1. Participant’s Overview

11.6.15.2. Financial Performance

11.6.15.3. Product Benchmarking

11.6.15.4. Recent Developments

List of Tables

Table 1 List of Abbreviation

Table 2 Global data denter logical security market, 2018 - 2030 (USD Billion)

Table 3 Global data denter logical security market, by region, 2018 - 2030 (USD Billion)

Table 4 Global data denter logical security market, by component, 2018 - 2030 (USD Billion)

Table 5 Global data denter logical security market, by software, 2018 - 2030 (USD Billion)

Table 6 Global data denter logical security market, by services, 2018 - 2030 (USD Billion)

Table 7 Global data denter logical security market, by application, 2018 - 2030 (USD Billion)

Table 8 Global data denter logical security market, by organization size, 2018 - 2030 (USD Billion)

Table 9 Global enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 10 Global software market by region, 2018 - 2030 (USD Billion)

Table 11 Global services market by region, 2018 - 2030 (USD Billion)

Table 12 Global audit management market by region, 2018 - 2030 (USD Billion)

Table 13 Global compliance management market by region, 2018 - 2030 (USD Billion)

Table 14 Global risk management market by region, 2018 - 2030 (USD Billion)

Table 15 Global policy management market by region, 2018 - 2030 (USD Billion)

Table 16 Global incident management market by region, 2018 - 2030 (USD Billion)

Table 17 Global others market by region, 2018 - 2030 (USD Billion)

Table 18 Global integration market by region, 2018 - 2030 (USD Billion)

Table 19 Global consulting market by region, 2018 - 2030 (USD Billion)

Table 20 Global support market by region, 2018 - 2030 (USD Billion)

Table 21 Global director board market by region, 2018 - 2030 (USD Billion)

Table 22 Global EHS market by region, 2018 - 2030 (USD Billion)

Table 23 Global ESG market by region, 2018 - 2030 (USD Billion)

Table 24 Global legal services market by region, 2018 - 2030 (USD Billion)

Table 25 Global others market by region, 2018 - 2030 (USD Billion)

Table 26 Global small & medium enterprise market by region, 2018 - 2030 (USD Billion)

Table 27 Global large enterprise market by region, 2018 - 2030 (USD Billion)

Table 28 Global BFSI market by region, 2018 - 2030 (USD Billion)

Table 29 Global construction & engineering market by region, 2018 - 2030 (USD Billion)

Table 30 Global energy & utilities market by region, 2018 - 2030 (USD Billion)

Table 31 Global government market by region, 2018 - 2030 (USD Billion)

Table 32 Global healthcare market by region, 2018 - 2030 (USD Billion)

Table 33 Global manufacturing market by region, 2018 - 2030 (USD Billion)

Table 34 Global retail & consumer goods market by region, 2018 - 2030 (USD Billion)

Table 35 Global telecom & IT market by region, 2018 - 2030 (USD Billion)

Table 36 Global transportation & logistics market by region, 2018 - 2030 (USD Billion)

Table 37 Global others market by region, 2018 - 2030 (USD Billion)

Table 38 North America enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 39 North America enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 40 North America enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 41 North America enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 ( USD Billion)

Table 42 North America enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 43 North America enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 44 U.S. enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 45 U.S. enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 46 U.S. enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 47 U.S. enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 48 U.S. enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 49 U.S. enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 50 Canada enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 51 Canada enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 52 Canada enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 53 Canada enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 54 Canada enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 55 Canada enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 56 Mexico enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 57 Mexico enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 58 Mexico enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 59 Mexico enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (USD Billion)

Table 60 Mexico enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 61 Mexico enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 62 Europe enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 63 Europe enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 64 Europe enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 65 Europe enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 66 Europe enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 67 Europe enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 68 UK enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 69 UK enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 70 UK enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 71 UK enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 72 UK enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 73 UK enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 74 Germany enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 75 Germany enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 76 Germany enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 77 Germany enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 78 Germany enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 79 Germany enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 80 France enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 81 France enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 82 France enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 83 France enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 84 France enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 85 France enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 86 Italy enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 87 Italy enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 88 Italy enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 89 Italy enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 90 Italy enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 91 Italy enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 92 Spain enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 93 Spain enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 94 Spain enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 95 Spain enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 96 Spain enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 97 Spain enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 98 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 99 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 100 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 101 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 102 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 103 Asia Pacific enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 104 China enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 105 China enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 106 China enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 107 China enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 108 China enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 109 China enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 110 India enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 111 India enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 112 India enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 113 India enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 114 India enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 115 India enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 116 Japan enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 117 Japan enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 118 Japan enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 119 Japan enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 120 Japan enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 121 Japan enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 122 Australia enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 123 Australia enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 124 Australia enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 125 Australia enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (USD Billion)

Table 126 Australia enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 127 Australia enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 128 Australia enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 129 South Korea enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 130 South Korea enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 131 South Korea enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 132 South Korea enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 133 South Korea enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 134 South Korea enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 135 Latin America enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 136 Latin America enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 137 Latin America enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 138 Latin America enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 139 Latin America enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 140 Latin America enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 141 Brazil enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 142 Brazil enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 143 Brazil enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 144 Brazil enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 145 Brazil enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 146 Brazil enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 147 Argentina enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 148 Argentina enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 149 Argentina enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 150 Argentina enterprise governance, risk and compliance (eGRC) market, by deployment mode, 2018 - 2030 (USD Billion)

Table 151 Argentina enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 152 Argentina enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 153 Middle East & Africa enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 154 Middle East & Africa enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 155 Middle East & Africa enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 156 Middle East & Africa enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 157 Middle East & Africa enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 158 Middle East & Africa enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 159 UAE enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 160 UAE enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 161 UAE enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 162 UAE enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 163 UAE enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 164 UAE enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 165 Saudi Arabia enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 166 Saudi Arabia enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 167 Saudi Arabia enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 168 Saudi Arabia enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 169 Saudi Arabia enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 170 Saudi Arabia enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

Table 171 South Africa enterprise governance, risk and compliance (eGRC) market, by component, 2018 - 2030 (USD Billion)

Table 172 South Africa enterprise governance, risk and compliance (eGRC) market, by software, 2018 - 2030 (USD Billion)

Table 173 South Africa enterprise governance, risk and compliance (eGRC) market, by services, 2018 - 2030 (USD Billion)

Table 174 South Africa enterprise governance, risk and compliance (eGRC) market, by application, 2018 - 2030 (USD Billion)

Table 175 South Africa enterprise governance, risk and compliance (eGRC) market, by organization size, 2018 - 2030 (USD Billion)

Table 176 South Africa enterprise governance, risk and compliance (eGRC) market, by vertical, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Enterprise Governance, Risk And Compliance (eGRC) Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot

Fig. 9 Competitive Landscape Snapshot

Fig. 10 Enterprise Governance, Risk And Compliance (eGRC): Industry Value Chain Analysis

Fig. 11 Enterprise Governance, Risk And Compliance (eGRC): Market Dynamics

Fig. 12 Enterprise Governance, Risk And Compliance (eGRC): PORTER’s Analysis

Fig. 13 Enterprise Governance, Risk And Compliance (eGRC): PESTEL Analysis

Fig. 14 Enterprise Governance, Risk And Compliance (eGRC) Share by Component, 2024 & 2030 (USD Billion)

Fig. 15 Enterprise Governance, Risk And Compliance (eGRC), by Component: Market Share, 2024 & 2030

Fig. 16 Software Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 17 Services Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 Enterprise Governance, Risk And Compliance (eGRC) Share by Software, 2024 & 2030 (USD Billion)

Fig. 19 Enterprise Governance, Risk And Compliance (eGRC), by Software: Market Share, 2024 & 2030

Fig. 20 Audit Management Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 21 Compliance Management Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 22 Risk Management Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 23 Policy Management Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 24 Incident Management Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 Enterprise Governance, Risk And Compliance (eGRC) Share by Services, 2024 & 2030 (USD Billion)

Fig. 27 Enterprise Governance, Risk And Compliance (eGRC), by Services: Market Share, 2024 & 2030

Fig. 28 Integration Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 Consulting Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Support Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 31 Enterprise Governance, Risk And Compliance (eGRC) Share by Application, 2024 & 2030 (USD Billion)

Fig. 32 Enterprise Governance, Risk And Compliance (eGRC), by Application: Market Share, 2024 & 2030

Fig. 33 Director Board Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 34 EHS Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 35 ESG Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 36 Legal Services Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 37 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 38 Enterprise Governance, Risk And Compliance (eGRC) Share by Organization Size, 2024 & 2030 (USD Billion)

Fig. 39 Enterprise Governance, Risk And Compliance (eGRC), by Organization Size: Market Share, 2024 & 2030

Fig. 40 Small & Medium Enterprise Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 41 Large Enterprise Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 42 Enterprise Governance, Risk And Compliance (eGRC) Share by Vertical, 2024 & 2030 (USD Billion)

Fig. 43 Enterprise Governance, Risk And Compliance (eGRC), by Vertical: Market Share, 2024 & 2030

Fig. 44 BFSI Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 45 Construction & Engineering Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 46 Energy & Utilities Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 47 Government Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 48 Healthcare Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 49 Manufacturing Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 50 Retail & consumer goods Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 51 Telecom & IT Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 52 Transportation & Logistics Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 53 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 54 Regional Market place: Key Takeaways

Fig. 55 North America Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 U.S. Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 Canada Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 58 Mexico Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 59 Europe Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 60 UK Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 61 Germany Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts 2018 - 2030 (USD Billion)2018 - 2030 (USD Billion)

Fig. 62 France Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts 2018 - 2030 (USD Billion)2018 - 2030 (USD Billion)

Fig. 63 Italy Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts 2018 - 2030 (USD Billion)2018 - 2030 (USD Billion)

Fig. 64 Spain Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts 2018 - 2030 (USD Billion)2018 - 2030 (USD Billion)

Fig. 65 Asia Pacific Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 66 China Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 67 India Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 68 Japan Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 69 Australia Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 70 South Korea Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 71 Latin America Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 72 Brazil Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 73 Argentina Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 74 MEA Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 75 Saudi Arabia Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 76 UAE Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 77 South Africa Enterprise Governance, Risk And Compliance (eGRC) Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 78 Key Company Categorization

Fig. 79 Company Market Positioning

Fig. 80 Key Company Market Share Analysis, 2024

Fig. 81 Strategic Framework

Market Segmentation

- Enterprise Governance, Risk and Compliance (eGRC) Component Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Services

- Enterprise Governance, Risk and Compliance (eGRC) Software Outlook (Revenue, USD Billion, 2018 - 2030)

- Audit Management

- Compliance Management

- Risk Management

- Policy Management

- Incident Management

- Others

- Enterprise Governance, Risk and Compliance (eGRC) Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Integration

- Consulting

- Support

- Enterprise Governance, Risk and Compliance (eGRC) Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Director Board

- EHS

- ESG

- Legal Services

- Others

- Enterprise Governance, Risk and Compliance (eGRC) Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Small & Medium Enterprise

- Large Enterprise

- Enterprise Governance, Risk and Compliance (eGRC) Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Construction & Engineering

- Energy & Utilities

- Government

- Healthcare

- Manufacturing

- Retail & consumer goods

- Telecom & IT

- Transportation & Logistics

- Others

- Enterprise Governance, Risk and Compliance (eGRC) Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Enterprise Governance, Risk and Compliance (eGRC), By Component (Revenue, USD Billion, 2018 - 2030)

- Software

- Services

- North America Enterprise Governance, Risk and Compliance (eGRC), By Software (Revenue, USD Billion, 2018 - 2030)

- Audit Management

- Compliance Management

- Risk Management

- Policy Management

- Incident Management

- Others

- North America Enterprise Governance, Risk and Compliance (eGRC) , By Services (Revenue, USD Billion, 2018 - 2030)

- Integration

- Consulting

- Support

- North America Enterprise Governance, Risk and Compliance (eGRC), By Application (Revenue, USD Billion, 2018 - 2030)

- Director Board

- EHS

- ESG

- Legal Services

- Others

- North America Enterprise Governance, Risk and Compliance (eGRC), By Organization Size (Revenue, USD Billion, 2018 - 2030)

- Small & Medium Enterprise

- Large Enterprise

- North America Enterprise Governance, Risk and Compliance (eGRC), By Vertical (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Construction & Engineering

- Energy & Utilities

- Government

- Healthcare

- Manufacturing

- Retail & consumer goods

- Telecom & IT

- Transportation & Logistics

- Others

- U.S.

- U.S. Enterprise Governance, Risk and Compliance (eGRC), By Component (Revenue, USD Billion, 2018 - 2030)

- Software

- Services

- U.S. Enterprise Governance, Risk and Compliance (eGRC), By Software (Revenue, USD Billion, 2018 - 2030)

- Audit Management

- Compliance Management

- Risk Management

- Policy Management

- Incident Management

- Others

- U.S. Enterprise Governance, Risk and Compliance (eGRC), By Services (Revenue, USD Billion, 2018 - 2030)

- Integration

- Consulting

- Support

- U.S. Enterprise Governance, Risk and Compliance (eGRC), By Application (Revenue, USD Billion, 2018 - 2030)

- Director Board

- EHS

- ESG

- Legal Services

- Others

- U.S. Enterprise Governance, Risk and Compliance (eGRC), By Organization Size (Revenue, USD Billion, 2018 - 2030)

- Small & Medium Enterprise

- Large Enterprise