Enterprise File Synchronization And Sharing Market Size, Share & Trends Analysis Report By Offering, By Deployment, By Enterprise Size, By Application, By End-use (BFSI, Retail), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-398-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

EFSS Market Size & Trends

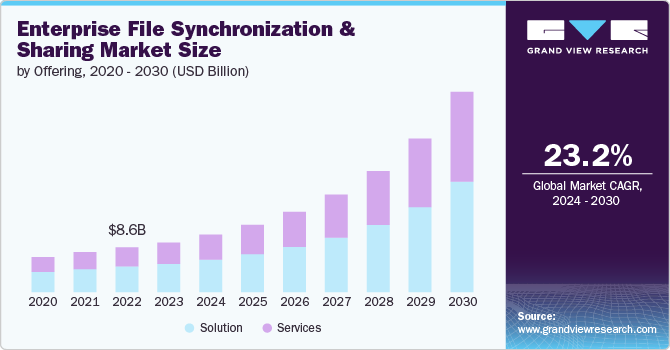

The global enterprise file synchronization and sharing market size was valued at USD 9.50 billion in 2023 and is anticipated to grow at a CAGR of 23.2% from 2024 to 2030. The increasing adoption of remote and hybrid work models has necessitated secure, efficient, and collaborative file-sharing solutions, propelling demand for enterprise file synchronization and sharing (EFSS) platforms. Additionally, the growing emphasis on data security and compliance with stringent regulatory standards has underscored the need for robust EFSS solutions that offer advanced encryption and access controls. The integration capabilities of EFSS with other enterprise applications, such as cloud storage, collaboration tools, and enterprise content management systems, further enhances their appeal by providing seamless workflows and improved productivity.

Moreover, the proliferation of mobile devices and the subsequent need for mobile access to corporate data have significantly contributed to the market's expansion. As organizations prioritize digital transformation and agility, the EFSS market is expected to witness sustained growth, driven by the ongoing need for secure, accessible, and efficient data management solutions.

The increasing adoption of remote and hybrid work models significantly drives the EFSS market. As organizations transition to more flexible work environments, the need for secure, efficient, and collaborative file-sharing solutions has become paramount. EFSS platforms enable seamless access to critical data from any location, ensuring remote and hybrid workers can collaborate effectively while maintaining data integrity and security. This shift in work dynamics has highlighted the importance of reliable EFSS solutions, fueling their demand and market growth.

The proliferation of mobile devices and the subsequent need for mobile access to corporate data have significantly contributed to the expansion of the EFSS market. As employees increasingly rely on smartphones and tablets for work, the demand for EFSS solutions that offer secure, seamless access to corporate data on mobile platforms has surged. These solutions enable employees to collaborate, share, and manage files from any device, enhancing productivity and flexibility. Consequently, the growing dependence on mobile technology in the workplace has been pivotal in driving the market's expansion.

Offering Insights

The solution segment accounted for the largest market share of 57% in 2023. The adoption of EFSS products is primarily driven by the need for secure, efficient, and seamless file management solutions within organizations. Companies increasingly recognize the importance of data security and regulatory compliance, which EFSS products address through advanced encryption, access controls, and audit trails. Furthermore, integrating EFSS products with existing enterprise applications and systems enhances workflow efficiency and collaboration, making them indispensable tools for modern businesses aiming to optimize productivity and data management.

The services segment is anticipated to grow at the fastest CAGR over the forecast period. The adoption of EFSS services is driven by the demand for scalable, flexible, and cost-effective solutions tailored to meet specific organizational needs. EFSS services offer the advantage of cloud-based deployment, reducing the need for significant upfront infrastructure investments and enabling more effortless scalability as business needs evolve. These services often include comprehensive support and maintenance, ensuring organizations can rely on expert assistance for seamless operation and rapid issue resolution. This flexibility and support make EFSS services particularly attractive to businesses seeking to enhance their file-sharing capabilities without the complexities of managing on-premises solutions.

Deployment Insights

The cloud segment accounted for the largest market share in 2023. The need for scalability, flexibility, and cost efficiency drives the adoption of cloud based EFSS. Cloud-based EFSS solutions offer organizations the ability to scale their storage and collaboration capabilities dynamically, adjusting to fluctuating business demands without significant upfront investments in infrastructure. This model also provides the advantage of remote accessibility, enabling employees to access and share files from any location, which is crucial for supporting remote and hybrid work environments. Additionally, cloud based EFSS services often include automatic updates and maintenance, reducing the burden on internal IT resources and ensuring continuous access to the latest features and security enhancements.

The on-premises segment is anticipated to expand at a compound annual growth rate of over 22% during the forecast period. The adoption of on-premises EFSS solutions is primarily driven by concerns over data security, control, and regulatory compliance. Organizations with stringent data protection requirements or those operating in highly regulated industries often prefer on-premises EFSS deployments to maintain complete control over their data and ensure compliance with specific legal and industry standards. On-premises solutions allow for greater customization and integration with existing enterprise systems and security protocols, providing a tailored data management and protection approach. This level of control and customization makes on-premises EFSS an attractive option for businesses prioritizing data sovereignty and precise compliance adherence.

Enterprise Size Insights

Large enterprises accounted for the largest market share of over 59% in 2023. The need for enhanced collaboration, streamlined workflows, and robust data security drives the adoption of EFSS among large enterprises. With their extensive operations and distributed teams, large enterprises require efficient file-sharing solutions to facilitate seamless communication and collaboration across different departments and locations. EFSS platforms enable real-time access to critical documents, support integration with other enterprise applications, and ensure compliance with stringent data protection regulations. The scalability and advanced features of EFSS solutions are particularly beneficial for large organizations seeking to optimize productivity while maintaining stringent security protocols.

The SMEs segment is anticipated to expand at the fastest CAGR during the forecast period. For SMEs, the adoption of EFSS is primarily driven by the need for cost-effective, scalable, and user-friendly solutions that enhance business efficiency. SMEs often operate with limited IT resources and budgets, making cloud based EFSS solutions attractive due to their lower upfront costs and minimal maintenance requirements. EFSS platforms provide SMEs with the tools to securely share and collaborate on files, improving operational agility and enabling them to compete more effectively in the market. Additionally, the flexibility to scale services according to business growth and the ease of use of EFSS solutions support SMEs' dynamic and evolving needs.

Application Insights

The file storage and backup segment accounted for the largest market share of 27% in 2023. The need for reliable, secure, and efficient data management solutions drives the application of EFSS for file storage and backup. Organizations prioritize protecting their critical data against loss, corruption, and unauthorized access. EFSS platforms provide robust storage solutions with advanced encryption and access controls, ensuring data is securely stored and easily retrievable during hardware failures or cyber incidents. Additionally, the automated backup features of EFSS solutions offer continuous protection and recovery capabilities, reducing downtime and safeguarding business continuity.

The document collaboration segment is anticipated to expand at the fastest CAGR during the forecast period. The application of EFSS for document collaboration is driven by the necessity for enhanced teamwork, productivity, and real-time communication. As organizations increasingly adopt remote and hybrid work models, seamlessly collaborating on documents becomes essential. EFSS solutions enable multiple users to access, edit, and comment on documents simultaneously, fostering a collaborative work environment. These platforms also integrate with other productivity tools, facilitating smoother workflows and ensuring that all team members are on the same page, regardless of location. This real-time collaboration capability significantly enhances efficiency and innovation within teams, driving the widespread adoption of EFSS for document collaboration.

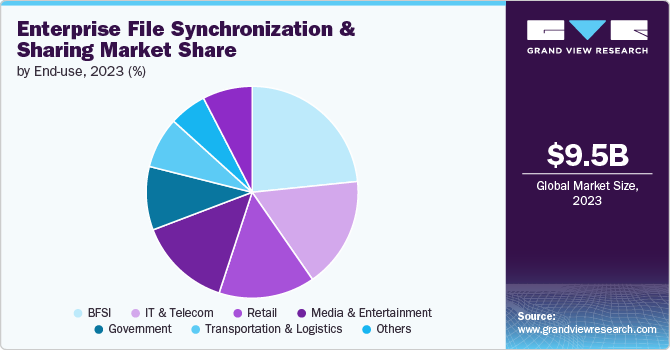

End-use Insights

The BFSI segment accounted for the largest market share of over 23% in 2023. The need for stringent data security, regulatory compliance, and efficient data management drives the adoption of EFSS in the BFSI sector. The BFSI sector deals with sensitive financial information that requires robust protection against breaches and unauthorized access. EFSS solutions provide advanced encryption, secure access controls, and compliance features that help financial institutions meet regulatory requirements such as GDPR, PCI DSS, and others. Additionally, EFSS platforms enhance operational efficiency by enabling secure, seamless sharing and collaboration on financial documents, supporting the sector’s need for timely and accurate information exchange.

The healthcare segment is anticipated to grow at the highest CAGR during the forecast period. The adoption of EFSS is primarily driven by the need to ensure patient data privacy, regulatory compliance, and improved collaboration among healthcare professionals. Healthcare organizations handle vast amounts of sensitive patient information that must be protected by regulations such as HIPAA. EFSS solutions offer secure storage, encryption, and access controls that help healthcare providers maintain compliance while safeguarding patient data. Moreover, EFSS platforms facilitate real-time collaboration among medical teams, enabling the efficient sharing of patient records, test results, and treatment plans. This improved collaboration enhances patient care and operational efficiency within healthcare facilities.

Regional Insights

North America enterprise file synchronization and sharing (EFSS) market held the major share of over 37% of the market in 2023. In North America, the EFSS market is experiencing robust growth, driven by the widespread adoption of remote and hybrid work models. Organizations in this region increasingly prioritize data security and regulatory compliance, leading to a significant uptake of EFSS solutions offering advanced encryption and secure access controls. The presence of major technology companies and a strong focus on digital transformation initiatives further fuel the market's expansion in North America.

U.S. Enterprise File Synchronization And Sharing Market Trends

The enterprise file synchronization and sharing (EFSS) market in the U.S. is expected to grow significantly from 2024 to 2030. In the U.S., the EFSS market is characterized by a high demand for cloud-based solutions, driven by the need for scalability, flexibility, and cost-efficiency. U.S. enterprises leverage EFSS platforms to enhance collaboration and productivity while ensuring data protection and compliance with stringent regulatory frameworks such as GDPR and CCPA. The rapid adoption of advanced technologies and a strong emphasis on innovation contribute to the market's dynamic growth in the U.S.

Europe Enterprise File Synchronization And Sharing Market Trends

The enterprise file synchronization and sharing (EFSS) market in Europe is expected to grow significantly at a CAGR of 21% from 2024 to 2030. The EFSS market in Europe is being propelled by strict data protection regulations, such as the General Data Protection Regulation (GDPR), which mandates robust data security measures. European organizations are adopting EFSS solutions to ensure compliance with these regulations while facilitating secure and efficient file sharing and collaboration. Additionally, the growing trend towards digital workplace solutions and the increasing need for remote access to corporate data are driving the adoption of EFSS in Europe.

Asia Pacific Enterprise File Synchronization And Sharing Market Trends

The enterprise file synchronization and sharing (EFSS) market in Asia Pacific is expected to grow significantly at a CAGR of over 24% from 2024 to 2030. The EFSS market is expanding rapidly in the Asia Pacific region due to the increasing adoption of cloud computing and digital transformation initiatives across various industries. Organizations in this region seek scalable and cost-effective EFSS solutions to enhance operational efficiency and support their growing remote workforce. The rising focus on data security and the need to comply with emerging regulatory standards also contribute to Asia Pacific's market growth. Moreover, many small and medium-sized enterprises (SMEs) in this region further drive the demand for flexible and affordable EFSS solutions.

Key Enterprise File Synchronization And Sharing Company Insights

Key players operating in the enterprise file synchronization and sharing (EFSS) market include Google LLC, IBM, Open Text, Microsoft, and Qnext Corp. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2024, Microsoft unveiled new features for OneDrive for Business, including integration with CoPilot AI assistant and enhanced collaboration capabilities for schools and enterprises. The enhanced search features now include new filters for file types, a date filter for specific timeframes, precise scoping options, and an updated interface with improved metadata. These enhancements help you locate files more efficiently.

-

In October 2023, Dropbox launched Dropbox Dash, an AI-based search feature currently in open beta. This tool enhances the user experience by providing smarter search capabilities across files and folders. Additionally, Dropbox introduced Dropbox Studio, an all-in-one tool for video content creation, editing, and feedback collection.

Key Enterprise File Synchronization And Sharing Companies:

The following are the leading companies in the enterprise file synchronization and sharing market. These companies collectively hold the largest market share and dictate industry trends.

- Acronis International GmbH

- Box

- Citrix Systems, Inc.

- CTERA Networks Ltd.

- Dropbox, Inc.

- Egnyte, Inc.

- Google LLC

- IBM

- Open Text

- Microsoft

- Qnext Corp.

- IPVanish, Inc

- Syncplicity LLC

- Thru, Inc.

Enterprise File Synchronization And Sharing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 11.02 billion |

|

Revenue forecast in 2030 |

USD 38.45 billion |

|

Growth rate |

CAGR of 23.2% from 2024 to 2030 |

|

Historical Data |

2018 - 2023 |

|

Base Year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, deployment, enterprise size, application, end use and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa |

|

Key companies profiled |

Acronis International GmbH, Box, Citrix Systems, Inc., CTERA Networks Ltd., Dropbox, Inc., Egnyte, Inc., Google LLC, IBM, Open Text, Microsoft, Qnext Corp., IPVanish, Inc, Syncplicity LLC, Thru, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Enterprise File Synchronization And Sharing Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise file synchronization and sharing (EFSS) market report based on offering, deployment, enterprise size, application, end-use, and region:

-

Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Standalone EFSS Solutions

-

Integrated EFSS Solutions

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Application Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

File Storage and Backup

-

Content Management System

-

Mobile Access & Productivity

-

Document Collaboration

-

Analytics & Reporting

-

Others

-

-

End-use Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Media & Entertainment

-

IT & Telecom

-

Retail

-

Government

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise file synchronization and sharing market size was estimated at USD 9.50 billion in 2023 and is expected to reach USD 11.02 billion in 2024

b. The global enterprise file synchronization and sharing market is expected to grow at a compound annual growth rate of 23.2% from 2024 to 2030 to reach USD 38.45 billion by 2030

b. North America dominated the enterprise file synchronization and sharing market with a market share of 37.75% in 2023. In North America, the EFSS market is experiencing robust growth, driven by the widespread adoption of remote and hybrid work models. Organizations in this region increasingly prioritize data security and regulatory compliance, leading to a significant uptake of EFSS solutions offering advanced encryption and secure access controls. The presence of major technology companies and a strong focus on digital transformation initiatives further fuel the market's expansion in North America.

b. Some key players operating in the EFSS market include Acronis International GmbH, Box, Citrix Systems, Inc., CTERA Networks Ltd., Dropbox, Inc., Egnyte, Inc., Google LLC, IBM, Open Text, Microsoft, Qnext Corp., IPVanish, Inc, Syncplicity LLC, and Thru, Inc.

b. Several key factors are driving the growth of the enterprise file synchronization and sharing market. The increasing adoption of remote and hybrid work models has necessitated secure, efficient, and collaborative file-sharing solutions, propelling demand for EFSS platforms. Additionally, the growing emphasis on data security and compliance with stringent regulatory standards has underscored the need for robust EFSS solutions that offer advanced encryption and access controls.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."