Enterprise Generative AI Market Size, Share & Trends Analysis Report By Component (Software, Services), By Model Type (Text, Image, Audio, Code), By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-164-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2025 - 2030

- Industry: Technology

Enterprise Generative AI Market Trends

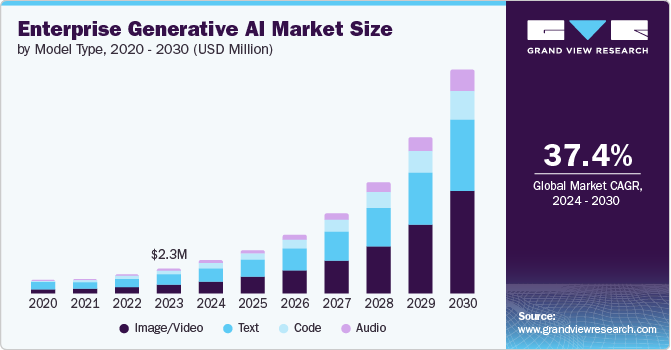

The global enterprise generative AI market size was estimated at USD 2,941.0 million in 2024 and is expected to grow at a CAGR of 38.4% from 2025 to 2030. The enterprise generative AI sector is experiencing significant growth, marked by an increasing number of startups entering the field. These companies are focusing on various aspects of quantum technology, including hardware, software, and diverse applications. Moreover, there has been a notable rise in investments within the enterprise generative AI market, with both private sectors and governments contributing substantial funding. Governments, in particular, are dedicating significant resources to advancing quantum research and development, with the aim of remaining competitive in the rapidly evolving landscape of emerging technologies.

The utilization of enterprise generative AI has surged due to its ability to create realistic images, engaging animations, and immersive audio, particularly benefiting graphic design and video marketing efforts. This technology has also become invaluable in streamlining administrative tasks such as claims processing, appointment scheduling, and overall operational management. Its adaptability and effectiveness make it an indispensable tool across various industries. The emergence and adoption of enterprise-ready generative AI models are on the rise, with platforms such as Google Cloud’s Vertex AI integrating these solutions. As these advancements continue, business leaders are discovering that generative AI can drive their organizations to unprecedented levels of speed, scalability, and execution efficiency.

Businesses are progressively embracing industry-tailored generative AI solutions. For instance, in October 2024, Wipro Limited, an Indian IT company, partnered with NVIDIA Corporation to utilize its AI technologies, including generative AI, through WeGA Studio and NIM Agent Blueprints. This partnership aims to create customized solutions for customer service, healthcare, and supply chain management. In healthcare, AI models support the analysis of medical images, facilitating the diagnosis and treatment strategies. Likewise, financial sectors benefit from AI algorithms aiding in assessing risks and detecting fraudulent activities. Retail industries rely on AI for customized product suggestions and managing inventory effectively. This trend encompasses the customization of AI models to tackle sector-specific hurdles, enhancing operational efficiencies, and outcomes while complying with industry regulations.

Components Insights

The software segment dominated the market with a share of over 72.5% in 2024. In the software sector of enterprise generative AI market, there's a clear trend towards an expanding range of specialized tools and platforms designed for specific business needs. These offerings cover various functions, including generating text, creating images, and specialized creative design applications. Both new startups and established companies are dedicated to developing adaptable software solutions to meet the distinct requirements of enterprises in different industries. For instance, in February 2024, Google LLC launched Gemini Business and Gemini Enterprise to provide businesses with customized AI software solutions to enhance productivity and drive growth. These plans offer specialized tools designed to meet the specific needs of organizations, enabling more effective utilization of generative AI.

The increase in the demand for Enterprise Generative AI within the service sector revolves around the rising presence of consulting firms and service providers offering specialized skills in implementing Generative AI solutions customized for enterprises. These services encompass guiding strategies, evaluating potential applications, and actively assisting during the implementation phase. Businesses are increasingly seeking this support to navigate the intricate process of effectively integrating Generative AI into their day-to-day operations, aiming to achieve peak efficiency and gain a competitive edge. Consulting firms play a pivotal role by sharing valuable insights and best practices, ensuring that businesses harness the full potential of Generative AI while staying aligned with their specific business goals.

Model Type Insights

The text segment dominated the market with a revenue share in 2024. The rise of customized language models customized to specific industries is driving innovation in enterprise generative AI, with a focus on enhancing text generation, comprehension, and ensuring data privacy. For instance, in July 2024, Fujitsu and Cohere, a U.S.-based artificial intelligence company, partnered to develop Takane, a Japanese language model for private cloud use, providing secure generative AI solutions for enterprises. This collaboration combines Fujitsu's AI expertise with Cohere’s advanced language models to boost productivity in industries such as finance and government.

The audio segment is projected to experience the fastest growth rate from 2025 to 2030. This growth is driven by advancements in speech recognition and natural language processing technologies. Increased adoption of voice-activated devices and applications across industries is contributing to the surge in demand for audio-based AI solutions. As a result, businesses are increasingly integrating audio-focused generative AI to enhance user experiences and streamline operations. Furthermore, the growing popularity of podcasts, audiobooks, and virtual assistants is also fueling the demand for audio AI innovations.

Application Insights

The marketing and sales segment dominated the market with the largest revenue share in 2024. This dominance is driven by the increasing adoption of generative AI to personalize customer experiences and optimize marketing strategies. Businesses are utilizing AI to automate content creation, improve customer engagement, and deliver targeted advertising more efficiently. Moreover, AI-powered tools are enhancing sales forecasting, lead generation, and customer insights, which are crucial for driving revenue growth. As a result, companies are increasingly investing in AI-driven marketing and sales solutions to maintain a competitive edge.

The advancement of generative AI is transforming customer service by enhancing the analysis of sentiments and emotion recognition in customer interactions. Utilizing advanced natural language processing and machine learning techniques, these AI systems can decode the complexities of customer emotions conveyed through both text and speech. By accurately understanding customer sentiments, companies can tailor their responses and support to meet individual needs, providing more empathetic and personalized experiences. This leads to greater customer satisfaction and fosters increased loyalty.

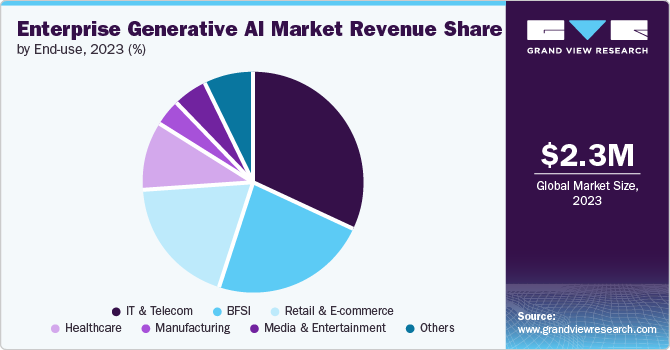

End Use Insights

The IT & Telecom segment dominated the market with the largest revenue share in 2024, driven by the growing adoption of generative AI in network optimization, customer support, and automation. For example, telecom companies are using AI-powered chatbots for customer service, automating routine inquiries, and improving response times. Moreover, AI is being utilized to enhance network management by predicting failures and optimizing performance, reducing operational costs. As a result, the IT & Telecom sector is increasingly integrating generative AI to improve efficiency, customer experience, and overall service quality. Furthermore, AI's ability to handle large-scale data analysis enables telecom providers to deliver real-time insights and make informed decisions.

The Retail & E-commerce segment is witnessing significant growth in the adoption of generative AI, driven by the need for personalized customer experiences and efficient operations. AI is being used to enhance product recommendations, customer service, and inventory management by analyzing consumer behavior and preferences. Moreover, generative AI tools are simplifying content creation for marketing, allowing retailers to generate product descriptions, ads, and promotional content more efficiently. E-commerce platforms are utilizing AI to automate pricing strategies and optimize supply chains, reducing costs and improving customer satisfaction.

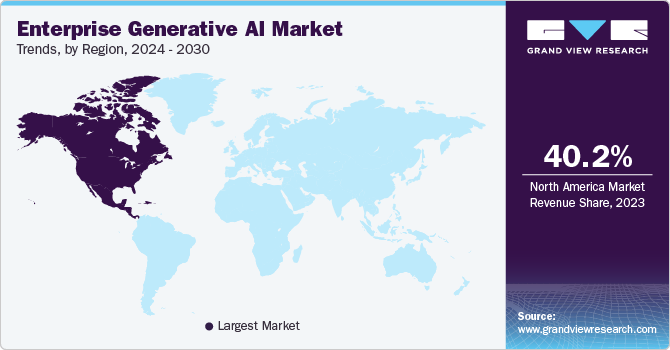

Regional Insights

North America dominated the enterprise generative AI market with a share of 41.0% in 2024, due to the presence of major technology companies such as OpenAI, Microsoft, and Google LLC, which are driving innovation in AI applications. The region benefits from robust research and development investments, particularly in the U.S., where AI adoption is accelerating across various industries. Sectors such as healthcare, finance, and media are increasingly leveraging generative AI for tasks such as drug discovery, fraud detection, and content creation, further boosting market growth. With strong infrastructure and a growing number of startups, North America continues to lead in the development and deployment of generative AI technologies across enterprises.

U.S. Enterprise Generative AI Market Trends

The U.S. enterprise generative ai market is characterized by widespread adoption of generative AI across industries such as technology, finance, healthcare, and entertainment. Major tech hubs such as Silicon Valley and Seattle are home to leading AI companies and startups that drive innovation in the field. The integration of generative AI with cloud computing services from giants such as Amazon Web Services (AWS) and Microsoft Azure enables scalable and efficient deployment of AI solutions. In addition, strong collaboration between academia and industry fosters continuous advancements in generative AI research and applications, further accelerating the market's growth.

Europe Enterprise Generative AI Market Trends

Europe's enterprise generative AI market is experiencing steady growth, driven by stringent data privacy regulations and a focus on ethical AI development. Countries such as Germany, the UK, and France are leading the adoption of generative AI technologies in sectors such as manufacturing, automotive, and the creative industries. The European Union's initiatives to establish a unified AI strategy and increase funding for AI research are key drivers of market expansion. Furthermore, the emphasis on sustainable and responsible AI practices encourages enterprises to implement generative AI solutions that comply with regulatory standards and meet societal expectations.

Asia Pacific Enterprise Generative AI Market Trends

The Asia Pacific region is experiencing the fastest growth in the enterprise generative AI market, fueled by rapid digital transformation, increasing investments in AI technologies, and the expanding presence of technology giants in countries such as China, Japan, South Korea, and India. The widespread adoption of mobile technologies and the growing e-commerce sector in the region present significant opportunities for generative AI applications in personalized marketing, customer service, and content generation. Government initiatives that promote AI research and development, along with a thriving startup ecosystem, further accelerate market expansion. These factors collectively contribute to the region's strong growth and adoption of generative AI technologies across industries.

Key Enterprise Generative AI Company Insights

The industry is characterized by fierce competition, dominated by a few major global players who possess significant market control. The focus revolves around developing groundbreaking products and promoting cooperation among key players within the industry. For instance, in April 2024, Microsoft, a U.S.-based technology company and Cognizant extended their partnership to deploy Microsoft's generative AI and Copilots, enhancing business operations and accelerating innovation in various industries. This initiative includes significant investments in AI training and technology for sectors such as healthcare, retail, and financial services.

Similarly, in September 2024, Cloudera collaborated with Amazon Web Services (AWS) to advance reliable enterprise generative AI. This collaboration enables Cloudera to utilize AWS offerings, aiming to provide ongoing advancements and cost reductions for customers utilizing Cloudera's open data lake house on AWS, specifically designed for trusted enterprise generative AI. Cloudera has opted for AWS to operate essential elements of the Cloudera Data Platform (CDP), encompassing aspects such as the data lake, data warehouse, operational database, artificial intelligence/machine learning capabilities, master data management, and comprehensive security measures.

Key Enterprise Generative AI Companies:

The following are the leading companies in the enterprise generative AI market. These companies collectively hold the largest market share and dictate industry trends.

- AWS Inc.

- Google LLC

- H20.ai

- IBM Corporation

- Intel Corporation

- Jasper.ai

- Microsoft Corporation

- Nvidia Corporation

- OpenAI

- Oracle Corporation

- Synthesis AI

Recent Development

-

In August 2024, NVIDIA Corporation, a computer manufacturing company, launched NIM Agent Blueprints, a collection of customizable AI workflows to help enterprises quickly create and implement generative AI applications for use cases such as customer service, drug discovery, and data extraction. Partners such as Accenture and Deloitte are enabling businesses to customize these solutions for faster digital transformation.

-

In June 2024, Amazon Web Services, Inc., Inc. announced a USD 230 million commitment aimed at accelerating the development of generative AI applications by startups across the globe. This initiative will offer startups, particularly those in their early stages, with mentorship, AWS credits, and educational resources to advance their use of AI and ML technologies.

-

In May 2024, Accenture, an IT company in Ireland, and Oracle partnered to accelerate generative AI adoption, focusing on transforming financial planning and analysis for CFOs using Oracle Cloud Infrastructure (OCI) Generative AI. Their collaboration aims to streamline tasks such as procurement spend analysis, financial forecasting, and dynamic scenario planning, enabling enterprises to optimize operations, improve decision-making, and drive growth.

-

In April 2024, AWS has announced the general availability of Amazon Q. This advanced generative artificial intelligence (AI)-powered assistant is designed to accelerate software development and utilize companies' internal data. Amazon Q excels at generating precise code, testing and debugging it, and offers multi-step planning and reasoning capabilities. It can transform existing code, such as performing Java version upgrades, and implement new code based on developer requests.

-

In March 2024, Adobe Inc. partnered with NVIDIA Corporation to harness the potential of generative AI to enhance creative workflows. The collaboration aimed to develop advanced generative AI models deeply integrated into applications utilized by top creators and marketers worldwide. The partnership is built on the longstanding relationship between the two companies in R&D, emphasizing the importance of generative AI in transforming creative processes and enabling more innovative outputs in the marketing domain.

-

In January 2024, Essential AI and Google Cloud announced a strategic partnership to streamline and drive the development of full-stack generative AI products and empower enterprise users to make more informed, data-driven decisions. As a preferred cloud provider, Google Cloud would enable Essential AI to deliver LLMs customized for enterprises, enhancing business productivity by automating repetitive and time-consuming tasks.

Enterprise Generative AI Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3,894.5 million |

|

Revenue forecast in 2030 |

USD 19,808.7 million |

|

Growth rate |

CAGR of 38.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Market revenue in USD million, CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments Covered |

Component, model type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa |

|

Key companies profiled |

AWS; Google LLC; H20.ai; IBM; Intel Corporation; Jasper.ai; Microsoft Corporation; Nvidia Corporation; OpenAI; Oracle; Synthesis AI |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Global Enterprise Generative AI Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global enterprise generative AI report based on component, model type, application, end use, and region:

-

Components Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Model Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Text

-

Image/Video

-

Audio

-

Code

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Marketing and Sales

-

Customer Service

-

Product Development

-

Supply Chain Management

-

Others (Research and Development, Risk Management, etc.)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Retail & E-commerce

-

Healthcare

-

Manufacturing

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise generative AI market size was estimated at USD 2,941.0 million in 2024 and is expected to reach USD 3,894.5 million in 2025.

b. The global enterprise generative AI market is expected to grow at a compound annual growth rate of 38.4 % from 2025 to 2030 and reach USD 19,808.7 million by 2030

b. North America dominated the enterprise generative AI market with a share of 41.0% in 2024. This dominance is driven by the region's advanced technological infrastructure, strong investment in AI research and development, and a high concentration of AI-focused companies and startups.

b. Some key players operating in the enterprise generative AI market include AWS, Google LLC, H20.ai, IBM, Intel Corporation, Jasper.ai, Microsoft Corporation, Nvidia Corporation, OpenAI, Oracle, and Synthesis AI.

b. Key factors that are driving the market growth include the availability of large datasets for training AI models, improved cloud computing infrastructure, growing interest in personalized customer experiences, and the expanding use of AI in sectors such as healthcare, finance, and manufacturing.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."